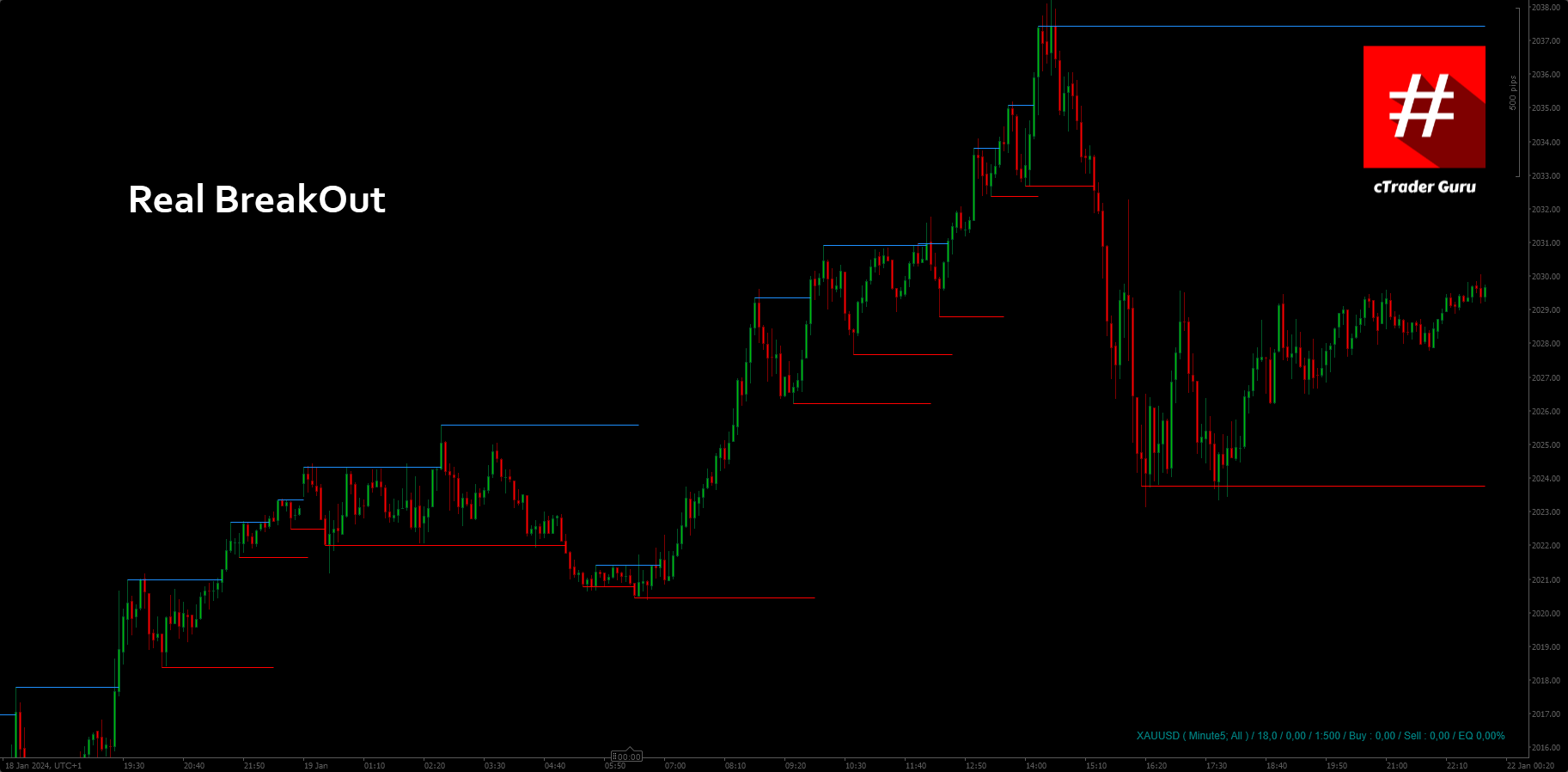

Description

During my teachings aimed at guiding my followers in structuring a breakout, it has come to my attention that they often struggle to find a starting point. Even after thorough explanations of the correct procedures, some continue to encounter difficulties.

To address this challenge, I have developed an indicator that simplifies the process significantly. All it requires is the adjustment of the period value to tailor it to your specific needs. This tool is designed to make the entire process more accessible and enjoyable. I trust it will prove valuable in your learning journey.

using cAlgo.API;

namespace cAlgo

{

[Indicator(AccessRights = AccessRights.None, IsOverlay = true)]

public class RealBreakOut : Indicator

{

#region Identity

public const string NAME = "Real BreakOut";

public const string VERSION = "1.01";

#endregion

#region Parameters

[Parameter("cTrader Guru", DefaultValue = NAME + " (" + VERSION + ") https://ctrader.guru/")]

public string Identity { get; set; }

[Parameter("Period", DefaultValue = 5, MinValue = 3)]

public int Period { get; set; }

[Parameter("Buy", Group = "Colors", DefaultValue = "DodgerBlue")]

public Color BuyColor { get; set; }

[Parameter("Sell", Group = "Colors", DefaultValue = "Red")]

public Color SellColor { get; set; }

#endregion

#region Property

private const string Sign = "TBO";

private TrendLevel LastBreakOutBuy { get; set; }

private TrendLevel LastBreakOutSell { get; set; }

private int LastIndex { get; set; }

#endregion

#region Indicator events

protected override void Initialize()

{

LastBreakOutBuy = null;

LastBreakOutSell = null;

LastIndex = -1;

}

public override void Calculate(int index)

{

// --> I need a sufficient number of bars

if (index < Period) return;

int A = index - Period;

int B = index;

// --> I check initialization

if (LastBreakOutBuy == null)

{

if (IsReadyForBuy(index, Period)) LastBreakOutBuy = new TrendLevel

{

Name = string.Format("{0}-Buy-{1}", Sign, A),

IndexA = A,

IndexB = B,

Price = Bars.HighPrices[A]

};

}

if (LastBreakOutSell == null)

{

if (IsReadyForSell(index, Period)) LastBreakOutSell = new TrendLevel

{

Name = string.Format("{0}-Sell-{1}", Sign, A),

IndexA = A,

IndexB = B,

Price = Bars.LowPrices[A]

};

}

// --> Draw trendlines

if(LastBreakOutBuy != null) LastBreakOutBuy.IndexB = B;

if(LastBreakOutSell != null)LastBreakOutSell.IndexB = B;

DrawTrendLevel(LastBreakOutBuy, BuyColor);

DrawTrendLevel(LastBreakOutSell, SellColor);

// --> I check for breakout

if (LastIndex != index)

{

LastIndex = index;

OnBar(index);

}

}

#endregion

#region Classes

private class TrendLevel

{

public string Name { get; set; }

public int IndexA { get; set; }

public int IndexB { get; set; }

public double Price { get; set; }

}

#endregion

#region Methods

private void OnBar(int index)

{

int B = index - 1;

int C = index - 2;

// --> check breakout buy

if (LastBreakOutBuy != null)

{

if (Bars.ClosePrices[B] > LastBreakOutBuy.Price)

{

LastBreakOutBuy.IndexB = B;

DrawTrendLevel(LastBreakOutBuy, BuyColor);

if (LastBreakOutSell != null)

{

int vPeriod = LastBreakOutBuy.IndexB - LastBreakOutBuy.IndexA - 1;

int newindexA = C;

for (int i = 0; i < vPeriod; i++)

{

if (Bars.LowPrices[C - i] < Bars.LowPrices[newindexA]) newindexA = C - i;

}

if (Bars.LowPrices[newindexA] > LastBreakOutSell.Price)

{

LastBreakOutSell = new TrendLevel

{

Name = string.Format("{0}-Sell-{1}", Sign, newindexA),

IndexA = newindexA,

IndexB = index,

Price = Bars.LowPrices[newindexA]

};

DrawTrendLevel(LastBreakOutSell, SellColor);

}

}

LastBreakOutBuy = null;

}

}

if (LastBreakOutSell != null)

{

if (Bars.ClosePrices[B] < LastBreakOutSell.Price)

{

LastBreakOutSell.IndexB = B;

DrawTrendLevel(LastBreakOutSell, SellColor);

if (LastBreakOutBuy != null)

{

int vPeriod = LastBreakOutSell.IndexB - LastBreakOutSell.IndexA - 1;

int newindexA = C;

for (int i = 0; i < vPeriod; i++)

{

if (Bars.HighPrices[C - i] > Bars.HighPrices[newindexA]) newindexA = C - i;

}

if (Bars.HighPrices[newindexA] < LastBreakOutBuy.Price)

{

LastBreakOutBuy = new TrendLevel

{

Name = string.Format("{0}-Buy-{1}", Sign, newindexA),

IndexA = newindexA,

IndexB = index,

Price = Bars.HighPrices[newindexA]

};

DrawTrendLevel(LastBreakOutBuy, BuyColor);

}

}

LastBreakOutSell = null;

}

}

}

private void DrawTrendLevel(TrendLevel tLine, Color color)

{

if (tLine == null) return;

Chart.DrawTrendLine(tLine.Name, tLine.IndexA, tLine.Price, tLine.IndexB, tLine.Price, color, 1);

}

private bool IsReadyForBuy(int index, int period)

{

bool result = true;

for (int i = 0; i < period; i++)

{

if (Bars.ClosePrices[index - i] > Bars.HighPrices[index - period])

{

result = false;

break;

}

}

return result;

}

private bool IsReadyForSell(int index, int period)

{

bool result = true;

for (int i = 0; i < period; i++)

{

if (Bars.ClosePrices[index - i] < Bars.LowPrices[index - period])

{

result = false;

break;

}

}

return result;

}

#endregion

}

}

ctrader.guru

Joined on 19.07.2018

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Real BreakOut.algo

- Rating: 5

- Installs: 1380

- Modified: 24/01/2024 08:15

Comments

It is an excellent card. It seems that this method is good for reveral transactions until breakout so that orders can be placed at those points.

I hope you can continue to work until the trading robot is in the support and resistance, it will do the transactions reveral in the zone and only when these areas are broken robot open breakout pos, I am not very familiar with the indicator algorithm. buo i hop you can do it.

using System;

using cAlgo.API;

namespace cAlgo.Robots

{

[Robot("DRKHASHIX", AccessRights = AccessRights.None)]

public class DRKHASHIX : Robot

{

[Parameter("Lot Size", Group = "Volume", DefaultValue = 0.01, MinValue = 0.00001, MaxValue = 100, Step = 0.00001)]

public double LotSize { get; set; }

[Parameter("Stop Loss (pips)", Group = "Risk Management", DefaultValue = 50, MinValue = 1)]

public int StopLossInPips { get; set; }

[Parameter("Take Profit (pips)", Group = "Risk Management", DefaultValue = 50, MinValue = 1)]

public int TakeProfitInPips { get; set; }

[Parameter("Period", DefaultValue = 10, MinValue = 3)]

public int Period { get; set; }

[Parameter("Buy", Group = "Colors", DefaultValue = "DodgerBlue")]

public Color BuyColor { get; set; }

[Parameter("Sell", Group = "Colors", DefaultValue = "Red")]

public Color SellColor { get; set; }

private const string Sign = "TBO";

private TrendLevel LastBreakOutBuy { get; set; }

private TrendLevel LastBreakOutSell { get; set; }

private int LastIndex { get; set; }

private bool isPositionOpen = false;

protected override void OnStart()

{

LastBreakOutBuy = null;

LastBreakOutSell = null;

LastIndex = -1;

}

protected override void OnBar()

{

int index = MarketSeries.Close.Count - 1;

int signal = SupportResistanceSignal(index);

if (!isPositionOpen && signal != -1)

{

TradeType tradeType = (signal == 0) ? TradeType.Buy : TradeType.Sell;

double volume = Symbol.NormalizeVolumeInUnits(Symbol.QuantityToVolumeInUnits(LotSize));

var position = ExecuteMarketOrder(tradeType, Symbol, volume, "SupportResistanceBot", StopLossInPips, TakeProfitInPips);

if (position != null)

{

isPositionOpen = true;

}

}

}

protected override void OnPositionClosed(Position position)

{

isPositionOpen = false;

}

private int SupportResistanceSignal(int index)

{

if (index < Period) return -1;

int A = index - Period;

int B = index;

if (LastBreakOutBuy == null)

{

if (ReadyResistance(index, Period))

LastBreakOutBuy = new TrendLevel

{

Name = string.Format("{0}-Buy-{1}", Sign, A),

IndexA = A,

IndexB = B,

Price = Bars.HighPrices[A]

};

}

if (LastBreakOutSell == null)

{

if (ReadySupport(index, Period))

LastBreakOutSell = new TrendLevel

{

Name = string.Format("{0}-Sell-{1}", Sign, A),

IndexA = A,

IndexB = B,

Price = Bars.LowPrices[A]

};

}

if (LastBreakOutBuy != null) LastBreakOutBuy.IndexB = B;

if (LastBreakOutSell != null) LastBreakOutSell.IndexB = B;

DrawTrendLevel(LastBreakOutBuy, BuyColor);

DrawTrendLevel(LastBreakOutSell, SellColor);

int signal = -1;

if (LastIndex != index)

{

LastIndex = index;

signal = OnBarforindicator(index);

}

return signal;

}

private int OnBarforindicator(int index)

{

int B = index - 1;

int C = index - 2;

int signal = -1;

if (LastBreakOutBuy != null)

{

if (Bars.ClosePrices[B] > LastBreakOutBuy.Price)

{

LastBreakOutBuy.IndexB = B;

DrawTrendLevel(LastBreakOutBuy, BuyColor);

if (LastBreakOutSell != null)

{

int vPeriod = LastBreakOutBuy.IndexB - LastBreakOutBuy.IndexA - 1;

int newindexA = C;

for (int i = 0; i < vPeriod; i++)

{

if (Bars.LowPrices[C - i] < Bars.LowPrices[newindexA]) newindexA = C - i;

}

if (Bars.LowPrices[newindexA] > LastBreakOutSell.Price)

{

LastBreakOutSell = new TrendLevel

{

Name = string.Format("{0}-Sell-{1}", Sign, newindexA),

IndexA = newindexA,

IndexB = index,

Price = Bars.LowPrices[newindexA]

};

DrawTrendLevel(LastBreakOutSell, SellColor);

signal = 1; // Sell signal

}

}

LastBreakOutBuy = null;

}

}

if (LastBreakOutSell != null)

{

if (Bars.ClosePrices[B] < LastBreakOutSell.Price)

{

LastBreakOutSell.IndexB = B;

DrawTrendLevel(LastBreakOutSell, SellColor);

if (LastBreakOutBuy != null)

{

int vPeriod = LastBreakOutSell.IndexB - LastBreakOutSell.IndexA - 1;

int newindexA = C;

for (int i = 0; i < vPeriod; i++)

{

if (Bars.HighPrices[C - i] > Bars.HighPrices[newindexA]) newindexA = C - i;

}

if (Bars.HighPrices[newindexA] < LastBreakOutBuy.Price)

{

LastBreakOutBuy = new TrendLevel

{

Name = string.Format("{0}-Buy-{1}", Sign, newindexA),

IndexA = newindexA,

IndexB = index,

Price = Bars.HighPrices[newindexA]

};

DrawTrendLevel(LastBreakOutBuy, BuyColor);

signal = 0; // Buy signal

}

}

LastBreakOutSell = null;

}

}

return signal;

}

private void DrawTrendLevel(TrendLevel tLine, Color color)

{

if (tLine == null) return;

Chart.DrawTrendLine(tLine.Name, tLine.IndexA, tLine.Price, tLine.IndexB, tLine.Price, color, 1);

}

private bool ReadyResistance(int index, int period)

{

bool result = true;

for (int i = 0; i < period; i++)

{

if (Bars.ClosePrices[index - i] > Bars.HighPrices[index - period])

{

result = false;

break;

}

}

return result;

}

private bool ReadySupport(int index, int period)

{

bool result = true;

for (int i = 0; i < period; i++)

{

if (Bars.ClosePrices[index - i] < Bars.LowPrices[index - period])

{

result = false;

break;

}

}

return result;

}

private class TrendLevel

{

public string Name { get; set; }

public int IndexA { get; set; }

public int IndexB { get; set; }

public double Price { get; set; }

}

}

}