Description

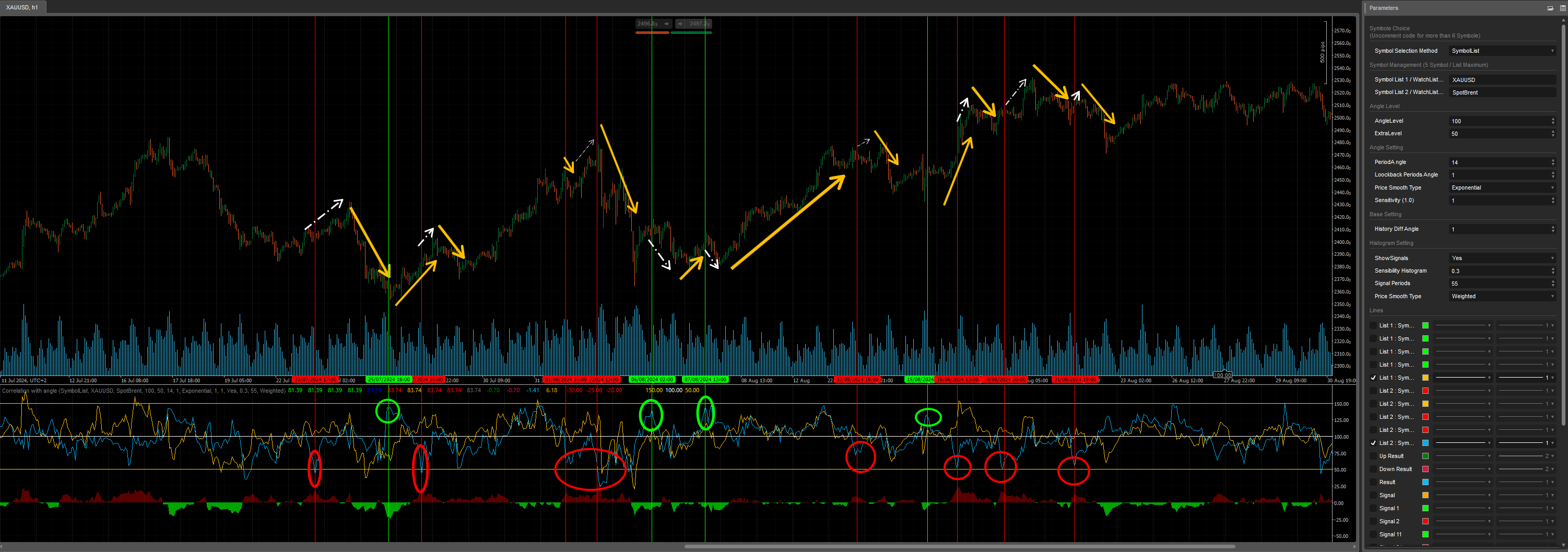

This indicator, called "Correlationwithanglev1", is a cTrader script that calculates and displays the correlation between multiple financial assets in the form of angles, using moving averages and ATR (Average True Range) indicators. It is designed to compare two lists of financial symbols (assets), and for each symbol, it calculates an "angle" based on price changes and the ATR.

Functionality and Explanation of Parameters

Symbol Selection Method: The user can choose to base the comparison on a Watchlist (a list of symbols defined by the user) or a Symbol List (a specific list of symbols specified in the parameters).

WatchList: Compares symbols from a watchlist.SymbolList: Compares symbols specified directly.

Symbols to Compare: The symbol lists are defined by the user:

TradedSymbols1: Defines the symbols for the first list (e.g., XAUUSD).TradedSymbols2: Defines the symbols for the second list (e.g., SpotBrent).

Angle Parameters:

PeriodAngle: The period used for calculating the moving average (default is 14).LookbackAngle: Number of periods for the lookback (default is 1).MaTypeAngle: The type of moving average used to smooth prices (e.g., Weighted Moving Average).

Histogram Sensitivity:

- The user can adjust the sensitivity of signals through parameters like

SensibilityHistoand choose whether to display signals withShowSignal.

Displaying the Results:

- Results for each symbol in both lists are displayed as lines on the chart, with a specific color for each list (e.g., symbols from the first list are shown in green, those from the second list in red).

- Static levels (extra levels) are also plotted to visualize the boundaries.

Calculation Principle

- For each symbol in each list, the indicator loads historical bar data (candlesticks) and calculates moving averages and ATRs.

- The angle is calculated based on the difference between the moving average of the current price and that of a previous period (

priceSmooth - priceSmoothLoockBack), normalized by the ATR. This measures the strength of the price movement. - The angle is determined using a trigonometric function based on momentum and the ATR. This results in an angle in degrees (between -90° and 90°), representing the slope of the price movement.

- A positive angle indicates an upward trend.

- A negative angle indicates a downward trend.

Visualization

- The indicator plots the calculated angles as lines for each symbol in both lists.

- Horizontal levels (High, Mid, Low) are plotted at 50, 0, and -50 to help read the angles.

- Text displaying historical differences (comparison with a past "Lookback") is drawn on the chart.

Utility

This indicator can be used to analyze the correlation between different assets (e.g., between gold and oil) and identify similar or divergent movements between them. The angles help visualize the strength and direction of trends, which can assist traders in making decisions based on the dynamics of the compared markets.

Telegram group : https://t.me/cTraderStrategyTesterProject

GitHub : https://github.com/YesOrNotCtrader/Ctrader-Stragegy-Tester-Project

Enjoy for Free =)

Previous account here : https://ctrader.com/users/profile/70920

Contact telegram : https://t.me/nimi012

(***This indicator does not include all the signals and additional outputs present on this page to maintain a simple and clear analysis***)

using System;

using System.Linq;

using System.Threading;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

using System.Collections.Generic;

using System.IO;

using System.Text;

namespace cAlgo

{

//[Cloud("Fast Smooth", "Slow Smooth", FirstColor = "Green", SecondColor = "Red", Opacity = 0.1)]

[Levels(0)]

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class AngleOfMultiSymbol : Indicator

{

[Parameter("Symbol Selection Method", DefaultValue = SymbolSelectionMethodType.SymbolList, Group = "Symbole Choice \n(Uncomment code for more than 6 Symbole)")]

public SymbolSelectionMethodType SymbolSelectionMethod { get; set; }

[Parameter("Symbol List", DefaultValue = "EURUSD GBPUSD AUDUSD USDCHF", Group = "Symbole Choice \n(Uncomment code for more than 6 Symbole)")]

public string TradedSymbols { get; set; }

[Parameter("Watchlist Name", DefaultValue = "My Watchlist", Group = "Symbole Choice \n(Uncomment code for more than 6 Symbole)")]

public string WatchlistName { get; set; }

public enum SymbolSelectionMethodType

{

CurrentChart,

SymbolList,

WatchList

}

[Parameter("History Diff Angle", DefaultValue = 1, Group = "Base Setting")]

public int HistoryTextLookback { get; set; }

[Parameter("Tf", DefaultValue = "Hour1", Group = "Base Setting")]

public TimeFrame Tf { get; set; }

[Parameter("Price Smooth Period (255)", DefaultValue = 255, Group = "Angle Setting")]

public int SmoothPeriods { get; set; }

[Parameter("Price Smooth Type", DefaultValue = MovingAverageType.Weighted, Group = "Angle Setting")]

public MovingAverageType MaType { get; set; }

[Parameter("Loockback Periods Angle", DefaultValue = 1, Group = "Angle Setting")]

public int LookbackPeriodsAngle { get; set; }

[Parameter("Sensitivity (1.0)", DefaultValue = 1, Group = "Angle Setting")]

public double Sensitivity { get; set; }

[Output("Symb n° 1", LineColor = "White", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN1 { get; set; }

[Output("Symb n° 2", LineColor = "Lime", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN2 { get; set; }

[Output("Symb n° 3", LineColor = "Green", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN3 { get; set; }

[Output("Symb n° 4", LineColor = "DeepSkyBlue", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN4 { get; set; }

[Output("Symb n° 5", LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN5 { get; set; }

[Output("Symb n° 6", LineColor = "Magenta", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN6 { get; set; }

/*Uncomment For more Symbole on the chart

[Output("Symb n° 7", LineColor = "Green", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN7 { get; set; }

[Output("Symb n° 8", LineColor = "DeepSkyBlue", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN8 { get; set; }

[Output("Symb n° 9", LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN9 { get; set; }

[Output("Symb n° 10", LineColor = "Magenta", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries SymbN10 { get; set; }

*/

private MovingAverage[] ma;

private AverageTrueRange[] atr;

private Symbol[] TradeList;

private Bars[] bars;

private IndicatorDataSeries[] Sources, ResSymbol;

private int[] indexBars;

protected override void Initialize()

{

if (SymbolSelectionMethod == SymbolSelectionMethodType.WatchList)

{

// Get the trade list from the watchlist provided by the user

foreach (Watchlist w in Watchlists)

{

if (w.Name == WatchlistName)

{

TradeList = Symbols.GetSymbols(w.SymbolNames.ToArray());

}

}

}

else if (SymbolSelectionMethod == SymbolSelectionMethodType.SymbolList)

{

// Get the trade list from the sysmbol list provided by the user

string[] SymbolList = TradedSymbols.ToUpper().Split(' ');

TradeList = Symbols.GetSymbols(SymbolList);

}

else

{

TradeList = new Symbol[1];

TradeList[0] = Symbol;

}

atr = new AverageTrueRange[TradeList.Length];

ma = new MovingAverage[TradeList.Length];

bars = new Bars[TradeList.Length];

indexBars = new int[TradeList.Length];

Sources = new IndicatorDataSeries[TradeList.Length];

ResSymbol = new IndicatorDataSeries[TradeList.Length];

Print("{0} traded symbols: ", TradeList.Length);

int i = 0;

foreach (var symbol in TradeList)

{

Print(symbol.Name);

bars[i] = MarketData.GetBars(Tf, symbol.Name);

if (bars[i].OpenTimes[0] > Bars.OpenTimes[0])

bars[i].LoadMoreHistory();

//Load indicators on start up EP5-ATR

Sources[i] = CreateDataSeries();

ResSymbol[i] = CreateDataSeries();

atr[i] = Indicators.AverageTrueRange(bars[i], 500, MovingAverageType.Simple);

ma[i] = Indicators.MovingAverage(Sources[i], SmoothPeriods, MaType);

i++;

}

}

public override void Calculate(int index)

{

if (index < SmoothPeriods)

return;

for (int i = 0; i < TradeList.Length; i++)

{

//indexBars[i] = GetIndexByDate(bars[i], Bars.OpenTimes[index]);

indexBars[i] = bars[i].OpenTimes.GetIndexByTime(Bars.OpenTimes[index]);

Sources[i][index] = bars[i].ClosePrices[indexBars[i]];

ResSymbol[i][index] = GetCalculationSymbol(ma[i].Result[index], ma[i].Result[index - LookbackPeriodsAngle], atr[i].Result[indexBars[i]]);

}

SymbN1[index] = ResSymbol[0][index];

SymbN2[index] = ResSymbol[1][index];

SymbN3[index] = ResSymbol[2][index];

SymbN4[index] = ResSymbol[3][index];

SymbN5[index] = ResSymbol[4][index];

SymbN6[index] = ResSymbol[5][index];

/* Uncomment For More Symbols on chart

SymbN7[index] = ResSymbol[2][index];

SymbN8[index] = ResSymbol[3][index];

SymbN9[index] = ResSymbol[4][index];

SymbN10[index] = ResSymbol[5][index];

*/

IndicatorArea.RemoveAllObjects();

for (int i = 0; i < TradeList.Length; i++)

{

IndicatorArea.DrawText((TradeList[i]).ToString() + index, TradeList[i] + " : " + ResSymbol[i][index].ToString("F2"), index, ResSymbol[i][index], ResSymbol[i][index] > ResSymbol[i][index - HistoryTextLookback] ? Color.Lime : Color.Red);

}

}

public double GetCalculationSymbol(double priceSmooth, double priceSmoothLoockBack, double atr)

{

var _momentumpositive = priceSmooth - priceSmoothLoockBack;

var _momentumnegative = priceSmoothLoockBack - priceSmooth;

var _momentum = priceSmooth > priceSmoothLoockBack

? _momentumpositive / atr

: _momentumnegative / atr;

var _hypothenuse = Math.Sqrt((_momentum * _momentum) + (LookbackPeriodsAngle * LookbackPeriodsAngle));

var _cos = (LookbackPeriodsAngle / _hypothenuse);

var _angle = priceSmooth > priceSmoothLoockBack

? (0 + (Math.Acos(_cos) * 100)) * Sensitivity

: (0 - (Math.Acos(_cos) * 100)) * Sensitivity;

return _angle;

}

}

}

YesOrNot2

Joined on 17.05.2024

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Correlation with angle v1.1.algo

- Rating: 5

- Installs: 574

- Modified: 07/09/2024 01:04