Description

Description: the bot is for free

if you really appreciate my hard work please drop any cent if you can in my PayPal: https://www.paypal.me/shapoorpopalzai, otherwise enjoy the bot and have fun ;-)

I have also removed the trail period, it is unlimited!!!

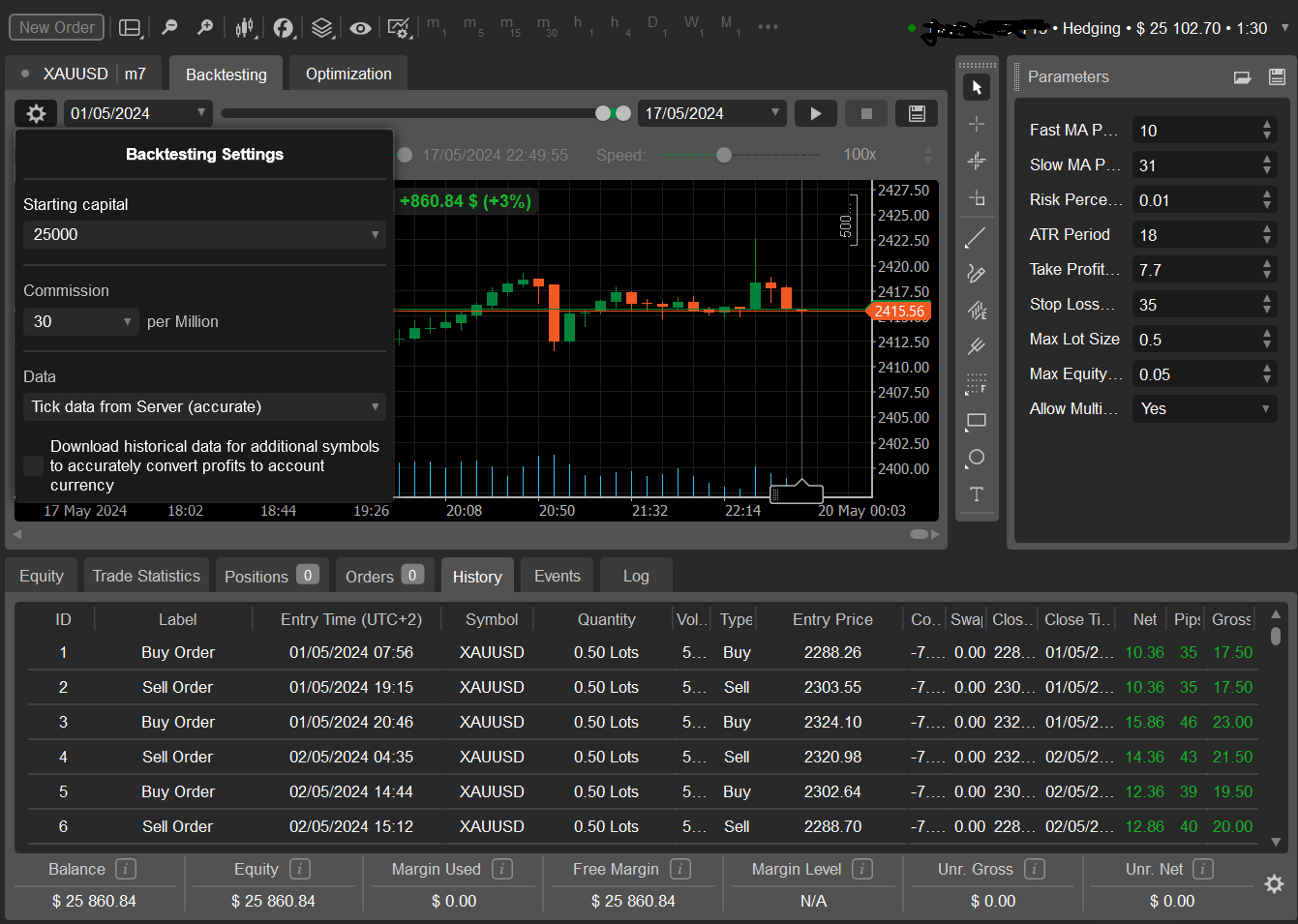

Note: check the bot in optimizer and choose the best as per your requirements. below is the example of the parameter which I use.

The optimizer give you the best time frame and parameters to trade.

You can choose with other Items like BTCUSD, EURUSD..etc

This C# code is for a cAlgo robot designed to execute trades based on a moving average crossover strategy. Here's a breakdown of its key components:

Parameters:

- FastMAPeriod: Specifies the period for the fast moving average.

- SlowMAPeriod: Specifies the period for the slow moving average.

- RiskPercentage: Sets the risk percentage per trade.

- ATRPeriod: Sets the period for calculating the Average True Range (ATR).

- TakeProfitATRMultiplier: Multiplier for calculating the take profit level based on ATR.

- StopLossPips: Sets the initial stop loss in pips.

- AdditionalStopLossPips: Sets an additional stop loss level in pips.

- MaxStopLossThreshold: Sets the maximum stop loss threshold in pips.

- MaxLotSize: Specifies the maximum lot size for a trade.

- MaxEquityDrawdown: Sets the maximum equity drawdown allowed as a percentage.

- AllowMultipleOrders: Determines whether multiple orders are allowed to be opened simultaneously.

Initialization:

- The robot initializes its moving averages (fastMA and slowMA) and sets initial values for variables like maxLotSize, maxEquityDrawdown, and peakEquity.

- It checks for an expiry date and stops trading if the current date exceeds it.

OnTick():

- This method is called on every tick (price update).

- It calculates the drawdown percentage based on peak equity and pauses trading if the drawdown exceeds a predefined threshold.

OnBar():

- This method is called on every new bar (candlestick).

- It checks for open positions or pending orders and exits if any exist.

- Calculates risk amount, ATR, and stop loss distances.

- Executes buy or sell orders based on moving average crossover, with appropriate stop loss and take profit levels.

- Pauses trading if stop loss exceeds the maximum threshold.

Helper Methods:

- IsBullishMarket() and IsBearishMarket(): Determine market sentiment based on open and close prices.

- CalculateATR(): Calculates the Average True Range.

PauseTrading():

- Method to pause trading when maximum drawdown is reached.

This robot aims to automate trading decisions based on a simple moving average crossover strategy while incorporating risk management techniques like stop loss and maximum drawdown control.

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class XAUSD5mctrader10000bot : Robot

{

[Parameter("Fast MA Period", DefaultValue = 10)]

public int FastMAPeriod { get; set; }

[Parameter("Slow MA Period", DefaultValue = 30)]

public int SlowMAPeriod { get; set; }

[Parameter("Risk Percentage", DefaultValue = 0.04, MinValue = 0.01, MaxValue = 0.04)]

public double RiskPercentage { get; set; }

[Parameter("ATR Period", DefaultValue = 14)]

public int ATRPeriod { get; set; }

[Parameter("Take Profit ATR Multiplier", DefaultValue = 1.0, MinValue = 0.5, MaxValue = 10)]

public double TakeProfitATRMultiplier { get; set; }

[Parameter("Stop Loss (pips)", DefaultValue = 75)]

public int StopLossPips { get; set; }

[Parameter("Max Lot Size", DefaultValue = 2.0, MinValue = 0.01)]

public double MaxLotSize { get; set; }

[Parameter("Max Equity Drawdown", DefaultValue = 0.04, MinValue = 0.01, MaxValue = 0.5)]

public double MaxEquityDrawdown { get; set; }

[Parameter("Allow Multiple Trades", DefaultValue = true)]

public bool AllowMultipleTradesEnabled { get; set; }

private MovingAverage fastMA;

private MovingAverage slowMA;

private double peakEquity = 0;

private bool canTrade = true; // Flag to control multiple trades

protected override void OnStart()

{

try

{

fastMA = Indicators.MovingAverage(Bars.ClosePrices, FastMAPeriod, MovingAverageType.Simple);

slowMA = Indicators.MovingAverage(Bars.ClosePrices, SlowMAPeriod, MovingAverageType.Simple);

peakEquity = Account.Equity;

}

catch (Exception ex)

{

Print("Error in OnStart: " + ex.Message);

LogError("OnStart", ex);

}

}

protected override void OnTick()

{

try

{

// Update peak equity

peakEquity = Math.Max(peakEquity, Account.Equity);

// Calculate drawdown as a percentage of peak equity

double equityDrawdown = (peakEquity - Account.Equity) / peakEquity;

// Check if drawdown exceeds the equity threshold

if (equityDrawdown > MaxEquityDrawdown)

{

// Take action to mitigate drawdown (e.g., pause trading)

PauseTrading();

}

}

catch (Exception ex)

{

Print("Error in OnTick: " + ex.Message);

LogError("OnTick", ex);

}

}

protected override void OnBar()

{

try

{

// Check if there are any open positions or pending orders

if (!AllowMultipleTradesEnabled && (!canTrade || Positions.Count > 0 || PendingOrders.Count > 0))

{

Print("There are open positions or pending orders. Cannot open new trades.");

return;

}

double riskAmount = Account.Balance * RiskPercentage;

double atr = CalculateATR(ATRPeriod);

double takeProfitPips = atr * TakeProfitATRMultiplier;

double volumeInUnits = Symbol.QuantityToVolumeInUnits(Math.Min(riskAmount / (StopLossPips * Symbol.PipSize * Symbol.LotSize), MaxLotSize));

// Moving Average Crossover Strategy

if (fastMA.Result.Last(1) > slowMA.Result.Last(1) && fastMA.Result.Last(2) <= slowMA.Result.Last(2))

{

if (IsBullishMarket())

{

double takeProfitPrice = Symbol.Ask + (takeProfitPips * Symbol.PipSize);

ExecuteMarketOrder(TradeType.Buy, SymbolName, volumeInUnits, "Buy Order", null, StopLossPips, takeProfitPrice.ToString());

canTrade = AllowMultipleTradesEnabled; // Allow multiple trades if set to true

}

}

else if (fastMA.Result.Last(1) < slowMA.Result.Last(1) && fastMA.Result.Last(2) >= slowMA.Result.Last(2))

{

if (IsBearishMarket())

{

double takeProfitPrice = Symbol.Bid - (takeProfitPips * Symbol.PipSize);

ExecuteMarketOrder(TradeType.Sell, SymbolName, volumeInUnits, "Sell Order", null, StopLossPips, takeProfitPrice.ToString());

canTrade = AllowMultipleTradesEnabled; // Allow multiple trades if set to true

}

}

}

catch (Exception ex)

{

Print("Error in OnBar: " + ex.Message);

LogError("OnBar", ex);

}

}

private bool IsBullishMarket()

{

return Bars.OpenPrices.Last(1) < Bars.ClosePrices.Last(1);

}

private bool IsBearishMarket()

{

return Bars.OpenPrices.Last(1) > Bars.ClosePrices.Last(1);

}

private double CalculateATR(int period)

{

try

{

double trSum = 0;

for (int i = 1; i <= period; i++)

{

double tr = Math.Max(Bars.HighPrices[i] - Bars.LowPrices[i], Math.Max(Math.Abs(Bars.HighPrices[i] - Bars.ClosePrices[i - 1]), Math.Abs(Bars.LowPrices[i] - Bars.ClosePrices[i - 1])));

trSum += tr;

}

return trSum / period;

}

catch (Exception ex)

{

Print("Error in CalculateATR: " + ex.Message);

LogError("CalculateATR", ex);

return 0;

}

}

private void PauseTrading()

{

// Implement logic to pause trading (e.g., set a flag to stop placing new trades)

// You might also consider closing existing positions or reducing position sizes

Print("Maximum Drawdown is exceeded. Pausing the trading...");

canTrade = false; // Prevent further trades

}

private void LogError(string method, Exception ex)

{

// Implement logging to an external file or service for better monitoring

Print($"{method} error: {ex.Message}");

}

}

}

shapor33

Joined on 08.04.2024 Blocked

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Arian Bot XAUUSD 5m BTCUSD 5m 1month trail bot.algo

- Rating: 3.33

- Installs: 473

- Modified: 18/05/2024 22:12

Comments

I have put it for free you can download it

Cannot download, its still set as paid algo, maybe set is as free? Thank you

Unable to download

Man I am not a good seller, you can use it for free, I have removed the expiry date

is it trail version??

Hello, the stop loss doesn't work?