Description

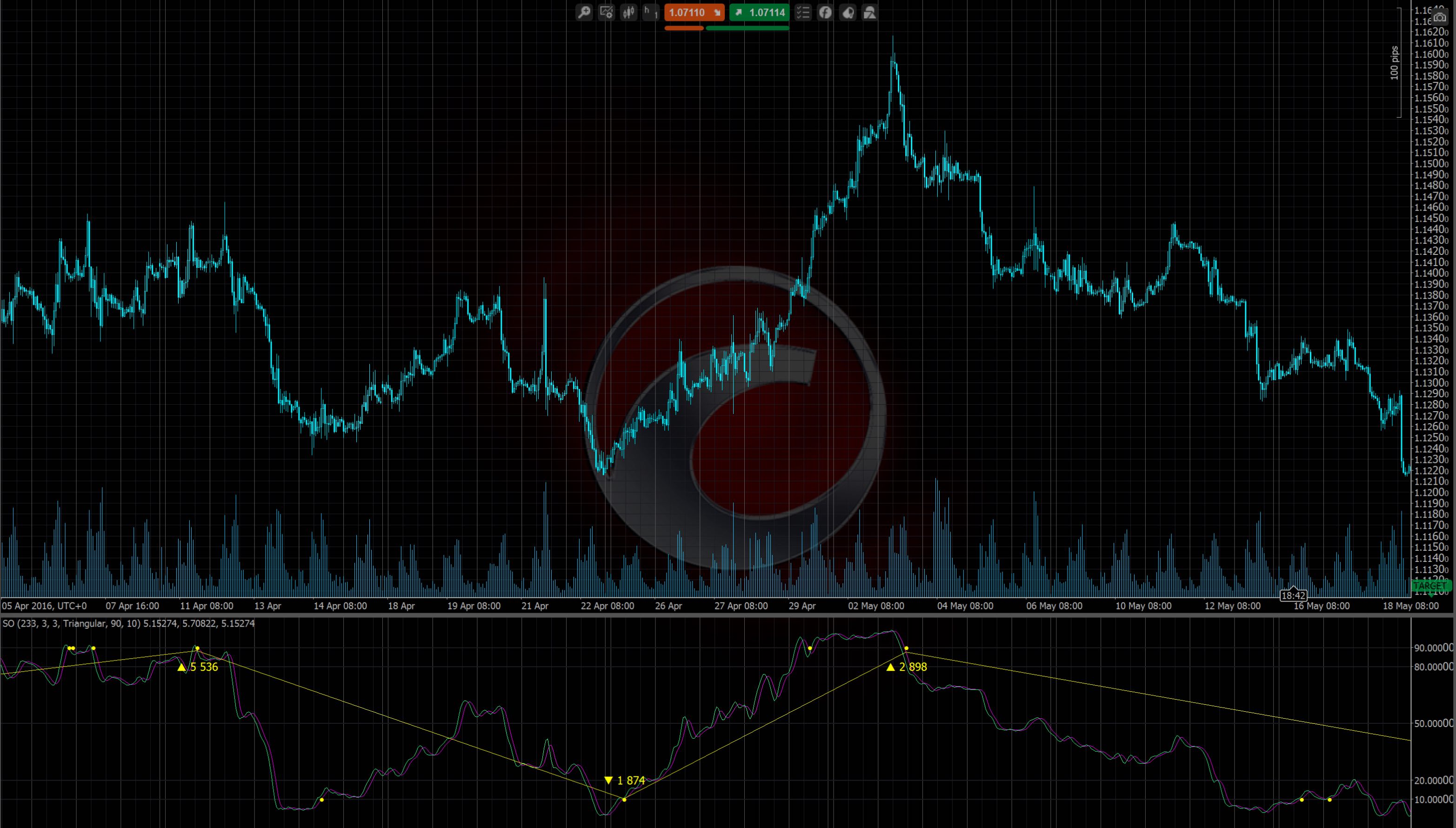

UP Trend begins when 2 lines cross DOWN level bottom-up and ends when 2 lines cross UP level top-down

DOWN Trend begins when 2 lines cross UP level top-down and ends when 2 lines cross DOWN level bottom-up

Also indicator shows changes between UP and DOWN trends.

/

#region Using declarations

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

#endregion

namespace cAlgo

{

[Levels(10, 20, 50, 80, 90)]

[Indicator(IsOverlay = false, AutoRescale = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SO : Indicator

{

#region Properties

[Parameter("K Periods", DefaultValue = 200)]

public int kPeriods { get; set; }

[Parameter("K Slowing", DefaultValue = 3)]

public int kSlowing { get; set; }

[Parameter("D Periods", DefaultValue = 3)]

public int dPeriods { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Triangular)]

public MovingAverageType maType { get; set; }

[Parameter("UP Level", DefaultValue = 90, MinValue = 80, MaxValue = 100, Step = 1)]

public int Up_Level { get; set; }

[Parameter("Down Level", DefaultValue = 10, MinValue = 0, MaxValue = 20, Step = 1)]

public int Down_Level { get; set; }

[Output("% D", Color = Colors.Aquamarine, Thickness = 2)]

public IndicatorDataSeries Percent_D { get; set; }

[Output("% K", Color = Colors.Purple, Thickness = 2)]

public IndicatorDataSeries Percent_K { get; set; }

[Output("Trend", Color = Colors.Yellow, Thickness = 1)]

public IndicatorDataSeries Value { get; set; }

#endregion

#region Variables

enum Direction

{

Up,

Down

}

private Direction direction = Direction.Down;

private StochasticOscillator so;

private double Extremum_Value = 0.0;

private int Extremum_Index = 0;

private int Last_Up_Index = 0;

private int Last_Down_Index = 0;

#endregion

protected override void Initialize()

{

so = Indicators.StochasticOscillator(kPeriods, kSlowing, dPeriods, maType);

if (Lines_Are_Lower_Level(Down_Level, 0))

direction = Direction.Up;

if (Lines_Are_Higher_Level(Up_Level, 0))

direction = Direction.Down;

}

public override void Calculate(int index)

{

Percent_K[index] = so.PercentK.LastValue;

Percent_D[index] = so.PercentD.LastValue;

/// Up Level

if (Lines_Just_Crossed_From_Up_To_Down_Level(Up_Level, index))

{

if (direction == Direction.Up)

{

direction = Direction.Down;

Last_Up_Index = index;

Set_Extremum_At(index, Up_Level);

}

if (direction == Direction.Down && Extremum_Value == Up_Level)

{

Last_Up_Index = index;

Move_Extremum_At(index, Up_Level);

}

}

/// Down Level

if (Lines_Just_Crossed_From_Down_To_Up_Level(Down_Level, index))

{

if (direction == Direction.Down)

{

direction = Direction.Up;

Last_Down_Index = index;

Set_Extremum_At(index, Down_Level);

}

if (direction == Direction.Up && Extremum_Value == Down_Level)

{

Last_Down_Index = index;

Move_Extremum_At(index, Down_Level);

}

}

if (index - 1 != Extremum_Index)

{

Value[index - 1] = Double.NaN;

Value[index] = Percent_D[index];

}

}

private bool Lines_Are_Lower_Level(double level, int index)

{

return Percent_K[index] < level && Percent_D[index] < level;

}

private bool Lines_Are_Higher_Level(double level, int index)

{

return Percent_K[index] > level && Percent_D[index] > level;

}

private bool Lines_Just_Crossed_From_Up_To_Down_Level(double level, int index)

{

return Lines_Are_Lower_Level(level, index) && (Percent_K[index - 1] >= level || Percent_D[index - 1] >= level);

}

private bool Lines_Just_Crossed_From_Down_To_Up_Level(double level, int index)

{

return Lines_Are_Higher_Level(level, index) && (Percent_K[index - 1] <= level || Percent_D[index - 1] <= level);

}

private void Move_Extremum_At(int index, double v)

{

Value[Extremum_Index] = Double.NaN;

ChartObjects.RemoveObject("Info " + Extremum_Index);

Set_Extremum_At(index, v);

}

private void Set_Extremum_At(int Index, double V)

{

Extremum_Index = Index;

Extremum_Value = V;

Value[Extremum_Index] = Extremum_Value;

VerticalAlignment Point_VA = VerticalAlignment.Center;

HorizontalAlignment Point_HA = HorizontalAlignment.Center;

Colors Point_Color = Colors.Yellow;

ChartObjects.DrawText("Direction " + Index, "•", Index, V, Point_VA, Point_HA, Point_Color);

double Low = MarketSeries.Low[Last_Down_Index];

double High = MarketSeries.High[Last_Up_Index];

double Trend_Value = (High - Low) / Symbol.TickSize;

string Dir = direction == Direction.Down ? "▲" : "▼";

string Info = Dir + " " + Trend_Value.ToString("N0");

VerticalAlignment Text_VA = VerticalAlignment.Center;

HorizontalAlignment Text_HA = HorizontalAlignment.Center;

Colors Text_Color = Colors.Yellow;

ChartObjects.DrawText("Info " + Index, Info, Index, V >= 50 ? V - 10 : V + 10, Text_VA, Text_HA, Text_Color);

}

}

}

diiptrade

Joined on 17.11.2016

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: SO.algo

- Rating: 5

- Installs: 6569

- Modified: 13/10/2021 09:54

Comments

// This has been modified, to be more easily understandable.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Levels(10, 20, 50, 80, 90)]

[Indicator(IsOverlay = false, AutoRescale = true, AccessRights = AccessRights.None)]

public class SO : Indicator

{

[Parameter("K Periods", DefaultValue = 200)]

public int kPeriods { get; set; }

[Parameter("K Slowing", DefaultValue = 3)]

public int kSlowing { get; set; }

[Parameter("D Periods", DefaultValue = 3)]

public int dPeriods { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Triangular)]

public MovingAverageType maType { get; set; }

[Parameter("UP Level", DefaultValue = 90, MinValue = 80, MaxValue = 100, Step = 1)]

public int Up_Level { get; set; }

[Parameter("Down Level", DefaultValue = 10, MinValue = 0, MaxValue = 20, Step = 1)]

public int Down_Level { get; set; }

[Output("% D", Color = Colors.Aquamarine, Thickness = 2)]

public IndicatorDataSeries Percent_D { get; set; }

[Output("% K", Color = Colors.Purple, Thickness = 2)]

public IndicatorDataSeries Percent_K { get; set; }

[Output("Trend", Color = Colors.Yellow, Thickness = 1)]

public IndicatorDataSeries Value { get; set; }

private StochasticOscillator so;

private double Extremum_Value = 0.0;

private int Extremum_Index = 0;

private int Last_Up_Index = 0;

private int Last_Down_Index = 0;

private int direction = 0;

protected override void Initialize()

{

so = Indicators.StochasticOscillator(kPeriods, kSlowing, dPeriods, maType);

}

public override void Calculate(int index)

{

Percent_K[index] = so.PercentK[index];

Percent_D[index] = so.PercentD[index];

//---------- K value is Stockastic value ( purple) , D is MA3 of it.

//----------- if ( K is now < 90% and D < 90% ) and (the previous K >= 90% or the Previous D is >= 90%)

//----------- this is to get the position for the dot.

//UP LEVEL

if ((Percent_K[index] < Up_Level && Percent_D[index] < Up_Level) && (Percent_K[index - 1] >= Up_Level || Percent_D[index - 1] >= Up_Level))

{

if (direction == 1)

{

direction = 0;

Last_Up_Index = index;

Extremum_Index = index;

Extremum_Value = Up_Level;

Value[Extremum_Index] = Extremum_Value;

ChartObjects.DrawText("Direction " + index, "•", index, Up_Level, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

double Low = MarketSeries.Low[Last_Down_Index];

double High = MarketSeries.High[Last_Up_Index];

double Trend_Value = (High - Low) / Symbol.TickSize;

string Dir = direction == 0 ? "▲" : "▼";

string Info = Dir + " " + Trend_Value.ToString("N0");

ChartObjects.DrawText("Info " + index, Info, index, Up_Level >= 50 ? Up_Level - 10 : Up_Level + 10, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

}

if (direction == 0 && Extremum_Value == Up_Level)

{

Last_Up_Index = index;

Value[Extremum_Index] = Double.NaN;

ChartObjects.RemoveObject("Info " + Extremum_Index);

Extremum_Index = index;

Extremum_Value = Up_Level;

Value[Extremum_Index] = Extremum_Value;

ChartObjects.DrawText("Direction " + index, "•", index, Up_Level, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

double Low = MarketSeries.Low[Last_Down_Index];

double High = MarketSeries.High[Last_Up_Index];

double Trend_Value = (High - Low) / Symbol.TickSize;

string Dir = direction == 0 ? "▲" : "▼";

string Info = Dir + " " + Trend_Value.ToString("N0");

ChartObjects.DrawText("Info " + index, Info, index, Up_Level >= 50 ? Up_Level - 10 : Up_Level + 10, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

}

}

//---------------------------------------------------------------------------------

/// Down Level

if ((Percent_K[index] > Down_Level && Percent_D[index] > Down_Level) && (Percent_K[index - 1] <= Down_Level || Percent_D[index - 1] <= Down_Level))

{

if (direction == 0)

{

direction = 1;

Last_Down_Index = index;

Extremum_Index = index;

Extremum_Value = Down_Level;

Value[Extremum_Index] = Extremum_Value;

ChartObjects.DrawText("Direction " + index, "•", index, Down_Level, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

double Low = MarketSeries.Low[Last_Down_Index];

double High = MarketSeries.High[Last_Up_Index];

double Trend_Value = (High - Low) / Symbol.TickSize;

string Dir = direction == 0 ? "▲" : "▼";

string Info = Dir + " " + Trend_Value.ToString("N0");

ChartObjects.DrawText("Info " + index, Info, index, Down_Level >= 50 ? Down_Level - 10 : Down_Level + 10, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

}

if (direction == 1 && Extremum_Value == Down_Level)

{

Last_Down_Index = index;

Value[Extremum_Index] = Double.NaN;

ChartObjects.RemoveObject("Info " + Extremum_Index);

Extremum_Index = index;

Extremum_Value = Down_Level;

Value[Extremum_Index] = Extremum_Value;

ChartObjects.DrawText("Direction " + index, "•", index, Down_Level, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

double Low = MarketSeries.Low[Last_Down_Index];

double High = MarketSeries.High[Last_Up_Index];

double Trend_Value = (High - Low) / Symbol.TickSize;

string Dir = direction == 0 ? "▲" : "▼";

string Info = Dir + " " + Trend_Value.ToString("N0");

ChartObjects.DrawText("Info " + index, Info, index, Down_Level >= 50 ? Down_Level - 10 : Down_Level + 10, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.Yellow);

}

}

if (index - 1 != Extremum_Index)

{

Value[index - 1] = Double.NaN;

Value[index] = Percent_D[index];

}

}

}

}

That's a good one, my comrade!

// This Just puts an Icon above the price, on the chart.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

// AutoRescale = true

namespace cAlgo

{

[Indicator(IsOverlay = true, AccessRights = AccessRights.None)]

public class SO : Indicator

{

[Parameter("K Periods", DefaultValue = 200)]

public int kPeriods { get; set; }

[Parameter("K Slowing", DefaultValue = 3)]

public int kSlowing { get; set; }

[Parameter("D Periods", DefaultValue = 3)]

public int dPeriods { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Triangular)]

public MovingAverageType maType { get; set; }

[Parameter("UP Level", DefaultValue = 90, MinValue = 80, MaxValue = 100, Step = 1)]

public int Up_Level { get; set; }

[Parameter("Down Level", DefaultValue = 10, MinValue = 0, MaxValue = 20, Step = 1)]

public int Down_Level { get; set; }

private StochasticOscillator so;

private double Extremum_Value = 0.0;

private int Extremum_Index = 0;

private int Last_Up_Index = 0;

private int Last_Down_Index = 0;

private int direction = 0;

protected override void Initialize()

{

so = Indicators.StochasticOscillator(kPeriods, kSlowing, dPeriods, maType);

}

public override void Calculate(int index)

{

//---------- K value is Stockastic value ( purple) , D is MA3 of it.

//----------- if ( K is now < 90% and the previous K >= 90% )

//----------- this is our setup for upper entry

//UP LEVEL

if (so.PercentK[index] < Up_Level && so.PercentK[index - 1] >= Up_Level)

{

var high = MarketSeries.High[index];

var highPlus2Pip = high + (5 * Symbol.PipSize);

ChartObjects.DrawText("Info " + index, "▼", index, highPlus2Pip, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.White);

}

//DOWN lEVEL

if (so.PercentK[index] > Down_Level && so.PercentK[index - 1] <= Down_Level)

{

var low = MarketSeries.Low[index];

var lowPlus2Pip = low - (5 * Symbol.PipSize);

ChartObjects.DrawText("Info " + index, "▲", index, lowPlus2Pip, VerticalAlignment.Center, HorizontalAlignment.Center, Colors.White);

}

}

}

}