Description

Description:

The SNR Engulfing Pattern Bot is a cTrader automated trading robot designed to trade based on support and resistance (SNR) levels combined with bullish and bearish engulfing candlestick patterns. This bot is ideal for traders who use price action strategies and want to automate their trading.

Key Features:

Support and Resistance Levels: The bot allows you to define initial support and resistance levels. These levels are crucial as they help determine entry points based on price action.

Bullish and Bearish Engulfing Patterns: The bot identifies bullish and bearish engulfing candlestick patterns. A bullish engulfing pattern is identified when a larger bullish candle completely engulfs the previous smaller bearish candle, while a bearish engulfing pattern is identified when a larger bearish candle completely engulfs the previous smaller bullish candle.

Order Placement: Upon identifying an engulfing pattern near the defined SNR levels, the bot places limit orders. For a bullish engulfing pattern, buy limit orders are placed just above the high of the bearish candle, and for a bearish engulfing pattern, sell limit orders are placed just below the low of the bullish candle.

Additional Orders: The bot can place a series of additional limit orders spaced apart by a specified number of pips from the initial order, allowing for scaling into positions.

Risk Management: Each order includes a configurable stop loss and take profit to manage risk effectively.

Parameters:

Minimum Body Size (Pips): The minimum size of the candlestick body in pips to qualify as an engulfing pattern.

Quantity (Lots): The size of each trade in lots.

Stop Loss (Pips): The distance in pips for the stop loss from the entry price.

Take Profit (Pips): The distance in pips for the take profit from the entry price.

Number of Additional Orders: The number of additional limit orders to place.

Spacing from Initial Order (Pips): The spacing in pips between the initial order and each additional order.

Initial Support Level: The initial support level on the chart.

Initial Resistance Level: The initial resistance level on the chart.

Usage:

Setup: Input your desired parameters for minimum body size, trade quantity, stop loss, take profit, number of additional orders, spacing, and initial SNR levels.

Execution: Attach the bot to a chart and let it monitor the price action. The bot will automatically identify qualifying engulfing patterns near the specified SNR levels and place the corresponding limit orders.

Monitoring: You can monitor the placed orders and positions directly on the cTrader platform. The bot also prints the SNR levels in the console for additional reference.

Code Summary:

The bot starts by drawing the initial support and resistance levels on the chart. It then continuously monitors the price action to identify bullish and bearish engulfing patterns. Upon identifying a pattern near the specified SNR levels, it places a limit order at the appropriate price level and can place additional orders at specified intervals. Each order is equipped with a stop loss and take profit to ensure proper risk management.

Example:

Bullish Engulfing Pattern: When a bullish engulfing pattern is detected and the price is above the initial support level, the bot places a buy limit order just above the high of the bearish candle.

Bearish Engulfing Pattern: When a bearish engulfing pattern is detected and the price is below the initial resistance level, the bot places a sell limit order just below the low of the bullish candle.

This bot combines the power of SNR levels with reliable candlestick patterns to provide a robust automated trading strategy. Happy trading!

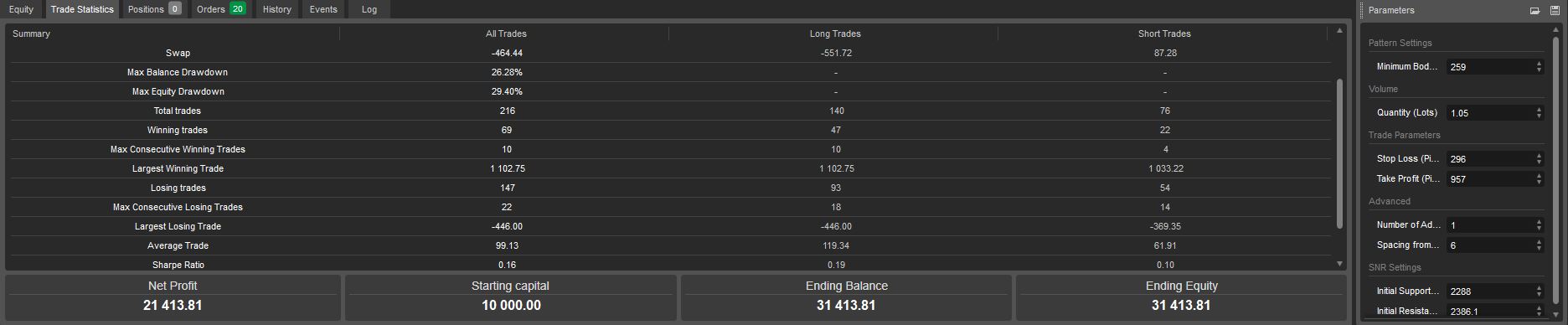

Disclaimer; past performances does not guarantee future results… do not rely on default settings, please do more back-testing and optimization for your own risk appetite. Use Tick data from Server (accurate) during backtesting for best results and on lower timeframes..

The author decided to hide the source code.

UncleDanFx

Joined on 08.06.2024

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: SNR Engulfing Pattern Bot.algo

- Rating: 5

- Installs: 610

- Modified: 08/06/2024 13:20

Comments

why so many trades are runnning, and is it on tick data?

Hi Marta,

Thank you for reaching out. I'm sorry to hear that your bot is experiencing issues with order execution in the demo account despite performing well during backtesting.

Since you are using a demo, you could try a lower TF and adjust the parameters such that it takes small targets or losses first to see if it works at all.

If it does, then you can revert to your desired parameters settings, and perhaps wait for the bot to look for the setups.

I hope this helps.

Dear UncleDanFx,

The bot performs perfectly during backtesting whereas it does not makes orders when it is turned on demo account.

I will appreciate the contact: marta.smektala@gmail.com

kind regards

Marta

Hi alexmbazira,

Thank you for reaching out. At this time, I am not available for individual discussions. However, I encourage you to share any feedback you may have here, as it would benefit the entire community.

Additionally, please be aware that if anyone contacts you via email regarding this bot and requests any form of payment, they are not associated with me and may be posing as me. Please disregard such requests.

Thank you.

Good day, Uncle…Can we have a discussion

My email is alexmbazira@gmail.com

Hi Davidmwabuka, u will have to go to the backtesting settings or if u r on optimization, go to the drop down list

This is best settings for lower timeframes trading such as the 15min timeframe and below.

And to answer ur question regarding why so many trades are running, u can set it to 0. Which would mean one trade at a time. When I created this, I had the idea of scaling my trades and adding layers of Pending orders below or above my initial entry. So to set it to 0…

On the Parameters…

This would only place a PO buy or sell once the bot found the setups.

I hope this helps and answers ur questions.