Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

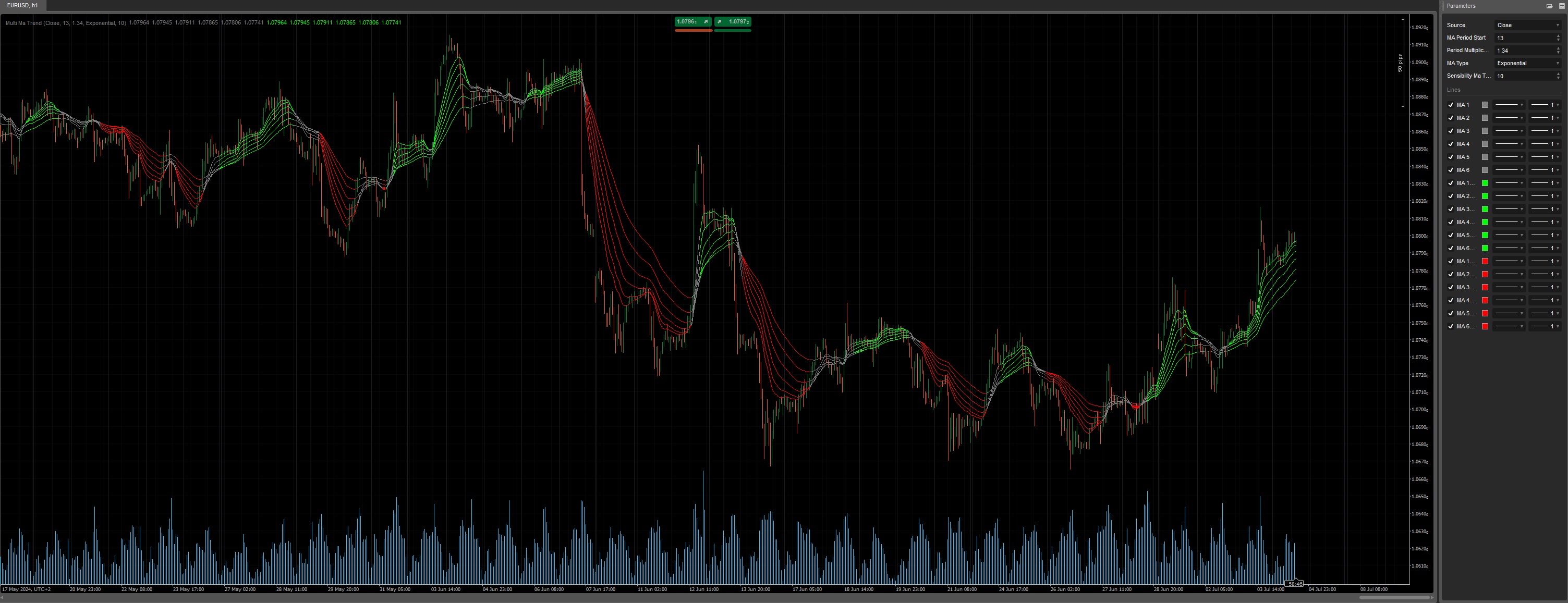

This indicator allows adding 6 Moving Average to the chart. The periods of each Moving Average depend on the Moving Average Period Start x Period Multiplier.

A sensitivity parameter is added to filter High trends from Slow trends.

Enjoy for Free =)

Previous account here : https://ctrader.com/users/profile/70920

Contact telegram : https://t.me/nimi012

using System;

using System.Linq;

using System.Reflection;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class MaMultiTrend : Indicator

{

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("MA Period Start", DefaultValue = 13)]

public double MAPeriodStart { get; set; }

[Parameter("Period Multiplicator", DefaultValue = 1.34)]

public double MAPeriodMulti { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType MaType { get; set; }

[Parameter("Sensibility Ma Trend ", DefaultValue = 10)]

public double SensibilityMaTrend { get; set; }

[Output("MA 1", LineColor = "Gray", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma1 { get; set; }

[Output("MA 2", LineColor = "Gray", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma2 { get; set; }

[Output("MA 3", LineColor = "Gray", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma3 { get; set; }

[Output("MA 4", LineColor = "Gray", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma4 { get; set; }

[Output("MA 5", LineColor = "Gray", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma5 { get; set; }

[Output("MA 6", LineColor = "Gray", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma6 { get; set; }

[Output("MA 1High", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma1High { get; set; }

[Output("MA 2High", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma2High { get; set; }

[Output("MA 3High", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma3High { get; set; }

[Output("MA 4High", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma4High { get; set; }

[Output("MA 5High", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma5High { get; set; }

[Output("MA 6High", LineColor = "Lime", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma6High { get; set; }

[Output("MA 1Low", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma1Low { get; set; }

[Output("MA 2Low", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma2Low { get; set; }

[Output("MA 3Low", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma3Low { get; set; }

[Output("MA 4Low", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma4Low { get; set; }

[Output("MA 5Low", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma5Low { get; set; }

[Output("MA 6Low", LineColor = "Red", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries Ma6Low { get; set; }

private IndicatorDataSeries[] res, resHigh, resLow;

private MovingAverage[] ma;

private int[] periods;

protected override void Initialize()

{

resHigh = new IndicatorDataSeries[6];

resHigh[0] = Ma1High;

resHigh[1] = Ma2High;

resHigh[2] = Ma3High;

resHigh[3] = Ma4High;

resHigh[4] = Ma5High;

resHigh[5] = Ma6High;

resLow = new IndicatorDataSeries[6];

resLow[0] = Ma1Low;

resLow[1] = Ma2Low;

resLow[2] = Ma3Low;

resLow[3] = Ma4Low;

resLow[4] = Ma5Low;

resLow[5] = Ma6Low;

res = new IndicatorDataSeries[6];

res[0] = Ma1;

res[1] = Ma2;

res[2] = Ma3;

res[3] = Ma4;

res[4] = Ma5;

res[5] = Ma6;

ma = new MovingAverage[6];

periods = new int[6];

for (int i = 0; i < ma.Length; i++)

{

periods[i] = (int)(Math.Round(Math.Pow(MAPeriodMulti, i) * MAPeriodStart));

ma[i] = Indicators.MovingAverage(Bars.HighPrices, periods[i], MaType);

}

}

public override void Calculate(int index)

{

int maAboveTotal = 0;

for (int i = 0; i < ma.Length; i++)

{

maAboveTotal += GetNumMaAbove(i, index);

}

for (int i = 0; i < ma.Length; i++)

{

res[i][index] = ma[i].Result[index];

resHigh[i][index] = (200.0 * maAboveTotal / (ma.Length * (ma.Length - 1.0))) < SensibilityMaTrend ? ma[i].Result[index] : double.NaN;

resLow[i][index] = (200.0 * maAboveTotal / (ma.Length * (ma.Length - 1.0))) > 100 - SensibilityMaTrend ? ma[i].Result[index] : double.NaN;

}

}

private int GetNumMaAbove(int reference, int index)

{

int count = 0;

for (int i = reference + 1; i < ma.Length; i++)

{

if (ma[i].Result[index] > ma[reference].Result[index])

count++;

}

return count;

}

}

}

YE

YesOrNot2

Joined on 17.05.2024

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Multi Ma Trend.algo

- Rating: 5

- Installs: 513

- Modified: 04/07/2024 13:10

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.