Description

The Median Renko Bars Indicator is a modified version of traditional Renko bars, designed to provide traders with a unique perspective on price movements. While similar to regular Renko charts in many ways, Median Renko bars differ in their approach to identifying reversals and presenting price action. This documentation will provide you with a clear understanding of Median Renko bars, their advantages, and how to use them effectively in your trading strategy.

Key Features:

Price-Centric Approach: Like traditional Renko charts, Median Renko bars focus solely on price movements, disregarding time. This means that each Median Renko bar is constructed based on a predefined price range, and new bars are formed only when this range is exceeded.

Midpoint Reversals: The primary distinction of Median Renko bars lies in how they define reversals. Instead of requiring price to move a fixed number of pips from the previous closing Renko brick, Median Renko bars consider the midpoint of price as a reversal point. This results in a more dynamic and potentially smoother representation of price movements.

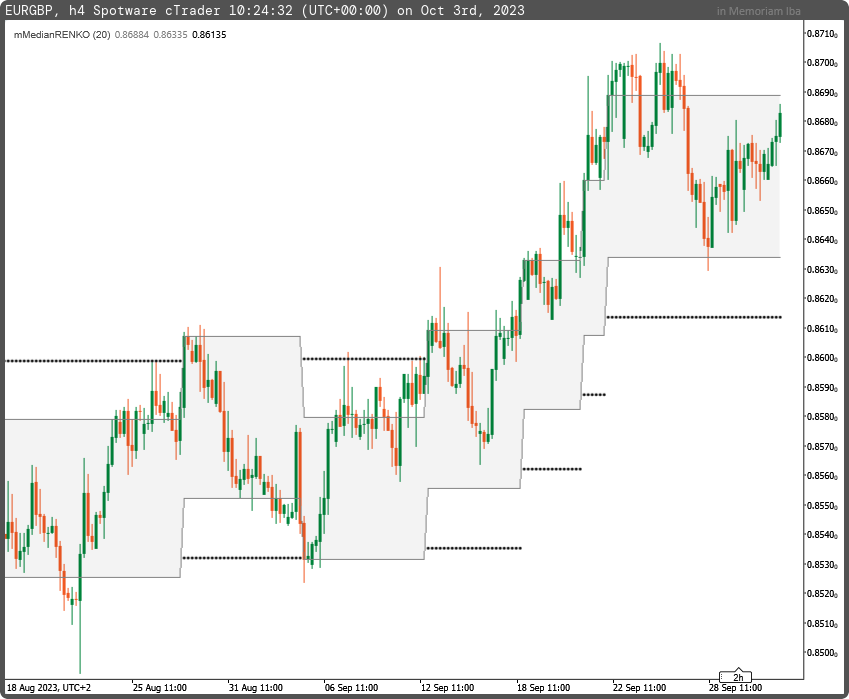

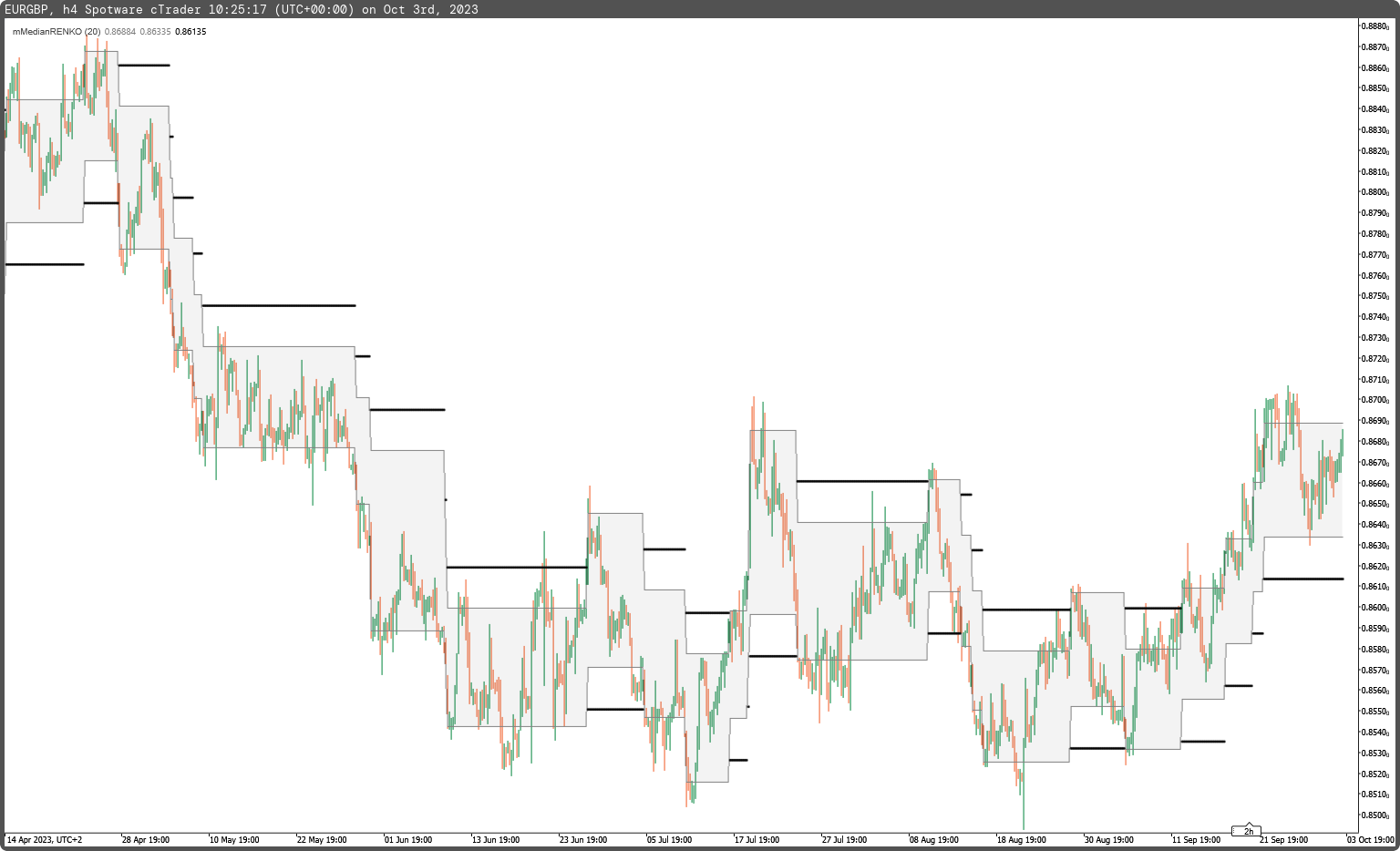

In the chart comparison, the traditional Renko Chart is displayed on the left, while the Median Renko Chart with a 50% retracement is shown on the right. The Median Renko bar is printed when price reverses from the 50% price point of the previous brick and closes 20 pips below or above.

Advantages of Median Renko Bars:

Smoother Price Movement: Median Renko charts often depict smoother price movements compared to traditional Renko charts. They tend to have fewer pullbacks with opposite-colored bricks and make it easier to recognize price trends.

Enhanced Trend Visibility: Median Renko charts are excellent for identifying and following established trends. Trends become more visible and easy to determine, aiding traders in making informed trading decisions.

Trend Reversal Clarity: Median Renko charts make it easier to spot trend reversals, providing valuable insights for both short-term and long-term traders.

Is Median Renko Better?

While Median Renko charts offer distinct advantages in terms of trend visibility and smoother price representation, whether they are "better" than traditional Renko charts depends on your trading style and objectives. Traders who prioritize trend following and clear trend reversal signals often find Median Renko charts to be a valuable tool.

Conclusion:

Median Renko bars provide traders with an alternative perspective on price movements, offering smoother price representation and enhanced trend visibility. Whether you choose to use Median Renko bars or traditional Renko charts depends on your trading preferences and objectives. As with any trading tool, it is advisable to thoroughly test Median Renko bars in a demo environment before incorporating them into your live trading strategy.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Cloud("Top", "Bottom", FirstColor = "Black", SecondColor = "Green", Opacity = 0.05)]

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class mMedianRENKO : Indicator

{

[Parameter("BoxSize in pips (20)", DefaultValue = 20)]

public double inpBoxSize { get; set; }

[Output("Top", LineColor = "Gray", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outTop { get; set; }

[Output("Bottom", LineColor = "Gray", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outBottom { get; set; }

[Output("Reversal", LineColor = "Black", PlotType = PlotType.Points, LineStyle = LineStyle.Solid, Thickness = 2)]

public IndicatorDataSeries outReversal { get; set; }

private IndicatorDataSeries _top, _bottom, _reversal;

private double _boxsize;

protected override void Initialize()

{

_boxsize = inpBoxSize * Symbol.PipSize;

_top = CreateDataSeries();

_bottom = CreateDataSeries();

_reversal = CreateDataSeries();

}

public override void Calculate(int i)

{

_top[i] = i>1 ? _top[i-1] : Bars.ClosePrices[i];

_bottom[i] = i>1 ? _bottom[i-1] : Bars.ClosePrices[i] - _boxsize;

_reversal[i] = i>1 ? _reversal[i-1] : Bars.ClosePrices[i] - _boxsize * 2;

if(Bars.ClosePrices[i] > _top[i] + _boxsize)

{

_top[i] = Bars.ClosePrices[i];

_bottom[i] = i>1 ? (_top[i-1] + _bottom[i-1]) / 2 : Bars.TypicalPrices[i];

_reversal[i] = _bottom[i] - _boxsize;

}

if(Bars.ClosePrices[i] < _bottom[i] - _boxsize)

{

_top[i] = i>1 ? (_top[i-1] + _bottom[i-1]) / 2 : Bars.TypicalPrices[i];

_bottom[i] = Bars.ClosePrices[i];

_reversal[i] = _top[i] + _boxsize;

}

outTop[i] = _top[i];

outBottom[i] = _bottom[i];

outReversal[i] = _reversal[i];

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mMedianRENKO.algo

- Rating: 5

- Installs: 746

- Modified: 03/10/2023 10:29