Description

Based on the method as used in the following BP thread: https://forums.babypips.com/t/trading-the-trend-with-strong-weak-analysis/

A few notes:

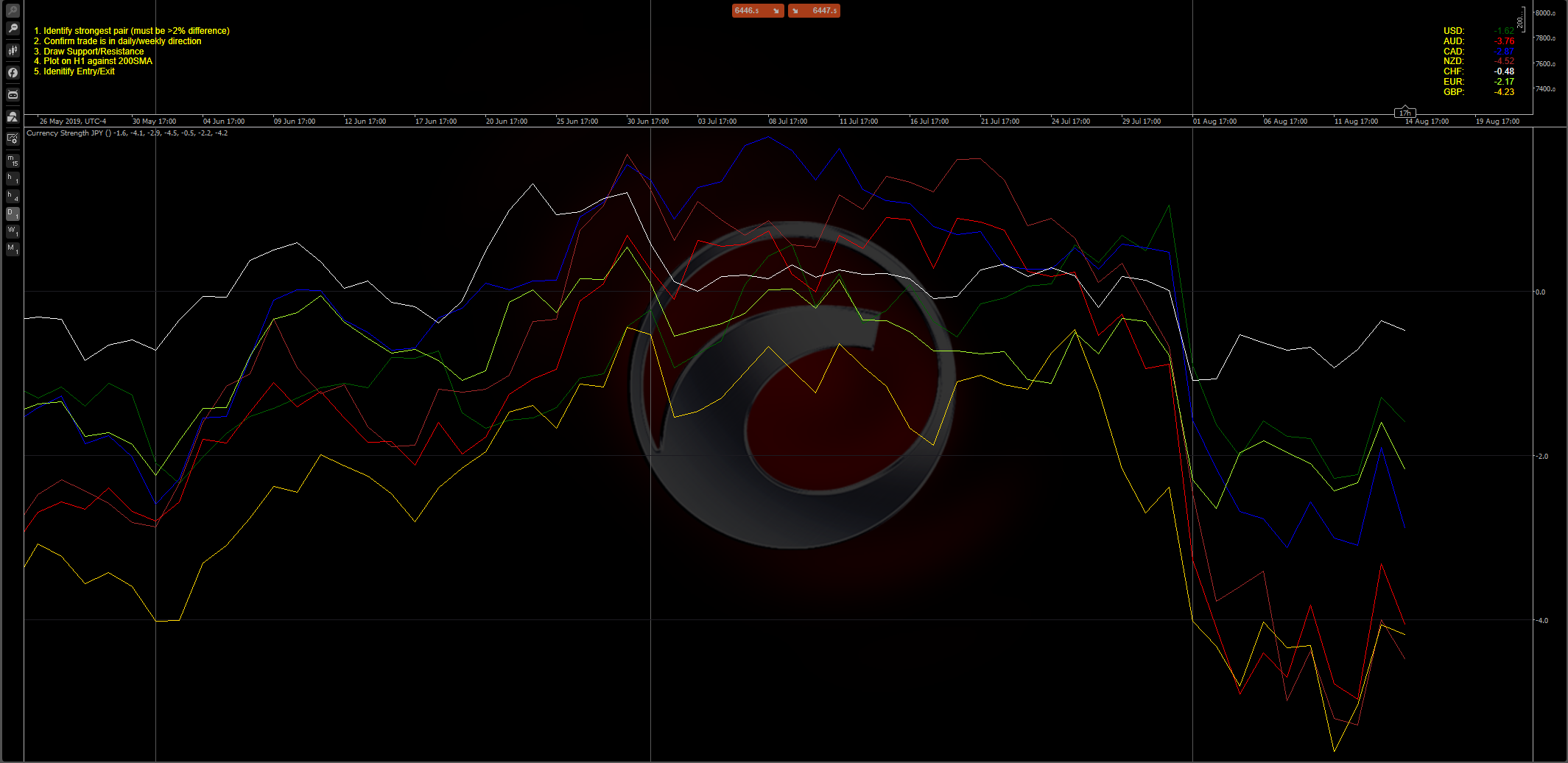

- Calculates and displays the strength of each currency relative to JPY.

- Calculation is performed on 4HR timeframe against the 200SMA

- JPY strength will always be 0 relative to the other currencies

- Can be ran on any chart, as it will always look at the same currencies

- I recommend you run it on the Daily timeframe

- Can take 30 to 60s to load

Suggested screen setup:

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Levels(-4, -2, 0, 2, 4)]

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class CurrencyStrengthJPY : Indicator

{

[Output("USD", LineColor = "DarkGreen")]

public IndicatorDataSeries USD { get; set; }

[Output("AUD", LineColor = "Red")]

public IndicatorDataSeries AUD { get; set; }

[Output("CAD", LineColor = "Blue")]

public IndicatorDataSeries CAD { get; set; }

[Output("NZD", LineColor = "Brown")]

public IndicatorDataSeries NZD { get; set; }

[Output("CHF", LineColor = "White")]

public IndicatorDataSeries CHF { get; set; }

[Output("EUR", LineColor = "GreenYellow")]

public IndicatorDataSeries EUR { get; set; }

[Output("GBP", LineColor = "Gold")]

public IndicatorDataSeries GBP { get; set; }

private MarketSeries sUSD, sAUD, sCAD, sNZD, sCHF, sEUR, sGBP;

protected override void Initialize()

{

TimeFrame tf = TimeFrame.Hour4;

sUSD = MarketData.GetSeries("USDJPY", tf);

sAUD = MarketData.GetSeries("AUDJPY", tf);

sCAD = MarketData.GetSeries("CADJPY", tf);

sNZD = MarketData.GetSeries("NZDJPY", tf);

sCHF = MarketData.GetSeries("CHFJPY", tf);

sEUR = MarketData.GetSeries("EURJPY", tf);

sGBP = MarketData.GetSeries("GBPJPY", tf);

Chart.DrawStaticText("1", "1. Identify strongest pair (must be >2% difference)", VerticalAlignment.Top, HorizontalAlignment.Left, Color.Yellow);

Chart.DrawStaticText("2", "\n" + "2. Confirm trade is in daily/weekly direction", VerticalAlignment.Top, HorizontalAlignment.Left, Color.Yellow);

Chart.DrawStaticText("3", "\n\n" + "3. Draw Support/Resistance", VerticalAlignment.Top, HorizontalAlignment.Left, Color.Yellow);

Chart.DrawStaticText("4", "\n\n\n" + "4. Plot on H1 against 200SMA", VerticalAlignment.Top, HorizontalAlignment.Left, Color.Yellow);

Chart.DrawStaticText("5", "\n\n\n\n" + "5. Idenitify Entry/Exit", VerticalAlignment.Top, HorizontalAlignment.Left, Color.Yellow);

}

public override void Calculate(int index)

{

var dUSD = (double)(getResult(sUSD, USD, index)) / 100;

var dAUD = (double)(getResult(sAUD, AUD, index)) / 100;

var dCAD = (double)(getResult(sCAD, CAD, index)) / 100;

var dNZD = (double)(getResult(sNZD, NZD, index)) / 100;

var dCHF = (double)(getResult(sCHF, CHF, index)) / 100;

var dEUR = (double)(getResult(sEUR, EUR, index)) / 100;

var dGBP = (double)(getResult(sGBP, GBP, index)) / 100;

Chart.DrawStaticText("Labels", "USD:" + "\t\t\n" + "AUD:" + "\t\t\n" + "CAD:" + "\t\t\n" + "NZD:" + "\t\t\n" + "CHF:" + "\t\t\n" + "EUR:" + "\t\t\n" + "GBP:" + "\t\t", VerticalAlignment.Top, HorizontalAlignment.Right, Color.Yellow);

Chart.DrawStaticText("USD", "\t" + dUSD, VerticalAlignment.Top, HorizontalAlignment.Right, Color.DarkGreen);

Chart.DrawStaticText("AUD", "\n\t" + dAUD, VerticalAlignment.Top, HorizontalAlignment.Right, Color.Red);

Chart.DrawStaticText("CAD", "\n\n\t" + dCAD, VerticalAlignment.Top, HorizontalAlignment.Right, Color.Blue);

Chart.DrawStaticText("NZD", "\n\n\n\t" + dNZD, VerticalAlignment.Top, HorizontalAlignment.Right, Color.Brown);

Chart.DrawStaticText("CHF", "\n\n\n\n\t" + dCHF, VerticalAlignment.Top, HorizontalAlignment.Right, Color.White);

Chart.DrawStaticText("EUR", "\n\n\n\n\n\t" + dEUR, VerticalAlignment.Top, HorizontalAlignment.Right, Color.GreenYellow);

Chart.DrawStaticText("GBP", "\n\n\n\n\n\n\t" + dGBP, VerticalAlignment.Top, HorizontalAlignment.Right, Color.Gold);

}

private int getResult(MarketSeries Ticker, IndicatorDataSeries result, int index)

{

MovingAverage ma = Indicators.SimpleMovingAverage(Ticker.Close, 200);

int index2 = GetIndexByDate(Ticker, MarketSeries.OpenTime[index]);

result[index] = ((Ticker.Close[index2] - ma.Result[index2]) / Ticker.Close[index2]) * 100;

return (int)(((Ticker.Close.LastValue - ma.Result.LastValue) / Ticker.Close.LastValue) * 10000);

}

private int GetIndexByDate(MarketSeries series, DateTime time)

{

for (int i = series.Close.Count - 1; i >= 0; i--)

if (time == series.OpenTime[i])

return i;

return -1;

}

}

}

4X

4x.dunder

Joined on 15.08.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Currency Strength JPY.algo

- Rating: 0

- Installs: 1756

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

FE

This bot is very useful and can make my tasks easier. My bot is currently being outsourced

You are right, I outsource many of my projects, for example, blockchain development. I know many people who use outsourcing services https://wow24-7.io/ in all areas. Mainly IT development, customer support, and e-commerce, it is very profitable.