Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

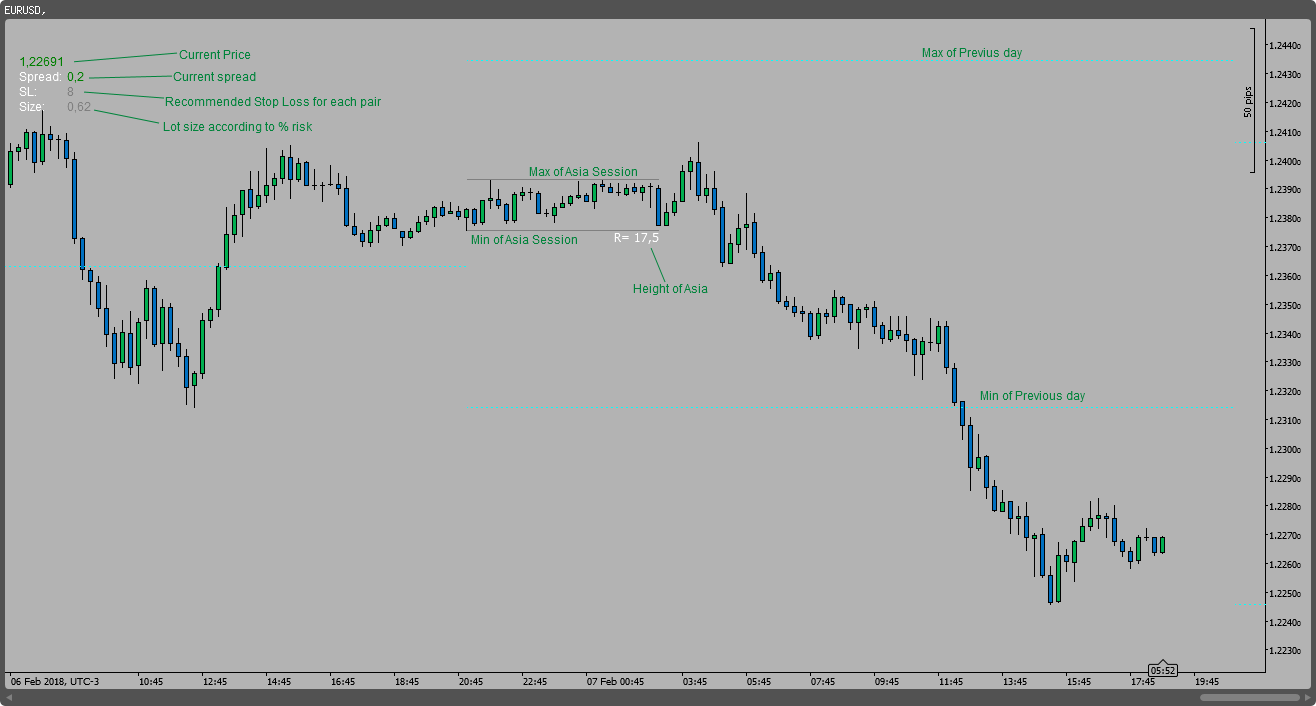

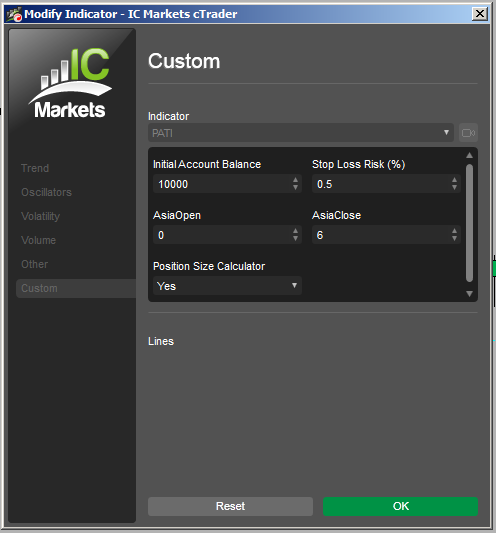

This is an indicator for the traders who trades PATI (Price Action Trader Institute) criteria. Plus, position size calculator.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class PATI : Indicator

{

//-----------PARAMETER---------------------------

[Parameter("Initial Account Balance", DefaultValue = 10000)]

public double IAB { get; set; }

[Parameter("Stop Loss Risk (%)", DefaultValue = 0.5)]

public double stopLossRiskPercent { get; set; }

[Parameter(DefaultValue = 0)]

public double AsiaOpen { get; set; }

[Parameter(DefaultValue = 6)]

public double AsiaClose { get; set; }

[Parameter("Position Size Calculator", DefaultValue = 1)]

public bool info { get; set; }

public double pipsrisk;

public double max;

public double min;

protected override void Initialize()

{

}

public override void Calculate(int index)

{

DisplayInfo();

// Max and Min of Previous Day

DateTime today = MarketSeries.OpenTime[index].Date;

DateTime tomorrow = today.AddDays(1);

DateTime aftertomorrow = today.AddDays(2);

DateTime monday = today.AddDays(3);

DateTime tuesday = today.AddDays(4);

double high = MarketSeries.High.LastValue;

double low = MarketSeries.Low.LastValue;

for (int i = MarketSeries.Close.Count - 1; i > 0; i--)

{

if (MarketSeries.OpenTime[i].Date < today)

break;

high = Math.Max(high, MarketSeries.High[i]);

low = Math.Min(low, MarketSeries.Low[i]);

}

ChartObjects.DrawLine("high " + tomorrow, tomorrow, high, aftertomorrow, high, Colors.Cyan, 1, LineStyle.DotsRare);

ChartObjects.DrawLine("low " + tomorrow, tomorrow, low, aftertomorrow, low, Colors.Cyan, 1, LineStyle.DotsRare);

if (today.DayOfWeek == DayOfWeek.Friday)

{

ChartObjects.DrawLine("high " + monday, monday, high, tuesday, high, Colors.Cyan, 1, LineStyle.DotsRare);

ChartObjects.DrawLine("low " + monday, monday, low, tuesday, low, Colors.Cyan, 1, LineStyle.DotsRare);

}

// Max and Min of Asia Session

DateTime asiaopen = MarketSeries.OpenTime[index].Date.AddHours(AsiaOpen);

DateTime asiaclose = MarketSeries.OpenTime[index].Date.AddHours(AsiaClose);

if ((MarketSeries.OpenTime[index].Hour >= AsiaOpen & MarketSeries.OpenTime[index].Hour < AsiaClose) || (MarketSeries.OpenTime[index].Hour == AsiaClose & MarketSeries.OpenTime[index].Minute == 0))

{

if (MarketSeries.OpenTime[index].Hour == AsiaOpen & MarketSeries.OpenTime[index].Minute == 0)

{

max = MarketSeries.High.LastValue;

min = MarketSeries.Low.LastValue;

}

else

{

if (MarketSeries.High.LastValue > max)

max = MarketSeries.High.LastValue;

if (MarketSeries.Low.LastValue < min)

min = MarketSeries.Low.LastValue;

}

}

if (MarketSeries.OpenTime[index].Hour == AsiaClose & MarketSeries.OpenTime[index].Minute == 0)

{

ChartObjects.DrawLine("Max" + max, asiaopen, max, asiaclose, max, Colors.Gray);

ChartObjects.DrawLine("Min" + max, asiaopen, min, asiaclose, min, Colors.Gray);

double range = Math.Round((max - min) / Symbol.PipSize, 2);

string Range = "R= " + string.Format("{0}", range);

ChartObjects.DrawText("Range" + index, Range, index, min, VerticalAlignment.Bottom, HorizontalAlignment.Left, Colors.White);

}

}

// Position Size Calculator

private void DisplayInfo()

{

string price = "" + MarketSeries.Close.LastValue;

ChartObjects.DrawText("Price", price, StaticPosition.TopLeft, Colors.Green);

var spread = Math.Round(Symbol.Spread / Symbol.PipSize, 2);

string text = string.Format("{0}", spread);

ChartObjects.DrawText("Label", "\n" + "Spread:" + "\n" + "SL:", StaticPosition.TopLeft, Colors.White);

if (spread <= 1)

ChartObjects.DrawText("spread", "\n" + "\t" + text, StaticPosition.TopLeft, Colors.Green);

if (spread > 1 & spread <= 3)

ChartObjects.DrawText("spread", "\n" + "\t" + text, StaticPosition.TopLeft, Colors.Yellow);

if (spread > 3)

ChartObjects.DrawText("spread", "\n" + "\t" + text, StaticPosition.TopLeft, Colors.Red);

string pair = MarketSeries.SymbolCode;

if (pair == "EURUSD" || pair == "USDCHF" || pair == "EURGBP")

{

pipsrisk = 8;

}

if (pair == "EURJPY" || pair == "GBPUSD" || pair == "AUDUSD" || pair == "USDJPY" || pair == "USDCAD" || pair == "NZDUSD")

{

pipsrisk = 10;

}

if (pair == "GBPJPY" || pair == "AUDJPY" || pair == "CADJPY")

{

pipsrisk = 12;

}

double costPerPip = (double)((int)(Symbol.PipValue * 10000000)) / 100;

string size = "" + Math.Round((IAB * stopLossRiskPercent / 100) / (pipsrisk * costPerPip), 2);

ChartObjects.DrawText("Pipsrisk", "\n" + "\n" + "\t" + pipsrisk, StaticPosition.TopLeft, Colors.Gray);

if (info == true)

{

ChartObjects.DrawText("Size", "\n" + "\n" + "\n" + "Size:", StaticPosition.TopLeft, Colors.White);

ChartObjects.DrawText("Position Size", "\n" + "\n" + "\n" + "\t" + size, StaticPosition.TopLeft, Colors.Gray);

}

}

}

}

BigDeal

Joined on 03.12.2015

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: PATI.algo

- Rating: 0

- Installs: 3431

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

Hi, Adding individual color change function possible?