Description

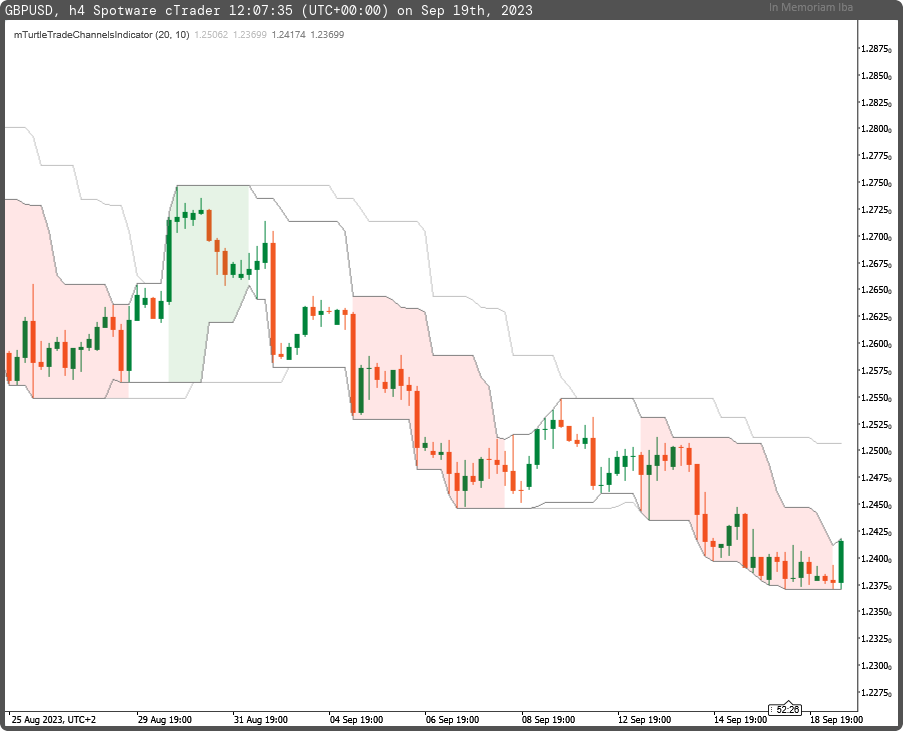

This indicator represents a legendary trading system, which proves that great traders can be made, not born.

The Turtle Trade trend-following system stands in stark contrast to the "buy low and sell high" approach. This system was taught to a group of average and ordinary individuals, and almost everyone transformed into a profitable trader. It is based on the fundamental principles of the well-known Donchian Channels, originally developed by Richard Donchian.

The primary rule is to "Trade on a 20-day breakout and take profits when a 10-day high or low is breached."

The original system operates as follows:

Go long when the price High is equal to or above the previous 20-day highest price.

Go short when the price Low is equal to or below the previous 20-day lowest price.

Exit long positions when the price touches the exit line.

Exit short positions when the price touches the exit line.

The recommended initial stop-loss is set at ATR * 2 from the opening price.

The default system parameters are 20, 10, and 55, 20.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Cloud("LongOpen", "LongSL", FirstColor = "Green", SecondColor = "Green", Opacity = 0.1)]

[Cloud("ShortOpen", "ShortSL", FirstColor = "Red", SecondColor = "Red", Opacity = 0.1)]

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class mTurtleTradeChannelsIndicator : Indicator

{

[Parameter("Entry Bars (20)", DefaultValue = 20)]

public int inpEntryBars { get; set; }

[Parameter("Exit Bars (10)", DefaultValue = 10)]

public int inpExitBars { get; set; }

[Output("Slow HH", LineColor = "Silver", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outHHslow { get; set; }

[Output("Slow LL", LineColor = "Silver", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outLLslow { get; set; }

[Output("Fast HH", LineColor = "Gray", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outHHfast { get; set; }

[Output("Fast LL", LineColor = "Gray", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outLLfast { get; set; }

[Output("LongOpen", LineColor = "Transparent", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 0)]

public IndicatorDataSeries outLongOpen { get; set; }

[Output("LongSL", LineColor = "Transparent", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 0)]

public IndicatorDataSeries outLongSL { get; set; }

[Output("ShortOpen", LineColor = "Transparent", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 0)]

public IndicatorDataSeries outShortOpen { get; set; }

[Output("ShortSL", LineColor = "Transparent", PlotType = PlotType.DiscontinuousLine, LineStyle = LineStyle.Solid, Thickness = 0)]

public IndicatorDataSeries outShortSL { get; set; }

private IndicatorDataSeries _hhslow, _llslow, _hhfast, _llfast, _islong, _isshort, _longopen, _longsl, _shortopen, _shortsl;

protected override void Initialize()

{

_hhslow = CreateDataSeries();

_llslow = CreateDataSeries();

_hhfast = CreateDataSeries();

_llfast = CreateDataSeries();

_islong = CreateDataSeries();

_isshort = CreateDataSeries();

_longopen = CreateDataSeries();

_longsl = CreateDataSeries();

_shortopen = CreateDataSeries();

_shortsl = CreateDataSeries();

}

public override void Calculate(int i)

{

_hhslow[i] = i>inpEntryBars ? Bars.HighPrices.Maximum(inpEntryBars) : Bars.HighPrices[i];

_llslow[i] = i>inpEntryBars ? Bars.LowPrices.Minimum(inpEntryBars) : Bars.LowPrices[i];

_hhfast[i] = i>inpExitBars ? Bars.HighPrices.Maximum(inpExitBars) : Bars.HighPrices[i];

_llfast[i] = i>inpExitBars ? Bars.LowPrices.Minimum(inpExitBars) : Bars.LowPrices[i];

_islong[i] = Bars.HighPrices[i] > _hhslow[i-1] || _islong[i-1] == +1 ? +1 : 0;

_isshort[i] = Bars.LowPrices[i] < _llslow[i-1] || _isshort[i-1] == -1 ? -1 : 0;

if(_llfast[i] < _llfast[i-1])

_islong[i] = 0;

if(_hhfast[i] > _hhfast[i-1])

_isshort[i] = 0;

_longopen[i] = _islong[i] > 0 ? _hhslow[i] : double.NaN;

_longsl[i] = _islong[i] > 0 ? _llfast[i] : double.NaN;

_shortopen[i] = _isshort[i] < 0 ? _llslow[i] : double.NaN;

_shortsl[i] = _isshort[i] < 0 ? _hhfast[i] : double.NaN;

outHHslow[i] = _hhslow[i];

outLLslow[i] = _llslow[i];

outHHfast[i] = _hhfast[i];

outLLfast[i] = _llfast[i];

outLongOpen[i] = _longopen[i];

outLongSL[i] = _longsl[i];

outShortOpen[i] = _shortopen[i];

outShortSL[i] = _shortsl[i];

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mTurtleTradeChannelsIndicator.algo

- Rating: 5

- Installs: 842

- Modified: 19/09/2023 12:12