Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

Description:

The ZScoreIndicator is designed to calculate the Z-score of a financial instrument's closing prices over a specified rolling window period. The Z-score is a statistical measurement that describes a value's relationship to the mean of a group of values, measured in terms of standard deviations. This indicator helps traders identify overbought or oversold conditions based on standard deviation thresholds.

Features:

- Rolling Window: Allows setting the period over which the rolling mean and standard deviation are calculated.

- Threshold Parameters:

- Buy Z-Score Threshold: Sets the Z-score level below which a buy signal is generated.

- Sell Z-Score Threshold: Sets the Z-score level above which a sell signal is generated.

- Close Z-Score Threshold: Sets the Z-score level at which positions should be closed.

- Signal Cool Down Period: Defines a period to wait before issuing a new signal after a buy or sell signal.

This indicator assists traders in identifying potential trading opportunities by highlighting overbought and oversold conditions using statistical measures.

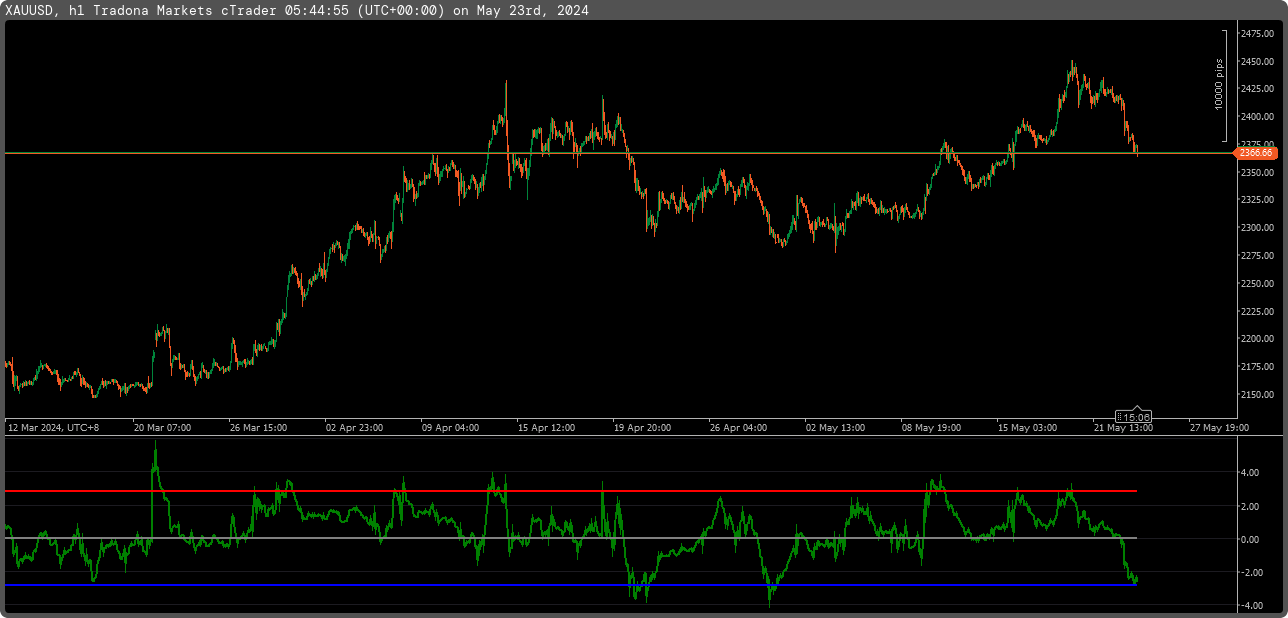

Above are the example of XAUUSD with H1 timeframe.

The threshold is 2.8 and -2.8 level.

The author decided to hide the source code.

HO

honglee_0903

Joined on 26.01.2024

- Distribution: Paid

- Language: C#

- Trading platform: cTrader Automate

- File name: Zscore.algo

- Rating: 0

- Installs: 0

- Modified: 23/05/2024 05:50

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

so where can i get this indicator?