Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

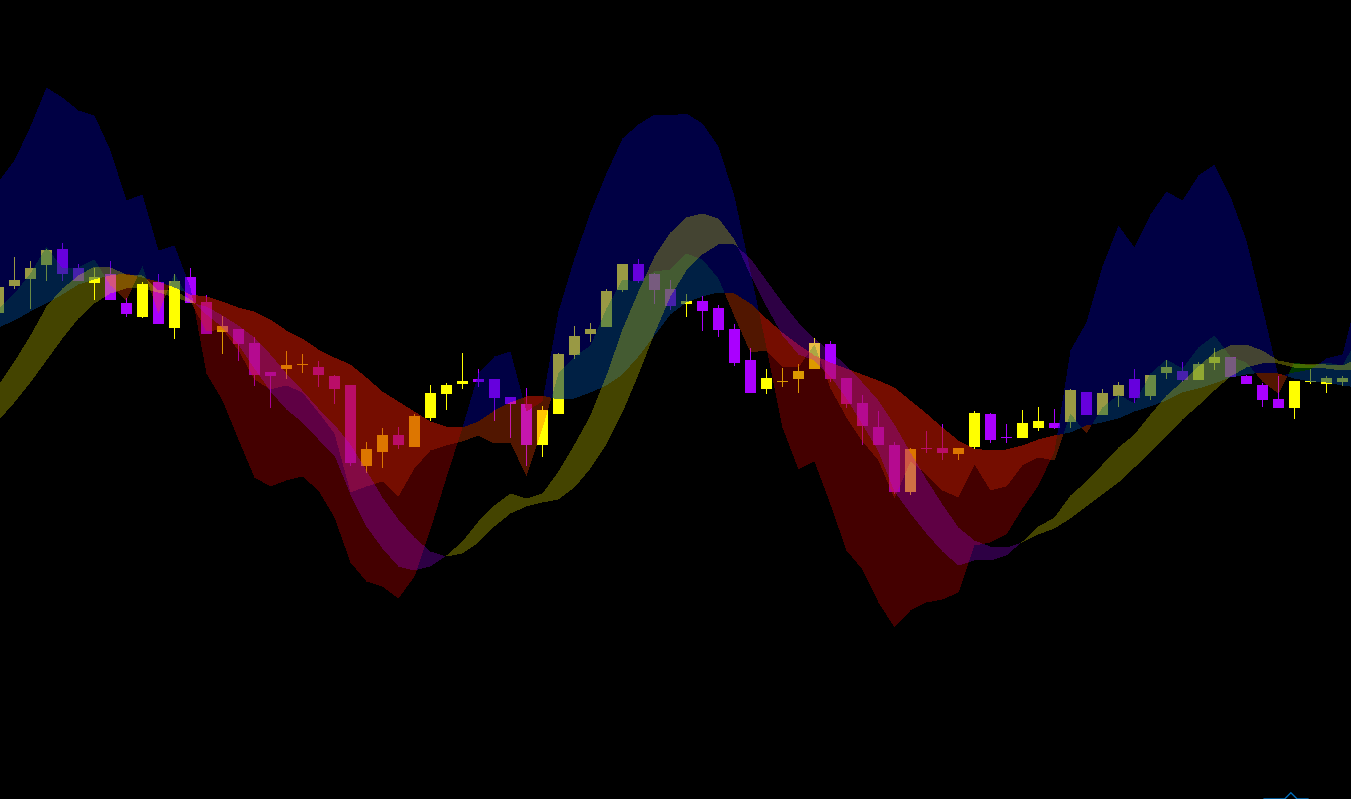

This is an update version that has been smoothed

to 7 bars that gives it a SMA as the base line.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Cloud ( "RSI", "RSI50", Opacity = 0.8 , FirstColor = "RSI", SecondColor = "RSI50")]

[Cloud ( "SCH", "SCH50", Opacity = 0.6 , FirstColor = "SCH", SecondColor = "SCH50")]

[Cloud ( "Macd", "Signal", Opacity = 1 , FirstColor = "Macd", SecondColor = "Signal")]

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class RSISCHON : Indicator

{ // EMA FFAA4400 SMA FF88AA44 50 AA7733AA P 88554488//

public DataSeries Source { get; set; }

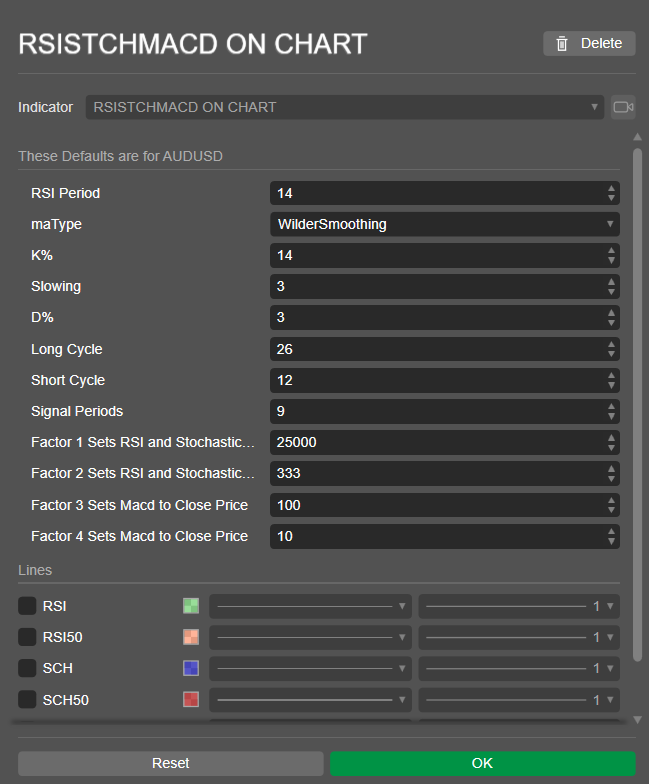

[Parameter("RSI Period",Group = "These Defaults are for AUDUSD", DefaultValue = 14)]

public int RPeriod { get; set; }

[Output("RSI", LineColor = "AA00AA00" )]

public IndicatorDataSeries RSI { get; set; }

[Output("RSI50", LineColor = "AAFF4400" )]

public IndicatorDataSeries RSI50 { get; set; }

[Parameter("maType",Group = "These Defaults are for AUDUSD")]

public MovingAverageType MAType { get; set; }

[Parameter("K%",Group = "These Defaults are for AUDUSD", DefaultValue = 14)]

public int KPeriod { get; set; }

[Parameter("Slowing",Group = "These Defaults are for AUDUSD", DefaultValue = 3)]

public int KSlowing { get; set; }

[Parameter("D%",Group = "These Defaults are for AUDUSD", DefaultValue = 3)]

public int DPeriod { get; set; }

[Output("SCH", LineColor = "AA0000AA" )]

public IndicatorDataSeries SCH { get; set; }

[Output("SCH50", LineColor = "AAAA0000" )]

public IndicatorDataSeries SCH50 { get; set; }

[Parameter("Long Cycle",Group = "These Defaults are for AUDUSD", DefaultValue = 26)]

public int LongCycle { get; set; }

[Parameter("Short Cycle",Group = "These Defaults are for AUDUSD", DefaultValue = 12)]

public int ShortCycle { get; set; }

[Parameter("Signal Periods",Group = "These Defaults are for AUDUSD", DefaultValue = 9)]

public int Periods { get; set; }

[Output("Macd", LineColor = "44FFFF00",Thickness =1, PlotType = PlotType.DiscontinuousLine)]

public IndicatorDataSeries Macd {get;set;}

[Output("Signal", LineColor = "44AA00FF",Thickness =1, PlotType = PlotType.DiscontinuousLine)]

public IndicatorDataSeries Signal {get;set;}

[Parameter("Factor 1 Sets RSI and Stochastic to Close Price ",Group = "These Defaults are for AUDUSD", DefaultValue = 25000)]

public int F1 { get; set; }

[Parameter("Factor 2 Sets RSI and Stochastic to Close Price",Group = "These Defaults are for AUDUSD", DefaultValue = 333)]

public int F2 { get; set; }

[Parameter("Factor 3 Sets Macd to Close Price",Group = "These Defaults are for AUDUSD", DefaultValue = 100)]

public int F3 { get; set; }

[Parameter("Factor 4 Sets Macd to Close Price",Group = "These Defaults are for AUDUSD", DefaultValue = 10)]

public int F4 { get; set; }

private RelativeStrengthIndex rsi;

private StochasticOscillator sch;

private MacdCrossOver macdCrossOver;

protected override void Initialize()

{

rsi = Indicators.RelativeStrengthIndex(Source, RPeriod);

sch = Indicators.StochasticOscillator(KPeriod, KSlowing, DPeriod, MAType);

macdCrossOver = Indicators.MacdCrossOver(LongCycle, ShortCycle, Periods);

}

public override void Calculate(int index)

{

var C1 = Bars.ClosePrices.Last(1);var C2 = Bars.ClosePrices.Last(2);var C3 = Bars.ClosePrices.Last(3);

var C4 = Bars.ClosePrices.Last(4);var C5 = Bars.ClosePrices.Last(5);var C6 = Bars.ClosePrices.Last(6);

var C7 = Bars.ClosePrices.Last(7);

var O1 = Bars.OpenPrices.Last(1);var O2 = Bars.OpenPrices.Last(2);var O3 = Bars.OpenPrices.Last(3);

var O4 = Bars.OpenPrices.Last(4);var O5 = Bars.OpenPrices.Last(5);var O6 = Bars.OpenPrices.Last(6);

var O7 = Bars.OpenPrices.Last(7);

var X = (C1+O1+C2+O2+C3+O3+C4+O4+C5+O5+C6+O6+C7+O7)/14;

RSI[index] = rsi.Result[index] / F1 + X - ( X / F2 ) ;

RSI50[index] = X;

SCH[index] = sch.PercentK[index] / F1 + X - ( X / F2 ) ;

SCH50[index] = X;

Macd[index] = macdCrossOver.MACD[index] * (( X * F3 + X ) * X / F4 ) + X ;

Signal[index] = macdCrossOver.Signal[index] * (( X * F3 + X ) * X / F4 ) + X ;

}

}

}

VE

VEI5S6C4OUNT0

Joined on 06.12.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: RSISTCHMACD ON CHART.algo

- Rating: 5

- Installs: 654

- Modified: 05/06/2023 12:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.