Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

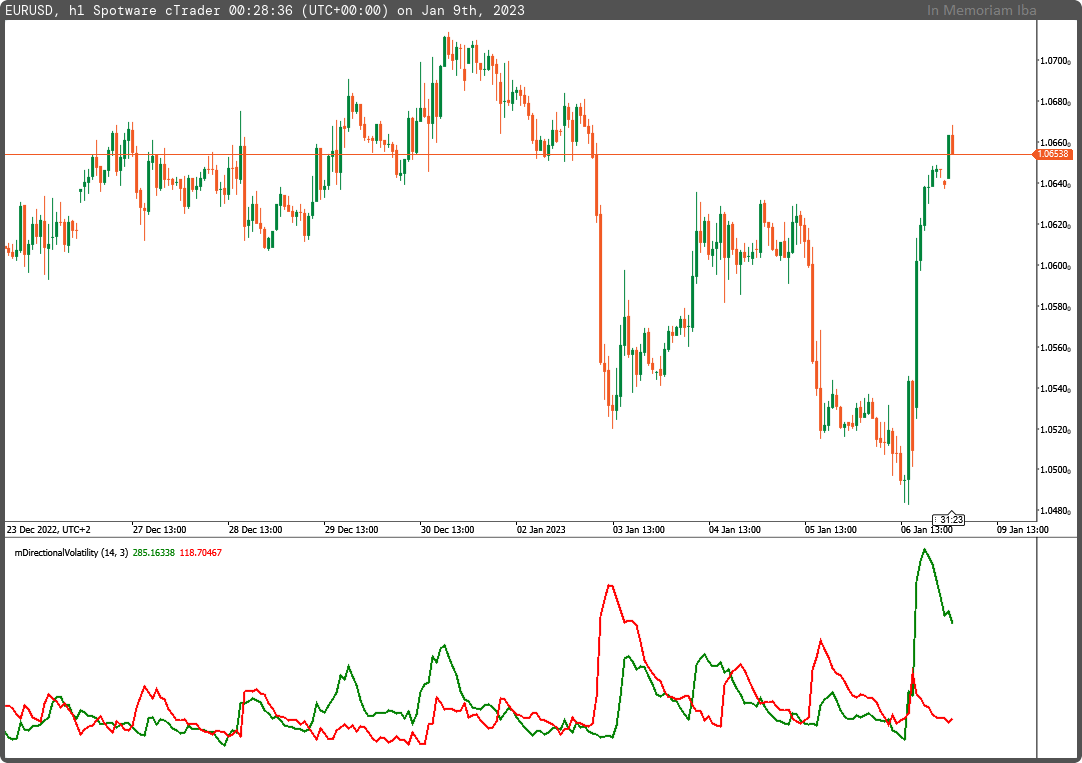

Directional Volatility indicator. The indicator displays two volatility lines; bullish (green component) and bearish (red component).

using System;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Levels(0)]

[Indicator(IsOverlay = false, AutoRescale = false, AccessRights = AccessRights.None)]

public class mDirectionalVolatility : Indicator

{

[Parameter("Periods (14)", DefaultValue = 14)]

public int inpPeriods { get; set; }

[Parameter("Deviation (3.0)", DefaultValue = 3.0)]

public double inpDeviation { get; set; }

[Output("DirectionalVolatility Bullish", LineColor = "Green", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outDirectionalVolatilityBullish { get; set; }

[Output("DirectionalVolatility Bearish", LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outDirectionalVolatilityBearish { get; set; }

private IndicatorDataSeries _pricelong, _priceshort;

private MovingAverage _malong, _mashort;

private StandardDeviation _stddevmalong, _stddevmashort;

protected override void Initialize()

{

_pricelong = CreateDataSeries();

_priceshort = CreateDataSeries();

_malong = Indicators.MovingAverage(_pricelong, inpPeriods, MovingAverageType.Exponential);

_mashort = Indicators.MovingAverage(_priceshort, inpPeriods, MovingAverageType.Exponential);

_stddevmalong = Indicators.StandardDeviation(_malong.Result, inpPeriods, MovingAverageType.Simple);

_stddevmashort = Indicators.StandardDeviation(_mashort.Result, inpPeriods, MovingAverageType.Simple);

}

public override void Calculate(int i)

{

_priceshort[i] = Bars.ClosePrices[i-1] - Bars.LowPrices[i];

_pricelong[i] = Bars.HighPrices[i] - Bars.ClosePrices[i-1];

outDirectionalVolatilityBullish[i] = (_malong.Result[i] + inpDeviation * _stddevmalong.Result[i]) / Symbol.TickSize;

outDirectionalVolatilityBearish[i] = (_mashort.Result[i] + inpDeviation * _stddevmashort.Result[i]) / Symbol.TickSize;

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mDirectionalVolatility.algo

- Rating: 5

- Installs: 755

- Modified: 09/01/2023 00:33

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.