Description

cTrader Smart Portfolio Architect

14-Day Refund Option

This systematic approach not only improves investment decision making by relying on rigorous quantitative analysis, but also facilitates more efficient risk management. By diversifying more effectively, investors can aim to achieve an optimal balance between risk and return by selecting highly liquid assets, tailoring their portfolio to their specific investment objectives and risk tolerance.

(OS) Type: Windows & Mac OS

Current version: 1.0.0

Updated: Wednesday, 28 February 2024

Author: Finwalt Trading

https://clickalgo.com/smart-portfolio-architect

Price: £24.99

🚀 Introduction

The "Minimum Correlation Portfolio" strategy is a cutting-edge investment method designed to enhance risk diversification and minimize asset correlation within portfolios, reducing volatility and stabilizing returns. Ideal for algorithmic or manual traders, it facilitates independent probability modeling for market events, significantly lowering risk interdependence. Leveraged through cAlgo, this strategy utilizes optimization algorithms for effective asset analysis and selection, aiming for portfolios resilient to market fluctuations and balanced exposure. Its systematic, data-driven approach not only streamlines investment decisions but also fortifies risk management, enabling investors to finely tune their portfolios according to their risk-return preferences with high liquidity assets. This marks a substantial leap in forex portfolio construction, integrating advanced technology with established investment strategies to optimize market performance.

⚙️ Configuration Parameters

In portfolio optimization using the Simulated Annealing algorithm, defining configuration parameters accurately is crucial for the optimization process's effectiveness and efficiency. Below are the essential configurable parameters for fine-tuning this algorithm, highlighting the unique features of our algorithmic trading application.

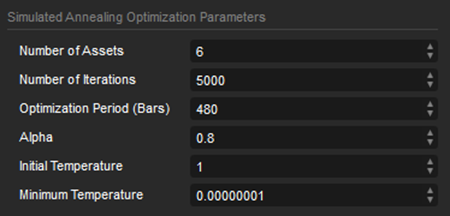

🔄 Simulated Annealing Optimization Parameters

- Number of Assets: Defines the number of assets in the portfolio, with a default of 6, and a range from 4 to 10, allowing customization for specific diversification needs.

- Number of Iterations: Set at a default of 5000, this parameter balances search thoroughness with computational efficiency.

- Look Back Period: Defaulting to 480 bars, this parameter allows adjustments between 100 and 1000 bars to suit various trading styles.

- Alpha: Controls the cooling rate of the algorithm with a default of 0.8, influencing the exploration of the solution space.

- Initial and Minimum Temperature: Sets the start and end points of the cooling process, with an initial temperature of 1.0 and a minimum close to zero.

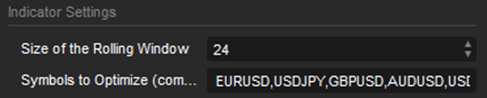

📊 Indicator Settings and Notification Parameter

- Rolling Window Size: Adjusts the calculation window for indicators, with a default of 24 and a range from 3 to 120.

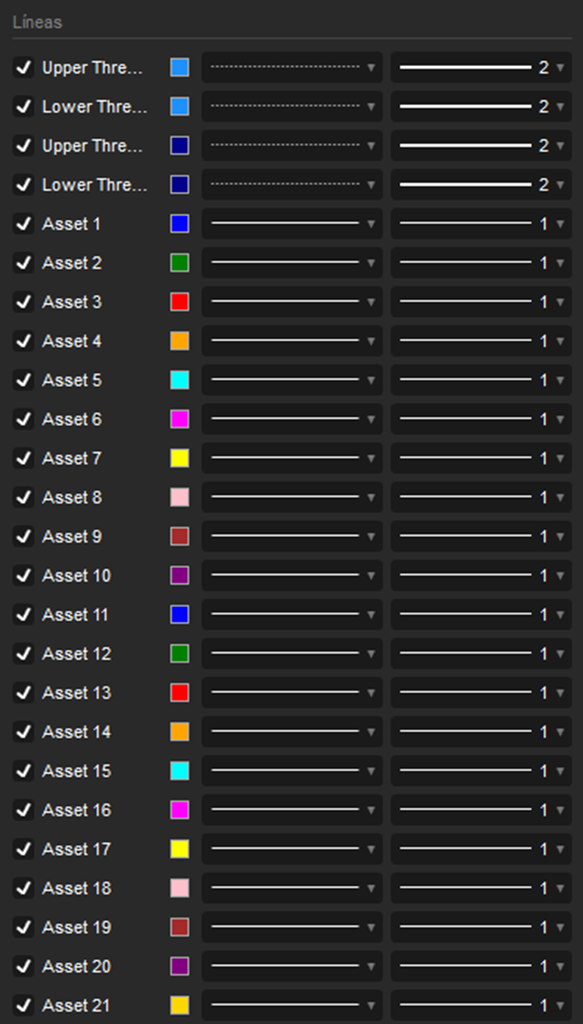

- Symbols To Optimize: Specifies the assets targeted for optimization, enhancing flexibility for various trading strategies.

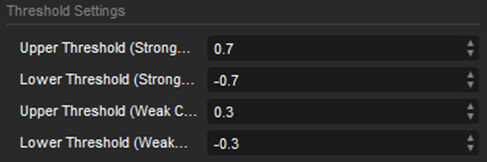

- Correlation Thresholds: Defines parameters for identifying strong and weak asset correlations, aiding in diversified portfolio construction.

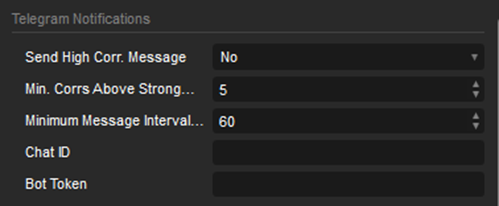

🔔 Telegram Notifications: Manages alerts via Telegram for updates on optimization status and relevant events.

🔧 Operation

- Data Collection: Automates historical price data collection for selected assets, ensuring data integrity for analysis.

- Correlation Calculation: Calculates the correlation matrix using asset closing prices to analyze price movement relationships.

- Portfolio Optimization: Applies optimization algorithms to determine the optimal asset weight combination, minimizing total portfolio correlation.

- Visualization and Reporting: Presents optimization results and implements notification mechanisms for informed decision-making.

🎯 Detailed Explanation of the Objective Function

The objective function aims to optimize the investment portfolio composition to achieve the lowest possible total asset correlation, reducing unsystematic risk through diversification and ensuring effective risk management in portfolio construction.

🛠️ Technical Considerations

- Computational Efficiency: Considers processing capabilities for optimization.

- Data Updating: Emphasizes the need for regular data re-evaluation to adapt to market changes.

- Model Limitations: Acknowledges the reliance on historical data and the importance of ongoing market analysis.

By carefully adjusting asset weights, investors can construct a portfolio capable of better withstanding market turbulence, essential for risk management in portfolio construction.

The author decided to hide the source code.

finwalt.trading

Joined on 21.01.2024

- Distribution: Paid

- Language: C#

- Trading platform: cTrader Automate

- File name: Smart Correlation Architect To Link.algo

- Rating: 0

- Installs: 0

- Modified: 28/02/2024 20:06