Description

The Stoch

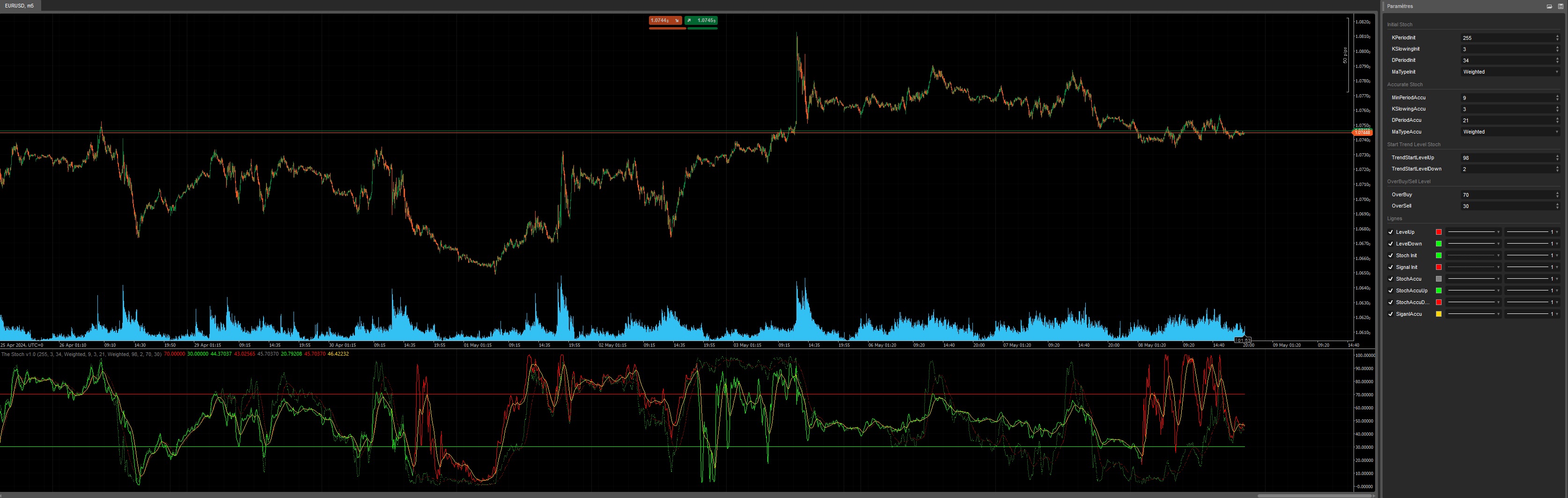

You are already familiar with the limitations of the traditional stochastic. So, here's 'The Stoch':

- It analyzes candlesticks using HighPrice and LowPrice, providing an optimal reading of new highs and lows.

- A new concept that dynamically increases the stochastic calculation periods at each bar once a specific threshold is crossed.

This Stochastique indicator provides advanced stochastic analysis by combining two sets of calculations: an initial stochastic indicator with user-defined periods, and a more accurate stochastic indicator that dynamically adjusts its periods based on detected trends. Here's what the different results display:

Initial Stochastic (ResultInit and SignalInit):

- ResultInit: Shows the %K line, representing the primary stochastic value.

- SignalInit: Shows the %D signal line, which is a moving average of %K.

- These lines provide a classic stochastic representation based on the periods defined in the initial parameters.

Accurate Stochastic (StochAccuRes, StochAccuUp, StochAccuDown, SignalAccu):

- StochAccuRes: Displays the %K line for the dynamically adjusted accurate stochastic.

- StochAccuUp and StochAccuDown: Show the adjusted %K lines, depending on the upward or downward trend.

- SignalAccu: Displays the corresponding %D signal line, based on a moving average of %K.

Overbought and Oversold Levels (LevelUp and LevelDown):

- LevelUp: Plots a fixed level (default: 70) indicating the overbought threshold.

- LevelDown: Plots another fixed level (default: 30) indicating the oversold threshold.

Interpretation of Results:

- If the %K line (initial or accurate) crosses above the overbought level (LevelUp) for the first time, it signals the birth of an upward trend.

- If %K drops below the oversold level (LevelDown) for the first time, it signals the birth of a downward trend.

- The accurate stochastic adjusts periods to capture trend changes more effectively.

In summary, the indicator provides both traditional and dynamic stochastic analysis, offering better adaptability to market conditions.

On telegram : https://t.me/nimi012 (direct messaging)

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class TheStochv10 : Indicator

{

[Parameter(DefaultValue = 255, Group = "Initial Stoch")]

public int KPeriodInit { get; set; }

[Parameter(DefaultValue = 3, Group = "Initial Stoch")]

public int KSlowingInit { get; set; }

[Parameter(DefaultValue = 34, Group = "Initial Stoch")]

public int DPeriodInit { get; set; }

[Parameter(DefaultValue = MovingAverageType.Weighted, Group = "Initial Stoch")]

public MovingAverageType MaTypeInit { get; set; }

[Parameter(DefaultValue = 9, Group = "Accurate Stoch")]

public int MinPeriodAccu { get; set; }

[Parameter(DefaultValue = 3, Group = "Accurate Stoch")]

public int KSlowingAccu { get; set; }

[Parameter(DefaultValue = 21, Group = "Accurate Stoch")]

public int DPeriodAccu { get; set; }

[Parameter(DefaultValue = MovingAverageType.Weighted, Group = "Accurate Stoch")]

public MovingAverageType MaTypeAccu { get; set; }

[Parameter(DefaultValue = 98, Group = "Start Trend Level Stoch")]

public int TrendStartLevelUp { get; set; }

[Parameter(DefaultValue = 2, Group = "Start Trend Level Stoch")]

public int TrendStartLevelDown { get; set; }

[Parameter(DefaultValue = 70, Group = "OverBuy/Sell Level")]

public int OverBuy { get; set; }

[Parameter(DefaultValue = 30, Group = "OverBuy/Sell Level")]

public int OverSell { get; set; }

[Output("LevelUp", LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Solid)]

public IndicatorDataSeries LevelUp { get; set; }

[Output("LevelDown", LineColor = "Lime", PlotType = PlotType.Line, LineStyle = LineStyle.Solid)]

public IndicatorDataSeries LevelDown { get; set; }

[Output("Stoch Init", LineColor = "Lime", PlotType = PlotType.Line, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries ResultInit { get; set; }

[Output("Signal Init", LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries SingalInit { get; set; }

[Output("StochAccu", LineColor = "Gray", PlotType = PlotType.Line)]

public IndicatorDataSeries StochAccuRes { get; set; }

[Output("StochAccuUp", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine)]

public IndicatorDataSeries StochAccuUp { get; set; }

[Output("StochAccuDown", LineColor = "Red", PlotType = PlotType.DiscontinuousLine)]

public IndicatorDataSeries StochAccuDown { get; set; }

[Output("SiganlAccu", LineColor = "Gold", PlotType = PlotType.DiscontinuousLine)]

public IndicatorDataSeries SignalAccu { get; set; }

private IndicatorDataSeries highData, medData, lowData, res1, res2;

private IndicatorDataSeries highData2, medData2, lowData2;

private MovingAverage kslowInit, dslowInit, kslowAccu, dslowAccu;

private int CountUp;

private int CountDown;

private int indexUp;

private int indexDown;

private bool StartCountUp;

private bool StartCountDown;

protected override void Initialize()

{

highData = CreateDataSeries();

medData = CreateDataSeries();

lowData = CreateDataSeries();

res1 = CreateDataSeries();

res2 = CreateDataSeries();

kslowInit = Indicators.MovingAverage(res1, KSlowingInit, MaTypeInit);

dslowInit = Indicators.MovingAverage(kslowInit.Result, DPeriodInit, MaTypeInit);

kslowAccu = Indicators.MovingAverage(res2, KSlowingAccu, MaTypeAccu);

dslowAccu = Indicators.MovingAverage(kslowAccu.Result, DPeriodAccu, MaTypeAccu);

highData2 = CreateDataSeries();

medData2 = CreateDataSeries();

lowData2 = CreateDataSeries();

CountUp = 0;

CountDown = 0;

StartCountUp = false;

StartCountDown = false;

}

public override void Calculate(int index)

{

highData[index] = (Bars.HighPrices.Last(0) - Bars.LowPrices.Minimum(KPeriodInit)) / (Bars.HighPrices.Maximum(KPeriodInit) - Bars.LowPrices.Minimum(KPeriodInit)) * 100;

medData[index] = (Bars.MedianPrices.Last(0) - Bars.LowPrices.Minimum(KPeriodInit)) / (Bars.HighPrices.Maximum(KPeriodInit) - Bars.LowPrices.Minimum(KPeriodInit)) * 100;

lowData[index] = (Bars.LowPrices.Last(0) - Bars.LowPrices.Minimum(KPeriodInit)) / (Bars.HighPrices.Maximum(KPeriodInit) - Bars.LowPrices.Minimum(KPeriodInit)) * 100;

res1[index] = medData[index];

ResultInit[index] = kslowInit.Result.Last(0);

SingalInit[index] = dslowInit.Result.Last(0);

LevelUp[index] = OverBuy;

LevelDown[index] = OverSell;

if (medData[index] > TrendStartLevelUp)

{

StartCountDown = false;

StartCountUp = true;

}

else if (medData[index] < TrendStartLevelDown)

{

StartCountUp = false;

StartCountDown = true;

}

if (StartCountUp && indexUp < index)

{

CountUp++;

CountDown = 0;

var period = MinPeriodAccu >= CountUp ? MinPeriodAccu : CountUp;

highData2[index] = (Bars.HighPrices.Last(0) - Bars.LowPrices.Minimum(period)) / (Bars.HighPrices.Maximum(period) - Bars.LowPrices.Minimum(period)) * 100;

medData2[index] = (Bars.MedianPrices.Last(0) - Bars.LowPrices.Minimum(period)) / (Bars.HighPrices.Maximum(period) - Bars.LowPrices.Minimum(period)) * 100;

lowData2[index] = (Bars.LowPrices.Last(0) - Bars.LowPrices.Minimum(period)) / (Bars.HighPrices.Maximum(period) - Bars.LowPrices.Minimum(period)) * 100;

res2[index] = lowData2[index];

StochAccuUp[index] = kslowAccu.Result.Last(0);

indexUp = index;

}

else if (StartCountDown && indexDown < index)

{

CountDown++;

CountUp = 0;

var period = MinPeriodAccu >= CountDown ? MinPeriodAccu : CountDown;

highData2[index] = (Bars.HighPrices.Last(0) - Bars.LowPrices.Minimum(period)) / (Bars.HighPrices.Maximum(period) - Bars.LowPrices.Minimum(period)) * 100;

medData2[index] = (Bars.MedianPrices.Last(0) - Bars.LowPrices.Minimum(period)) / (Bars.HighPrices.Maximum(period) - Bars.LowPrices.Minimum(period)) * 100;

lowData2[index] = (Bars.LowPrices.Last(0) - Bars.LowPrices.Minimum(period)) / (Bars.HighPrices.Maximum(period) - Bars.LowPrices.Minimum(period)) * 100;

res2[index] = highData2[index];

StochAccuDown[index] = kslowAccu.Result.Last(0);

indexDown = index;

}

StochAccuRes[index] = kslowAccu.Result.Last(0);

SignalAccu[index] = dslowAccu.Result.Last(0);

}

}

}

YesOrNot

Joined on 10.10.2022 Blocked

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: The Stoch v1.0.algo

- Rating: 0

- Installs: 141

- Modified: 08/05/2024 20:27