Description

Just to say hi to those who blocked me, and sent a bomb =)

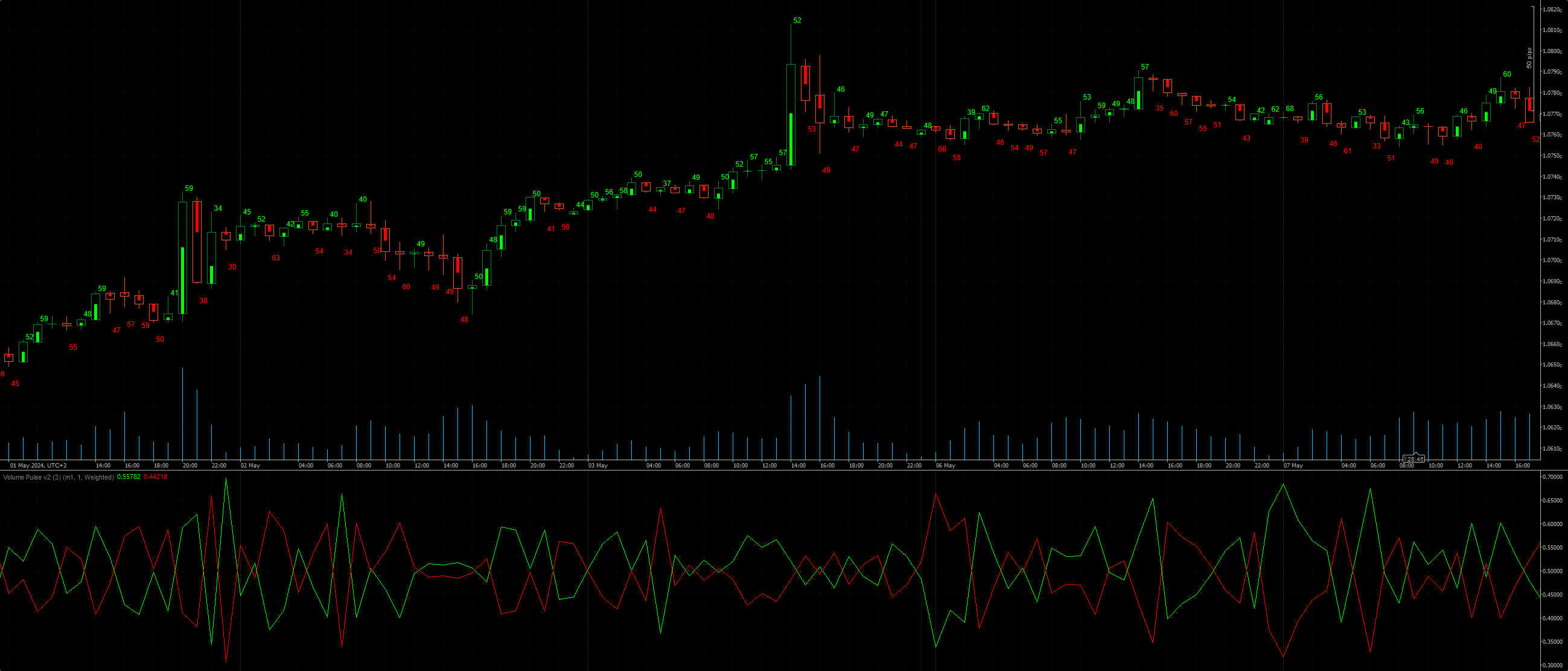

Is the candle True or False Volume ? Now you know =)

Enjoy for Free =)

Previous account here : https://ctrader.com/users/profile/70920

Contact telegram : https://t.me/nimi012

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class VolumePulsev21 : Indicator

{

[Parameter("Lower Timeframe Volume Cumulation", DefaultValue = "Minute")]

public TimeFrame TF { get; set; }

[Parameter("Period", DefaultValue = 1)]

public int Period { get; set; }

[Parameter("Lower Timeframe Volume Cumulation", DefaultValue = MovingAverageType.Weighted)]

public MovingAverageType MaType { get; set; }

[Output("Volume Delta Plus", LineColor = "Lime")]

public IndicatorDataSeries VolumeDeltaPlus2 { get; set; }

[Output("Volume Delta Min ", LineColor = "Red")]

public IndicatorDataSeries VolumeDeltaMin2 { get; set; }

[Output("Histo Plus", LineColor = "Lime", PlotType = PlotType.Histogram)]

public IndicatorDataSeries HistoUp { get; set; }

[Output("Histo Min ", LineColor = "Red", PlotType = PlotType.Histogram)]

public IndicatorDataSeries HistoDown { get; set; }

private Bars barsTick;

private DateTime prevBars;

private MovingAverage smoothvolumPlus, smoothvolumMinus;

private IndicatorDataSeries resvolumPlus, resolumMinus;

private IndicatorDataSeries VolumeDeltaPlus, VolumeDeltaMin;

private double barsCount;

private int pct = 0;

private int nbBarsLast;

private bool isLastB;

protected override void Initialize()

{

barsTick = MarketData.GetBars(TF);

if (!IsBacktesting)

{

while (barsTick.OpenTimes[0] > Bars.OpenTimes[0])

barsTick.LoadMoreHistory();

}

prevBars = Bars.OpenTimes.Last(0);

resvolumPlus = CreateDataSeries();

resolumMinus = CreateDataSeries();

VolumeDeltaPlus = CreateDataSeries();

VolumeDeltaMin = CreateDataSeries();

smoothvolumPlus = Indicators.MovingAverage(resvolumPlus, Period, MaType);

smoothvolumMinus = Indicators.MovingAverage(resolumMinus, Period, MaType);

pct = 0;

barsCount = Bars.Count;

nbBarsLast = 0;

isLastB = false;

Bars.BarOpened += Bars_BarOpened;

barsTick.BarOpened += BarsTick_BarOpened;

}

private void BarsTick_BarOpened(BarOpenedEventArgs obj)

{

nbBarsLast++;

isLastB = true;

}

private void Bars_BarOpened(BarOpenedEventArgs obj)

{

nbBarsLast = 0;

isLastB = true;

}

public override void Calculate(int index)

{

barsCount = Bars.Count;

if (index == 0) return;

var index1 = barsTick.OpenTimes.GetIndexByTime(Bars.OpenTimes[index]);

if (Bars.OpenTimes.Last(0) != prevBars || isLastB)

{

double deltaVolumePlus = 0.0;

double deltaVolumeMin = 0.0;

double countDeltaPlus = 0;

double countDeltaMinus = 0;

int nbBars = 0;

DateTime BarsTick = barsTick.OpenTimes[index1];

if (!isLastB)

for (int i = 0; Bars.OpenTimes[index - 1] < BarsTick; i++)

{

BarsTick = barsTick.OpenTimes[index1 - i];

nbBars++;

}

for (int i = 0; i < (isLastB ? nbBarsLast : nbBars); i++)

{

double prevClose = barsTick.OpenPrices[index1 - i];

double currentClose = barsTick.ClosePrices[index1 - i];

double volume = barsTick.TickVolumes[index1 - i];

double pipsizeUp = Math.Abs(barsTick.ClosePrices[index1 - i] - barsTick.LowPrices[index1 - i]) / (barsTick.HighPrices[index1 - i] - barsTick.LowPrices[index1 - i]);

double pipsizeDown = Math.Abs(barsTick.HighPrices[index1 - i] - barsTick.ClosePrices[index1 - i]) / (barsTick.HighPrices[index1 - i] - barsTick.LowPrices[index1 - i]);

if (currentClose > prevClose)

{

deltaVolumePlus = deltaVolumePlus + volume * pipsizeUp;

//countDeltaPlus++;

}

else if (currentClose < prevClose)

{

deltaVolumeMin = deltaVolumeMin + volume * pipsizeDown;

//countDeltaMinus++;

}

}

resvolumPlus[index] = deltaVolumePlus / Bars.TickVolumes.Last(0);

resolumMinus[index] = deltaVolumeMin / Bars.TickVolumes.Last(0);

VolumeDeltaPlus[index] = smoothvolumPlus.Result.Last(0);

VolumeDeltaMin[index] = smoothvolumMinus.Result.Last(0); ;

VolumeDeltaPlus2[index] = VolumeDeltaPlus[index] / (VolumeDeltaMin[index] + VolumeDeltaPlus[index]);

VolumeDeltaMin2[index] = VolumeDeltaMin[index] / (VolumeDeltaMin[index] + VolumeDeltaPlus[index]);

}

if (Bars.ClosePrices[index] > Bars.OpenPrices[index])

{

Chart.RemoveObject("VolumeDowntxt" + index);

Chart.RemoveObject("VolumeDown" + index);

Chart.DrawTrendLine("VolumeUp" + index, index, (Bars.ClosePrices[index] - Bars.OpenPrices[index]) * (VolumeDeltaPlus[index] / (VolumeDeltaMin[index] + VolumeDeltaPlus[index])) + Bars.OpenPrices[index], index, Bars.OpenPrices[index], Color.Lime, 5);

Chart.DrawText("VolumeUptxt" + index, ((VolumeDeltaPlus[index] / (VolumeDeltaMin[index] + VolumeDeltaPlus[index])) * 100).ToString("F0"), index, Bars.HighPrices[index] + 5 * Symbol.PipSize, Color.Lime);

}

else if (Bars.ClosePrices[index] < Bars.OpenPrices[index])

{

Chart.RemoveObject("VolumeUptxt" + index);

Chart.RemoveObject("VolumeUp" + index);

Chart.DrawTrendLine("VolumeDown" + index, index, Bars.OpenPrices[index] - (Bars.OpenPrices[index] - Bars.ClosePrices[index]) * (VolumeDeltaMin[index] / (VolumeDeltaPlus[index] + VolumeDeltaMin[index])), index, Bars.OpenPrices[index], Color.Red, 5);

Chart.DrawText("VolumeDowntxt" + index, ((VolumeDeltaMin[index] / (VolumeDeltaMin[index] + VolumeDeltaPlus[index])) * 100).ToString("F0"), index, Bars.LowPrices[index] - 5 * Symbol.PipSize, Color.Red);

}

if (!isLastB)

prevBars = Bars.OpenTimes.Last(0);

double test = index / barsCount * 100;

if (pct < test + 0.1 && pct < 105)

{

Print("Load : " + test.ToString("F0") + " %");

pct += 10;

}

}

}

}

YesOrNot2

Joined on 17.05.2024

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Volume Pulse v2.1 .algo

- Rating: 5

- Installs: 737

- Modified: 17/05/2024 12:35

Comments

Your conclusions are probably not accurate. This may be why someone was bitterly jealous of your good work in producing accurate indicator readings. I was unable to install your Volume Pulse V.2.1 indicator in my CTrader, I received a message that you are blocked. This is probably all unfortunate, I'm wasting my time working in CTrader. I do not exclude that for clarification you need to contact the support service of the administration of this site SPOWARE CTRADER. Sincerely. I wish you a speedy exit from self-isolation. And I apologize for the inaccurate translation. I also express my gratitude to you for your work in creating indicators.

whoever got you blocked is obviously a complete w*nker as everything you've given is given generously and for free.

welcome back!!

Thank you for the support!

sherlock828r If needed, I am available on Telegram. =)