Description

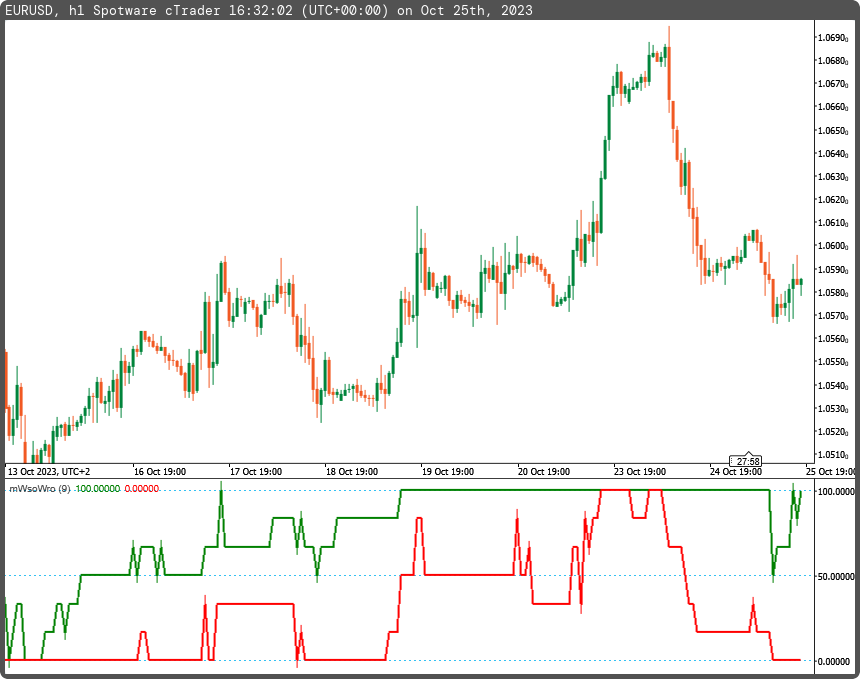

This custom oscillator is based on the 'Automated Support And Resistance' concept from an article by Mel Widner published in TASC.

The indicator consists of two components: the WSO (Widner Support Oscillator) and the WRO (Widner Resistance Oscillator).

The WSO compares the current Close with the six most recent support levels. Values range from 0 to 100. WSO = 0 indicates that the Close is below all six support levels, while WSO = 100 indicates that the current Close is above all six support levels. Changes in WSO indicate shifts in support, either breaking an old level or establishing a new one.

A similar concept applies to the WRO. The WRO compares the current Close with the six most recent resistance levels. Values also range from 0 to 100. WRO = 0 means that the Close is below all six resistance levels, and WRO = 100 means that the current Close is above all six resistance levels. Changes in WRO indicate changes in resistance, which can involve breaking an old level or establishing a new one.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Levels(0, 50, 100)]

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class mWsoWro : Indicator

{

[Parameter("Periods (9)", DefaultValue = 9)]

public int inpPeriod { get; set; }

[Output("WSO Support", LineColor = "Green", PlotType = PlotType.Line, Thickness = 2)]

public IndicatorDataSeries outWSO { get; set; }

[Output("WRO Resistance", LineColor = "Red", PlotType = PlotType.Line, Thickness = 2)]

public IndicatorDataSeries outWRO { get; set; }

private IndicatorDataSeries _wso, _wro;

private double[] _min, _max;

private int centerid;

protected override void Initialize()

{

_min = new double[6];

_max = new double[6];

_wso = CreateDataSeries();

_wro = CreateDataSeries();

centerid = Convert.ToInt16((inpPeriod - 1) / 2); //4

}

public override void Calculate(int i)

{

if(Bars.LowPrices.Minimum(inpPeriod) == Bars.LowPrices[i-centerid])

{

_min[5] = _min[4];

_min[4] = _min[3];

_min[3] = _min[2];

_min[2] = _min[1];

_min[1] = _min[0];

_min[0] = Bars.LowPrices[i-centerid];

}

if(Bars.HighPrices.Maximum(inpPeriod) == Bars.HighPrices[i-centerid])

{

_max[5] = _max[4];

_max[4] = _max[3];

_max[3] = _max[2];

_max[2] = _max[1];

_max[1] = _max[0];

_max[0] = Bars.HighPrices[i-centerid];

}

_wso[i] = 100 * (1 -

( Sigmo(_min[0] / Bars.ClosePrices[i])

+ Sigmo(_min[1] / Bars.ClosePrices[i])

+ Sigmo(_min[2] / Bars.ClosePrices[i])

+ Sigmo(_min[3] / Bars.ClosePrices[i])

+ Sigmo(_min[4] / Bars.ClosePrices[i])

+ Sigmo(_min[5] / Bars.ClosePrices[i])

) / 6.0);

_wro[i] = 100 * (1 -

( Sigmo(_max[0] / Bars.ClosePrices[i])

+ Sigmo(_max[1] / Bars.ClosePrices[i])

+ Sigmo(_max[2] / Bars.ClosePrices[i])

+ Sigmo(_max[3] / Bars.ClosePrices[i])

+ Sigmo(_max[4] / Bars.ClosePrices[i])

+ Sigmo(_max[5] / Bars.ClosePrices[i])

) / 6.0);

outWSO[i] = _wso[i];

outWRO[i] = _wro[i];

}

private double Sigmo(double inValue)

{

return(inValue >= 1.0 ? 1 : 0);

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mWsoWro.algo

- Rating: 5

- Installs: 708

- Modified: 25/10/2023 16:36

http://traders.com/documentation/feedbk_docs/1998/05/Abstracts_new/Widner/WIDMER.html