Description

This bot makes use of price action mixed with standard Bollinger bands and an exponential moving average to find a good trading opportunity.

----------------------------------------------------------------------------------------------------------------

Trading using leverage carries a high degree of risk to your capital, and it is possible to lose more than

your initial investment. Only speculate with money you can afford to lose.

----------------------------------------------------------------------------------------------------------------

tested using NAS100 symbol and 2m chart.

Symbol = NAS100

Timeframe = m2

Source = Close

Period = 50

Volume = 1 lot

Bars Range = 5

Offset Pips StopLoss = 15

BE Start = 15

TP/SL Ratio = 3

Trail = 2

BBO Source = Close

BBO MA Type = Exponential

Periods = 20

St. Dev = 2

Results :

Date = Between 01/01/2020 and 08/11/2021 profit of $1070.30 USD (+107%)

Net profit = 1070.30 USD

Ending Equity = 2070.30 USD

Sharpe Ratio = 0.13

Sortino Ratio = 0.17

Effectiveness = 162/235 = 68.9%

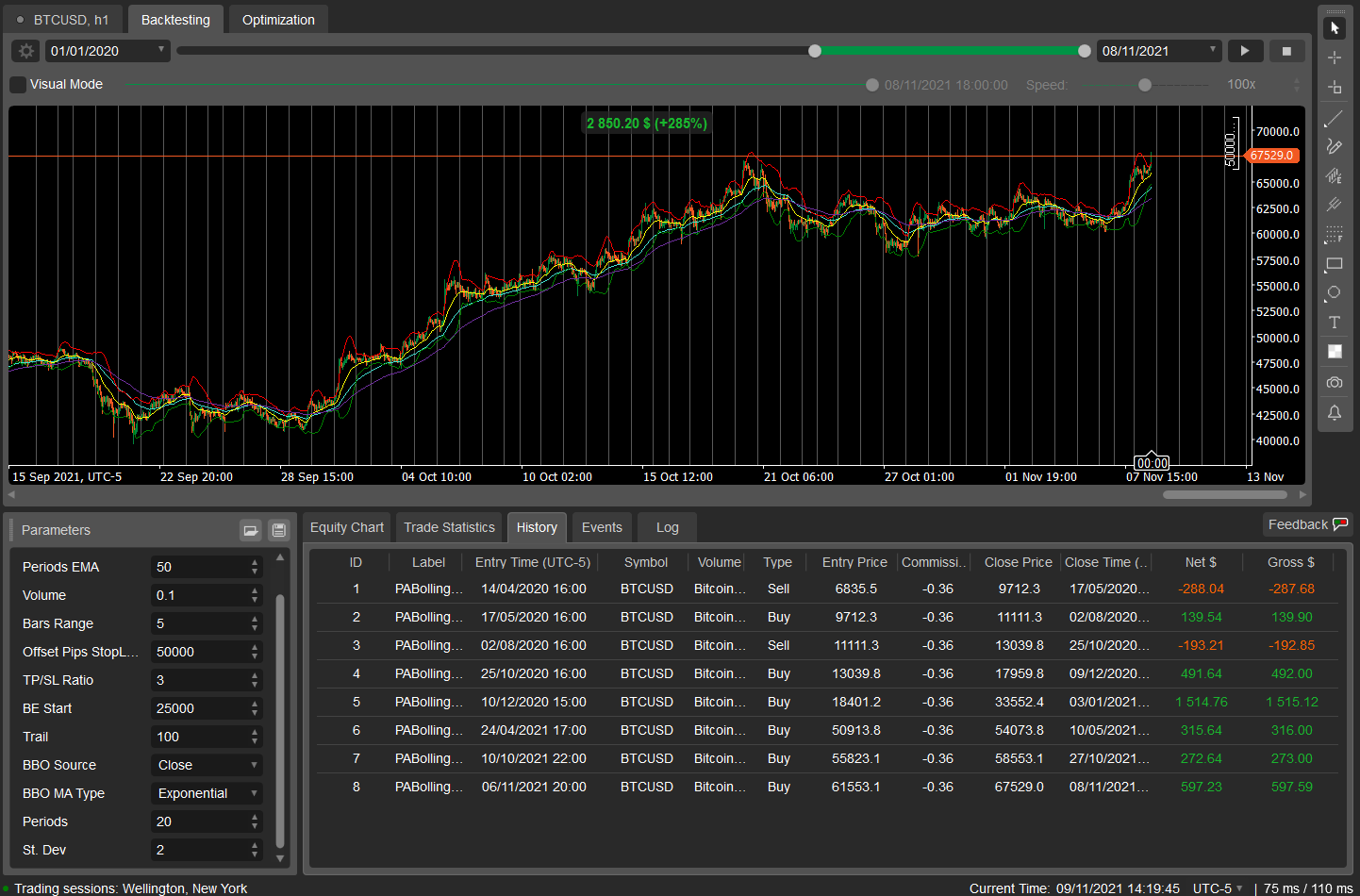

tested using BTCUSD symbol and h1chart.

Symbol = BTCUSD

Timeframe = h1

Source = Close

Period = 50

Volume = 0.1 lot

Bars Range = 5

Offset Pips StopLoss = 50000

BE Start = 25000

TP/SL Ratio = 3

Trail = 100

BBO Source = Close

BBO MA Type = Exponential

Periods = 20

St. Dev = 2

Results :

Date = Between 01/01/2020 and 08/11/2021 profit of $2805.20 USD (+285%)

Net profit = 2805.20 USD

Ending Equity = 3805.20 USD

Sharpe Ratio = 0.64

Sortino Ratio = 01.11

Effectiveness = 6/8 = 75%

#region cBot Parameters Comments

// Symbole = NAS100

// Timeframe = m2

//

// Source = Close

// Period = 50

// Volume = 1 lot

//

// Bars Range = 5

// Offset Pips StopLoss = 15

// BE Start = 15

// TP/SL Ratio = 3

// Trail = 2

//

// BBO Source = Close

// BBO MA Type = Exponential

// Periods = 20

// St. Dev = 2

//

// Results :

// Date = Between 01/01/2020 and 08/11/2021 profit of $1070.30 USD (+107%)

// Net profit = 1070.30 USD

// Ending Equity = 2070.30 USD

// Sharpe Ratio = 0.13

// Sortino Ratio = 0.17

// effectiveness = 162/235 = 68.9%

#endregion

#region advertisement

// -------------------------------------------------------------------------------

// Trading using leverage carries a high degree of risk to your capital, and it is possible to lose more than

// your initial investment. Only speculate with money you can afford to lose.

// -------------------------------------------------------------------------------

#endregion

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class PABollingerScalper : Robot

{

#region Prameters

[Parameter("Source EMA")]

public DataSeries Source_EMA { get; set; }

[Parameter("Periods EMA", DefaultValue = 50)]

public int Periods_EMA { get; set; }

[Parameter("Volume", DefaultValue = 1, MinValue = 1E-06)]

public double Volume { get; set; }

[Parameter("Bars Range", DefaultValue = 5, MinValue = 1)]

public int barsRange { get; set; }

[Parameter("Offset Pips StopLoss", DefaultValue = 15, MinValue = 1)]

public int offsetStopLoss { get; set; }

[Parameter("TP/SL Ratio", DefaultValue = 3, MinValue = 1)]

public int ratio { get; set; }

[Parameter("BE Start", DefaultValue = 15, MinValue = 1)]

public int BE_Start { get; set; }

[Parameter("Trail", DefaultValue = 2, MinValue = 1)]

public int Trail { get; set; }

[Parameter("BBO Source")]

public DataSeries source_BBO { get; set; }

[Parameter("BBO MA Type", DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType BBO_MaType { get; set; }

[Parameter("Periods", DefaultValue = 20)]

public int BBO_Periods { get; set; }

[Parameter("St. Dev", DefaultValue = 2)]

public int BBO_ST_Dev { get; set; }

#endregion

#region Globals

private ExponentialMovingAverage _EMA;

private BollingerBands _BBO;

// Bot Name

private const string botName = "PABollingerScalper";

private const int highCeil = 80;

private const int lowCeil = 20;

private double extremeHigh = 0;

private double extremeLow = 0;

private int idxHigh = 0;

private int idxLow = 0;

#endregion

#region cBot Events

protected override void OnStart()

{

base.OnStart();

_EMA = Indicators.ExponentialMovingAverage(Source_EMA, Periods_EMA);

_BBO = Indicators.BollingerBands(source_BBO, BBO_Periods, BBO_ST_Dev, BBO_MaType);

Positions.Closed += OnPositionClosed;

}

protected override void OnStop()

{

base.OnStop();

closePositions();

}

protected override void OnTick()

{

foreach (var position in Positions.FindAll(botName, Symbol.Name))

{

if (position.Pips > BE_Start)

{

double actualPrice = isBuy(position) ? Symbol.Bid : Symbol.Ask;

int factor = isBuy(position) ? 1 : -1;

double? newStopLoss = position.StopLoss;

/// Stop a ZERO

if ((position.EntryPrice - newStopLoss) * factor > 0)

{

newStopLoss = position.EntryPrice;

}

if ((actualPrice - newStopLoss) * factor > Trail * Symbol.PipSize)

{

newStopLoss += factor * Trail * Symbol.PipSize;

if (newStopLoss != position.StopLoss)

ModifyPosition(position, newStopLoss, position.TakeProfit.Value);

}

}

}

//searchSignals();

}

protected override void OnBar()

{

searchSignals();

}

private void searchSignals()

{

var index = this.Bars.ClosePrices.Count - 2;

var earliest = index - barsRange;

for (var i = index; i >= earliest; i--)

{

if (i >= 0)

{

var high = this.Bars.HighPrices[i];

var low = this.Bars.LowPrices[i];

if (high > this.extremeHigh)

{

idxHigh = i;

}

if (low < this.extremeLow)

{

idxLow = i;

}

this.extremeHigh = Math.Max(high, this.extremeHigh);

this.extremeLow = this.extremeLow == 0 ? low : Math.Min(low, this.extremeLow);

}

else

{

break;

}

}

if (!isBuyPositions && isPABBuySignal)

{

closePositions(TradeType.Sell);

Open(TradeType.Buy);

}

else if (!isSellPositions && isPABSellSignal)

{

closePositions(TradeType.Buy);

Open(TradeType.Sell);

}

this.extremeLow = 0;

this.extremeHigh = 0;

}

private void OnPositionClosed(PositionClosedEventArgs args)

{

}

#endregion

#region cBot Action

private void Open(TradeType tradeType)

{

double actualPrice = isBuy(tradeType) ? Symbol.Bid : Symbol.Ask;

int stopLoss = (int)(isBuy(tradeType) ? actualPrice - this.extremeLow : this.extremeHigh - actualPrice) + offsetStopLoss;

ExecuteMarketOrder(tradeType, Symbol.Name, Volume, botName, stopLoss, stopLoss * ratio);

}

private void closePosition(Position position)

{

var result = ClosePosition(position);

if (!result.IsSuccessful)

Print("error : {0}", result.Error);

}

// Close all positiones by "tradeType"

private void closePositions(TradeType tradeType)

{

foreach (Position position in Positions.FindAll(botName, Symbol.Name, tradeType))

closePosition(position);

}

// Close all position

private void closePositions()

{

closePositions(TradeType.Buy);

closePositions(TradeType.Sell);

}

#endregion

#region cBot Predicate

private bool isPABBuySignal

{

get { return _BBO.Bottom[this.idxLow] > this.extremeLow && _EMA.Result.IsRising() && (Symbol.Bid > this.extremeHigh) && (Symbol.Bid > _BBO.Main.LastValue) && (Symbol.Bid < _BBO.Top.LastValue); }

}

private bool isPABSellSignal

{

get { return _BBO.Top[this.idxHigh] < this.extremeHigh && _EMA.Result.IsFalling() && (Symbol.Ask < this.extremeLow) && (Symbol.Ask < _BBO.Main.LastValue) && (Symbol.Ask > _BBO.Bottom.LastValue); }

}

private bool isBuy(Position position)

{

return TradeType.Buy == position.TradeType;

}

private bool isBuy(TradeType tradeType)

{

return TradeType.Buy == tradeType;

}

private bool isBuyPositions

{

get { return Positions.Find(botName, Symbol.Name, TradeType.Buy) != null; }

}

private bool isSellPositions

{

get { return Positions.Find(botName, Symbol.Name, TradeType.Sell) != null; }

}

#endregion

#region cBot Utils

private int OpenedTrades

{

get { return Positions.FindAll(botName, Symbol.Name).Count(); }

}

#endregion

}

}

andres.barar

Joined on 09.11.2021

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: PABollingerScalper.algo

- Rating: 5

- Installs: 2354

- Modified: 09/11/2021 19:20

Comments

Which instrument it works on? It doesn't work on Forex it seems?

What exactly is this bot doing? When does it open/close positions?

What is 'Bars Range' parameter?

Thanks

Is it really working? Can we make it work on Gacha Neon? As it is the best-modified version of Gacha Club, also it has few features of Gacha Life too.