Description

BBands Trend Follower / cTrader platform - Automatic Trading System

New release "BBands Trend Follower 02.21"

----------------------------------------------------------------------

Open an account with Gumroad and become an affiliate and start earning by selling our products: Become an affiliate for Active cTrader Bot

----------------------------------------------------------------------

In the new release we have added and implemented the following parameters:

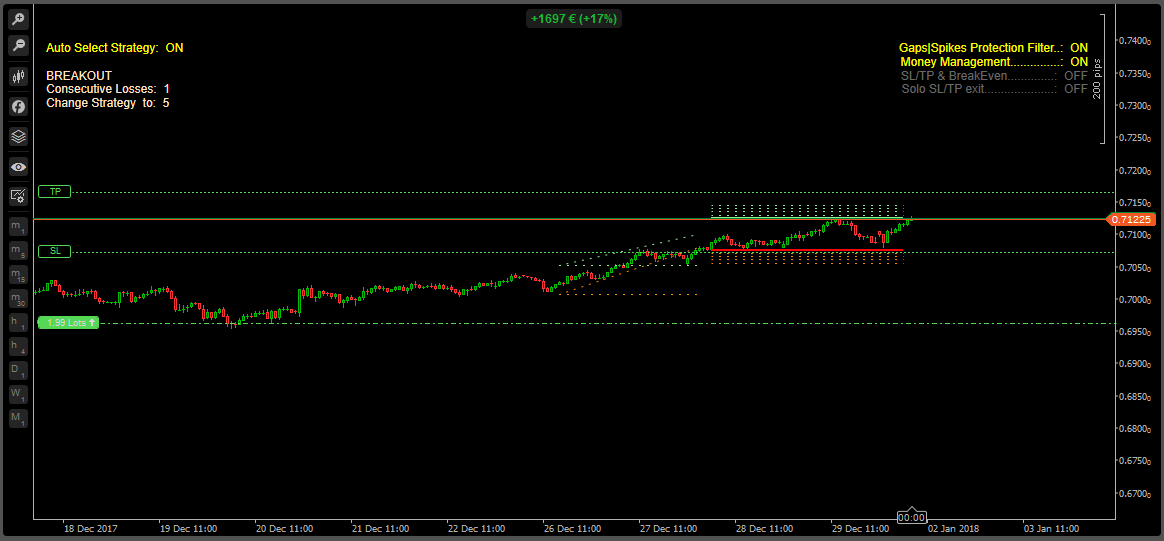

- Strategy Auto Select: with the cBot running, change automatically the strategy (Reverse or Breakout) after a certain number of losses specifying from the parameters after how many losing trades will be applied.

- Gap/Spike Protection: It protects against opening "Gaps" and sudden "Spikes" that can generate continuous opening and closing of positions.

- Solo SL/TP exit: if selected, it uses StopLoss or TakeProfit as the only exit strategy.

- SL/TP & BreakEven: if selected, it helps the main exit strategy or the "Solo SL / TP exit" in bringing the StopLoss above EntryPrice as soon as you are in profit.

- Money Management (Position Sizing) on winning and loosing trade. If the previous position was closed with a profit, increase the volume of the next position. If, on the other hand, the previous position was closed at a loss, it decreases the volume of the next position. From the parameters you can set the amount of volume to increase or decrease by specifying after how many losing trades will be applied.

Gap/Spike Protection:

Opening Gap

Spike

Equity Line with "Gap/Spike Protection OFF"

Equity Line with "Gap/Spike Protection ON"

----------------------------------------------------------------------------

The Trading System uses Bollinger Bands for volatility, but is used in a different way than usual, with long periods and Standard Deviation from 0.1 to 1 with a weighted moving average (it looks like a river). The Bollinger Bands serve mainly as a filter in entering the market avoiding periods of laterality.

cBot can be set as Reverse or Breakout strategy, the optimization will indicate the best strategy for each particular Currencies Cross, indices, Metals, Crypto Currencies.

Exit strategy is Trend Follower.

This strategy is characterized by more trades in loss of small amounts and less trades in gain with larger amounts, the ratio is 55/60% trades in loss and 45/40% trades in gain.

The strategy exploits the evolution of the trend while cutting losing positions if the market moves against.

Money Management with Position Sizing on winning and loosing trades.

In the event that there is a series of loss trades, Position Sizing (on Lose) is very effective as it reduces the amount of volume (lots) after each losing trade.

If you have a series of winning trades the Position Sizing (on gain) increases the volume (lots) quantity after each winning trade.

Money Management can be activated or deactivated.

STRATEGIES DO NOT USE ANY GRID SYSTEM OR MARTINGALE

In the markets of the major Forex Currencies Crosses, Metals, oil, Indices and Crypto some of them adapt better on Reverse/Breakout strategies and you can find it out through optimization.

In the strategy:(All positions are protected with StopLoss)

- Select Reverse/Breakout strategy

- StopLoss & TakeProfit are automatically assigned. (Depending on volatility and volume traded in the book)

- Money Management (Position Sizing) on winning and loosing trade.

- Exit Strategy: Trend Follow (TakeProfit is floating and is used only as security in case the bot is no more controllable due to connection failure or other causes. When the Bot is active the position is closed only by the StopLoss which Trails).

- As soon as you enter the market if the price moves against your position, the Position is closed before the stop Loss is touched. As soon as the Trend Follower is automatically activated, the position is closed only by the Trailing Stop Loss.

The Trading System has been designed to work at the best with all types of Forex Cross Currencies, Metals, Oil, Indices, futures and Crypto Currencies that are sensible to Reverse or Breakout strategies.

Pay attention to the Trade volume for each instrument as it changes from Forex to CFD (Indices, Metals, Oil, Futures and Crypto Currencies). Some Brokers for CFDs give you the opportunity to trade all of them with micro lots. Others use different Lotsize (example for Indices minimum 1 contract, Gold 0.1 / 1 Oz).

In the Trading System, if you enter a wrong Volume value, the Bot will automatically use the minimum tradable volume.

Warning: when trading CFDs the results can vary widely between one broker and another. The suggestion is to operate on CFDs using the same broker in which the optimization was made.

Backtest and optimization must be done considering the following parameters at best (lined up in sequence of importance and priority):

- SharpRatio: (which is a reward to risk ratio) minimum value 0.13

- Max Balance Drawdown & Max Equity Drawdown: Max 15% better under 10%. Discard higher values. Rather than earning, you should consider what you can lose. If you don't pay attention to Drawdown, working with a high leverage is very easy to lose the whole capital. With high leverage you can earn a lot compared to the capital but you can also easily drain the whole account. Using Position Sizing (on gain) you can double or triple the earnings and in this case the Drawdown can go up to max 23%. Do it only if it is worth on increasing the gain. To reduce the Drawdown use Position Sizing (on lose) the gain in this case will be slightly reduced.

- Profit Factor: minimum value 1.40 - better if it is higher than 1.50

- Net Profit

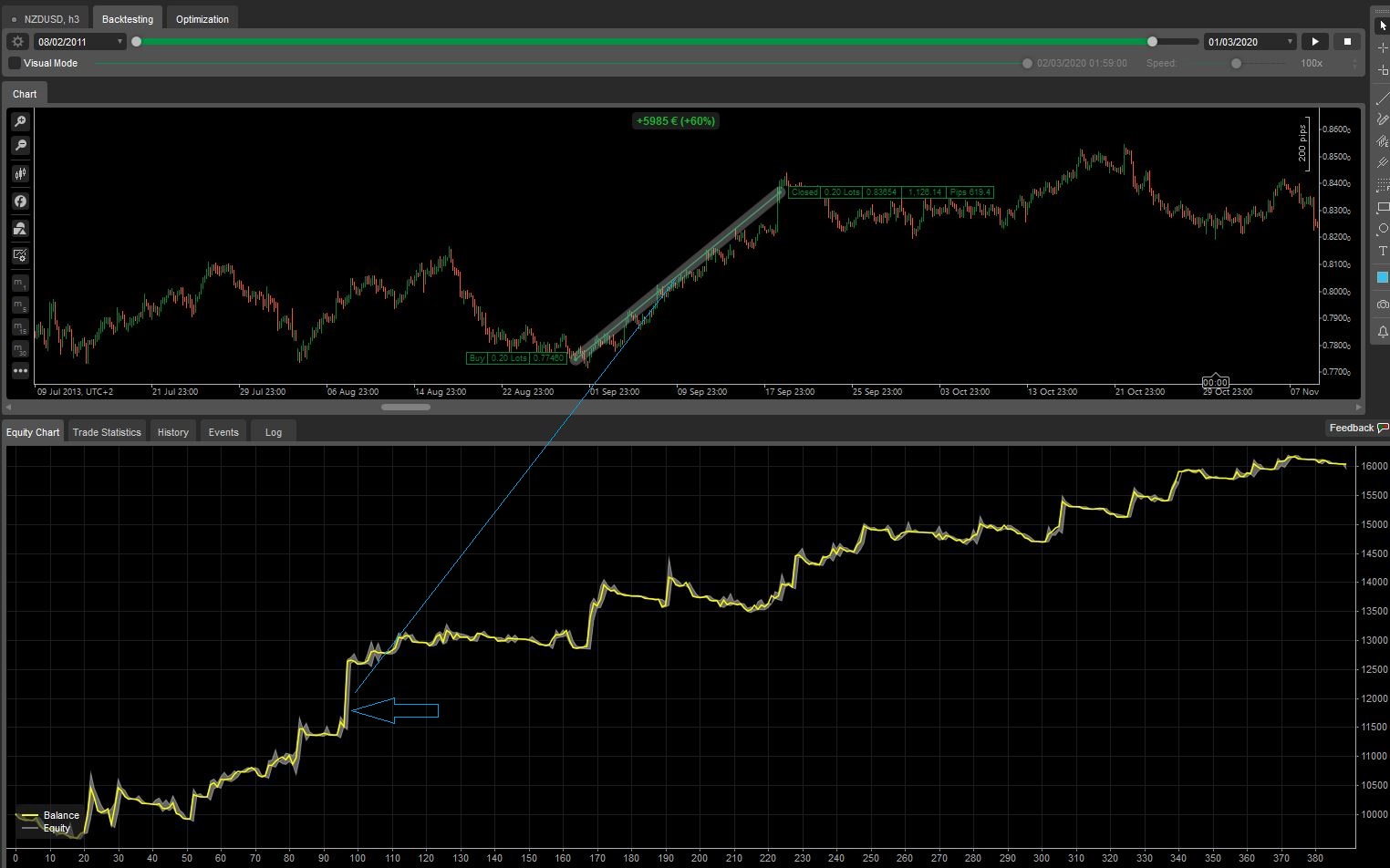

- Trades number: all optimizations must be done over a minimum of 8/9 years period to have reliable results.

- Average Trade: The average earnings for each individual trade. Considering an initial capital of $ 10,000, 200 leverage, (Forex) ordersize (bet) 0.10 lots (10,000 volume). The Average Trade must be more then 20.00 $ per Trade

P.S .: When you optimize or backtest put Commission to 50 (x million) and Spread to 2 for major Forex crosses and more for minor crosses. This is used to amortize slippage.

- The parameters attached to the bot have been optimized using ICMarket Broker from 08/02/2011 to 01/03/2020. (with some parameters the Drawdown comes out higher then 15% because it was worth pushing on the Money Management (Position Sizing on gain).

Initial capital of $ 10,000, 200 leverage

- Forex Currencies: ordersize (bet) 0.10 lots (10,000 volume), Commission 50(x million) and Spread to 2.

- BitCoin/USD: ordersize (bet) 0.30 lots, Commission 50(x million) and Spread to 167.

To avoid "Over-Fitting":

- Optimizations and Backtests must be performed for at least 8/9 or more years for reliable results. The optimization done on short periods is not absolutely reliable. Professional traders optimize and backtest their automatic systems using very long periods (10/15/20 years) of data feeds with paid Data Feeds providers. All Brokers who use cTrader platform for Forex give a free set of Data Feeds of about 8/9 years and for CFDs 5/6 years.

- To test if the parameters obtained are robust, do backtests by varying them slightly (do not change REVERSE/BREAKOUT selection). If you get positive results, even if qualitatively lower than the optimized ones, this means that the parameter set is robust and not "Overfitted".

----------------------------------------------------------------------

Additional products:

----------------------------------------------------------------------

Contacts write to: active.ctrader.bot@gmail.com

----------------------------------------------------------------------

Open an account with Gumroad and become an affiliate and start earning by selling our products: Become an affiliate for Active cTrader Bot

----------------------------------------------------------------------

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class BBands_Trend_Follower : Robot

{

[Parameter(DefaultValue = 0.0)]

public double Parameter { get; set; }

protected override void OnStart()

{

if (RunningMode != RunningMode.Optimization)

{

Chart.DrawStaticText("d", "https://gumroad.com/l/VbfSY ||| https://gumroad.com/activebot" + "\n\nContacts please write to: active.ctrader.bot@gmail.com", VerticalAlignment.Top, HorizontalAlignment.Center, Color.Yellow);

}

}

protected override void OnTick()

{

// IS NOT POSSIBLE TO DOWLOAD THE DEMO VERSION HERE PLEASE VISIT:

// https://gumroad.com/l/VbfSY

// https://gumroad.com/activebot

// FOR CONTACTS: active.ctrader.bot@gmail.com

}

protected override void OnStop()

{

// Put your deinitialization logic here

}

}

}

mparama

Joined on 11.10.2016

- Distribution: Paid

- Language: C#

- Trading platform: cTrader Automate

- File name: ADD_Bot_BBands_Trend_Follower.algo

- Rating: 5

- Installs: 1036

- Modified: 13/10/2021 09:54

Concrete Curing Time: Thanks for Sharing the code. This code increase my knowledge,

top 10 construction companies in the usa

disadvantages of glass fiber reinforced gypsum

residential building

what is rebar size and rebar diameters

what is bridge abutment

types of wooden beams

tributary area

concrete topping

brick masonry

well point