Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

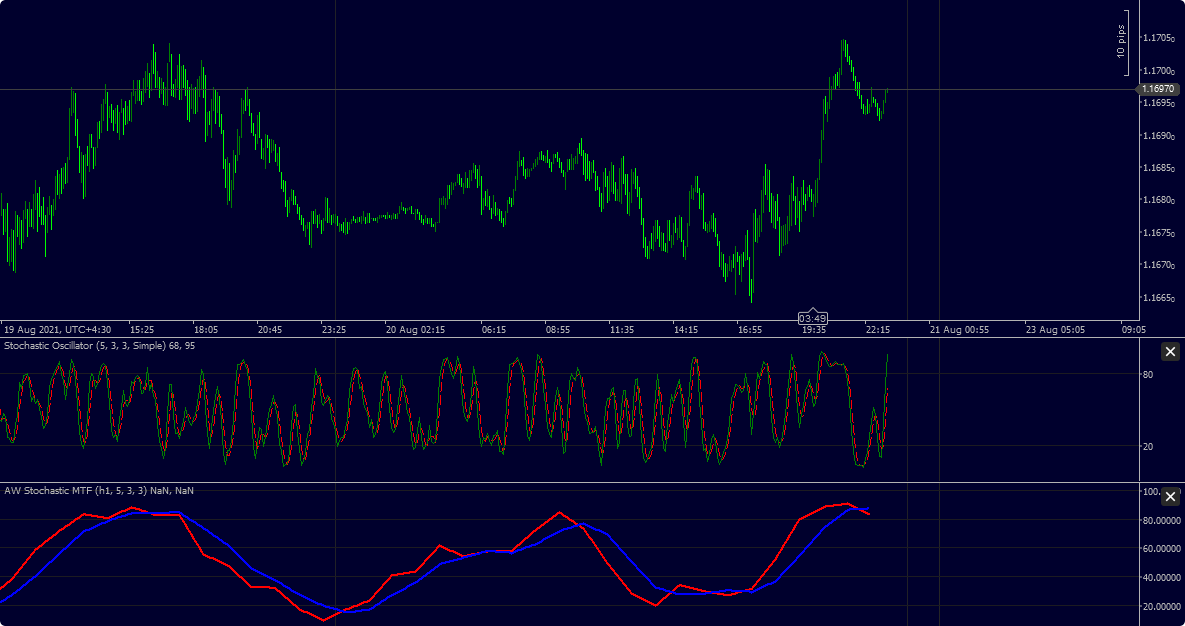

Stochastic MTF (Multi Time Frame)

This indicator is a complete version of this topic

cTDN Forum - stochastic multitime (ctrader.com)

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class AWStochasticMTF : Indicator

{

// you could change default Value to Minute,Minute15,Hour2 and ...

[Parameter("Base Timeframe", DefaultValue = "Minute15")]

public TimeFrame BaseTimeFrame { get; set; }

[Parameter("K%", DefaultValue = 5)]

public int kPeriod { get; set; }

[Parameter("K slowing", DefaultValue = 3)]

public int kslowing { get; set; }

[Parameter("D%", DefaultValue = 3)]

public int dPeriod { get; set; }

[Output("K%,", LineColor = "Red", LineStyle = LineStyle.Solid, Thickness = 2)]

public IndicatorDataSeries k_Line { get; set; }

[Output("D%,", LineColor = "Blue", LineStyle = LineStyle.Solid, Thickness = 2)]

public IndicatorDataSeries d_Line { get; set; }

private StochasticOscillator _stoch;

private Bars _baseTimeFrameBars;

double slopeK, slopeD;

int n, nBars, lastBar = 0, One = 0, modeTimeframe = 0;

protected override void Initialize()

{

_baseTimeFrameBars = MarketData.GetBars(BaseTimeFrame);

_stoch = Indicators.StochasticOscillator(_baseTimeFrameBars, kPeriod, kslowing, dPeriod, MovingAverageType.Simple);

nBars = Bars.Count;

if (Chart.TimeFrame < BaseTimeFrame)

modeTimeframe = 1;

else if (Chart.TimeFrame == BaseTimeFrame)

modeTimeframe = 2;

}

private void Draw()

{

for (int j = 1; j <= nBars; j++)

{

var baseSeriesIndex = _baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[j]);

double k1 = _stoch.PercentK[baseSeriesIndex];

double d1 = _stoch.PercentD[baseSeriesIndex];

var baseSeriesIndexB = _baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[j - 1]);

double k2 = _stoch.PercentK[baseSeriesIndexB];

if (k1 != k2)

{

for (int i = j; i <= nBars; i++)

{

k2 = _stoch.PercentK[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[i])];

if (k1 != k2)

{

slopeK = (k2 - k1) / (i - j);

double d2 = _stoch.PercentD[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[i])];

slopeD = (d2 - d1) / (i - j);

n = 0;

lastBar = j;

break;

}

}

}

k_Line[j] = k1 + (slopeK * n);

d_Line[j] = d1 + (slopeD * n);

n++;

}

}

public override void Calculate(int index)

{

if (modeTimeframe == 1)

{

if (nBars < Bars.Count)

nBars = Bars.Count;

if (One != nBars)

{

Draw();

One = nBars;

}

if (IsLastBar)

{

var baseSeriesIndex = _baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[index]);

double k3 = _stoch.PercentK[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[lastBar - 1])];

double k4;

for (int i = lastBar - 1; i > 0; i--)

{

k4 = _stoch.PercentK[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[i])];

if (k3 != k4)

{

k4 = _stoch.PercentK[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[i + 1])];

k3 = _stoch.PercentK[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[lastBar])];

slopeK = (k3 - k4) / (lastBar - i);

double d4 = _stoch.PercentD[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[i + 1])];

double d3 = _stoch.PercentD[_baseTimeFrameBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[lastBar])];

slopeD = (d3 - d4) / (lastBar - i);

n = 0;

for (int j = i + 1; j <= lastBar; j++)

{

k_Line[j] = k4 + (slopeK * n);

d_Line[j] = d4 + (slopeD * n);

n++;

}

break;

}

}

}

}

else if (modeTimeframe == 2)

{

k_Line[index] = _stoch.PercentK[index];

d_Line[index] = _stoch.PercentD[index];

}

}

}

}

AM

Amin.fx

Joined on 02.08.2021

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: AW Stochastic MTF.algo

- Rating: 0

- Installs: 2046

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

hi…

do u know why this ind not draw for HA candle ??

/rgs