Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

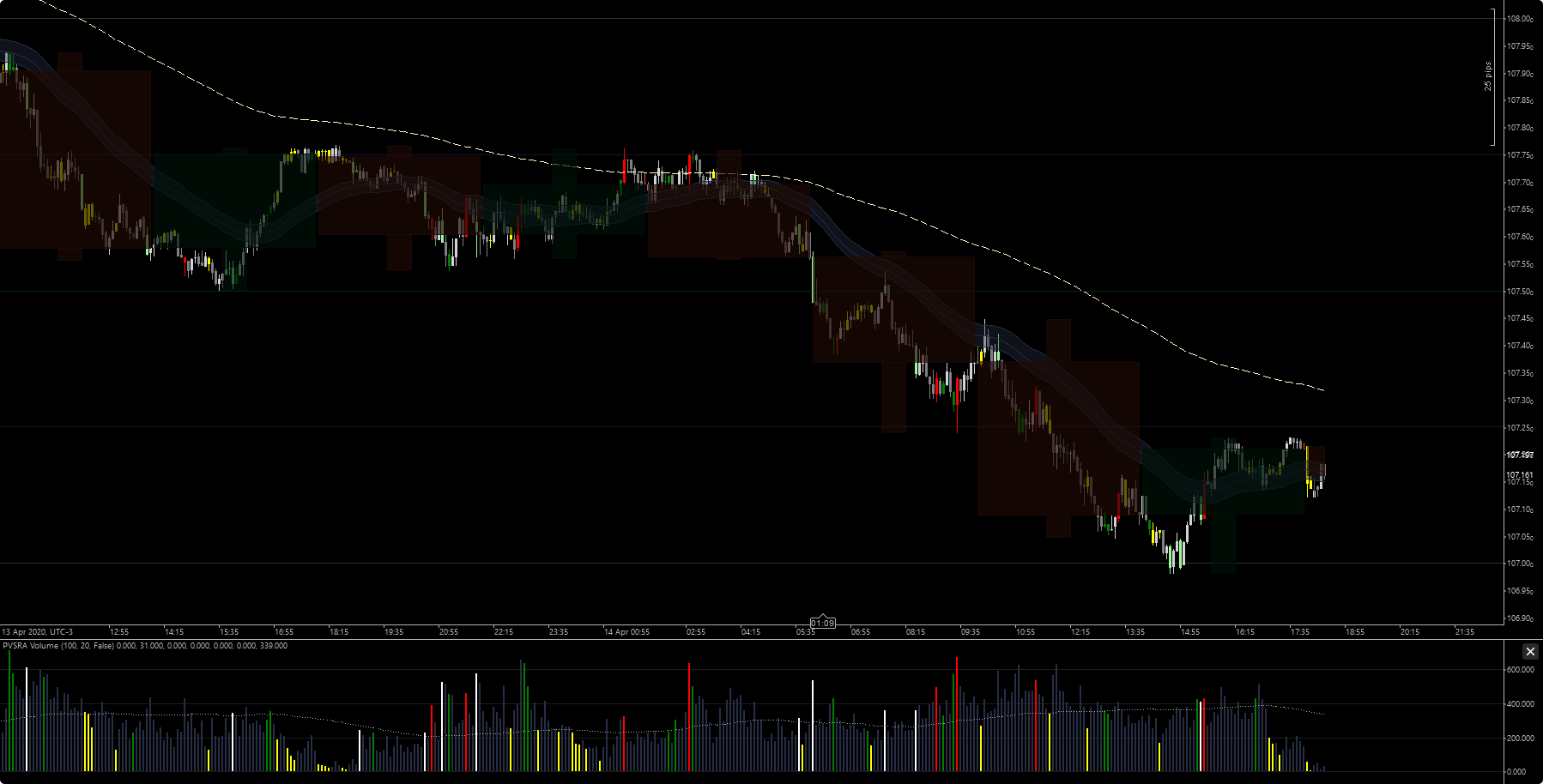

Volume indicator of PVSRA

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Levels(0)]

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class PVSRAVolume : Indicator

{

[Parameter("LookBack", DefaultValue = 10)]

public int LookBack { get; set; }

[Output("Bullish Normal", LineColor = "EE9FA0A2", PlotType = PlotType.Histogram, Thickness = 5)]

public IndicatorDataSeries BullNormalVolume { get; set; }

[Output("Bearish Normal", LineColor = "EE6A6A75", PlotType = PlotType.Histogram, Thickness = 5)]

public IndicatorDataSeries BearNormalVolume { get; set; }

[Output("Bullish Climax", LineColor = "EE1FC047", PlotType = PlotType.Histogram, Thickness = 5)]

public IndicatorDataSeries BullClimaxVolume { get; set; }

[Output("Bearish Climax", LineColor = "EEE00106", PlotType = PlotType.Histogram, Thickness = 5)]

public IndicatorDataSeries BearClimaxVolume { get; set; }

[Output("Bullish Rising", LineColor = "EE1188FF", PlotType = PlotType.Histogram, Thickness = 5)]

public IndicatorDataSeries BullRisingVolume { get; set; }

[Output("Bearish Rising", LineColor = "EEAD0FFF", PlotType = PlotType.Histogram, Thickness = 5)]

public IndicatorDataSeries BearRisingVolume { get; set; }

protected override void Initialize()

{

}

public override void Calculate(int index)

{

var open = Bars.OpenPrices[index];

var high = Bars.HighPrices[index];

var low = Bars.LowPrices[index];

var close = Bars.ClosePrices[index];

var volume = Bars.TickVolumes[index];

var isBullish = close > open;

double av = 0;

int va = 0;

for (int n = 1; n <= LookBack; n++)

{

av += Bars.TickVolumes.Last(n);

}

av = av / LookBack;

var range = high - low;

var val = volume * range;

double hiValue = 0;

for (int n = 1; n <= LookBack; n++)

{

var temp = Bars.TickVolumes.Last(n) * (Bars.HighPrices.Last(n) - Bars.LowPrices.Last(n));

if (temp >= hiValue)

hiValue = temp;

}

if (val >= hiValue || volume >= av * 2)

{

va = 1;

}

if (va == 0 && volume >= av * 1.5)

{

va = 2;

}

switch (va)

{

case 0:

if (isBullish)

BullNormalVolume[index] = volume;

else

BearNormalVolume[index] = volume;

break;

case 1:

if (isBullish)

BullClimaxVolume[index] = volume;

else

BearClimaxVolume[index] = volume;

break;

case 2:

if (isBullish)

BullRisingVolume[index] = volume;

else

BearRisingVolume[index] = volume;

break;

}

}

private static T GetAttributeFrom<T>(object instance, string propertyName)

{

var attrType = typeof(T);

var property = instance.GetType().GetProperty(propertyName);

return (T)property.GetCustomAttributes(attrType, false).GetValue(0);

}

}

}

reyx

Joined on 16.02.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: PVSRA Volume.algo

- Rating: 5

- Installs: 3135

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

TOPPPPP VALEU

EXATAMENTE O QUE EU ESTAVA PROCURANDO.