Description

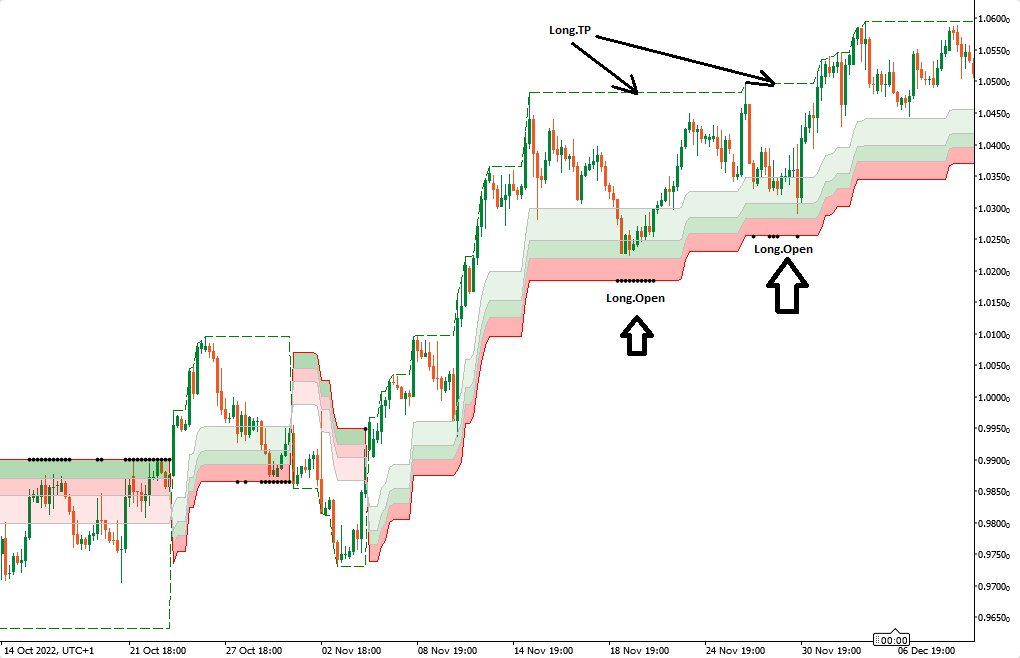

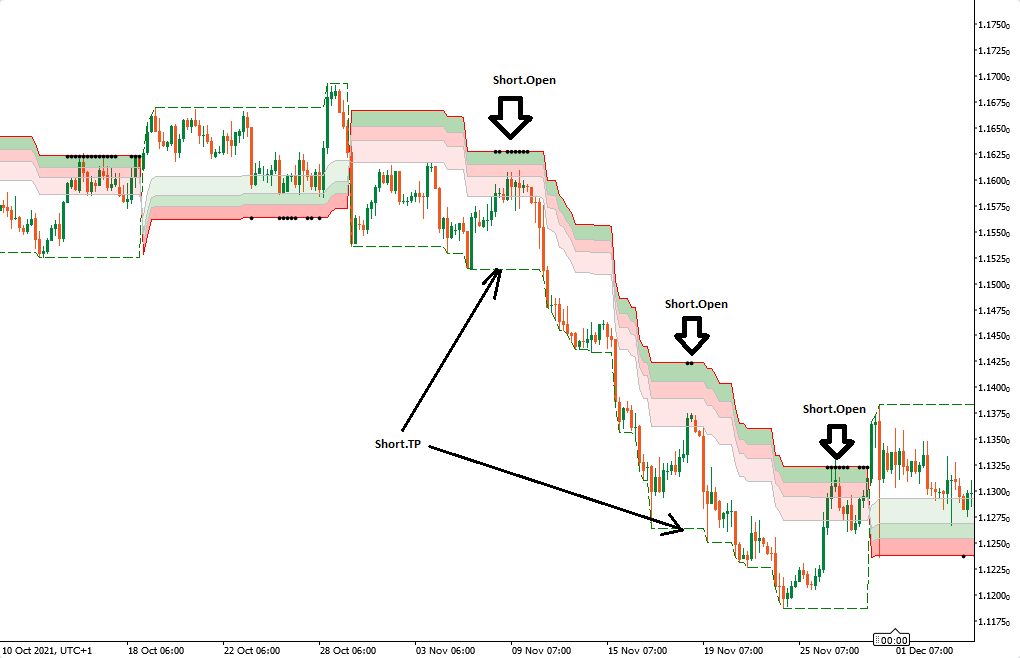

The general idea of using SwingArms is to provide a visual confirmation of a trend change, define of trailing price and entering zone.

This indicator and FIR Slope generate useful signals to trade

using System;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Cloud("ZoneUp1", "ZoneDn1", FirstColor = "Green", SecondColor = "Red", Opacity = 0.1)]

[Cloud("ZoneUp2", "ZoneDn2", FirstColor = "Green", SecondColor = "Red", Opacity = 0.2)]

[Cloud("ZoneUp3", "ZoneDn3", FirstColor = "Green", SecondColor = "Red", Opacity = 0.3)]

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class mSwingArmATRtrend : Indicator

{

[Parameter("Trial Type (modified)", DefaultValue = enumTrialType.Modified)]

public enumTrialType inpTrailType { get; set; }

[Parameter("ATR Period (26)", DefaultValue = 28)]

public int inpPeriodATR { get; set; }

[Parameter("ATR Factor (5)", DefaultValue = 5)]

public int inpFactorATR { get; set; }

[Parameter("Show Fib (true)", DefaultValue = true)]

public bool inpShowFib { get; set; }

[Parameter("Fib Level 1 (61.8)", DefaultValue = 61.8)]

public double inpFibLevel1 { get; set; }

[Parameter("Fib Level 2 (78.6)", DefaultValue = 78.6)]

public double inpFibLevel2 { get; set; }

[Parameter("Fib Level 3 (88.6)", DefaultValue = 88.6)]

public double inpFibLevel3 { get; set; }

[Output("Extremum", LineColor = "Green", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Lines, Thickness = 1)]

public IndicatorDataSeries outExtremum { get; set; }

[Output("TrailingStop", LineColor = "Red", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outTrail { get; set; }

[Output("Level 1", LineColor = "Silver", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outLevel1 { get; set; }

[Output("Level 2", LineColor = "Silver", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outLevel2 { get; set; }

[Output("Level 3", LineColor = "Silver", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outLevel3 { get; set; }

[Output("ZoneUp1", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outZoneUp1 { get; set; }

[Output("ZoneDn1", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outZoneDn1 { get; set; }

[Output("ZoneUp2", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outZoneUp2 { get; set; }

[Output("ZoneDn2", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outZoneDn2 { get; set; }

[Output("ZoneUp3", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outZoneUp3 { get; set; }

[Output("ZoneDn3", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outZoneDn3 { get; set; }

[Output("OpenLong trigger", LineColor = "Black", PlotType = PlotType.Points, Thickness = 3)]

public IndicatorDataSeries outLongOpen { get; set; }

[Output("OpenShort trigger", LineColor = "Black", PlotType = PlotType.Points, Thickness = 3)]

public IndicatorDataSeries outShortOpen { get; set; }

private MovingAverage _no, _nh, _nl, _nc;

private IndicatorDataSeries _href, _lref, _hilo, _range, _trueRange, _wild, _loss, _rawup, _rawdn, _trendup, _trenddn, _trend, _trail, _extremum, _level1, _level2, _level3;

private MovingAverage _smoothrange;

protected override void Initialize()

{

_no = Indicators.MovingAverage(Bars.OpenPrices, 1, MovingAverageType.Simple);

_nh = Indicators.MovingAverage(Bars.HighPrices, 1, MovingAverageType.Simple);

_nl = Indicators.MovingAverage(Bars.LowPrices, 1, MovingAverageType.Simple);

_nc = Indicators.MovingAverage(Bars.ClosePrices, 1, MovingAverageType.Simple);

_href = CreateDataSeries();

_lref = CreateDataSeries();

_range = CreateDataSeries();

_smoothrange = Indicators.MovingAverage(_range, inpPeriodATR, MovingAverageType.Simple);

_hilo = CreateDataSeries();

_trueRange = CreateDataSeries();

_wild = CreateDataSeries();

_loss = CreateDataSeries();

_rawup = CreateDataSeries();

_rawdn = CreateDataSeries();

_trendup = CreateDataSeries();

_trenddn = CreateDataSeries();

_trend = CreateDataSeries();

_trail = CreateDataSeries();

_extremum = CreateDataSeries();

_level1 = CreateDataSeries();

_level2 = CreateDataSeries();

_level3 = CreateDataSeries();

}

public override void Calculate(int i)

{

_href[i] = _nl.Result[i] <= _nh.Result[i-1] ? _nh.Result[i] - _nc.Result[i-1] : (_nh.Result[i] - _nc.Result[i-1]) - 0.5 * (_nl.Result[i] - _nh.Result[i-1]);

_lref[i] = _nh.Result[i] >= _nl.Result[i-1] ? _nc.Result[i-1] - _nl.Result[i] : (_nc.Result[i] - _nl.Result[i-1]) - 0.5 * (_nl.Result[i-1] - _nh.Result[i]);

_range[i] = _nh.Result[i] - _nl.Result[i];

_hilo[i] = Math.Min(_nh.Result[i] - _nl.Result[i], 1.5 * (i>inpPeriodATR ? _smoothrange.Result[i] : _range[i]));

_trueRange[i] = inpTrailType == enumTrialType.Modified ? Math.Max(_hilo[i], Math.Max(_href[i], _lref[i])) :

Math.Max(_nh.Result[i] - _nl.Result[i], Math.Max(Math.Abs(_nh.Result[i] - _nc.Result[i-1]), Math.Abs(_nl.Result[i] - _nc.Result[i-1])));

_wild[i] = i>1 ? (_wild[i-1] + (_trueRange[i] - _wild[i-1]) / inpPeriodATR) : 0;

_loss[i] = inpFactorATR * _wild[i];

_rawup[i] = _nc.Result[i] - _loss[i];

_rawdn[i] = _nc.Result[i] + _loss[i];

_trendup[i] = i>1 && _nc.Result[i-1] > _trendup[i-1] ? Math.Max(_rawup[i], _trendup[i-1]) : _rawup[i];

_trenddn[i] = i>1 && _nc.Result[i-1] < _trenddn[i-1] ? Math.Min(_rawdn[i], _trenddn[i-1]) : _rawdn[i];

_trend[i] = _nc.Result[i] > _trenddn[i-1] ? +1 : _nc.Result[i] < _trendup[i-1]? -1 : (i>1 ? _trend[i-1] : +1);

_trail[i] = _trend[i] == +1 ? _trendup[i] : _trenddn[i];

_extremum[i] = i>1 && _trend[i-1] != +1 && _trend[i] == +1 ? _nh.Result[i]

: i>1 && _trend[i-1] != -1 && _trend[i] == -1 ? _nl.Result[i]

: i>1 && _trend[i] == +1 ? Math.Max(_extremum[i-1], _nh.Result[i])

: i>1 && _trend[i] == -1 ? Math.Min(_extremum[i-1], _nl.Result[i])

: _extremum[i-1];

_level1[i] = _extremum[i] + (_trail[i] - _extremum[i]) * inpFibLevel1 / 100;

_level2[i] = _extremum[i] + (_trail[i] - _extremum[i]) * inpFibLevel2 / 100;

_level3[i] = _extremum[i] + (_trail[i] - _extremum[i]) * inpFibLevel3 / 100;

outTrail[i] = _trail[i];

outExtremum[i] = _extremum[i];

outLevel1[i] = _level1[i];

outLevel2[i] = _level2[i];

outLevel3[i] = _level3[i];

outZoneUp1[i] = _level1[i];

outZoneDn1[i] = _level2[i];

outZoneUp2[i] = _level2[i];

outZoneDn2[i] = _level3[i];

outZoneUp3[i] = _trail[i];

outZoneDn3[i] = _level3[i];

outLongOpen[i] = _trend[i]==+1 && Bars.ClosePrices[i] < _level1[i] ? _trail[i] : double.NaN;

outShortOpen[i] = _trend[i]==-1 && Bars.ClosePrices[i] > _level1[i] ? _trail[i] : double.NaN;

}

}

public enum enumTrialType

{

Modified,

UnModified

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mSwingArmATRtrend.algo

- Rating: 5

- Installs: 3976

- Modified: 14/01/2023 22:06

Comments

using System; using cAlgo.API; using cAlgo.API.Collections; using cAlgo.API.Indicators; using cAlgo.API.Internals; namespace cAlgo { [Cloud("ZoneUp1", "ZoneDn1", FirstColor = "Green", SecondColor = "Red", Opacity = 0.1)] [Cloud("ZoneUp2", "ZoneDn2", FirstColor = "Green", SecondColor = "Red", Opacity = 0.2)] [Cloud("ZoneUp3", "ZoneDn3", FirstColor = "Green", SecondColor = "Red", Opacity = 0.3)] [Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class mSwingArmATRtrend : Indicator { [Parameter("Trial Type (modified)", DefaultValue = enumTrialType.Modified)] public enumTrialType inpTrailType { get; set; } [Parameter("ATR Period (26)", DefaultValue = 28)] public int inpPeriodATR { get; set; } [Parameter("ATR Factor (5)", DefaultValue = 5)] public int inpFactorATR { get; set; } [Parameter("Show Fib (true)", DefaultValue = true)] public bool inpShowFib { get; set; } [Parameter("Fib Level 1 (61.8)", DefaultValue = 61.8)] public double inpFibLevel1 { get; set; } [Parameter("Fib Level 2 (78.6)", DefaultValue = 78.6)] public double inpFibLevel2 { get; set; } [Parameter("Fib Level 3 (88.6)", DefaultValue = 88.6)] public double inpFibLevel3 { get; set; } [Output("Extremum", LineColor = "Green", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Lines, Thickness = 1)] public IndicatorDataSeries outExtremum { get; set; } [Output("TrailingStop", LineColor = "Red", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outTrail { get; set; } [Output("Level 1", LineColor = "Silver", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outLevel1 { get; set; } [Output("Level 2", LineColor = "Silver", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outLevel2 { get; set; } [Output("Level 3", LineColor = "Silver", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outLevel3 { get; set; } [Output("ZoneUp1", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outZoneUp1 { get; set; } [Output("ZoneDn1", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outZoneDn1 { get; set; } [Output("ZoneUp2", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outZoneUp2 { get; set; } [Output("ZoneDn2", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outZoneDn2 { get; set; } [Output("ZoneUp3", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outZoneUp3 { get; set; } [Output("ZoneDn3", LineColor = "Transparent", LineStyle = LineStyle.Solid, Thickness = 1)] public IndicatorDataSeries outZoneDn3 { get; set; } [Output("OpenLong trigger", LineColor = "Black", PlotType = PlotType.Points, Thickness = 3)] public IndicatorDataSeries outLongOpen { get; set; } [Output("OpenShort trigger", LineColor = "Black", PlotType = PlotType.Points, Thickness = 3)] public IndicatorDataSeries outShortOpen { get; set; } private MovingAverage _no, _nh, _nl, _nc; private IndicatorDataSeries _href, _lref, _hilo, _range, _trueRange, _wild, _loss, _rawup, _rawdn, _trendup, _trenddn, _trend, _trail, _extremum, _level1, _level2, _level3; private MovingAverage _smoothrange; protected override void Initialize() { _no = Indicators.MovingAverage(Bars.OpenPrices, 1, MovingAverageType.Simple); _nh = Indicators.MovingAverage(Bars.HighPrices, 1, MovingAverageType.Simple); _nl = Indicators.MovingAverage(Bars.LowPrices, 1, MovingAverageType.Simple); _nc = Indicators.MovingAverage(Bars.ClosePrices, 1, MovingAverageType.Simple); _href = CreateDataSeries(); _lref = CreateDataSeries(); _range = CreateDataSeries(); _smoothrange = Indicators.MovingAverage(_range, inpPeriodATR, MovingAverageType.Simple); _hilo = CreateDataSeries(); _trueRange = CreateDataSeries(); _wild = CreateDataSeries(); _loss = CreateDataSeries(); _rawup = CreateDataSeries(); _rawdn = CreateDataSeries(); _trendup = CreateDataSeries(); _trenddn = CreateDataSeries(); _trend = CreateDataSeries(); _trail = CreateDataSeries(); _extremum = CreateDataSeries(); _level1 = CreateDataSeries(); _level2 = CreateDataSeries(); _level3 = CreateDataSeries(); } public override void Calculate(int i) { _href[i] = _nl.Result[i] <= _nh.Result[i-1] ? _nh.Result[i] - _nc.Result[i-1] : (_nh.Result[i] - _nc.Result[i-1]) - 0.5 * (_nl.Result[i] - _nh.Result[i-1]); _lref[i] = _nh.Result[i] >= _nl.Result[i-1] ? _nc.Result[i-1] - _nl.Result[i] : (_nc.Result[i] - _nl.Result[i-1]) - 0.5 * (_nl.Result[i-1] - _nh.Result[i]); _range[i] = _nh.Result[i] - _nl.Result[i]; _hilo[i] = Math.Min(_nh.Result[i] - _nl.Result[i], 1.5 * (i>inpPeriodATR ? _smoothrange.Result[i] : _range[i])); _trueRange[i] = inpTrailType == enumTrialType.Modified ? Math.Max(_hilo[i], Math.Max(_href[i], _lref[i])) : Math.Max(_nh.Result[i] - _nl.Result[i], Math.Max(Math.Abs(_nh.Result[i] - _nc.Result[i-1]), Math.Abs(_nl.Result[i] - _nc.Result[i-1]))); _wild[i] = i>1 ? (_wild[i-1] + (_trueRange[i] - _wild[i-1]) / inpPeriodATR) : 0; _loss[i] = inpFactorATR * _wild[i]; _rawup[i] = _nc.Result[i] - _loss[i]; _rawdn[i] = _nc.Result[i] + _loss[i]; _trendup[i] = i>1 && _nc.Result[i-1] > _trendup[i-1] ? Math.Max(_rawup[i], _trendup[i-1]) : _rawup[i]; _trenddn[i] = i>1 && _nc.Result[i-1] < _trenddn[i-1] ? Math.Min(_rawdn[i], _trenddn[i-1]) : _rawdn[i]; _trend[i] = _nc.Result[i] > _trenddn[i-1] ? +1 : _nc.Result[i] < _trendup[i-1]? -1 : (i>1 ? _trend[i-1] : +1); _trail[i] = _trend[i] == +1 ? _trendup[i] : _trenddn[i]; _extremum[i] = i>1 && _trend[i-1] != +1 && _trend[i] == +1 ? _nh.Result[i] : i>1 && _trend[i-1] != -1 && _trend[i] == -1 ? _nl.Result[i] : i>1 && _trend[i] == +1 ? Math.Max(_extremum[i-1], _nh.Result[i]) : i>1 && _trend[i] == -1 ? Math.Min(_extremum[i-1], _nl.Result[i]) : _extremum[i-1]; _level1[i] = _extremum[i] + (_trail[i] - _extremum[i]) * inpFibLevel1 / 100; _level2[i] = _extremum[i] + (_trail[i] - _extremum[i]) * inpFibLevel2 / 100; _level3[i] = _extremum[i] + (_trail[i] - _extremum[i]) * inpFibLevel3 / 100; outTrail[i] = _trail[i]; outExtremum[i] = _extremum[i]; outLevel1[i] = _level1[i]; outLevel2[i] = _level2[i]; outLevel3[i] = _level3[i]; outZoneUp1[i] = _level1[i]; outZoneDn1[i] = _level2[i]; outZoneUp2[i] = _level2[i]; outZoneDn2[i] = _level3[i]; outZoneUp3[i] = _trail[i]; outZoneDn3[i] = _level3[i]; outLongOpen[i] = _trend[i]==+1 && Bars.ClosePrices[i] < _level1[i] ? _trail[i] : double.NaN; outShortOpen[i] = _trend[i]==-1 && Bars.ClosePrices[i] > _level1[i] ? _trail[i] : double.NaN; } } public enum enumTrialType { Modified, UnModified } }

PARABENS MUITO BONS SEUS INDICADORES, POREIA CRIAR ALTOMATIZAÇÃO PELO MENOS DOS STOPS AUTOMÁTICOS?

I love this indicator thank you so much. Can I ask you please to add a code that changes the candlestick colors to green if they are above the trailing stop line and to red if they are below the trailing stop line. PLEAAASE