Description

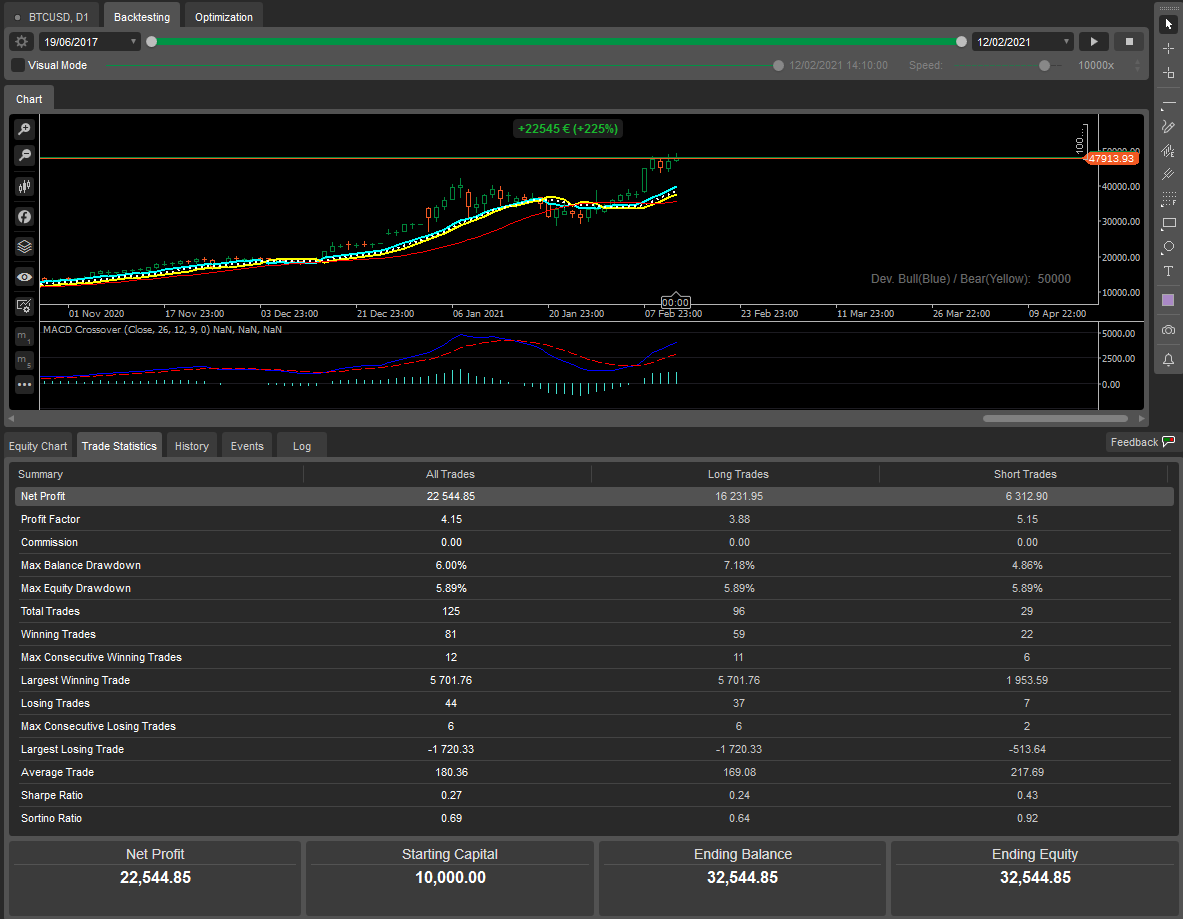

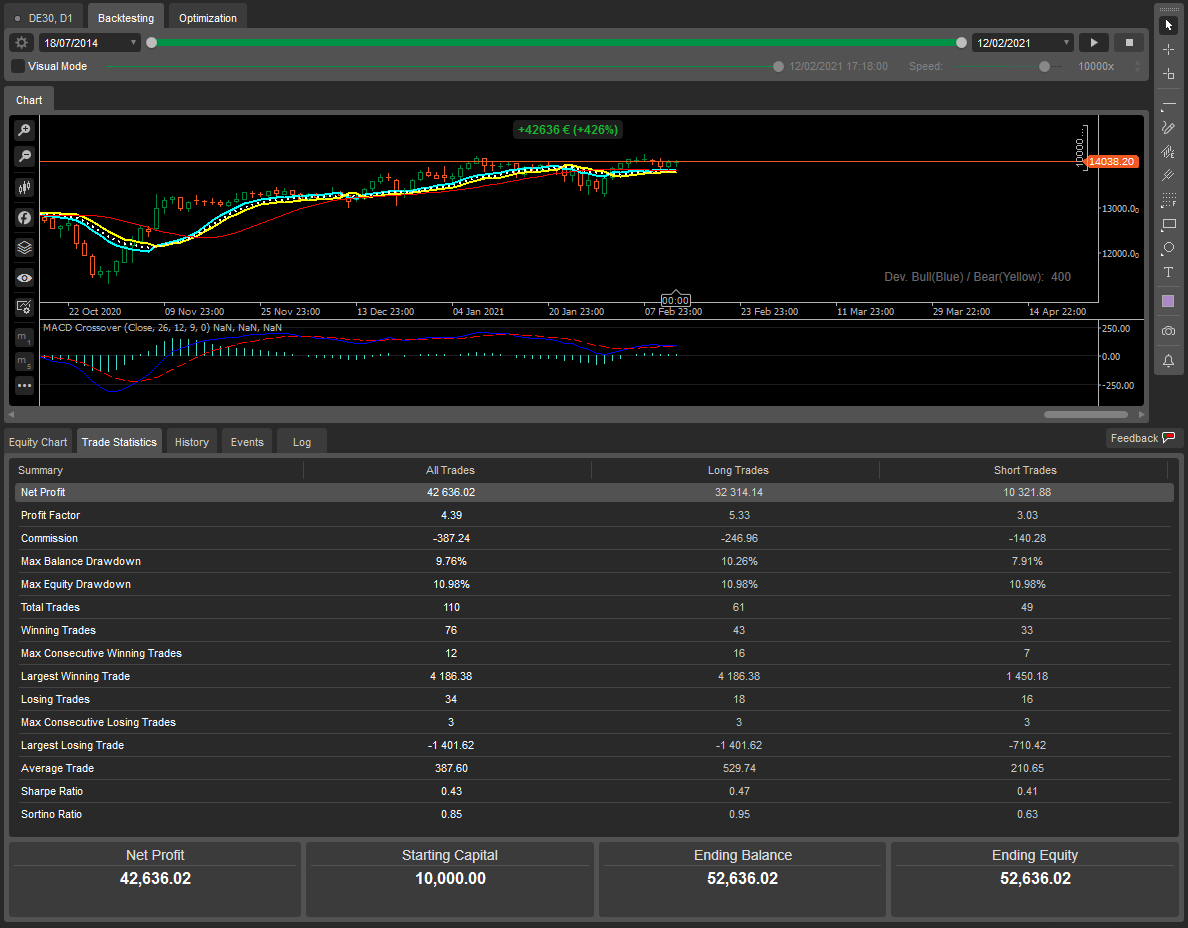

Chart on Daily TimeFrame

cTrader Platform Trading System based on BIAS IntraWeek Strategy.

The "Bias" is a recurring / repeated inefficiency of the market from which we can take advantage.

----------------------------------------------------------------------

Open an account with Gumroad and become an affiliate and start earning by selling our products: Become an affiliate for Active cTrader Bot

----------------------------------------------------------------------

A Bias is an inefficiency that reappears on the market with a certain systematicity: it can be linked to specific time slots, or to certain days of the week, but it can also extend to several weeks, and in these cases we are talking about seasonal trends. It is a fairly simple analysis to conduct, but it can give very useful information, both to the discretionary trader and to the systematic trader.

The "Bias Weekly Time cBot", through the optimization on daily time bands, analyzes the market of a specific Forex Currency Cross, CFDs (Indices, Futures, Crypto Currencies, Metals ...), to identify the presence of Bias on a weekly basis and detecting the repeated trend over time of a symbol going Short / Long in a weekly time slot.

THE STRATEGY DO NOT USE ANY GRID SYSTEM OR MARTINGALA

Buy & Sell must be optimized separately.

In the strategy:

- Use Daily TimeFrame

- UTC Time (time zone): Date and time are based on "Utc Server Time". UTC (country time difference) can be set from the parameters section from -12 to +14

- Daylight saving time (where applied) is set automatically.

- Different Parameters for Long & Short, they work autonomously.

- Automatic adjustment for opening / closing time: During the optimization process if the opening time is greater than the closing time the last one will be moved towards the maximum allowed closing time. The same for CFDs for opening hours.

- Symbol Market Hours (Open / Close): for CFDs (Indices, Futures, Crypto Currencies, Metals ...) are already set up for ICMarket and Pepperstone brokers. By sending us an email we can set them up for different brokers.

- StopLoss & TakeProfit can be set as Price or Equity percentage. The optimization process will choose the percentage that best suits the price range of the analyzed symbol.

- 4 indicators to filter market entry: MACD Crossover, Triangular Mov. Average, SMA_TRMA_Ind, Sma_Bull_Bear_Ind. (The last 2 indicators are setted for Daily TimeFrame and will be downloaded together with the cBot)

- 18 variable combinations, using indicators, to filter market entry. From -7 to 10. Negative numbers indicate a reversal bias (mean reverting propensity). With the variable set to 0 (zero) all filters are excluded and the cBot will only work on the time bands. The optimization process will choose the filters that best suit the analyzed symbol.

- Buy/Sell Consecutive Loss Protection.

- Optimization Criteria (GetFitness), you can set it to "Custom" with the following Criteria:

Chart on Daily TimeFrame

NetProfit

SharpeRatio

ProfitFactor/ minimize MaxEquityDrawDownPercentage

TotalTrades

AverageTrade

- Money Management on winning and loosing trade (Position Sizing).

Pay attention to the Trade volume for each instrument as it changes from Forex to Indices, Metals, Oil, Futures and Crypto Currencies. Some Brokers for CFD give you the opportunity to trade all of them with micro lots. Others use different Lotsize (example for Indices minimum 1 contract, Gold 0.1 / 1 Oz).

In the Trading System, if you enter a wrong value, the Bot will automatically use the minimum tradable volume.

Warning: when trading CFDs (Indices, Futures, Crypto Currencies, Metals) the results can vary widely between one broker and another. The suggestion is to operate on CFDs using the same broker in which the optimization was made.

Backtest and optimization must be done considering the following parameters at best

(lined up in sequence of importance and priority):

- SharpRatio: (which is a reward to risk ratio) minimum value 0.13

- Max Balance Drawdown & Max Equity Drawdown: Max 8/9% better under 5%. Discard higher values. Rather than earning, you should consider what you can lose. If you don't pay attention to Drawdown, working with a high leverage is very easy to lose the whole capital. With high leverage you can earn a lot compared to the capital but you can also easily drain the whole account.

Using Position Sizing (on gain) you can double or triple the earnings and in this case the Drawdown can go up to max 15%. Do it only if it is worth on increasing the gain. To reduce the Drawdown use "Position Sizing (on lose)" or "Consecutive Loss Protection" the gain in this case will be slightly reduced.

- Profit Factor: minimum value 1.40 - better if it is higher than 1.50

- Net Profit

- Trades number: all optimizations must be done over a minimum of 8/9 years period to have reliable results. In this period consider at minimum to have more than 400 trades adding up all the Long and Short trades of all the days of the week involved.

- Average Trade: The average earnings for each individual trade. Considering an initial capital of $ 10,000, 200 leverage, ordersize (bet) 0.10 lots (10,000 volume). The Average Trade must be more then 20.00 $ per Trade.

P.S .: When you optimize or backtest put Commission to 50 (x million) and Spread to 2 for major Forex crosses and more for minor crosses and CFDs. This is used to amortize slippage.

- The parameters attached to the bot have been optimized using ICMarket Broker (Forex from 08/02/2011 to 31/10/2020) (with some parameters the Drawdown comes out higher because it was worth pushing on the Money Management).

To avoid "Over-Fitting":

- Optimizations and Backtests must be performed for at least 8/9 or more years for reliable results. The optimization done on short periods is not absolutely reliable. Professional traders optimize and backtest their automatic systems using very long periods (10/15/20 years) of data feeds with paid Data Feeds providers. All Brokers who use cTrader platform for Forex give a free set of Data Feeds of about 8/9 years and for CFDs 5/6 years.

- To test if the parameters obtained are robust, do backtests by varying them slightly. If you get positive results, even if qualitatively lower than the optimized ones, this means that the parameter set is robust and not "Overfitted".

----------------------------------------------------------------------

Additional products:

----------------------------------------------------------------------

Brokers using cTrader platform can be found at the following link:

https://ctrader.com/featured-brokers/

Contacts and information: active.ctrader.bot@gmail.com

----------------------------------------------------------------------

Open an account with Gumroad and become an affiliate and start earning by selling our products: Become an affiliate for Active cTrader Bot

----------------------------------------------------------------------

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class ZZZ_Add_new_BIAS_Weekly_Time_Bot : Robot

{

[Parameter(DefaultValue = 0.0)]

public double Parameter { get; set; }

protected override void OnStart()

{

if (RunningMode != RunningMode.Optimization)

{

Chart.DrawStaticText("a", "https://gumroad.com/l/LkhaO", VerticalAlignment.Top, HorizontalAlignment.Center, Color.Yellow);

Chart.DrawStaticText("b", "\n\n" + "https://gumroad.com/activebot", VerticalAlignment.Top, HorizontalAlignment.Center, Color.Yellow);

Chart.DrawStaticText("c", "\n\n\n" + "active.ctrader.bot@gmail.com", VerticalAlignment.Top, HorizontalAlignment.Center, Color.Yellow);

}

}

protected override void OnTick()

{

// IS NOT POSSIBLE TO DOWLOAD THE DEMO VERSION HERE PLEASE VISIT:

Chart.DrawStaticText("DEMO", "https://gumroad.com/l/LkhaO" + "\n" + "active.ctrader.bot@gmail.com", VerticalAlignment.Top, HorizontalAlignment.Center, Color.Yellow);

// FOR CONTACTS:

}

protected override void OnStop()

{

// Put your deinitialization logic here

}

}

}

mparama

Joined on 11.10.2016

- Distribution: Paid

- Language: C#

- Trading platform: cTrader Automate

- File name: Add_BIAS_Weekly_Time_Bot.algo

- Rating: 0

- Installs: 781

- Modified: 13/10/2021 09:54