Description

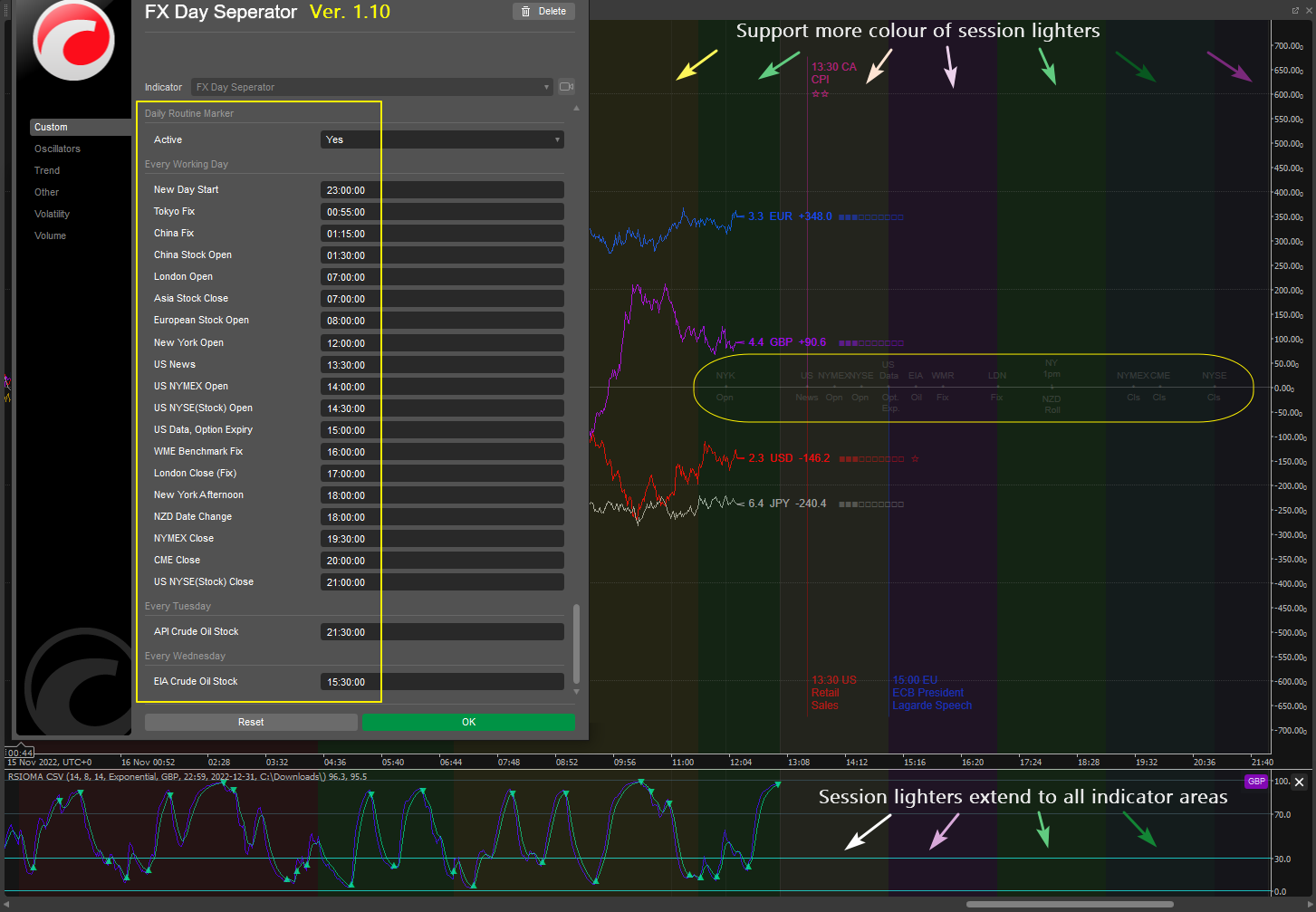

Update to Ver 1.11 with new functions:

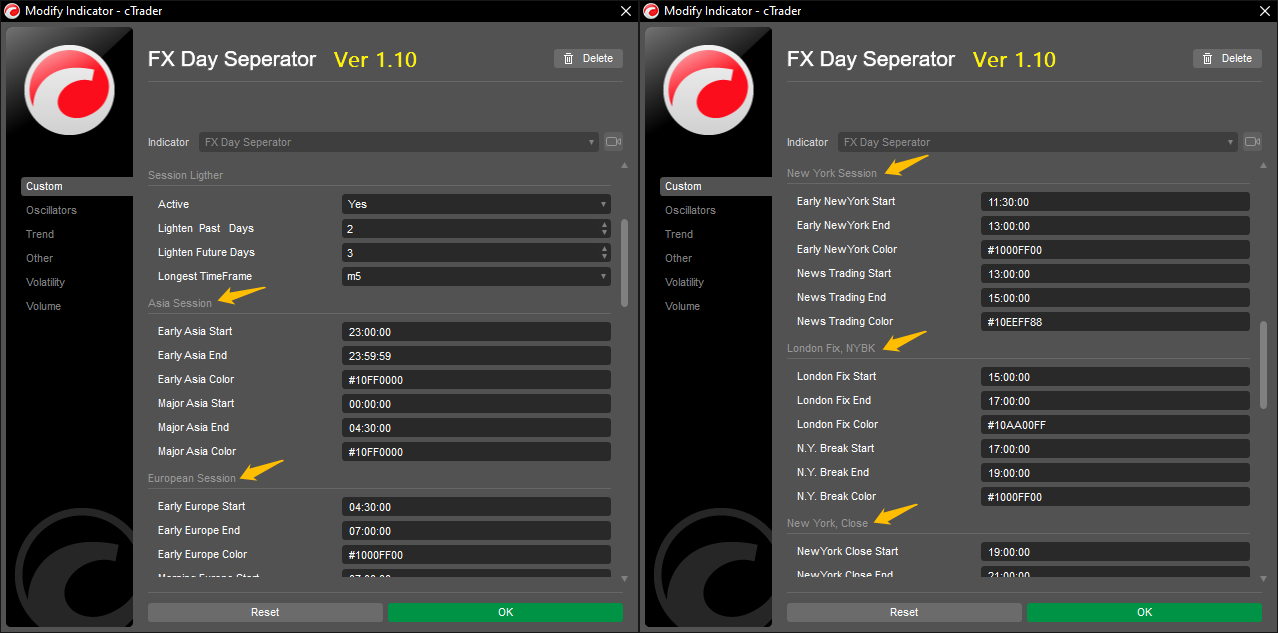

- Session lighter split into 5 groups, each one has 2 colours,

- (Asia, European, New York, London Fix, New York Close);

- Session lighters can extend to all indicator areas;

- Daily routine markers added to timeline;

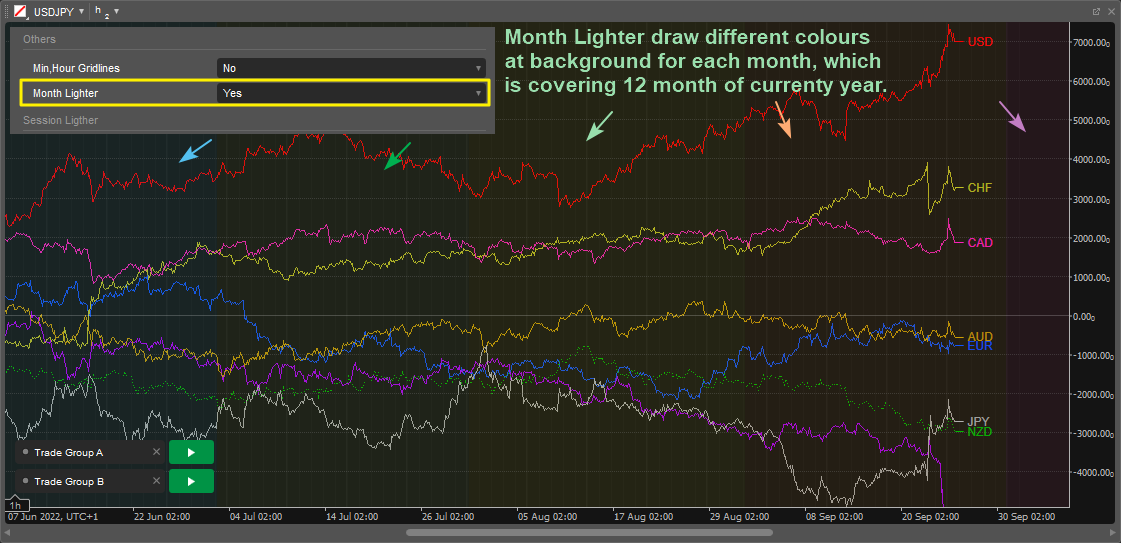

- MonthLighter covers 3 Years (Past, Current and Next year);

Ver 1.09 and previous:

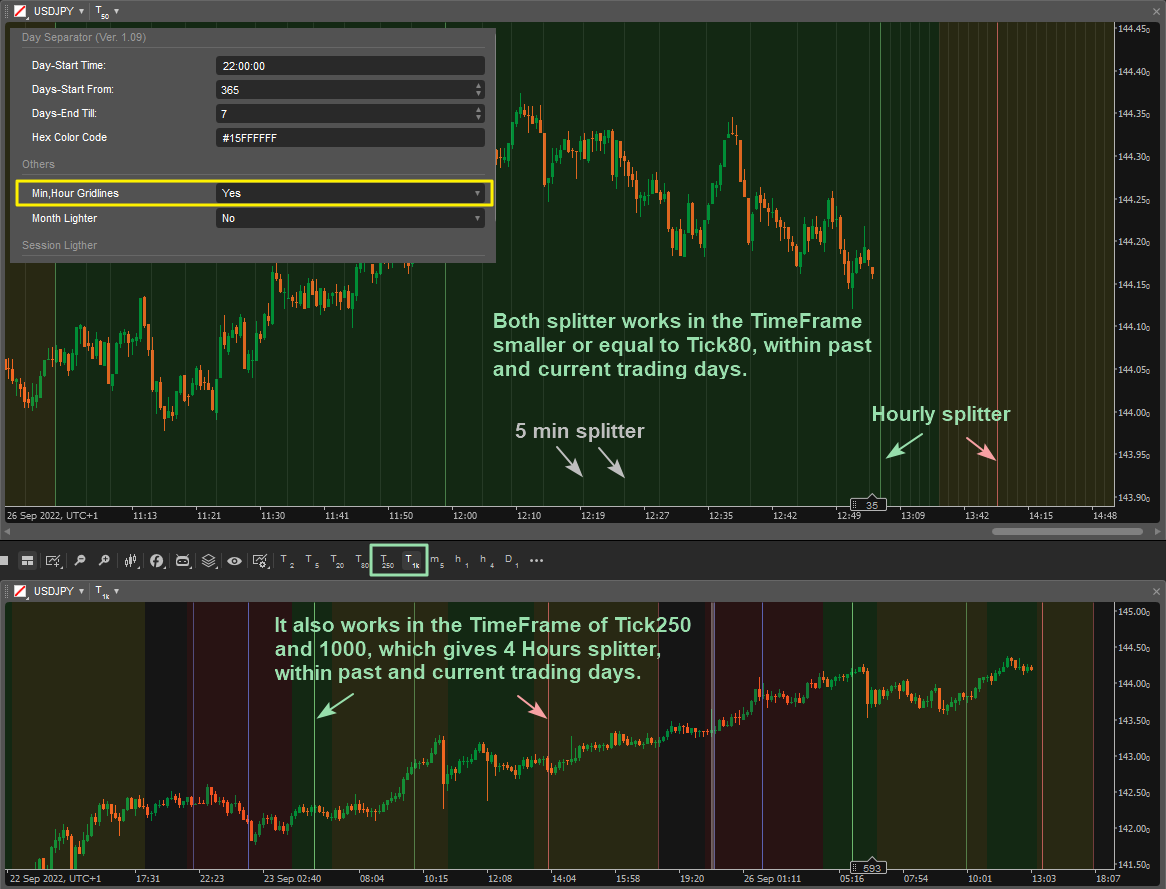

- Draw vertical lines as day separators;

- Draw background colour to highlight sessions;

- Users can set start and end day numbers and times;

- Users can set the colour of the session background and separators;

- Users can set highlight gridlines by 5 min, (4) hourly at different timeframes;

- Users can turn on/off the background colour for each month;

- Framework .NET 6.0 ready, Source code is compatible with .NET 4.0;

Note: The attachment .algo is compiled by .NET6.0, to run with the old version (4.1.17), please copy the source code and compile it at the cTrader version to fit your environment.

Interested in the currency strength meter in the chart?

Get the free download link at Telegram Group: cTrader FOREX Club

using System;

using System.Linq;

using System.Globalization;

using cAlgo.API;

//v1.01 Add Function: Day-Separator time setting;

//v1.02 Add Function: Setting Day-Separator Start-End as days range;

//v1.03 Add Function: Session Lither to highlight market sessions;

//v1.04 Add Function: User can set start and end time for each session;

//v1.05 Optimise : Session background color up to Y-axis ±9999;

//v1.06 Optimise : CodeStructure, User can set each session start and end;

//v1.07 Add Function: User can set color for each sessions;

//v1.08 Add Function: User can set Session Lighter On/Off in setting;

//v1.09 Add Function: User can set 5Min 1, 4Hour Gridlines On/Off; Month Lighter On/Off;

// Optimise : Framework .NET 6.0 ready;

//v1.10 Optimise : Session lighter split to 5 groups (Assia, European, New York, London Fix, New York Close);

// : Each session has 2 background lighters, and extend to all indicator areas;

// Add Function: Time of Daily Routine display as background text;

// Add Function: MonthLighter covers 2 Years (current and NEXT year);

//v1.11 Optimise : MonthLighter covers 3 Years (Past, Current and NEXT year);

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class FXDaySeperator : Indicator

{

[Parameter("Day-Start Time:", DefaultValue = "22:00:00", Group = "Day Separator (Ver. 1.11)" )] public string DayStartTime { get; set; }

[Parameter("Days-Start From: ", DefaultValue = 365, MinValue = 0, Group = "Day Separator (Ver. 1.11)" )] public int DaysStart { get; set; }

[Parameter("Days-End Till:", DefaultValue = 7, MinValue = 0, Group = "Day Separator (Ver. 1.11)" )] public int DaysEnd { get; set; }

[Parameter("Hex Color Code", DefaultValue = "#15FFFFFF", Group = "Day Separator (Ver. 1.11)" )] public string DaySepColor { get; set; }

[Parameter("Min,Hour Gridlines",DefaultValue = true, Group = "Min,Hour,Month Seperators" )] public bool MinHorLne { get; set; }

[Parameter("Month Lighter", DefaultValue = false, Group = "Min,Hour,Month Seperators" )] public bool MnthLit { get; set; }

[Parameter("Active", DefaultValue = true, Group = "Session Ligther")] public bool LiterOn { get; set; }

[Parameter("Lighten Past Days", DefaultValue = 5, MaxValue = 30, MinValue = 0, Step = 1, Group = "Session Ligther")] public int PastDaysNumber { get; set; }

[Parameter("Lighten Future Days", DefaultValue = 1, MaxValue = 7, MinValue = 0, Step = 1, Group = "Session Ligther")] public int FutrDaysNumber { get; set; }

[Parameter("Longest TimeFrame", DefaultValue = "Minute5", Group = "Session Ligther")] public TimeFrame LgstTmFrm { get; set; }

[Parameter("Early Asia Start", DefaultValue = "23:00:00", Group = "Asia Session" )] public string AS1S { get; set; }

[Parameter("Early Asia End", DefaultValue = "23:59:59", Group = "Asia Session" )] public string AS1E { get; set; }

[Parameter("Early Asia Color", DefaultValue = "#10FF0000", Group = "Asia Session" )] public string AS1CL { get; set; } //DarkRed Asia

[Parameter("Major Asia Start", DefaultValue = "00:00:00", Group = "Asia Session" )] public string AS2S { get; set; }

[Parameter("Major Asia End", DefaultValue = "04:30:00", Group = "Asia Session" )] public string AS2E { get; set; }

[Parameter("Major Asia Color", DefaultValue = "#10FF0000", Group = "Asia Session" )] public string AS2CL { get; set; } //DarkRed Asia

[Parameter("Early Europe Start", DefaultValue = "04:30:00", Group = "European Session")] public string EZ1S { get; set; }

[Parameter("Early Europe End", DefaultValue = "07:00:00", Group = "European Session")] public string EZ1E { get; set; }

[Parameter("Early Europe Color", DefaultValue = "#1000FF00", Group = "European Session")] public string EZ1CL { get; set; } //DarkGrn Early Europe

[Parameter("Morning Europe Start", DefaultValue = "07:00:00", Group = "European Session")] public string EZ2S { get; set; }

[Parameter("Morning Europe End", DefaultValue = "11:30:00", Group = "European Session")] public string EZ2E { get; set; }

[Parameter("Morning Europe Color", DefaultValue = "#10FFFF00", Group = "European Session")] public string EZ2CL { get; set; } //DarkYlw Morning Europe

[Parameter("Early NewYork Start", DefaultValue = "11:30:00", Group = "New York Session")] public string NYES { get; set; }

[Parameter("Early NewYork End", DefaultValue = "13:00:00", Group = "New York Session")] public string NYEE { get; set; }

[Parameter("Early NewYork Color", DefaultValue = "#1000FF00", Group = "New York Session")] public string NYECL { get; set; } //DarkGrn Early NewYork

[Parameter("News Trading Start", DefaultValue = "13:00:00", Group = "New York Session")] public string NWTS { get; set; }

[Parameter("News Trading End", DefaultValue = "15:00:00", Group = "New York Session")] public string NWTE { get; set; }

[Parameter("News Trading Color", DefaultValue = "#10EEFF88", Group = "New York Session")] public string NWTCL { get; set; } //LightGrey NeWsTrading

[Parameter("London Fix Start", DefaultValue = "15:00:00", Group = "London Fix, NYBK")] public string LDFS { get; set; }

[Parameter("London Fix End", DefaultValue = "17:00:00", Group = "London Fix, NYBK")] public string LDFE { get; set; }

[Parameter("London Fix Color", DefaultValue = "#10AA00FF", Group = "London Fix, NYBK")] public string LDFCL { get; set; } //Purple London Fix

[Parameter("N.Y. Break Start", DefaultValue = "17:00:00", Group = "London Fix, NYBK")] public string NYKS { get; set; }

[Parameter("N.Y. Break End", DefaultValue = "19:00:00", Group = "London Fix, NYBK")] public string NYKE { get; set; }

[Parameter("N.Y. Break Color", DefaultValue = "#1000FF00", Group = "London Fix, NYBK")] public string NYKCL { get; set; } //DarkGrn NewYork Break

[Parameter("NewYork Close Start", DefaultValue = "19:00:00", Group = "New York, Close" )] public string NYCS { get; set; }

[Parameter("NewYork Close End", DefaultValue = "21:00:00", Group = "New York, Close" )] public string NYCE { get; set; }

[Parameter("NewYork Close Color", DefaultValue = "#0800FFFF", Group = "New York, Close" )] public string NYCCL { get; set; } //DarkTurquoise NewYork Close

[Parameter("Day Ending Start", DefaultValue = "21:00:00", Group = "New York, Close" )] public string ENDS { get; set; }

[Parameter("Day Ending End", DefaultValue = "22:00:00", Group = "New York, Close" )] public string ENDE { get; set; }

[Parameter("Day Ending Color", DefaultValue = "#050000FF", Group = "New York, Close" )] public string ENDCL { get; set; } //DarkBlue Day Ending

[Parameter("Active", DefaultValue = true, Group = "Daily Routine Marker" )] public bool DailyRtMkr { get; set; }

[Parameter("New Day Start", DefaultValue = "23:00:00", Group = "Every Working Day" )] public string RNWD { get; set; }

[Parameter("Tokyo Fix", DefaultValue = "00:55:00", Group = "Every Working Day" )] public string RJPX { get; set; }

[Parameter("China Fix", DefaultValue = "01:15:00", Group = "Every Working Day" )] public string RCNX { get; set; }

[Parameter("China Stock Open", DefaultValue = "01:30:00", Group = "Every Working Day" )] public string RCNS { get; set; }

[Parameter("London Open", DefaultValue = "07:00:00", Group = "Every Working Day" )] public string RLDO { get; set; }

[Parameter("Asia Stock Close", DefaultValue = "07:00:00", Group = "Every Working Day" )] public string RASC { get; set; }

[Parameter("European Stock Open", DefaultValue = "08:00:00", Group = "Every Working Day" )] public string RESO { get; set; }

[Parameter("New York Open", DefaultValue = "12:00:00", Group = "Every Working Day" )] public string RNYO { get; set; }

[Parameter("US News", DefaultValue = "13:30:00", Group = "Every Working Day" )] public string RNYN { get; set; }

[Parameter("US NYMEX Open", DefaultValue = "14:00:00", Group = "Every Working Day" )] public string RNXO { get; set; }

[Parameter("US NYSE(Stock) Open", DefaultValue = "14:30:00", Group = "Every Working Day" )] public string RNYS { get; set; }

[Parameter("US Data, Option Expiry",DefaultValue = "15:00:00", Group = "Every Working Day" )] public string RNYD { get; set; }

[Parameter("WME Benchmark Fix", DefaultValue = "16:00:00", Group = "Every Working Day" )] public string RWMR { get; set; }

[Parameter("European Stock Close", DefaultValue = "16:30:00", Group = "Every Working Day" )] public string RESC { get; set; }

[Parameter("London HomeTime", DefaultValue = "17:00:00", Group = "Every Working Day" )] public string RLDC { get; set; }

[Parameter("Bank of Canada Fix", DefaultValue = "17:00:00", Group = "Every Working Day" )] public string RCAX { get; set; }

[Parameter("New York Afternoon", DefaultValue = "18:00:00", Group = "Every Working Day" )] public string RNYA { get; set; }

[Parameter("NZD Date Change", DefaultValue = "18:00:00", Group = "Every Working Day" )] public string RNZR { get; set; }

[Parameter("NYMEX Close", DefaultValue = "19:30:00", Group = "Every Working Day" )] public string RNXC { get; set; }

[Parameter("CME Close", DefaultValue = "20:00:00", Group = "Every Working Day" )] public string RCME { get; set; }

[Parameter("US NYSE(Stock) Close", DefaultValue = "21:00:00", Group = "Every Working Day" )] public string RNYC { get; set; }

[Parameter("API Crude Oil Stock", DefaultValue = "21:30:00", Group = "Every Tuesday" )] public string RAPI { get; set; }

[Parameter("EIA Crude Oil Stock", DefaultValue = "15:30:00", Group = "Every Wednesday" )] public string REIA { get; set; }

private Bars Seires_D1; //Bars to load TF.Daily

private DateTime LstStart; //Time of LastTradingDayStart

private DateTime DayStart; //Time of DayStart

private DateTime DayEnd; //Time of DayEnd

private readonly string pfx_DySp = "DaySep_", fmt_DySp = "yyyy-MM-dd "; //DaySeparator : NamePrefix, ObjectName format;

private readonly string pfx_AS1 = "AS1_", pfx_AS2 = "AS2_"; //NamePrefix: Session Lighter Box;

private readonly string pfx_EZ1 = "EZ1_", pfx_EZ2 = "EZ2_";

private readonly string pfx_NYE = "NYE_", pfx_NWT = "NWT_";

private readonly string pfx_LDF = "LDF_", pfx_NYK = "NYK_";

private readonly string pfx_NYC = "NYC_", pfx_END = "END_";

private readonly Color cl_Rtn = Color.FromHex("#55777777"); //Color of daily routin marker

private readonly string pfx_RNWD="RNWD_", mkr_RNWD= "New\n ⬩\nDay"; //NamePrefix, MarkerContent: DailyRoutine's Text;

private readonly string pfx_RJPX="RJPX_", mkr_RJPX= "TKY\n ⬩\n Fix";

private readonly string pfx_RCNX="RCNX_", mkr_RCNX= "CNH\n ⬩\n Fix";

private readonly string pfx_RCNS="RCNS_", mkr_RCNS= "STK\n ⬩\n Opn";

private readonly string pfx_RLDO="RLDO_", mkr_RLDO= "LDN\nOpn\n ˖\n\n ";

private readonly string pfx_RASC="RASC_", mkr_RASC= " \n\n ⬩\n AZ STK\n Cls";

private readonly string pfx_RESO="RESO_", mkr_RESO= "EZ STK\n Opn\n ˖\n\n ";

private readonly string pfx_RNYO="RNYO_", mkr_RNYO= "NYK\n ⬩\nOpn";

private readonly string pfx_RNXO="RNXO_", mkr_RNXO= "NYMEX\n ⬩\n Opn";

private readonly string pfx_RNYN="RNYN_", mkr_RNYN= " US\n ⬩\nNews";

private readonly string pfx_RNYS="RNYS_", mkr_RNYS= "NYSE\n ⬩\n Opn";

private readonly string pfx_RNYD="RNYD_", mkr_RNYD= " US\n Data \n ⬩\n Opt.\n Exp.";

private readonly string pfx_RWMR="RWMR_", mkr_RWMR= "WMR\n ⬩\n Fix";

private readonly string pfx_RESC="RESC_", mkr_RESC= " EZ \nSTK\n ˖\n Cls\n ";

private readonly string pfx_RLDC="RLDC_", mkr_RLDC= " LDN\n Hme \n ˖\n\n ";

private readonly string pfx_RCAX="RCAX_", mkr_RCAX= " \n\n ⬩\n BoC \n Fix";

private readonly string pfx_RNYA="RNYA_", mkr_RNYA= " NY\n1pm\n ˖\n\n ";

private readonly string pfx_RNZR="RNZR_", mkr_RNZR= " \n\n ⬩\nNZD\n Roll";

private readonly string pfx_RNXC="RNXC_", mkr_RNXC= "NYMEX\n ⬩\n Cls";

private readonly string pfx_RCME="RCME_", mkr_RCME= "CME\n ⬩\n Cls";

private readonly string pfx_RNYC="RNYC_", mkr_RNYC= "NYSE\n ⬩\n Cls";

private readonly string pfx_RAPI="RAPI_", mkr_RAPI= "API\n ⬩\n Oil";

private readonly string pfx_REIA="REIA_", mkr_REIA= "EIA\n ⬩\n Oil";

protected override void Initialize()

{

//Get TF.Day1 Bars

Seires_D1 = MarketData.GetBars(TimeFrame.Daily);

LstStart = Seires_D1.Last(1).OpenTime;

DayStart = Seires_D1.LastBar.OpenTime;

DayEnd = DayStart.AddDays(1);

//Plot DaySeparator (-365 ~ +7 Days) of all TimeFrame

PlotDaySeprt();

//Plot WokingHour on TradingDays

PlotDayLight();

//Plot MonthLighter on HalfYearChart

PlotMthLight();

//Plot Intraday VerticalLines

DrawIntradayVertLnes();

Bars.BarOpened += Bars_BarOpened;

//Chart.DrawStaticText("Debug", TFGroup(TimeFrame), VerticalAlignment.Bottom, HorizontalAlignment.Center, Color.FromHex("AAEEDDCC"));

}

public override void Calculate(int index) { }

//ChartControl - NewBar to Plot Intraday VerticalLines

private void Bars_BarOpened(BarOpenedEventArgs obj)

{

if (Seires_D1.LastBar.OpenTime > DayStart)

{

LstStart = Seires_D1.Last(1).OpenTime;

DayStart = Seires_D1.LastBar.OpenTime;

DayEnd = DayStart.AddDays(1);

DrawIntradayVertLnes();

}

}

//Plot DaySeparator

private void PlotDaySeprt() //On Past365 + Next7 EveryDay(include weekend), of all TimeFrame;

{

Color cl_DaySep = Color.FromHex(DaySepColor); //Convert Color code to Color

DateTime dt_TdySepHr = DateTime.Parse(DateTime.Today.ToString(fmt_DySp) + DayStartTime).Add(-Application.UserTimeOffset); //Get SplitTime Today, and Convert UserTime to ServerTime;

for (DateTime crntDay = (dt_TdySepHr.AddDays(-DaysStart)); crntDay <= (dt_TdySepHr.AddDays(+DaysEnd)); crntDay = crntDay.AddDays(1)) //Separator Past365 ~ Next7 Days

{ Chart.DrawVerticalLine(pfx_DySp+crntDay.ToString(fmt_DySp), crntDay, cl_DaySep, 1, LineStyle.Solid); } //Plot VerticalLines

}

//Plot SessionLighter on TradingDays

private void PlotDayLight()

{

//Plot only in TimeFrame shorter than Setting

if ( !LiterOn || TimeFrame > LgstTmFrm ) return;

//Define Parameters for and WorkHour Highlight: DateTime of FirstDate, LastDate;

DateTime startDate = (Bars.LastBar.OpenTime.AddDays(-PastDaysNumber)).Date; DayOfWeek FDoW = startDate.DayOfWeek;

startDate = (FDoW==DayOfWeek.Saturday) ? startDate.AddDays(-1) : (FDoW==DayOfWeek.Sunday) ? startDate.AddDays(-2) : startDate; //Move startDate Friday, if allocated in Weekend

DateTime last_Date = (Bars.LastBar.OpenTime.AddDays(+FutrDaysNumber)).Date; DayOfWeek LDoW = last_Date.DayOfWeek;

last_Date = (LDoW==DayOfWeek.Saturday) ? last_Date.AddDays(+2) : (FDoW==DayOfWeek.Sunday) ? last_Date.AddDays(+1) : last_Date; //Move last_Date Monday, if allocated in Weekend

//Define color for each working period

Color cl_AS1 = Color.FromHex(AS1CL), cl_AS2 = Color.FromHex(AS2CL); //DarkRed Asia

Color cl_EZ1 = Color.FromHex(EZ1CL), cl_EZ2 = Color.FromHex(EZ2CL); //DarkBlue Europe

Color cl_NYE = Color.FromHex(NYECL), cl_NWT = Color.FromHex(NWTCL); //DarkYlw NewYork

Color cl_LDF = Color.FromHex(LDFCL), cl_NYK = Color.FromHex(NYKCL); //Purple London Fix

Color cl_NYC = Color.FromHex(NYCCL), cl_END = Color.FromHex(ENDCL); //DarkTurquoise NewYork Close

//Prefix of each working period

//Get startDate in string format

string s_fstDay = startDate.ToString(fmt_DySp);

//Fix FirstDayTime for X1, X2 positions of all Periods Initialize X1, X2 Positions of all Periods - Vars. to Plot

DateTime dt_AS1S = DateTime.Parse(s_fstDay + AS1S).Add(-Application.UserTimeOffset).AddDays(-1), dt_AS1E = DateTime.Parse(s_fstDay + AS1E).Add(-Application.UserTimeOffset).AddDays(-1), dt_as1s = dt_AS1S, dt_as1e = dt_AS1E; //EarlyAsia StartTime, EndTime

DateTime dt_AS2S = DateTime.Parse(s_fstDay + AS2S).Add(-Application.UserTimeOffset) , dt_AS2E = DateTime.Parse(s_fstDay + AS2E).Add(-Application.UserTimeOffset) , dt_as2s = dt_AS2S, dt_as2e = dt_AS2E; //MajorAsia StartTime, EndTime

DateTime dt_EZ1S = DateTime.Parse(s_fstDay + EZ1S).Add(-Application.UserTimeOffset) , dt_EZ1E = DateTime.Parse(s_fstDay + EZ1E).Add(-Application.UserTimeOffset) , dt_ez1s = dt_EZ1S, dt_ez1e = dt_EZ1E; //EarlyEurope StartTime, EndTime

DateTime dt_EZ2S = DateTime.Parse(s_fstDay + EZ2S).Add(-Application.UserTimeOffset) , dt_EZ2E = DateTime.Parse(s_fstDay + EZ2E).Add(-Application.UserTimeOffset) , dt_ez2s = dt_EZ2S, dt_ez2e = dt_EZ2E; //MorningEurope StartTime, EndTime

DateTime dt_NYES = DateTime.Parse(s_fstDay + NYES).Add(-Application.UserTimeOffset) , dt_NYEE = DateTime.Parse(s_fstDay + NYEE).Add(-Application.UserTimeOffset) , dt_nyes = dt_NYES, dt_nyee = dt_NYEE; //Early NewYork StartTime, EndTime

DateTime dt_NWTS = DateTime.Parse(s_fstDay + NWTS).Add(-Application.UserTimeOffset) , dt_NWTE = DateTime.Parse(s_fstDay + NWTE).Add(-Application.UserTimeOffset) , dt_nwts = dt_NWTS, dt_nwte = dt_NWTE; //NewsTrading StartTime, EndTime

DateTime dt_LDFS = DateTime.Parse(s_fstDay + LDFS).Add(-Application.UserTimeOffset) , dt_LDFE = DateTime.Parse(s_fstDay + LDFE).Add(-Application.UserTimeOffset) , dt_ldfs = dt_LDFS, dt_ldfe = dt_LDFE; //London Fix StartTime, EndTime

DateTime dt_NYKS = DateTime.Parse(s_fstDay + NYKS).Add(-Application.UserTimeOffset) , dt_NYKE = DateTime.Parse(s_fstDay + NYKE).Add(-Application.UserTimeOffset) , dt_nyks = dt_NYKS, dt_nyke = dt_NYKE; //NewYork Break StartTime, EndTime

DateTime dt_NYCS = DateTime.Parse(s_fstDay + NYCS).Add(-Application.UserTimeOffset) , dt_NYCE = DateTime.Parse(s_fstDay + NYCE).Add(-Application.UserTimeOffset) , dt_nycs = dt_NYCS, dt_nyce = dt_NYCE; //NewYork Close StartTime, EndTime

DateTime dt_ENDS = DateTime.Parse(s_fstDay + ENDS).Add(-Application.UserTimeOffset) , dt_ENDE = DateTime.Parse(s_fstDay + ENDE).Add(-Application.UserTimeOffset) , dt_ends = dt_ENDS, dt_ende = dt_ENDE; //DayEnding StartTime, EndTime

//... for X-Positions of DailyRoutineMarkers Ini. DailyRoutine's X-Positions

DateTime dt_RNWD = DateTime.Parse(s_fstDay + RNWD).Add(-Application.UserTimeOffset).AddDays(-1), dt_rnwd = dt_RNWD; //23:00 New Day Start

DateTime dt_RJPX = DateTime.Parse(s_fstDay + RJPX).Add(-Application.UserTimeOffset) , dt_rjpx = dt_RJPX; //00:55 Tokyo Fix (Tokyo 8:55am)

DateTime dt_RCNX = DateTime.Parse(s_fstDay + RCNX).Add(-Application.UserTimeOffset) , dt_rcnx = dt_RCNX; //01:15 China Fix (Beijing 9:15am)

DateTime dt_RCNS = DateTime.Parse(s_fstDay + RCNS).Add(-Application.UserTimeOffset) , dt_rcns = dt_RCNS; //01:30 China Stock Open (Beijing 9:30am)

DateTime dt_RLDO = DateTime.Parse(s_fstDay + RLDO).Add(-Application.UserTimeOffset) , dt_rldo = dt_RLDO; //07:00 London Open

DateTime dt_RASC = DateTime.Parse(s_fstDay + RASC).Add(-Application.UserTimeOffset) , dt_rasc = dt_RASC; //07:00 Asia Stock Close (Beijing 15:00pm)

DateTime dt_RESO = DateTime.Parse(s_fstDay + RESO).Add(-Application.UserTimeOffset) , dt_reso = dt_RESO; //08:00 EuroZone Stock Open

DateTime dt_RNYO = DateTime.Parse(s_fstDay + RNYO).Add(-Application.UserTimeOffset) , dt_rnyo = dt_RNYO; //12:00 New York Open (NewYork 7:00am)

DateTime dt_RNYN = DateTime.Parse(s_fstDay + RNYN).Add(-Application.UserTimeOffset) , dt_rnyn = dt_RNYN; //13:30 US News (NewYork 8:30am)

DateTime dt_RNXO = DateTime.Parse(s_fstDay + RNXO).Add(-Application.UserTimeOffset) , dt_rnxo = dt_RNXO; //14:00 US NYMEX Open (NewYork 9:00am)

DateTime dt_RNYS = DateTime.Parse(s_fstDay + RNYS).Add(-Application.UserTimeOffset) , dt_rnys = dt_RNYS; //14:30 US NYSE(Stock) Open (NewYork 9:30am)

DateTime dt_RNYD = DateTime.Parse(s_fstDay + RNYD).Add(-Application.UserTimeOffset) , dt_rnyd = dt_RNYD; //15:00 US Data/OptionExpiry(NewYork 10:00am)

DateTime dt_RWMR = DateTime.Parse(s_fstDay + RWMR).Add(-Application.UserTimeOffset) , dt_rwmr = dt_RWMR; //16:00 WMR Benchmark Fix (London 16:00pm)

DateTime dt_RESC = DateTime.Parse(s_fstDay + RESC).Add(-Application.UserTimeOffset) , dt_resc = dt_RESC; //16:30 European Stock Close(London 16:30pm)

DateTime dt_RLDC = DateTime.Parse(s_fstDay + RLDC).Add(-Application.UserTimeOffset) , dt_rldc = dt_RLDC; //17:00 London HomeTime (London 17:00pm)

DateTime dt_RCAX = DateTime.Parse(s_fstDay + RCAX).Add(-Application.UserTimeOffset) , dt_rcax = dt_RCAX; //17:00 Bank of Canada Fix (London 17:00pm)

DateTime dt_RNYA = DateTime.Parse(s_fstDay + RNYA).Add(-Application.UserTimeOffset) , dt_rnya = dt_RNYA; //18:00 New York Afternoon (NewYork 13:00pm)

DateTime dt_RNZR = DateTime.Parse(s_fstDay + RNZR).Add(-Application.UserTimeOffset) , dt_rnzr = dt_RNZR; //18:00 NZD Date Change (WLG 7:00am)

DateTime dt_RNXC = DateTime.Parse(s_fstDay + RNXC).Add(-Application.UserTimeOffset) , dt_rnxc = dt_RNXC; //19:30 US NYMEX Close (NewYork 14:30pm)

DateTime dt_RCME = DateTime.Parse(s_fstDay + RCME).Add(-Application.UserTimeOffset) , dt_ecme = dt_RCME; //20:00 US CME Close (NewYork 15:00pm)

DateTime dt_RNYC = DateTime.Parse(s_fstDay + RNYC).Add(-Application.UserTimeOffset) , dt_rnyc = dt_RNYC; //21:00 US NYSE(Stock) Close(NewYork 16:00pm)

DateTime dt_RAPI = DateTime.Parse(s_fstDay + RAPI).Add(-Application.UserTimeOffset) , dt_rapi = dt_RAPI; //21:30 US API Oil Stock CHG(NewYork 21:30pm Tuesday Only)

DateTime dt_REIA = DateTime.Parse(s_fstDay + REIA).Add(-Application.UserTimeOffset) , dt_reia = dt_REIA; //15:30 US EIA Oil Stock CHG(NewYork 10:30pm Wednesday Only)

//Initialize Accumulator, Variable of rectangle

int i = 0; ChartRectangle rt_DLit; ChartText tx_RMkr;

//Day by Day plot Retangles

for ( DateTime crntme = startDate; crntme <= last_Date; crntme = startDate.AddDays(i) )

{

if ( crntme.DayOfWeek != DayOfWeek.Saturday && crntme.DayOfWeek != DayOfWeek.Sunday ) //Skip Weekend

{

//Reset Ploting X1 X2 DateTime

dt_as1s = dt_AS1S.AddDays(i); dt_as1e = dt_AS1E.AddDays(i); if (dt_as1s.DayOfWeek == DayOfWeek.Sunday) {dt_as1s = dt_as1s.AddDays(-2);} //Move Start from Sunday evening to Friday evening;

dt_as2s = dt_AS2S.AddDays(i); dt_as2e = dt_AS2E.AddDays(i);

dt_ez1s = dt_EZ1S.AddDays(i); dt_ez1e = dt_EZ1E.AddDays(i);

dt_ez2s = dt_EZ2S.AddDays(i); dt_ez2e = dt_EZ2E.AddDays(i);

dt_nyes = dt_NYES.AddDays(i); dt_nyee = dt_NYEE.AddDays(i);

dt_nwts = dt_NWTS.AddDays(i); dt_nwte = dt_NWTE.AddDays(i);

dt_ldfs = dt_LDFS.AddDays(i); dt_ldfe = dt_LDFE.AddDays(i);

dt_nyks = dt_NYKS.AddDays(i); dt_nyke = dt_NYKE.AddDays(i);

dt_nycs = dt_NYCS.AddDays(i); dt_nyce = dt_NYCE.AddDays(i);

dt_ends = dt_ENDS.AddDays(i); dt_ende = dt_ENDE.AddDays(i);

//Plot the Rectangles (BreakPeriods, PreHeatPeriods, PeakHours)

rt_DLit = Chart.DrawRectangle(pfx_AS1 + dt_as1s, dt_as1s, -9999, dt_as1e, 9999, cl_AS1, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_AS2 + dt_as2s, dt_as2s, -9999, dt_as2e, 9999, cl_AS2, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_EZ1 + dt_ez1s, dt_ez1s, -9999, dt_ez1e, 9999, cl_EZ1, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_EZ2 + dt_ez2s, dt_ez2s, -9999, dt_ez2e, 9999, cl_EZ2, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_NYE + dt_nyes, dt_nyes, -9999, dt_nyee, 9999, cl_NYE, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_NWT + dt_nwts, dt_nwts, -9999, dt_nwte, 9999, cl_NWT, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_LDF + dt_ldfs, dt_ldfs, -9999, dt_ldfe, 9999, cl_LDF, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_NYK + dt_nyks, dt_nyks, -9999, dt_nyke, 9999, cl_NYK, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_NYC + dt_nycs, dt_nycs, -9999, dt_nyce, 9999, cl_NYC, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.DrawRectangle(pfx_END + dt_ends, dt_ends, -9999, dt_ende, 9999, cl_END, 0); rt_DLit.IsFilled = true;

//Plot the Rectangles to indicator areas

for (int i_id = 0; i_id < Chart.IndicatorAreas.Count; i_id++)

{

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_AS1 + dt_as1s, dt_as1s, -9999, dt_as1e, 9999, cl_AS1, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_AS2 + dt_as2s, dt_as2s, -9999, dt_as2e, 9999, cl_AS2, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_EZ1 + dt_ez1s, dt_ez1s, -9999, dt_ez1e, 9999, cl_EZ1, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_EZ2 + dt_ez2s, dt_ez2s, -9999, dt_ez2e, 9999, cl_EZ2, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_NYE + dt_nyes, dt_nyes, -9999, dt_nyee, 9999, cl_NYE, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_NWT + dt_nwts, dt_nwts, -9999, dt_nwte, 9999, cl_NWT, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_LDF + dt_ldfs, dt_ldfs, -9999, dt_ldfe, 9999, cl_LDF, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_NYK + dt_nyks, dt_nyks, -9999, dt_nyke, 9999, cl_NYK, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_NYC + dt_nycs, dt_nycs, -9999, dt_nyce, 9999, cl_NYC, 0); rt_DLit.IsFilled = true;

rt_DLit = Chart.IndicatorAreas[i_id].DrawRectangle(pfx_END + dt_ends, dt_ends, -9999, dt_ende, 9999, cl_END, 0); rt_DLit.IsFilled = true;

}

//Plot DailyRoutineMarker

if (DailyRtMkr)

{

//Reset Ploting X-Position DateTime

dt_rnwd = dt_RNWD.AddDays(i); if (dt_rnwd.DayOfWeek == DayOfWeek.Sunday) {dt_rnwd = dt_rnwd.AddDays(-2);} //Move Start from Sunday evening to Friday evening;

dt_rjpx = dt_RJPX.AddDays(i); dt_rcnx = dt_RCNX.AddDays(i); dt_rcns = dt_RCNS.AddDays(i); dt_rldo = dt_RLDO.AddDays(i); dt_rasc = dt_RASC.AddDays(i); dt_reso = dt_RESO.AddDays(i);

dt_rnyo = dt_RNYO.AddDays(i); dt_rnyn = dt_RNYN.AddDays(i); dt_rnxo = dt_RNXO.AddDays(i); dt_rnys = dt_RNYS.AddDays(i); dt_rnyd = dt_RNYD.AddDays(i); dt_rwmr = dt_RWMR.AddDays(i);

dt_resc = dt_RESC.AddDays(i); dt_rcax = dt_RCAX.AddDays(i); dt_rldc = dt_RLDC.AddDays(i); dt_rnya = dt_RNYA.AddDays(i); dt_rnzr = dt_RNZR.AddDays(i); dt_rnxc = dt_RNXC.AddDays(i);

dt_ecme = dt_RCME.AddDays(i); dt_rnyc = dt_RNYC.AddDays(i); dt_rapi = dt_RAPI.AddDays(i); dt_reia = dt_REIA.AddDays(i);

//Plot the DailyRoutineMarkers

tx_RMkr = Chart.DrawText(pfx_RNWD + dt_rnwd, mkr_RNWD, dt_rnwd, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RJPX + dt_rjpx, mkr_RJPX, dt_rjpx, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RCNX + dt_rcnx, mkr_RCNX, dt_rcnx, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RCNS + dt_rcns, mkr_RCNS, dt_rcns, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RLDO + dt_rldo, mkr_RLDO, dt_rldo, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RASC + dt_rasc, mkr_RASC, dt_rasc, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RESO + dt_reso, mkr_RESO, dt_reso, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNYO + dt_rnyo, mkr_RNYO, dt_rnyo, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNYN + dt_rnyn, mkr_RNYN, dt_rnyn, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNXO + dt_rnxo, mkr_RNXO, dt_rnxo, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNYS + dt_rnys, mkr_RNYS, dt_rnys, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNYD + dt_rnyd, mkr_RNYD, dt_rnyd, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RWMR + dt_rwmr, mkr_RWMR, dt_rwmr, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RESC + dt_resc, mkr_RESC, dt_resc, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RLDC + dt_rldc, mkr_RLDC, dt_rldc, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RCAX + dt_rcax, mkr_RCAX, dt_rcax, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNYA + dt_rnya, mkr_RNYA, dt_rnya, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNZR + dt_rnzr, mkr_RNZR, dt_rnzr, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNXC + dt_rnxc, mkr_RNXC, dt_rnxc, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RCME + dt_ecme, mkr_RCME, dt_ecme, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

tx_RMkr = Chart.DrawText(pfx_RNYC + dt_rnyc, mkr_RNYC, dt_rnyc, 0, cl_Rtn); ChTxtCenter(tx_RMkr);

if (dt_rapi.DayOfWeek == DayOfWeek.Tuesday ) { tx_RMkr = Chart.DrawText(pfx_RAPI + dt_rapi, mkr_RAPI, dt_rapi, 0, cl_Rtn); ChTxtCenter(tx_RMkr); }

if (dt_reia.DayOfWeek == DayOfWeek.Wednesday) { tx_RMkr = Chart.DrawText(pfx_REIA + dt_reia, mkr_REIA, dt_reia, 0, cl_Rtn); ChTxtCenter(tx_RMkr); }

}

}

//Next Day

i++;

}

}

private void ChTxtCenter(ChartText tx_cnt) //Set ChartText Horizontal,Vertical Center

{ tx_cnt.VerticalAlignment = VerticalAlignment.Center; tx_cnt.HorizontalAlignment = HorizontalAlignment.Center; tx_cnt.FontSize = 10; }

//Plot MonthLighter on HalfYearChart

private void PlotMthLight()

{

if (!MnthLit) return;

ChartRectangle rt_Mnt;

int yr = DayStart.Year;

for (int iYr = yr-1; iYr <= yr+1; iYr++)

{

string sYr = iYr.ToString();

rt_Mnt = Chart.DrawRectangle(sYr+"-Jan", new DateTime(iYr, 1, 1, 0, 0, 0), -9999, new DateTime(iYr, 2, 1, 0, 0, 0), 9999, Color.FromHex("103333FF"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Feb", new DateTime(iYr, 2, 1, 0, 0, 0), -9999, new DateTime(iYr, 3, 1, 0, 0, 0), 9999, Color.FromHex("10AAAAAA"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Mar", new DateTime(iYr, 3, 1, 0, 0, 0), -9999, new DateTime(iYr, 4, 1, 0, 0, 0), 9999, Color.FromHex("10AAFFAA"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Apr", new DateTime(iYr, 4, 1, 0, 0, 0), -9999, new DateTime(iYr, 5, 1, 0, 0, 0), 9999, Color.FromHex("1033FF33"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-May", new DateTime(iYr, 5, 1, 0, 0, 0), -9999, new DateTime(iYr, 6, 1, 0, 0, 0), 9999, Color.FromHex("1000FFAA"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Jun", new DateTime(iYr, 6, 1, 0, 0, 0), -9999, new DateTime(iYr, 7, 1, 0, 0, 0), 9999, Color.FromHex("1055FFFF"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Jul", new DateTime(iYr, 7, 1, 0, 0, 0), -9999, new DateTime(iYr, 8, 1, 0, 0, 0), 9999, Color.FromHex("10AAEE55"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Aug", new DateTime(iYr, 8, 1, 0, 0, 0), -9999, new DateTime(iYr, 9, 1, 0, 0, 0), 9999, Color.FromHex("10FFFF00"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Sep", new DateTime(iYr, 9, 1, 0, 0, 0), -9999, new DateTime(iYr,10, 1, 0, 0, 0), 9999, Color.FromHex("10FF9900"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Oct", new DateTime(iYr,10, 1, 0, 0, 0), -9999, new DateTime(iYr,11, 1, 0, 0, 0), 9999, Color.FromHex("10FF3377"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Nov", new DateTime(iYr,11, 1, 0, 0, 0), -9999, new DateTime(iYr,12, 1, 0, 0, 0), 9999, Color.FromHex("10EE11AA"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

rt_Mnt = Chart.DrawRectangle(sYr+"-Dec", new DateTime(iYr,12, 1, 0, 0, 0), -9999, new DateTime(iYr,12,31,23,59,59), 9999, Color.FromHex("10AAAAFF"), 0, LineStyle.Solid); rt_Mnt.IsFilled = true;

}

}

//Plot 5Mins, 1-4Hour on(Today and Yesterday) <=80Tick, 250Tick, 1000Tick TimeFrame

private void DrawIntradayVertLnes()

{

if (!MinHorLne) return;

string TFGroup = new string(TimeFrame.ToString().Take(4).ToArray()); //Get TimeFrame GroupName

if (TFGroup == "Tick" && TimeFrame <= TimeFrame.Tick80)

{

for (DateTime currentTime = DayStart; currentTime <= DayEnd; currentTime = currentTime.AddMinutes(5))

{

DateTime dt5MinMkr = currentTime; string s5MinMkr = string.Format("5Min_VertLnes {0}", dt5MinMkr); //Time of 5Min Seperator Marker, Line ObjectName

Chart.DrawVerticalLine(s5MinMkr, dt5MinMkr, clrTikMkr(DayStart, dt5MinMkr), 1, LineStyle.Dots);

}

}

else if (TimeFrame.ToString() == "Tick250" || TimeFrame.ToString() == "Minute5")

{

for (DateTime currentTime = DayStart; currentTime <= DayEnd; currentTime = currentTime.AddHours(1))

{

DateTime dt1hrMkr = currentTime; string s1hrMkr = string.Format("1Hour_VertLnes {0}", dt1hrMkr); //Time of 1hour Seperator Marker, Line ObjectName

Chart.DrawVerticalLine(s1hrMkr, dt1hrMkr, clrTikMkr(DayStart, dt1hrMkr), 1, LineStyle.Solid);

}

}

else if (TimeFrame.ToString() == "Tick1000")

{

for (DateTime currentTime = LstStart; currentTime <= DayStart; currentTime = currentTime.AddHours(4)) //2 Days ago

{

DateTime dt4hrMkr = currentTime; string s4hrMkr = string.Format("4Hour_VertLnes {0}", dt4hrMkr); //Time of 4Hour Seperator Marker, Line ObjectName

Chart.DrawVerticalLine(s4hrMkr, dt4hrMkr, clrTikMkr(LstStart, dt4hrMkr), 1, LineStyle.Solid);

}

for (DateTime currentTime = DayStart; currentTime <= DayEnd; currentTime = currentTime.AddHours(4)) //1 Day ago

{

DateTime dt4hrMkr = currentTime; string s4hrMkr = string.Format("4Hour_VertLnes {0}", dt4hrMkr); //Time of 4Hour Seperator Marker, Line ObjectName

Chart.DrawVerticalLine(s4hrMkr, dt4hrMkr, clrTikMkr(DayStart, dt4hrMkr), 1, LineStyle.Solid);

}

}

}

//Define 5Min 1-4Hour Seperator's Colour

private Color clrTikMkr(DateTime dt_St, DateTime dtTMkr)

{

if (dtTMkr == dt_St || dtTMkr == dt_St.AddHours( 1) || dtTMkr == dt_St.AddHours( 2) || dtTMkr == dt_St.AddHours( 3) ) { return Color.FromHex("#667788FF"); } //DarkBlue

else if (dtTMkr == dt_St.AddHours( 4) || dtTMkr == dt_St.AddHours( 5) || dtTMkr == dt_St.AddHours( 6) || dtTMkr == dt_St.AddHours( 7) ) { return Color.FromHex("#AA7788FF"); } //LightBlue

else if (dtTMkr == dt_St.AddHours( 8) || dtTMkr == dt_St.AddHours( 9) || dtTMkr == dt_St.AddHours(10) || dtTMkr == dt_St.AddHours(11) ) { return Color.FromHex("#AA99FF99"); } //MorningGreen

else if (dtTMkr == dt_St.AddHours(12) || dtTMkr == dt_St.AddHours(13) || dtTMkr == dt_St.AddHours(14) || dtTMkr == dt_St.AddHours(15) ) { return Color.FromHex("#6699FF99"); } //MorningNoon

else if (dtTMkr == dt_St.AddHours(16) || dtTMkr == dt_St.AddHours(17) || dtTMkr == dt_St.AddHours(18) || dtTMkr == dt_St.AddHours(19) ) { return Color.FromHex("#AAFF7777"); } //AfternoonFight

else if (dtTMkr == dt_St.AddHours(20) || dtTMkr == dt_St.AddHours(21) || dtTMkr == dt_St.AddHours(22) || dtTMkr == dt_St.AddHours(23) ) { return Color.FromHex("#66FF7777"); } //AfternoonToEnd

else { return Color.FromHex("#15FFFFFF"); } //5min Grey

}

}

}

Capt.Z-Fort.Builder

Joined on 03.06.2020

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: FX Day Seperator.algo

- Rating: 5

- Installs: 3900

- Modified: 01/01/2023 23:02

Comments

Your indicator looks amazing, thanks a lot and respect from all aspects :)

This is a great indicator to identify Sessions.

I have customized the day starting and London session timings .

@jerry.bogart89

It should work fine, with no problem.

this one still working?. cause its not working even after installing thanks.

...compare it with your Windows 10.Net installed components...

@kaizen.coaching.jp

You may like to check if .Net Framework components had been fully installed in your new Windows 11 system, there are .Net 3.5, 4.5 , .Net Core Runtime etc. You can compare it with your windows .Net installed list. Hope this could be helpful to your issue.

Thank you for your reply. I tried to compile it locally, but no luck. So, I tried it on another PC and it worked well. The only difference was that I'm using the newest version of Windows 11, but not sure if it can cause any issues. My old laptop is on Win10, same version of cTrader. I tried other session indicators, all are displaying ok, but functionally very useless. Yours is the only one which is good.

Do you have any idea that windows 11 could cause such an issue?

Thank you.

@kaizen.coaching.jp

Please try copying the source code, pasting it to your local desktop cTrader app, and compiling it locally. I'm ok with the indicator working fine.

Hi,

Thanks for making such an useful indicator. I had to reinstall Windows, including cTrader and Axiory cTrader and after the reinstall, the indicator stopped working. On cTrader it's just not showing on the chart and on Axiory cTrader it's showing an error.

Do you have any idea where the issue could be?

Thank you.

Regards,

Francis

shourai2100@gmail.com

What if there was a platform where you could instantly unbox any or all mystery boxes and win a prize? Not only that, but you can get a shopping location to visit right now - today - in the next minute - right now - in addition to exciting prizes and perks! Yup!

If you want to learn to code, you should always keep learning, even when you're working full time. C is a good thing for you to learn. C is similar to C++, so you won't have to relearn from the beginning. It's one of the basic of programming language. Here you will learn about day separator and session lighter in C. Source pay someone to do my essay for me

i have already thanked you, but, i am very happy with your indicator, i used to place lines my self on chart to separate 4h candles on lower timeframes and tick frames, you sir deserve a medal!

Thank you once more!!!