Description

FTMO OPTIMIZED BOT

Highly profitable algo which trades the Nasdaq 100

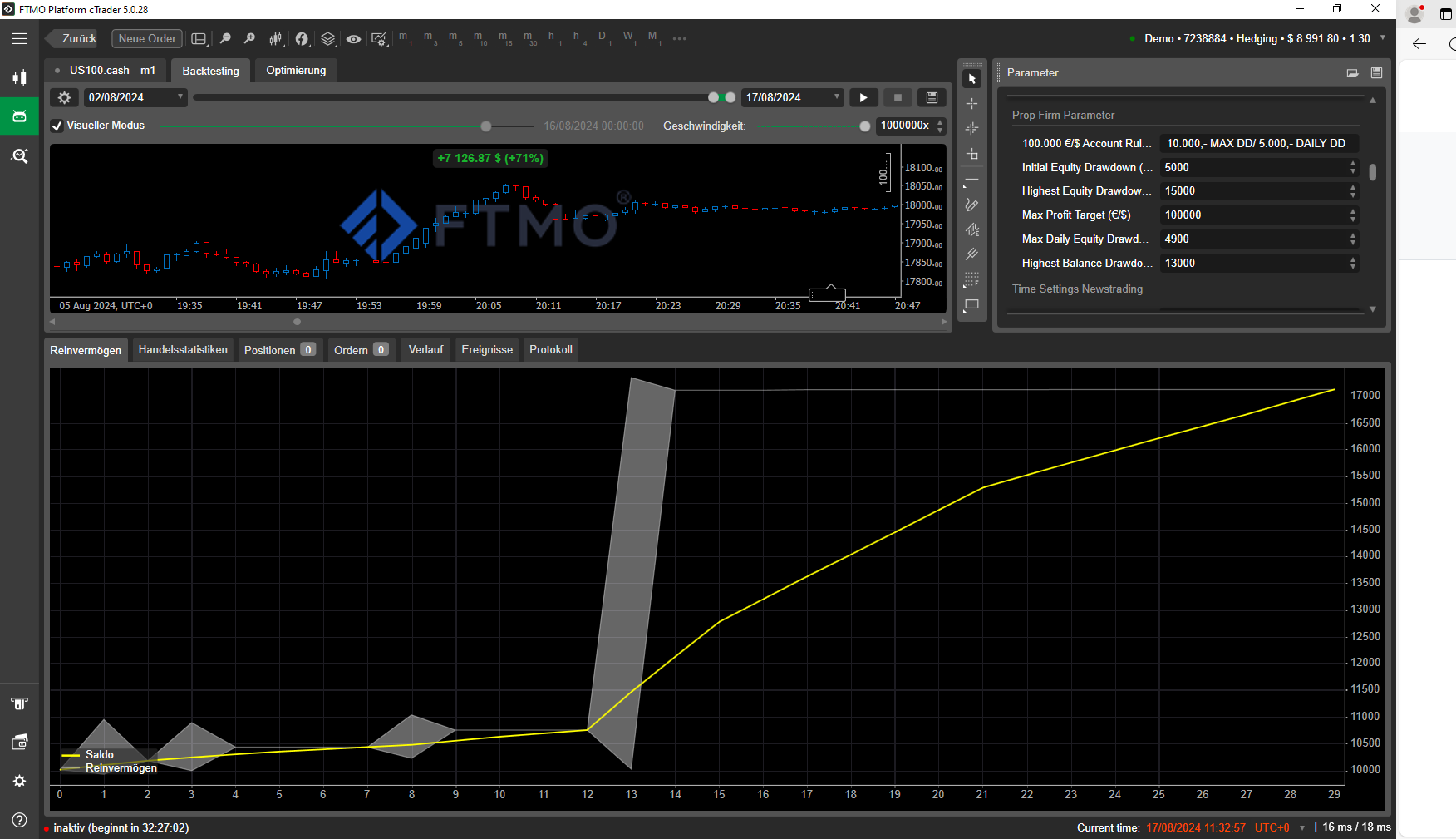

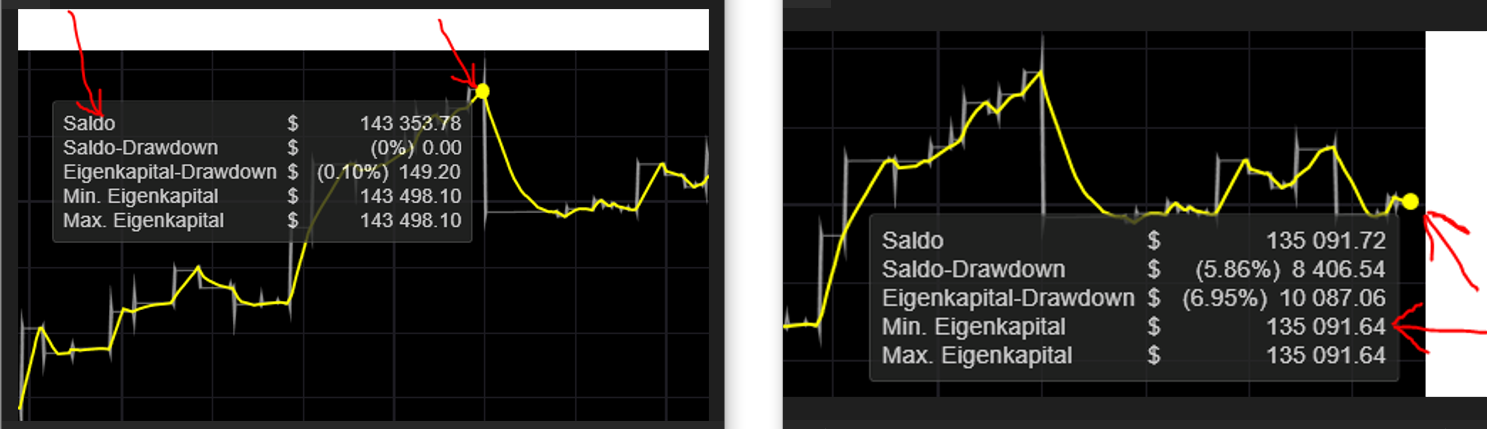

Backtesting from 08.11.2020-01.08.2024 with Tick Data

The Prop Firm Bot is preset for FTMO at US100.Cash. I include various cbotset files for other optimizations.

Here you can download the Bot from Google Drive for backtesting until 31.10.24:

https://drive.google.com/file/d/13DdOEDQl-_4_HOZWAbaMBlmUlpPGIord/view?usp=sharing

average 2233,-$/Month with 0.5 Lot

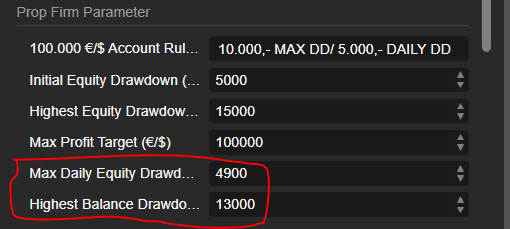

Max Daily DD: <4900,-$

Max Balance DD: <13.000$

Update 05.08.24:

On 01.08. the bot stopped during the backtest with the Max Risk of 0.5 Lot. This is where the Max Daily Drawdown of 4900,- worked well. You can start the bot again the next day on 02.08. as normal.

And from 02.08. to 16.08. the results look quite decent again:

Note: I have the impression that after some time, when I repeat the backtest with the same settings, sometimes the backtest results turn out differently. It must be FTMO's fault. Before, for example, I had 86,000 in the backtest, now 100,000,-. This is not the case with IC Markets.

As PDF Guide:

https://drive.google.com/file/d/11FadKK4tvwpNCwnV-95IwBEqHjjmhIaH/view

For EURUSD on FTMO optimized:

average 660,-$/Month with 0.03 Lot

Max Daily DD: <4800,-$

Max Balance DD: <9800$

Download CBOTSET File:

https://drive.google.com/file/d/18tBA2oaiYEtv9NsDNg7yC9yH_JZthhcS/view?usp=sharing

For all the IC Markets Optimizations I used IC Markets Europe with leverage 1:30, as a result, you need a high margin of 600,- Euro. E.G. on Fusion Markets you need 178,- Euro per 1 Lot with leverage 1:100.

After new optimization, you can set a maximum of 30 trades. The result is the same, but the margin would be lower.

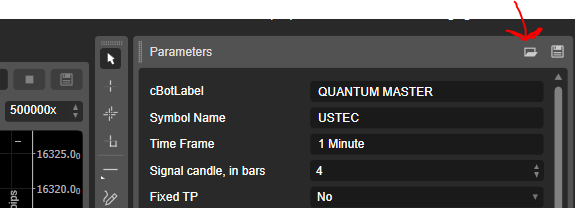

For USTEC on IC Markets optimized:

average 1735,-€/Month with 1 Lot

Max Balance DD: <13.000,-€

+ Margin 18.000,-€ (now optimized with max 30 Trades)

recommended minimum capital 31.000,- Euro

Download CBOTSET File:

https://drive.google.com/file/d/1fn4okfNBEd1MwZPa1UYDXs_83HSEsDuS/view?usp=sharing

For USTEC m1 on IC Markets optimized:

average 2500,-€/Month with 1 Lot

Max Balance DD: <20.000,-€

+ Margin 21.000,-€ (now optimized with max 35 Trades)

recommended minimum capital 41.000,- Euro

Download CBOTSET File:

https://drive.google.com/file/d/1vt4VQzojTsTm_DAn5xvOsF28TB036UbO/view?usp=drive_link

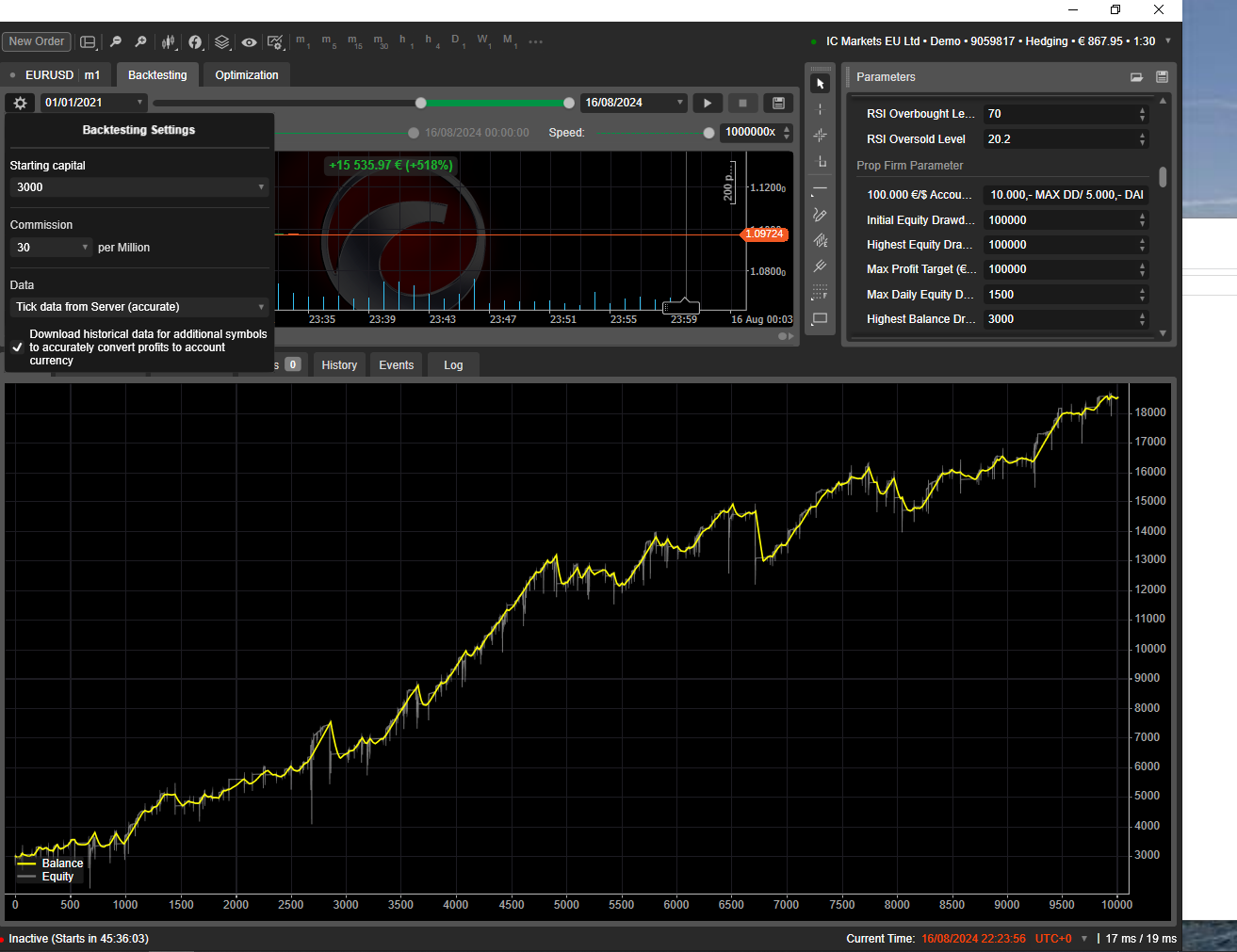

For EURUSD on IC Markets optimized:

average 353,-€/Month with 0.01 Lot

Max Daily DD: <1500,-€

Max Balance DD: <3000,-€

+ 5000,- € for Margin by max. 150 open Trades (recommended minimum capital: 8000,- Euro)

Download CBOTSET File:

https://drive.google.com/file/d/1dBNnlIYr-PVqdE5bdYvIrrMBC0HFr-mK/view?usp=drive_link

There will be regular updates here on the website.

What is a Cbotset File?

Here you can load the special Settings for each Optimization with a Cbotset file:

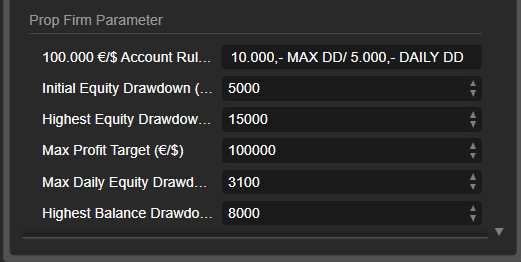

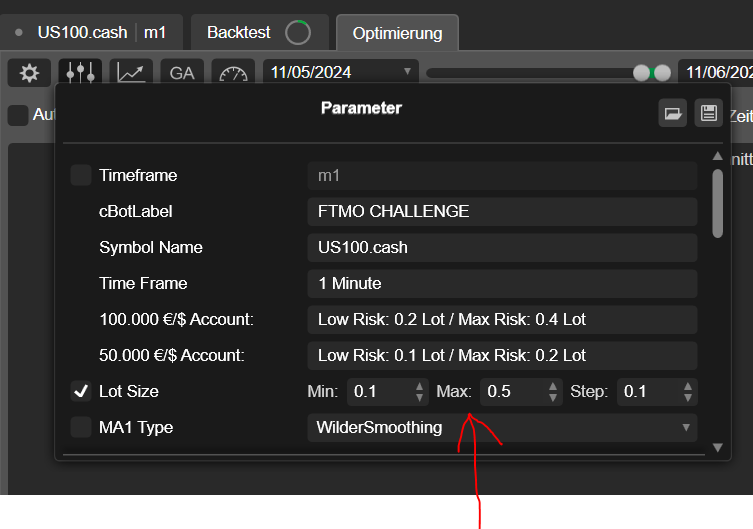

PROP FIRM PARAMETER

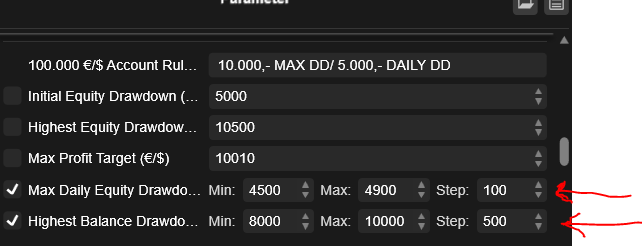

Initial Equity Drawdown:

It means the initial equity when the algo starts.

For example, with a 100k account, you set 5.000,- and the bot stops at 95.000,-.

Highest Equity Drawdown:

Here, the stop is determined on the basis of the maximum equity.

If, for example, the equity reaches its peak after some time, then the stop is set on the basis of this.

Even if the equity increases intraday, e.g. with all open positions, from 10.000,- to 11.000,- and falls again to 10.000,- , the new high is 11.000,-. And if you have activated a stop of 1.000,-, then you will be stopped out by 10.000,-.

You can also use this tool for optimization, but it's not quite as accurate because, as we said, the win of one day can be considered as new reference. To determine the actual decline, you have to consider the maximum balance and the minimum equity. And the difference is then the real maximum drawdown.

This tool is more intended for example, if you are trading your account from 100k to 150k, so that you can then hedge the equity at 120k.

It is also intended in case your prop company requires a trailing drawdown on equity.

Max Profit Target:

Here you can enter the profit target, what you need to achieve.

So you don't have to be afraid that the equity will run 10.000,- into the profit during your absence. Only to find out in the evening that the account may even be in the red.

Max Daily Equity Drawdown:

I programmed this tool so that you can survive the daily drawdown at all prop companies.

On each new day, server time, the bot checks the current equity including all open positions.

This mark will now become the reference value for the maximum permissible daily loss.

You can also use it for backtest optimization as a useful tool, because this allows much more precise optimization.

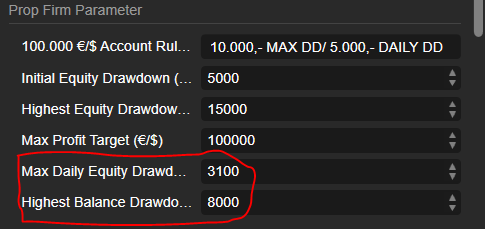

I have preset 3100 as max Drawdowon for a 100k account.

You can also change the value and also take an even higher risk and trade with 0.8 lots, for example, but keep in mind that you need some buffer.

Settings for 0.3 Lot:

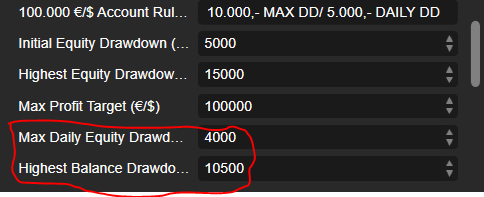

Settings for 0.4 Lot:

Settings for 0.5 Lot:

But also keep in mind that the 4900,- can be exceeded if the market fluctuates extremely strongly within a very short time. Unfortunately, there is no guarantee.

Determine the lot size for the respective challenge account size and

when optimising, enter the appropriate Daily DD and determine the appropriate lot size to trade with:

Highest Balance Drawdown:

Thats the Drawdown from the Highest Balance to the minimum Equity. Its more accurate than the highest Equity Drawdown and the Balance Drawdown from the CTrader Platform.

Notice!

- For example, if you stop the bot in between, then after the restart the initial equity drawdown is no longer at 95.000,- as in the example above, but is then redetermined based on the current balance.

- Always think of some buffer due to unpredictable market events. The algo cannot trigger the stop to the penny exactly.

- Depending on which stop level is reached first, the bot then stops and all positions will be closed automatically. The same applies to the profit target.

- Of course, you can use it for any broker, prop trading company or with your own capital and for any other symbol, so I would recommend copysoftware, for example.

- Don't forget to change the symbol name of other brokers if the Nasdaq has a different name.

- And it is also important that you enter a personal name in the "cBotLabel" parameter window. This increases the chance of not being recognized by the prop companies if several people use the same EA.

However, during the challenge, it shouldn't be a problem.

- As far as I know, FTMO will only approach you after the challenge on the Funded account, if there are several EA with the same parameters.

- Keep in mind that with other brokers, the results can differ significantly with the same settings.

- However, I compared it with Funding Pips with the same settings. And there the bot has even made more profit. Unfortunately, you can only backtest Funding Pips until 23.02.2024.

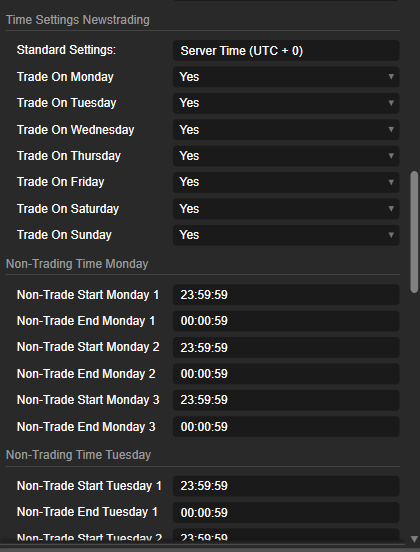

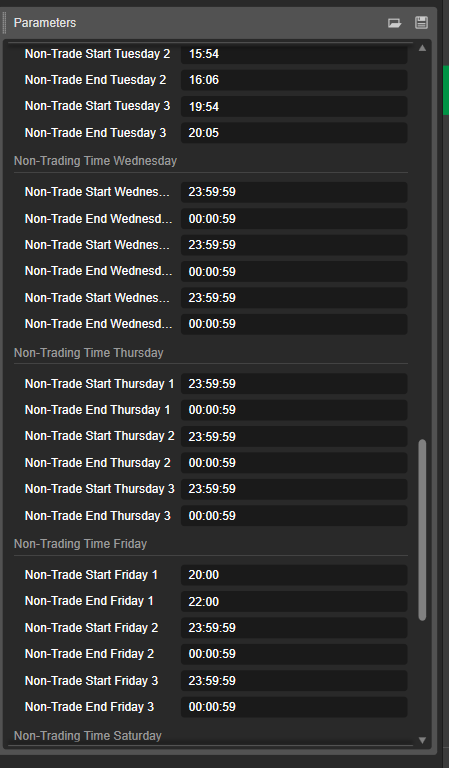

Time Settings News Trading

(Standard Settings)

With this tool, you can also trade on news days without violating the rules. With the FTMO account "Swing" you have no restrictions. But otherwise, you are not allowed to trade a few minutes before and after the news. The same applies to many other prop companies.

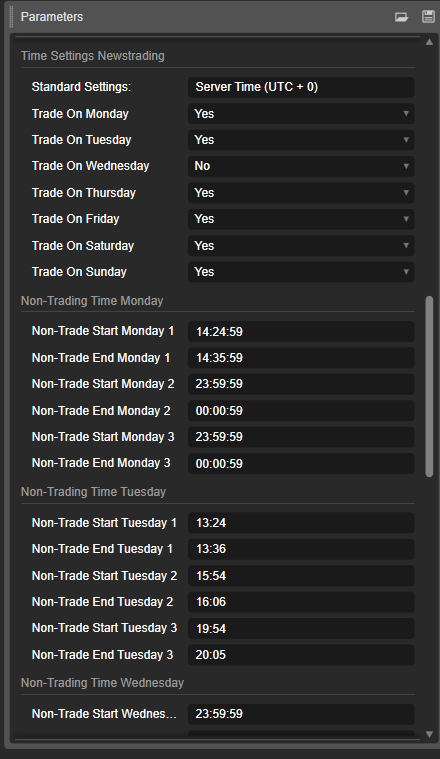

In principle, you can determine whether trading should be carried out on certain days: set "yes" or "no".

Then you decide on the basis of the "Non-Trading Time" in which time window not to trade.

You have the possibility the enter 3 Non-Trading Times on each day.

If you have set "No" on a day, it does not matter what non-trading time is set.

Otherwise, if you do not want to trade from 14:24-14:36, for example, then all open positions will be closed at 14:24. And after that, trading starts again at 14:36. So check very carefully when you are allowed to trade. The bot is not stopped, but from 14:36 the signal logic starts again and positions can be opened.

You can also decide to close all positions every Friday evening. To do this, enter for Non-Trade Start: 20:00 and for Non-Trade End: 22:00.

What doesn't work is if you set "Trade on Saturday" to "no" in the hope that all positions will be automatically closed on Friday. This only applies to Friday, because here only the non-trade end time of 22:00 can be used for the signal logic. On all other weekdays it always closes at 00:00 if you set “no” for the next day.

The default values are always from 23:59:59-00:00:59. This means that the Algo runs completely without interruption. If you want to have an interruption on a specific day or several, then it is important to always set a value for the "Non-Trade End Time" before 00:00. So e.g. from 23:50-23:59. Otherwise, it won't work for that day.

Except on Friday, on this day you have to enter 22:00 (UTC+0) as the maximum non-trade end time, because that's when the markets close.

The weekend days saturday and sunday don't matter to FTMO now. I have only programmed it in case you trade with a broker where the markets are also open on weekends. As long as the C-trader platform is inactive, due to closed markets, the 2 days will not be included in the trading logic. But if you set the value to "No" on "Trade on Sunday", then positions at the market opening that would have been opened on Sunday (from 22:00) would no longer be taken into account.

And what else you need to know, the settings are implemented due to the server time (UTC+0). You'll need to try out which settings are right for you based on your own time zone.

Some Examples:

As an Example for Intraday Trading only. The Trades will be closed either when the Trade Logic close them, or at the End of Trading Day with the Time Settings 20:57.

So in summary: All positions are either closed at 00:00 if you enter the word "no" for the following day. Or they will closed due to the non-trade start time. After that, positions are opened again as normal and continue to run until the next non-trade start time or non-trade day. And you can have the trading session interrupted on Tuesday for just a few minutes, suspended completely for Wednesday, and then continue trading from Thursday to Friday at the close of the market.

How does the Strategy works

It is not a Martingale system. In case of loss, no duplicate position sizes are created. The same lots are traded all the time. The bot usually opens several trades in a row, but never at the same time. The interval between the trades is at least one minute.

This is a robust strategy that looks for strengths in trend. And by opening several trades, there is the possibility of achieving an optimal average price in volatile phases.

The trades will be closed if an opposite trading signal appears or you have set a fixed TP.

I have preset a trailing stop at 3800 pips, so you always have a stop in the market. FTMO doesn't require it, though, as far as I know. But other prop companies do. It is far enough away and will not be triggered in the backtest. At 0.5 lots, it is less than 2% risk per trade.

Time Frame: 1 Minute

The trades are held from mostly one day to several days or few weeks

Profitfactor: 2.14

Max Balance Drawdown: <8000,- with 0.3 Lot/ <13000,- with 0.5 Lot

Max Daily Drawdown: <3100,- with 0.3 Lot/ <4900,- with 0.5 Lot

No Martingale

The bot recognizes open positions after restart

100% automatic, runs 24h

Ready to go immediately

100% made in Germany

Including updates

No matter which bot you buy, you get all the settings for the other brokers for free.

And I will give lifetime Updates for this Bot for free. So look sometimes on this Page.

And if I develop the bot further in the future, everyone who has purchased it will get the updated bot.

Discount for Prop Companies

FUNDING PIPS 5%:

https://app.fundingpips.com/register?ref=e1147ca2

INSTANT FUNDING 10%:

Use Code: AFFO0WVM1G8XGL

THE TRADING PIT up to 10%:

https://www.thetradingpit.com?ref=njg4mdi

Price: 2000,- Euro

(With Lifetime License, without Source Code)

Payment methods: PayPal and bank transfers

email: german.algotrading@gmail.com

The bot now has a new code that recognizes existing open positions. So if you stop the bot in between, all open positions will be treated as if it had never been stopped.

If necessary, I will give you instructions on how to install the bot.

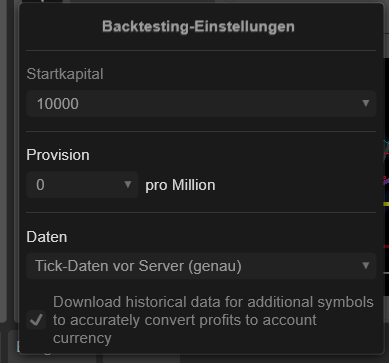

In order for the backtest to work properly, it is essential that you enter „Tick Data from server accurate“.

Of course, this bot is free and you can optimize it for all values and symbols. The settings of all my other "Quantum" bots can also be adopted here.

I can also recommend copy software that I have tested myself. I don't earn anything from it. If you run the Cbot on a demo, you can copy it to other C-trader brokers or MetaTrader accounts.

Heron Copier. cTrader, MetaTrader 4, MetaTrader 5, TradeLocker, MatchTrader Trade Copier.

You can trust me that all the images on the site are accurate and all the information is true.

Please contact me for any questions.

Best regards,

Luke

The author decided to hide the source code.

german.algotrading

Joined on 22.04.2024

- Distribution: Paid

- Language: C#

- Trading platform: cTrader Automate

- File name: New cBot test.algo

- Rating: 0

- Installs: 0

- Modified: 15/06/2024 20:55