Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

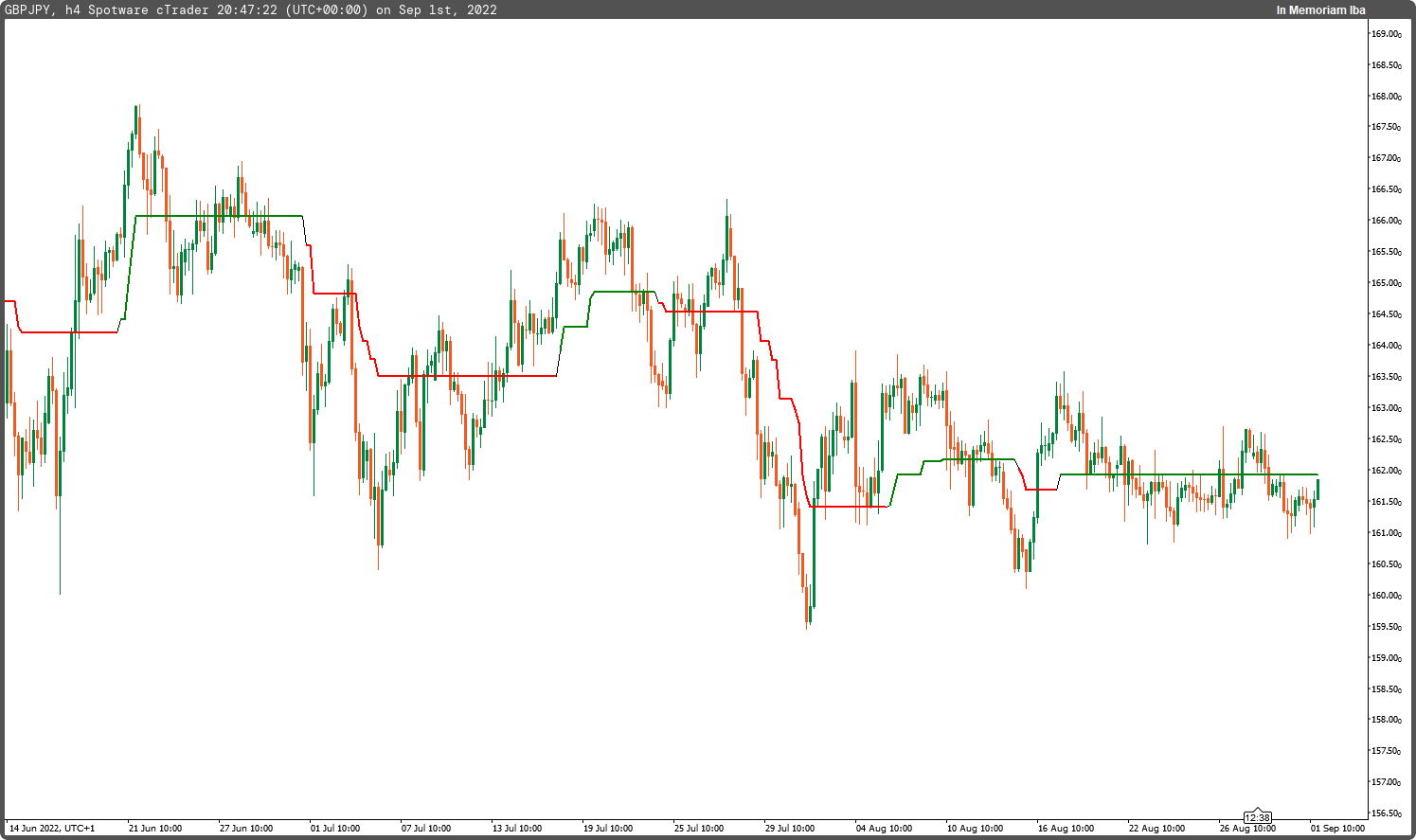

This indicator shows the trend and real market value of the financial instrument.

When the price is below the indicator and the indicator is green, it indicates a discount on the quote currency. Conversely, when the price is above the indicator value and the indicator is red, it indicates a discount on the base currency.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class mAlphaTrend : Indicator

{

[Parameter("Periods (14)", DefaultValue = 14)]

public int inpPeriods { get; set; }

[Parameter("Multiplier", DefaultValue = 1.618)]

public double inpMultiplier { get; set; }

[Parameter("ATR Smooth Type", DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType inpATRSmoothType { get; set; }

[Parameter("Volume Data (no)", DefaultValue = false)]

public bool inpVolumeData { get; set; }

[Output("AlphaTrend", LineColor = "Black", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outAlphaTrend { get; set; }

[Output("AlphaTrend Signal", LineColor = "Transparent", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outAlphaTrendSignal { get; set; }

[Output("AlphaTrend - Bullish", LineColor = "Green", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 2)]

public IndicatorDataSeries outAlphaTrendBullish { get; set; }

[Output("AlphaTrend - Bearish", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 2)]

public IndicatorDataSeries outAlphaTrendBearish { get; set; }

private AverageTrueRange _atr;

private RelativeStrengthIndex _rsi;

private MoneyFlowIndex _mfi;

private IndicatorDataSeries _trendup, _trenddn, _alphatrend, _trend;

protected override void Initialize()

{

_atr = Indicators.AverageTrueRange(inpPeriods, inpATRSmoothType);

_rsi = Indicators.RelativeStrengthIndex(Bars.ClosePrices, inpPeriods);

_mfi = Indicators.MoneyFlowIndex(inpPeriods);

_trendup = CreateDataSeries();

_trenddn = CreateDataSeries();

_alphatrend = CreateDataSeries();

_trend = CreateDataSeries();

}

public override void Calculate(int i)

{

_trendup[i] = Bars.LowPrices[i] - _atr.Result[i] * inpMultiplier;

_trenddn[i] = Bars.HighPrices[i] + _atr.Result[i] * inpMultiplier;

_alphatrend[i] = (inpVolumeData == true ? _rsi.Result[i] >= 50.0 : _mfi.Result[i] >= 50) ? _trendup[i] < _alphatrend[i - 1] ? _alphatrend[i - 1] : _trendup[i] : _trenddn[i] > _alphatrend[i - 1] ? _alphatrend[i - 1] : _trenddn[i];

_trend[i] = _alphatrend[i] > _alphatrend[i - 1] ? +1 : _alphatrend[i] < _alphatrend[i - 1] ? -1 : _alphatrend[i - 1];

outAlphaTrend[i] = _alphatrend[i];

outAlphaTrendBullish[i] = outAlphaTrendBullish[i - 1];

outAlphaTrendBearish[i] = outAlphaTrendBearish[i - 1];

if (_trend[i] == +1)

{

outAlphaTrendBullish[i] = _alphatrend[i];

outAlphaTrendBearish[i] = double.NaN;

outAlphaTrendSignal[i] = outAlphaTrend[i] - Symbol.TickSize;

}

if (_trend[i] == -1)

{

outAlphaTrendBullish[i] = double.NaN;

outAlphaTrendBearish[i] = _alphatrend[i];

outAlphaTrendSignal[i] = outAlphaTrend[i] + Symbol.TickSize;

}

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mAlphaTrend.algo

- Rating: 5

- Installs: 1513

- Modified: 01/09/2022 20:59

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

Loved the concept your described from it.