Description

Here’s a simple description of the C# code and its importance for the cTrader Strategy Tester v1.12 bot : (https://ctrader.com/algos/cbots/show/4487/)

Code Description

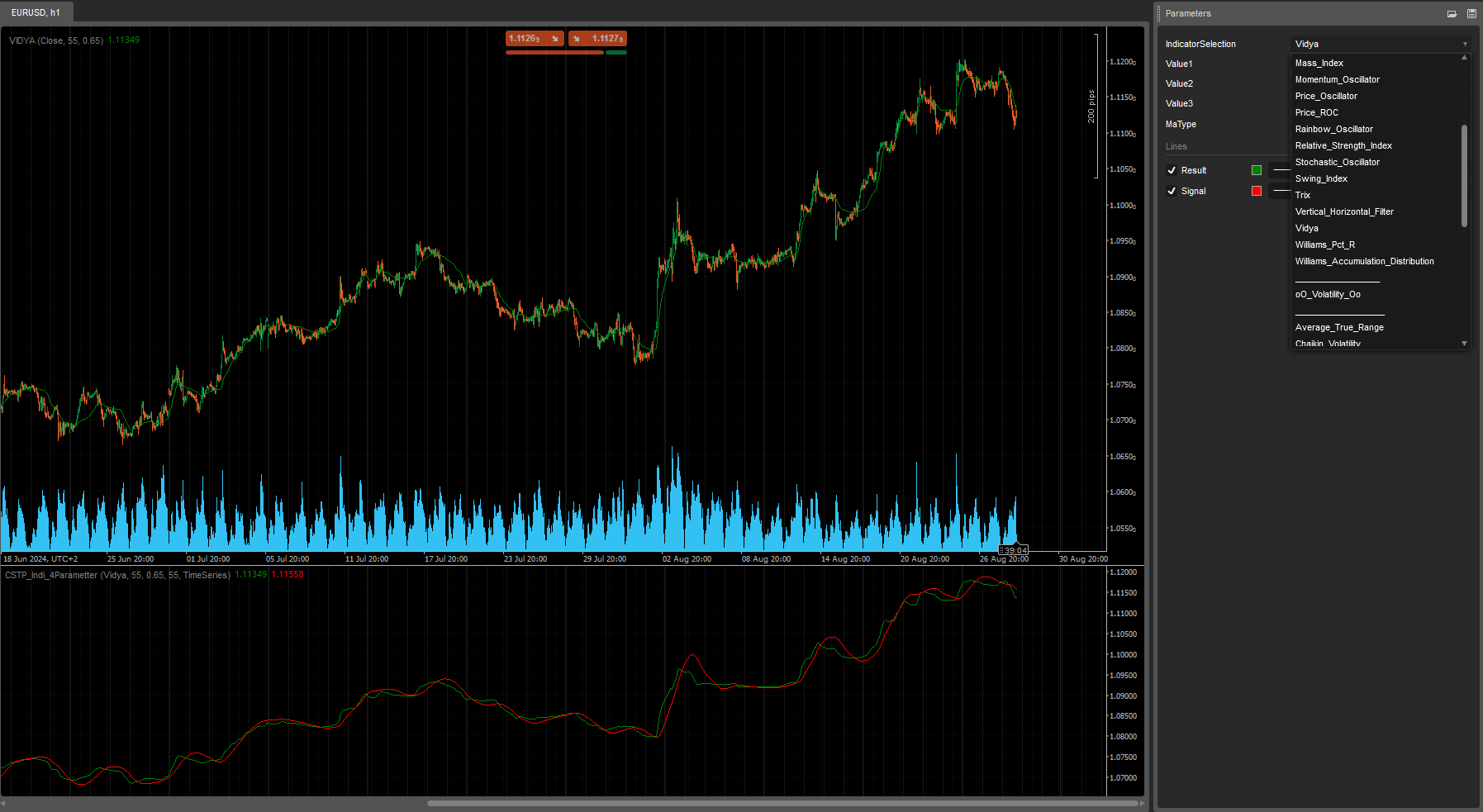

Declaration and Parameters:

- The code defines an indicator called

CSTP_Indi_4Parametter, which allows users to select from a broad range of technical indicators using theIndicatorSelectionparameter. - It includes three additional parameters (

Value1,Value2,Value3) and one for choosing the type of moving average (MaType).

Indicator Enumeration:

- The

EnumIndiSelectionenumeration lists various technical indicators, such as oscillators, volatility measures, and volume indicators. These are used for different types of market analysis.

Indicator Calculations:

- The

Calculate(int index)method is called for each new data point (bar). Based on the selected indicator, it calculates values forResultandSignal. - For instance:

- For MACD Cross Over, it computes the difference between two moving averages and applies another moving average to this result.

- For Commodity Channel Index (CCI), it calculates the moving average of the CCI values.

- For Relative Strength Index (RSI), it calculates the moving average of RSI values.

Result Display:

- The results of these calculations are plotted on the chart as two lines (

ResultandSignal), with specified colors and styles.

Importance for the cTrader Strategy Tester v1.12 Bot

This code is crucial for the cTrader Strategy Tester v1.12 bot. It enables the bot to test and analyze a wide variety of technical indicators, including oscillators, volatility measures, and volume indicators. This functionality is essential for generating and evaluating different trading signals, which helps in optimizing trading strategies and making well-informed trading decisions under various market conditions.

We are looking for all types of profiles interested in joining the adventure, so if you want to discuss this further, this is the place to do it :

Telegram group : https://t.me/cTraderStrategyTesterProject

GitHub : https://github.com/YesOrNotCtrader/Ctrader-Stragegy-Tester-Project

Enjoy for Free =)

Previous account here : https://ctrader.com/users/profile/70920

Contact telegram : https://t.me/nimi012

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class CSTP_Indi_4Parametter : Indicator

{

[Parameter(DefaultValue = EnumIndiSelection.Relative_Strength_Index)]

public EnumIndiSelection IndicatorSelection { get; set; }

public enum EnumIndiSelection

{

oO_Oscilator_Oo,

________________,

Accumulative_Swing_Index,

Center_Of_Gravity,

Commodity_Channel_Index,

Cyber_Cycle,

Detrended_Price_Oscillator,

Linear_Regression_RSquared,

Linear_Regression_Slope,

Macd_Cross_Over,

Mass_Index,

Momentum_Oscillator,

Price_Oscillator,

Price_ROC,

Rainbow_Oscillator,

Relative_Strength_Index,

Stochastic_Oscillator,

Swing_Index,

Trix,

Vertical_Horizontal_Filter,

Vidya,

Williams_Pct_R,

Williams_Accumulation_Distribution,

_________________,

oO_Volatility_Oo,

__________________,

Average_True_Range,

Chaikin_Volatility,

Historical_Volatility,

Standard_Deviation,

ADX,

ADXR,

oO_Volume_Oo,

____________________,

Chaikin_Money_Flow,

Ease_Of_Movement,

Money_Flow_Index,

Negative_Volume_Index,

Positive_Volume_Index,

On_Balance_Volume,

Price_Volume_Trend,

Tick_Volume,

Trade_Volume_Index,

Volume_Oscillator,

Volume_ROC

}

[Parameter(DefaultValue = 14)]

public double Value1 { get; set; }

[Parameter(DefaultValue = 3)]

public double Value2 { get; set; }

[Parameter(DefaultValue = 9)]

public double Value3 { get; set; }

[Parameter(DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType MaType { get; set; }

[Output("Result", IsHistogram = false, LineColor = "Green", LineStyle = LineStyle.Solid, PlotType = PlotType.Line, Thickness = 1)]

public IndicatorDataSeries Result { get; set; }

[Output("Signal", IsHistogram = false, LineColor = "Red", LineStyle = LineStyle.Solid, PlotType = PlotType.Line, Thickness = 1)]

public IndicatorDataSeries Signal { get; set; }

protected override void Initialize()

{

}

public override void Calculate(int index)

{

switch (IndicatorSelection)

{

// Oscillator

case (EnumIndiSelection.Macd_Cross_Over):

Result[index] = Indicators.MovingAverage(Bars.ClosePrices, (int)Value2, MaType).Result[index] - Indicators.MovingAverage(Bars.ClosePrices, (int)Value1, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Commodity_Channel_Index):

Result[index] = Indicators.MovingAverage(Indicators.CommodityChannelIndex(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Cyber_Cycle):

Result[index] = Indicators.MovingAverage(Indicators.CyberCycle(Value1).Cycle, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Detrended_Price_Oscillator):

Result[index] = Indicators.MovingAverage(Indicators.DetrendedPriceOscillator(Bars.ClosePrices, (int)Value1, MaType).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index]; break;

case (EnumIndiSelection.Mass_Index):

Result[index] = Indicators.MovingAverage(Indicators.MassIndex(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Momentum_Oscillator):

Result[index] = Indicators.MovingAverage(Indicators.MomentumOscillator(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Price_Oscillator):

Result[index] = Indicators.PriceOscillator(Bars.ClosePrices, (int)Value1, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Price_ROC):

Result[index] = Indicators.MovingAverage(Indicators.PriceROC(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Rainbow_Oscillator):

Result[index] = Indicators.MovingAverage(Indicators.RainbowOscillator(Bars.ClosePrices, (int)Value1, MaType).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Vertical_Horizontal_Filter):

Result[index] = Indicators.MovingAverage(Indicators.VerticalHorizontalFilter(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Williams_Pct_R):

Result[index] = Indicators.MovingAverage(Indicators.WilliamsPctR(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Accumulative_Swing_Index):

Result[index] = Indicators.MovingAverage(Indicators.AccumulativeSwingIndex(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Swing_Index):

Result[index] = Indicators.MovingAverage(Indicators.SwingIndex(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Relative_Strength_Index):

Result[index] = Indicators.MovingAverage(Indicators.RelativeStrengthIndex(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Trix):

Result[index] = Indicators.MovingAverage(Indicators.Trix(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Stochastic_Oscillator):

Result[index] = Indicators.StochasticOscillator(Bars, (int)Value1, (int)Value2, (int)Value3, MaType).PercentK[index];

Signal[index] = Indicators.StochasticOscillator(Bars, (int)Value1, (int)Value2, (int)Value3, MaType).PercentD[index];

break;

case (EnumIndiSelection.Center_Of_Gravity):

Result[index] = Indicators.MovingAverage(Indicators.CenterOfGravity((int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Williams_Accumulation_Distribution):

Result[index] = Indicators.MovingAverage(Indicators.WilliamsAccumulationDistribution(Bars).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Linear_Regression_RSquared):

Result[index] = Indicators.MovingAverage(Indicators.LinearRegressionRSquared(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Linear_Regression_Slope):

Result[index] = Indicators.MovingAverage(Indicators.LinearRegressionSlope(Bars.ClosePrices, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Vidya):

Result[index] = Indicators.Vidya(Bars.ClosePrices, (int)Value1, Value2).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

// Volatility

case (EnumIndiSelection.Average_True_Range):

Result[index] = Indicators.MovingAverage(Indicators.AverageTrueRange((int)Value1, MaType).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Chaikin_Volatility):

Result[index] = Indicators.ChaikinVolatility((int)Value1, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Historical_Volatility):

Result[index] = Indicators.HistoricalVolatility(Bars.ClosePrices, (int)Value1, (int)Value2).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Standard_Deviation):

Result[index] = Indicators.MovingAverage(Indicators.StandardDeviation(Bars.ClosePrices, (int)Value1, MaType).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.ADX):

Result[index] = Indicators.MovingAverage(Indicators.AverageDirectionalMovementIndexRating((int)Value1).ADX, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.ADXR):

Result[index] = Indicators.MovingAverage(Indicators.AverageDirectionalMovementIndexRating((int)Value1).ADXR, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

// Volume

case (EnumIndiSelection.Chaikin_Money_Flow):

Result[index] = Indicators.MovingAverage(Indicators.ChaikinMoneyFlow(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Ease_Of_Movement):

Result[index] = Indicators.MovingAverage(Indicators.EaseOfMovement((int)Value1, MaType).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Money_Flow_Index):

Result[index] = Indicators.MovingAverage(Indicators.MoneyFlowIndex(Bars, (int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Negative_Volume_Index):

Result[index] = Indicators.MovingAverage(Indicators.NegativeVolumeIndex(Bars.ClosePrices).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Positive_Volume_Index):

Result[index] = Indicators.MovingAverage(Indicators.PositiveVolumeIndex(Bars.ClosePrices).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.On_Balance_Volume):

Result[index] = Indicators.MovingAverage(Indicators.OnBalanceVolume(Bars.ClosePrices).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Price_Volume_Trend):

Result[index] = Indicators.MovingAverage(Indicators.PriceVolumeTrend(Bars.ClosePrices).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Tick_Volume):

Result[index] = Indicators.MovingAverage(Indicators.TickVolume().Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Trade_Volume_Index):

Result[index] = Indicators.MovingAverage(Indicators.TradeVolumeIndex(Bars.ClosePrices).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Volume_Oscillator):

Result[index] = Indicators.VolumeOscillator((int)Value1, (int)Value2).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

case (EnumIndiSelection.Volume_ROC):

Result[index] = Indicators.MovingAverage(Indicators.VolumeROC((int)Value1).Result, (int)Value2, MaType).Result[index];

Signal[index] = Indicators.MovingAverage(Result, (int)Value3, MaType).Result[index];

break;

}

//Result[index] = result[index];

}

}

}

YesOrNot2

Joined on 17.05.2024

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: CSTP_Indi_4Parametter.algo

- Rating: 0

- Installs: 493

- Modified: 28/08/2024 15:22