Description

Order Flow Ticks brings the main concepts of Order Flow (aka Footprint) for cTrader, adapted for Tick Volume.

Using ideas from my previous creations (Volume for Renko/Range, TPO Profile v2.0) made this possible.

Also works on Ticks/Renko/Range* Charts

Last Update -> 12/12/2024

Previous Downloads: 4387+

See also -->> Weis & Wyckoff System v2.0 <<--

See also -->> VWAP Midas Buttons <<--

What's new in v2.0?

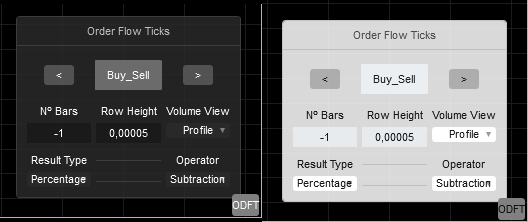

- Added Params Panel for quickly switch between settings (volume modes, row height, etc) as well as more user-friendly.

- Refactor to only use Colors API

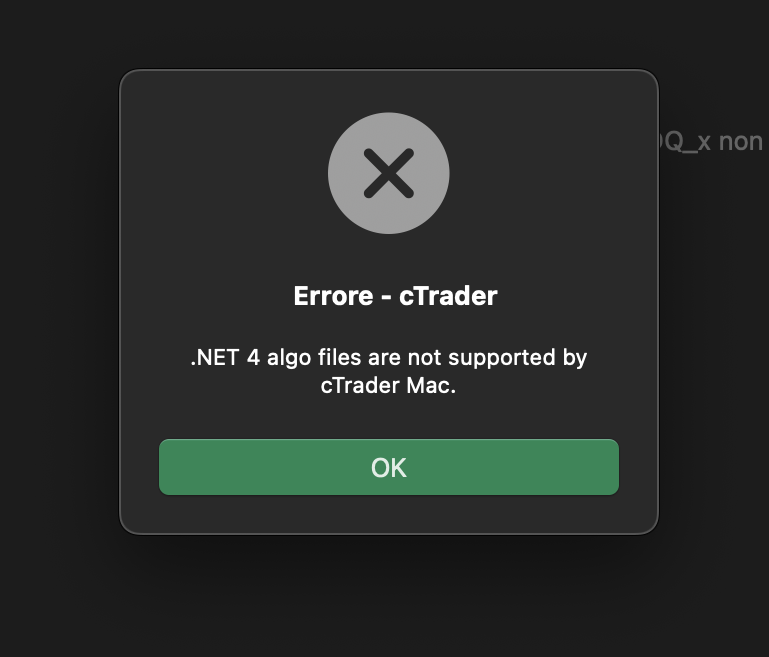

- Should work with Mac OS users.

- .NET 6.0+ is Required

=================================================

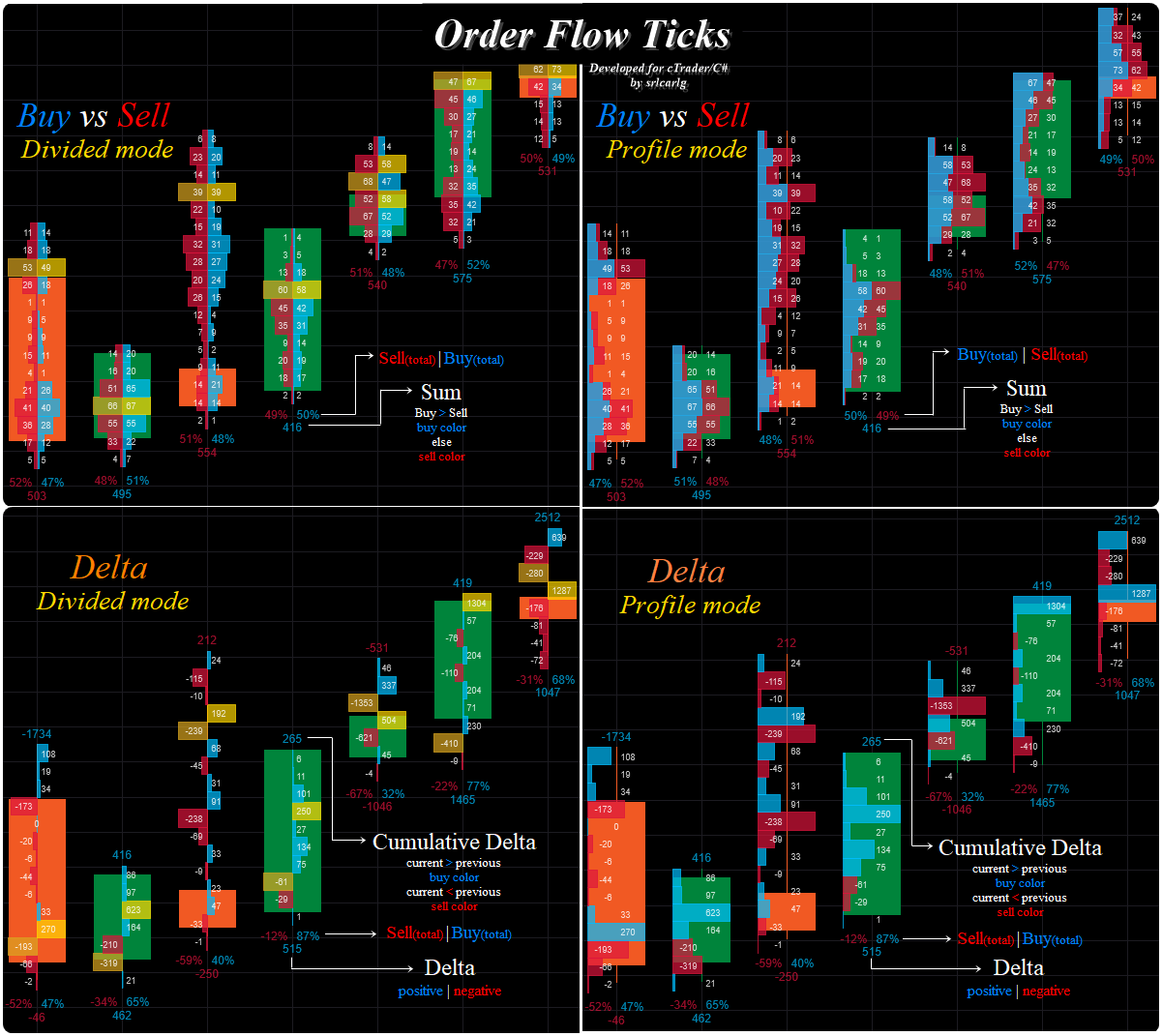

Comparing with Footprint, we have the features:

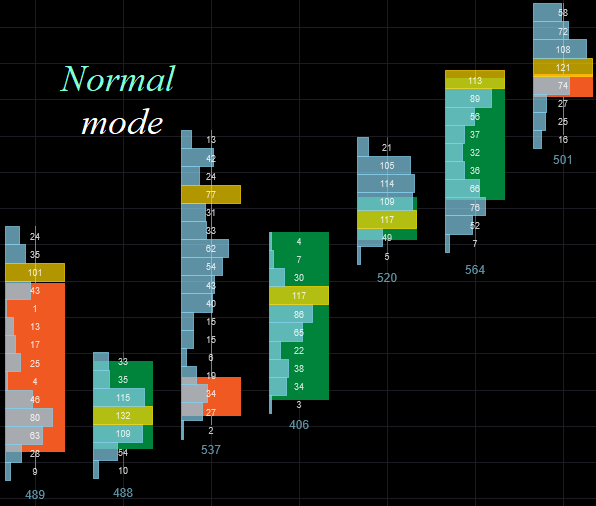

- Normal Mode = Volume Profile of Bar

- Buy vs Sell Divided Mode = Bid/Ask Footprint

- Buy vs Sell Profile Mode = Same but Profile

- Delta Divided Mode = Delta Footprint

- Delta Profile Mode = Same but Profile

Update:

12/12/2024 - Version 2.0

25/10/2023 - A great refactoring has been done, plus:

Previous Downloads: 4387+

- Added "Show Side(total)?" Option in Result/Numbers Area.

- Added "[Delta] Only Larguest?" Option in Volume Coloring Area. (Divided mode only)

- Fixed “Delta Histograms disappear" when there are new candles on the Live Market timebased chart.

07/12/2022 - Added "Large Result Filter" Area, imported from [Renko] Weis & Wyckoff System, adapted of course.

Previous Downloads: 4104+

- Large R. Ratio value is optimized for Delta Mode, if you want to use other Modes, change the value between 1 to 2. (recommended less than 1.5)

- The smaller the Large R. Ratio value, the more occurrences will appear.

26/11/2022 - Added "[Renko] Show Wicks" Option, giving more accuracy in reading on Renko.

21/11/2022 - Added "Sum or Subtraction Option" in Buy/Sell mode (only), also a small design fix in Delta Profile mode.

16/11/2022 - A "new" and correct way of segmentation has been added, where there is no more "repaint/flicker" when a new high was formed in Live Market.

The old wrong segmentation has been replaced by this one.

=======================================================================

All parameters are self-explanatory.

*Remember that they are Non-Timebased Timeframes, so in Real-time Market on the right side of current bar, the right histogram follows the current time, and because of this (Non-Timebased) it ends up stretching the histogram away giving a impression that goes to infinity... after the bar closes it will be corrected automatically, and this explanation is repeated :).

/*

--------------------------------------------------------------------------------------------------------------------------------

Order Flow Ticks v2.0

Order Flow Ticks brings the main concepts of Order Flow (aka Footprint) for cTrader.

Using ideas from my previous creations (Volume for Renko/Range, TPO Profile) made this possible.

Comparing with Footprint, we have the features:

* Normal Mode = Volume Profile of Bar

* Buy vs Sell Divided Mode = Bid/Ask Footprint

* Buy vs Sell Profile Mode = Same but Profile

* Delta Divided Mode = Delta Footprint

* Delta Profile Mode = Same but Profile

All parameters are self-explanatory.

Also works on Ticks/Renko/Range Charts

.NET 6.0+ is Required

What's new in v2.0?

-Added Params Panel for quickly switch between settings (volume modes, row height, etc) and most importantly, more user-friendly.

-Refactor to only use Colors API.

-Should work with Mac OS users.

Performance Tips!

- Set 'Nº Bars' to 20+ or more if switching settings is taking too long

AUTHOR: srlcarlg

== DON"T BE an ASSHOLE SELLING this FREE and OPEN-SOURCE indicator ==

----------------------------------------------------------------------------------------------------------------------------

*/

using System.Globalization;

using System;

using System.Collections.Generic;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using static cAlgo.OrderFlowTicksV20;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class OrderFlowTicksV20 : Indicator

{

public enum LoadFromData

{

Existing_on_Chart,

Today,

Yesterday,

One_Week,

Two_Week,

Monthly,

Custom

}

[Parameter("Load From:", DefaultValue = LoadFromData.Existing_on_Chart, Group = "==== Tick Volume Settings ====")]

public LoadFromData LoadFromInput { get; set; }

[Parameter("Custom (dd/mm/yyyy):", DefaultValue = "00/00/0000", Group = "==== Tick Volume Settings ====")]

public string StringDate { get; set; }

public enum PanelAlignData

{

Top_Left,

Top_Center,

Top_Right,

Center_Left,

Center_Right,

Bottom_Left,

Bottom_Center,

Bottom_Right,

}

[Parameter("Panel Position:", DefaultValue = PanelAlignData.Bottom_Right, Group = "==== Order Flow Ticks v2.0 ====")]

public PanelAlignData PanelAlignInput { get; set; }

public enum ConfigRowData

{

Predefined,

Custom,

}

[Parameter("Row Config:", DefaultValue = ConfigRowData.Predefined, Group = "==== Order Flow Ticks v2.0 ====")]

public ConfigRowData ConfigRowInput { get; set; }

[Parameter("Custom Row Height:", DefaultValue = 0.2, MinValue = 0.2, Group = "==== Order Flow Ticks v2.0 ====")]

public double CustomHeightInput { get; set; }

[Parameter("Fill Histogram?", DefaultValue = true, Group = "==== Visualization ====")]

public bool FillHist { get; set; }

[Parameter("Show Numbers?", DefaultValue = true, Group = "==== Visualization ====")]

public bool ShowNumbers { get; set; }

[Parameter("Show Results?", DefaultValue = true, Group = "==== Visualization ====")]

public bool ShowResults { get; set; }

[Parameter("Show Side(total)?", DefaultValue = true, Group = "==== Visualization ====")]

public bool ShowSideTotalInput { get; set; }

[Parameter("[Renko] Show Wicks?", DefaultValue = true, Group = "==== Visualization ====")]

public bool ShowWicks { get; set; }

[Parameter("Font Size Numbers:", DefaultValue = 8, MinValue = 1, MaxValue = 80, Group = "==== Font Size ====")]

public int FontSizeNumbers { get; set; }

[Parameter("Font Size Results:", DefaultValue = 10, MinValue = 1, MaxValue = 80, Group = "==== Font Size ====")]

public int FontSizeResults { get; set; }

public enum ResultsColoringData

{

bySide,

Fixed,

}

[Parameter("Results Coloring:", DefaultValue = ResultsColoringData.bySide, Group = "==== Results/Numbers ====")]

public ResultsColoringData ResultsColoringInput { get; set; }

[Parameter("Fixed Color RT/NB:", DefaultValue = "#CCFFFFFF", Group = "==== Results/Numbers ====")]

public Color RtnbFixedColor { get; set; }

[Parameter("Enable Filter?", DefaultValue = true, Group = "==== Large Result Filter ====")]

public bool EnableFilter { get; set; }

[Parameter("MA Filter Type:", DefaultValue = MovingAverageType.Exponential, Group = "==== Large Result Filter ====")]

public MovingAverageType MAtype { get; set; }

[Parameter("MA Filter Period:", DefaultValue = 5, MinValue = 1, Group = "==== Large Result Filter ====")]

public int MAperiod { get; set; }

[Parameter("Large R. Ratio", DefaultValue = 1.5, MinValue = 1, MaxValue = 2, Group = "==== Large Result Filter ====")]

public double Filter_Ratio { get; set; }

[Parameter("Large R. Color", DefaultValue = "Gold", Group = "==== Large Result Filter ====")]

public Color ColorLargeResult { get; set; }

[Parameter("Coloring Bar?", DefaultValue = true, Group = "==== Large Result Filter ====")]

public bool ColoringBars { get; set; }

[Parameter("[Delta] Coloring Cumulative?", DefaultValue = true, Group = "==== Large Result Filter ====")]

public bool ColoringCD { get; set; }

[Parameter("Color Volume:", DefaultValue = "#B287CEEB", Group = "==== Volume ====")]

public Color VolumeColor { get; set; }

[Parameter("Color Largest Volume:", DefaultValue = "#B2FFD700", Group = "==== Volume ====")]

public Color VolumeLargeColor { get; set; }

[Parameter("Color Buy:", DefaultValue = "#B200BFFF", Group = "==== Buy ====")]

public Color BuyColor { get; set; }

[Parameter("Color Largest Buy:", DefaultValue = "#B2FFD700", Group = "==== Buy ====")]

public Color BuyLargeColor { get; set; }

[Parameter("Color Sell:", DefaultValue = "#B2DC143C", Group = "==== Sell ====")]

public Color SellColor { get; set; }

[Parameter("Color Largest Sell:", DefaultValue = "#B2DAA520", Group = "==== Sell ====")]

public Color SellLargeColor { get; set; }

[Parameter("Developed for cTrader/C#", DefaultValue = "by srlcarlg", Group = "==== Credits ====")]

public string Credits { get; set; }

private List<double> Segments = new();

private readonly IDictionary<double, int> VolumesRank = new Dictionary<double, int>();

private readonly IDictionary<double, int> VolumesRank_Up = new Dictionary<double, int>();

private readonly IDictionary<double, int> VolumesRank_Down = new Dictionary<double, int>();

private readonly IDictionary<double, int> DeltaRank = new Dictionary<double, int>();

private readonly IDictionary<double, int> CumulDeltaRank = new Dictionary<double, int>();

private double heightPips = 4;

private double rowHeight = 0;

private DateTime fromDateTime;

private Bars TicksOHLC;

private bool isWrong = false;

private bool isLive = false;

private bool isNewBar = false;

private bool isCalcFinished = false;

private bool isCalcLocked = false;

// For Filter

// DynamicSeries can be Normal, BuyxSell or Delta Volume

private IndicatorDataSeries CumulDeltaSeries, DynamicSeries;

private MovingAverage MACumulDelta, MADynamic;

// Moved from cTrader Input to Params Panel

public int Lookback { get; set; } = -1;

public enum VolumeModeData

{

Normal,

Buy_Sell,

Delta,

}

public VolumeModeData VolumeModeInput { get; set; } = VolumeModeData.Delta;

public enum VolumeViewData

{

Divided,

Profile,

}

public VolumeViewData VolumeViewInput { get; set; } = VolumeViewData.Profile;

public enum OperatorBuySell_Data

{

Sum,

Subtraction,

}

public OperatorBuySell_Data OperatorBuySellInput { get; set; } = OperatorBuySell_Data.Subtraction;

public enum ResultsType_Data

{

Percentage,

Value,

Both

}

public ResultsType_Data ResultsTypeInput { get; set; } = ResultsType_Data.Percentage;

public bool ColorOnlyLarguestInput { get; set; } = true;

// Params Panel

private Border ParamBorder;

public class IndicatorParams

{

public double NBars { get; set; }

public VolumeModeData VolMode { get; set; }

public VolumeViewData VolView { get; set; }

public double RowHeight { get; set; }

public ResultsType_Data ResultType { get; set; }

public OperatorBuySell_Data OperatorBuySell { get; set; }

public bool OnlyLargestDivided { get; set; }

}

private void AddHiddenButton(Panel panel, Color btnColor)

{

Button button = new()

{

Text = "ODFT",

Padding = 0,

Height = 22,

Margin = 2,

BackgroundColor = btnColor

};

button.Click += HiddenEvent;

panel.AddChild(button);

}

private void HiddenEvent(ButtonClickEventArgs obj)

{

if (ParamBorder.IsVisible)

ParamBorder.IsVisible = false;

else

ParamBorder.IsVisible = true;

}

protected override void Initialize()

{

// ====== Predefined Config ==========

if (ConfigRowInput == ConfigRowData.Predefined && (Chart.TimeFrame >= TimeFrame.Minute && Chart.TimeFrame <= TimeFrame.Monthly))

{

if (Chart.TimeFrame >= TimeFrame.Minute && Chart.TimeFrame <= TimeFrame.Minute4)

SetHeightPips(0.3, 5);

else if (Chart.TimeFrame >= TimeFrame.Minute5 && Chart.TimeFrame <= TimeFrame.Minute10)

SetHeightPips(1, 10);

else if (Chart.TimeFrame >= TimeFrame.Minute15 && Chart.TimeFrame <= TimeFrame.Hour8)

{

if (Chart.TimeFrame >= TimeFrame.Minute15 && Chart.TimeFrame < TimeFrame.Minute30)

SetHeightPips(2, 15);

if (Chart.TimeFrame >= TimeFrame.Minute30 && Chart.TimeFrame <= TimeFrame.Hour)

SetHeightPips(4, 30);

else if (Chart.TimeFrame >= TimeFrame.Hour4 && Chart.TimeFrame <= TimeFrame.Hour8)

SetHeightPips(6, 50);

}

else if (Chart.TimeFrame >= TimeFrame.Hour12 && Chart.TimeFrame <= TimeFrame.Day3)

SetHeightPips(15, 180);

else if (Chart.TimeFrame >= TimeFrame.Weekly && Chart.TimeFrame <= TimeFrame.Monthly)

SetHeightPips(50, 380);

}

else

{

if (ConfigRowInput == ConfigRowData.Predefined)

{

string msg = "'Predefined Config' is designed only for Standard Timeframe (Minutes, Hours, Days, Weekly, Monthly)\n\n use 'Custom Config' to others Chart Timeframes (Renko/Range/Ticks).";

Chart.DrawStaticText("txt", $"{msg}", VerticalAlignment.Top, HorizontalAlignment.Center, Color.Orange);

isWrong = true;

return;

}

heightPips = CustomHeightInput;

}

void SetHeightPips(double digits5, double digits2)

{

if (Symbol.Digits == 5)

heightPips = digits5;

else if (Symbol.Digits == 2)

{

heightPips = digits2;

if (Symbol.PipSize == 0.1)

heightPips /= 2;

}

}

if (EnableFilter)

{

DynamicSeries = CreateDataSeries();

CumulDeltaSeries = CreateDataSeries();

MADynamic = Indicators.MovingAverage(DynamicSeries, MAperiod, MAtype);

MACumulDelta = Indicators.MovingAverage(CumulDeltaSeries, MAperiod, MAtype);

}

// First Ticks Data

TicksOHLC = MarketData.GetBars(TimeFrame.Tick);

string currentTimeframe = Chart.TimeFrame.ToString();

if (currentTimeframe.Contains("Renko") || currentTimeframe.Contains("Range") || currentTimeframe.Contains("Tick"))

Bars.BarOpened += SetNewBar;

if (LoadFromInput != LoadFromData.Existing_on_Chart)

VolumeInitialize();

// Ex: 4 pips to Volume calculation(rowHeight)

rowHeight = Symbol.PipSize * heightPips;

DrawOnScreen("Calculating...");

Second_DrawOnScreen("Taking too long? \nSet Nº Bars to Show");

// PARAMS PANEL

VerticalAlignment vAlign = VerticalAlignment.Bottom;

HorizontalAlignment hAlign = HorizontalAlignment.Right;

if (PanelAlignInput == PanelAlignData.Bottom_Left)

hAlign = HorizontalAlignment.Left;

else if (PanelAlignInput == PanelAlignData.Top_Left)

vAlign = VerticalAlignment.Top;

else if (PanelAlignInput == PanelAlignData.Top_Right) {

vAlign = VerticalAlignment.Top;

hAlign = HorizontalAlignment.Right;

} else if (PanelAlignInput == PanelAlignData.Center_Right) {

vAlign = VerticalAlignment.Center;

hAlign = HorizontalAlignment.Right;

} else if (PanelAlignInput == PanelAlignData.Center_Left) {

vAlign = VerticalAlignment.Center;

hAlign = HorizontalAlignment.Left;

} else if (PanelAlignInput == PanelAlignData.Top_Center) {

vAlign = VerticalAlignment.Top;

hAlign = HorizontalAlignment.Center;

} else if (PanelAlignInput == PanelAlignData.Bottom_Center) {

vAlign = VerticalAlignment.Bottom;

hAlign = HorizontalAlignment.Center;

}

IndicatorParams DefaultParams = new()

{

NBars = Lookback,

VolMode = VolumeModeInput,

VolView = VolumeViewInput,

RowHeight = rowHeight,

ResultType = ResultsTypeInput,

OperatorBuySell = OperatorBuySellInput,

OnlyLargestDivided = ColorOnlyLarguestInput

};

ParamsPanel ParamPanel = new(this, DefaultParams);

Border borderParam = new()

{

VerticalAlignment = vAlign,

HorizontalAlignment = hAlign,

Style = Styles.CreatePanelBackgroundStyle(),

Margin = "20 40 20 20",

Width = 225,

Child = ParamPanel

};

Chart.AddControl(borderParam);

ParamBorder = borderParam;

var wrapPanel = new WrapPanel

{

VerticalAlignment = vAlign,

HorizontalAlignment = hAlign,

};

AddHiddenButton(wrapPanel, Color.Gray);

Chart.AddControl(wrapPanel);

}

public override void Calculate(int index)

{

if (isWrong)

return;

// Removing Messages

if (!IsLastBar)

{

DrawOnScreen("");

Second_DrawOnScreen("");

}

// LookBack

if (index < (Bars.OpenTimes.GetIndexByTime(Server.Time) - Lookback) && (Lookback != -1 && Lookback > 0))

return;

// Historical data

if (!IsLastBar)

{

if (!isLive)

CreateOrderFlow(index);

else

isNewBar = true;

}

else

{

// Required for Non-Time based charts (Renko, Range, Ticks)

isLive = true;

if (isNewBar)

{

string currentTimeframe = Chart.TimeFrame.ToString();

if (VolumeModeInput == VolumeModeData.Normal && !isCalcFinished &&

(currentTimeframe.Contains("Renko") || currentTimeframe.Contains("Range")))

{

isCalcFinished = true;

CreateOrderFlow(index - 1);

isCalcLocked = true;

return;

}

CreateOrderFlow(index - 1);

isNewBar = false;

return;

}

CreateOrderFlow(index);

}

void CreateOrderFlow(int idx)

{

Segments.Clear();

VolumesRank.Clear();

VolumesRank_Up.Clear();

VolumesRank_Down.Clear();

DeltaRank.Clear();

OrderFlow(idx);

}

}

private void OrderFlow(int iStart)

{

// ======= Highest and Lowest =======

double highest = Bars.HighPrices[iStart], lowest = Bars.LowPrices[iStart], open = Bars.OpenPrices[iStart];

if (Chart.TimeFrame.ToString().Contains("Renko") && ShowWicks)

{

var currentOpenTime = Bars.OpenTimes[iStart];

var NextOpenTime = Bars.OpenTimes[iStart + 1];

bool isBullish = (Bars.ClosePrices[iStart] > Bars.OpenPrices[iStart]);

if (isBullish)

lowest = GetWicks(currentOpenTime, NextOpenTime, isBullish);

else

highest = GetWicks(currentOpenTime, NextOpenTime, isBullish);

}

List<double> currentSegments = new();

double prevSegment = open;

while (prevSegment >= (lowest - rowHeight))

{

currentSegments.Add(prevSegment);

prevSegment = Math.Abs(prevSegment - rowHeight);

}

prevSegment = open;

while (prevSegment <= (highest + rowHeight))

{

currentSegments.Add(prevSegment);

prevSegment = Math.Abs(prevSegment + rowHeight);

}

Segments = currentSegments.OrderBy(x => x).ToList();

// ======= Volume on Tick =======

VP_Tick(iStart);

// ======= Drawing =======

if (Segments.Count == 0)

return;

double loopPrevSegment = 0;

for (int i = 0; i < Segments.Count; i++)

{

if (loopPrevSegment == 0)

loopPrevSegment = Segments[i];

double priceKey = Segments[i];

if (!VolumesRank.ContainsKey(priceKey))

continue;

int largestVOL = VolumesRank.Values.Max();

// ======= HISTOGRAMs + Texts =======

/*

Indeed, the value of X-Axis is simply a rule of three,

where the maximum value of the respective side (One/Buy/Sell) will be the maxLength (in Milliseconds),

from there the math adjusts the histograms.

MaxValue maxLength(ms)

x ?(ms)

The values 1.50 and 3 are the manually set values like the size of the Bar body in any timeframe (Candle, Ticks, Renko, Range)

*/

double lowerSegment = loopPrevSegment;

double upperSegment = Segments[i];

string currentTimeframe = Chart.TimeFrame.ToString();

// All Volume

double maxLength = 0;

if (!IsLastBar)

maxLength = Bars[iStart + 1].OpenTime.Subtract(Bars[iStart].OpenTime).TotalMilliseconds;

else

{

maxLength = Bars[iStart].OpenTime.Subtract(Bars[iStart - 1].OpenTime).TotalMilliseconds;

if ((currentTimeframe.Contains("Renko") || currentTimeframe.Contains("Range"))

&& VolumeModeInput == VolumeModeData.Normal && isCalcFinished && !isCalcLocked)

maxLength = Bars[iStart + 1].OpenTime.Subtract(Bars[iStart].OpenTime).TotalMilliseconds;

}

double proportion = VolumesRank[priceKey] * (maxLength - (maxLength / 1.50));

double dynLength = proportion / largestVOL;

// Bull/Up/Buy

double proportion_Up = VolumesRank_Up[priceKey] * (maxLength - (maxLength / 1.50));

double dynLength_Up = proportion_Up / VolumesRank_Up.Values.Max();

// Bear/Down/Sell

double maxLength_Left = Bars[iStart].OpenTime.Subtract(Bars[iStart - 1].OpenTime).TotalMilliseconds;

double proportion_Down = VolumesRank_Down[priceKey] * (maxLength_Left - (maxLength_Left / 1.50));

double dynLength_Down = proportion_Down / VolumesRank_Down.Values.Max();

// Delta

double proportion_Delta = DeltaRank[priceKey] * (maxLength - (maxLength / 1.50));

double dynLength_Delta = proportion_Delta / DeltaRank.Values.Max();

if (DeltaRank[priceKey] < 0 && VolumeViewInput == VolumeViewData.Divided && VolumeModeInput == VolumeModeData.Delta)

{

// Negative Delta

proportion_Delta = DeltaRank[priceKey] * (maxLength_Left - (maxLength_Left / 1.50));

dynLength_Delta = proportion_Delta / DeltaRank.Values.Where(n => n < 0).Min();

}

if (VolumeViewInput == VolumeViewData.Profile && VolumeModeInput == VolumeModeData.Buy_Sell)

{

// Buy vs Sell = Pseudo Delta

int buyVolume = VolumesRank_Up.Values.Max();

int sellVolume = VolumesRank_Down.Values.Max();

int sideVolMax = buyVolume > sellVolume ? buyVolume : sellVolume;

proportion_Up = VolumesRank_Up[priceKey] * (maxLength - (maxLength / 1.20));

dynLength_Up = proportion_Up / sideVolMax;

proportion_Down = VolumesRank_Down[priceKey] * (maxLength - (maxLength / 1.50));

dynLength_Down = proportion_Down / sideVolMax;

}

else if (VolumeViewInput == VolumeViewData.Profile && VolumeModeInput == VolumeModeData.Delta)

{

int Positive_Delta = DeltaRank.Values.Max();

IEnumerable<int> allNegative = DeltaRank.Values.Where(n => n < 0);

int Negative_Delta = 0;

try { Negative_Delta = Math.Abs(allNegative.Min()); } catch { }

int deltaMax = Positive_Delta > Negative_Delta ? Positive_Delta : Negative_Delta;

dynLength_Delta = proportion_Delta / deltaMax;

}

if (VolumeModeInput == VolumeModeData.Normal)

{

Color dynColor = VolumesRank[priceKey] != largestVOL ? VolumeColor : VolumeLargeColor;

ChartRectangle volHist;

if (currentTimeframe.Contains("Renko") || currentTimeframe.Contains("Range"))

volHist = Chart.DrawRectangle($"{iStart}_{i}", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(dynLength), upperSegment, dynColor);

else

volHist = Chart.DrawRectangle($"{iStart}_{i}", Bars.OpenTimes[iStart].AddMilliseconds(-(maxLength / 3)), lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-(maxLength / 3)).AddMilliseconds(dynLength * 2), upperSegment, dynColor);

if (FillHist)

volHist.IsFilled = true;

if (ShowNumbers)

{

ChartText C = Chart.DrawText($"{iStart}_{i}Center", $"{VolumesRank[priceKey]}", Bars.OpenTimes[iStart], priceKey, RtnbFixedColor);

C.HorizontalAlignment = HorizontalAlignment.Center;

C.FontSize = FontSizeNumbers;

}

if (ShowResults)

{

ChartText Center;

Color dynResColor = ResultsColoringInput == ResultsColoringData.Fixed ? RtnbFixedColor : VolumeColor;

Center = Chart.DrawText($"{iStart}SumCenter", $"\n{VolumesRank.Values.Sum()}", Bars.OpenTimes[iStart], lowest, dynResColor);

Center.HorizontalAlignment = HorizontalAlignment.Center;

if (EnableFilter)

{

DynamicSeries[iStart] = VolumesRank.Values.Sum();

// ====== Dynamic Series Filter ======

double DynamicFilter = DynamicSeries[iStart] / MADynamic.Result[iStart];

double DynamicLarge = DynamicFilter >= Filter_Ratio ? DynamicSeries[iStart] : 0;

Color dynBarColor = DynamicLarge >= 2 ? ColorLargeResult : dynResColor;

Center.Color = dynBarColor;

if (ColoringBars && dynBarColor == ColorLargeResult)

Chart.SetBarFillColor(iStart, ColorLargeResult);

}

}

}

else if (VolumeModeInput == VolumeModeData.Buy_Sell)

{

Color dynColorBuy = VolumesRank_Up[priceKey] != VolumesRank_Up.Values.Max() ? BuyColor : BuyLargeColor;

Color dynColorSell = VolumesRank_Down[priceKey] != VolumesRank_Down.Values.Max() ? SellColor : SellLargeColor;

ChartRectangle buyHist;

ChartRectangle sellHist;

if (VolumeViewInput == VolumeViewData.Divided)

{

buyHist = Chart.DrawRectangle($"{iStart}_{i}Buy", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(dynLength_Up), upperSegment, dynColorBuy);

sellHist = Chart.DrawRectangle($"{iStart}_{i}Sell", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-dynLength_Down), upperSegment, dynColorSell);

}

else

{

if (currentTimeframe.Contains("Renko") || currentTimeframe.Contains("Range"))

{

sellHist = Chart.DrawRectangle($"{iStart}_{i}Sell", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(dynLength_Down), upperSegment, SellColor);

buyHist = Chart.DrawRectangle($"{iStart}_{i}Buy", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(dynLength_Up), upperSegment, BuyColor);

}

else

{

sellHist = Chart.DrawRectangle($"{iStart}_{i}Sell", Bars.OpenTimes[iStart].AddMilliseconds(-(maxLength / 3)), lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-(maxLength / 3)).AddMilliseconds(dynLength_Down * 2), upperSegment, SellColor);

buyHist = Chart.DrawRectangle($"{iStart}_{i}Buy", Bars.OpenTimes[iStart].AddMilliseconds(-(maxLength / 3)), lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-(maxLength / 3)).AddMilliseconds(dynLength_Up * 2), upperSegment, BuyColor);

}

}

if (FillHist)

{

buyHist.IsFilled = true;

sellHist.IsFilled = true;

}

if (ShowNumbers)

{

ChartText L = Chart.DrawText($"{iStart}_{i}SellNumber", $"{VolumesRank_Down[priceKey]}", Bars.OpenTimes[iStart], priceKey, RtnbFixedColor);

ChartText R = Chart.DrawText($"{iStart}_{i}BuyNumber", $"{VolumesRank_Up[priceKey]}", Bars.OpenTimes[iStart], priceKey, RtnbFixedColor);

if (VolumeViewInput == VolumeViewData.Divided)

{

L.HorizontalAlignment = HorizontalAlignment.Left;

R.HorizontalAlignment = HorizontalAlignment.Right;

}

else

{

L.HorizontalAlignment = HorizontalAlignment.Right;

R.HorizontalAlignment = HorizontalAlignment.Left;

}

L.FontSize = FontSizeNumbers;

R.FontSize = FontSizeNumbers;

}

if (ShowResults)

{

var selected = ResultsTypeInput;

int volBuy = VolumesRank_Up.Values.Sum();

int volSell = VolumesRank_Down.Values.Sum();

Color compare = volBuy > volSell ? BuyColor : volBuy < volSell ? SellColor : RtnbFixedColor;

Color dynColorCenter = ResultsColoringInput == ResultsColoringData.Fixed ? RtnbFixedColor : compare;

if (ShowSideTotalInput)

{

Color dynColorLeft = ResultsColoringInput == ResultsColoringData.Fixed ? RtnbFixedColor : SellColor;

Color dynColorRight = ResultsColoringInput == ResultsColoringData.Fixed ? RtnbFixedColor : BuyColor;

int percentBuy = (volBuy * 100) / (volBuy + volSell);

int percentSell = (volSell * 100) / (volBuy + volSell);

string dynStrBuy = selected == ResultsType_Data.Percentage ? $"\n{percentBuy}%" : selected == ResultsType_Data.Value ? $"\n{volBuy}" : $"\n{percentBuy}%\n({volBuy})";

string dynStrSell = selected == ResultsType_Data.Percentage ? $"\n{percentSell}%" : selected == ResultsType_Data.Value ? $"\n{volSell}" : $"\n{percentSell}%\n({volSell})";

ChartText Left, Right;

Left = Chart.DrawText($"{iStart}SellSum", $"{dynStrSell}", Bars.OpenTimes[iStart], lowest, dynColorLeft);

Right = Chart.DrawText($"{iStart}BuySum", $"{dynStrBuy}", Bars.OpenTimes[iStart], lowest, dynColorRight);

if (VolumeViewInput == VolumeViewData.Divided)

{

Left.HorizontalAlignment = HorizontalAlignment.Left;

Right.HorizontalAlignment = HorizontalAlignment.Right;

}

else

{

Left.HorizontalAlignment = HorizontalAlignment.Right;

Right.HorizontalAlignment = HorizontalAlignment.Left;

}

Left.FontSize = FontSizeResults;

Right.FontSize = FontSizeResults;

}

string dynSpaceSum = (selected == ResultsType_Data.Percentage || selected == ResultsType_Data.Value) ? $"\n\n" : $"\n\n\n";

ChartText Center;

if (OperatorBuySellInput == OperatorBuySell_Data.Sum)

Center = Chart.DrawText($"{iStart}SumCenter", $"{dynSpaceSum}{VolumesRank_Up.Values.Sum() + VolumesRank_Down.Values.Sum()}", Bars.OpenTimes[iStart], lowest, dynColorCenter);

else

Center = Chart.DrawText($"{iStart}SumCenter", $"{dynSpaceSum}{VolumesRank_Up.Values.Sum() - VolumesRank_Down.Values.Sum()}", Bars.OpenTimes[iStart], lowest, dynColorCenter);

Center.HorizontalAlignment = HorizontalAlignment.Center;

Center.FontSize = FontSizeResults;

if (EnableFilter)

{

if (OperatorBuySellInput == OperatorBuySell_Data.Sum)

DynamicSeries[iStart] = VolumesRank_Up.Values.Sum() + VolumesRank_Down.Values.Sum();

else

DynamicSeries[iStart] = VolumesRank_Up.Values.Sum() - VolumesRank_Down.Values.Sum();

// ====== Dynamic Series Filter ======

double DynamicFilter = DynamicSeries[iStart] / MADynamic.Result[iStart];

double DynamicLarge = DynamicFilter >= Filter_Ratio ? DynamicSeries[iStart] : 0;

Color dynBarColor = DynamicLarge >= 2 ? ColorLargeResult : dynColorCenter;

Center.Color = dynBarColor;

if (ColoringBars && dynBarColor == ColorLargeResult)

Chart.SetBarFillColor(iStart, ColorLargeResult);

}

}

}

else

{

IEnumerable<int> allNegative = DeltaRank.Values.Where(n => n < 0);

int Negative_Delta = 0;

try { Negative_Delta = allNegative.Min(); } catch { }

Color dynColorBuy = DeltaRank[priceKey] != DeltaRank.Values.Max() ? BuyColor : BuyLargeColor;

Color dynColorSell = DeltaRank[priceKey] != Negative_Delta ? SellColor : SellLargeColor;

if (ColorOnlyLarguestInput)

{

if (DeltaRank[priceKey] == DeltaRank.Values.Max())

dynColorBuy = DeltaRank.Values.Max() > Math.Abs(Negative_Delta) ? VolumeLargeColor : BuyColor;

if (DeltaRank[priceKey] == Negative_Delta)

dynColorSell = DeltaRank.Values.Max() < Math.Abs(Negative_Delta) ? VolumeLargeColor : SellColor;

}

ChartRectangle deltaHist;

if (VolumeViewInput == VolumeViewData.Divided)

{

try

{

if (DeltaRank[priceKey] >= 0)

deltaHist = Chart.DrawRectangle($"{iStart}_{i}DynDelta", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(dynLength_Delta), upperSegment, dynColorBuy);

else

deltaHist = Chart.DrawRectangle($"{iStart}_{i}DynDelta", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-dynLength_Delta), upperSegment, dynColorSell);

}

catch

{

if (DeltaRank[priceKey] >= 0)

deltaHist = Chart.DrawRectangle($"{iStart}_{i}DynDelta", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime, upperSegment, dynColorBuy);

else

deltaHist = Chart.DrawRectangle($"{iStart}_{i}DynDelta", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime, upperSegment, dynColorSell);

}

}

else

{

try

{

if (currentTimeframe.Contains("Renko") || currentTimeframe.Contains("Range"))

{

if (DeltaRank[priceKey] >= 0)

deltaHist = Chart.DrawRectangle($"{iStart}_{i}ProfileDelta", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(dynLength_Delta), upperSegment, BuyColor);

else

deltaHist = Chart.DrawRectangle($"{iStart}_{i}ProfileDelta", Bars.OpenTimes[iStart], lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-dynLength_Delta), upperSegment, SellColor);

}

else

{

if (DeltaRank[priceKey] >= 0)

deltaHist = Chart.DrawRectangle($"{iStart}_{i}ProfileDelta", Bars.OpenTimes[iStart].AddMilliseconds(-(maxLength / 3)), lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-(maxLength / 3)).AddMilliseconds(dynLength_Delta * 2), upperSegment, BuyColor);

else

deltaHist = Chart.DrawRectangle($"{iStart}_{i}ProfileDelta", Bars.OpenTimes[iStart].AddMilliseconds(-(maxLength / 3)), lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-(maxLength / 3)).AddMilliseconds(-dynLength_Delta * 2), upperSegment, SellColor);

}

}

catch

{

deltaHist = Chart.DrawRectangle($"{iStart}_{i}ProfileDelta", Bars.OpenTimes[iStart].AddMilliseconds(-(maxLength / 3)), lowerSegment, Bars[iStart].OpenTime.AddMilliseconds(-(maxLength / 3)), upperSegment, RtnbFixedColor);

}

}

if (FillHist)

deltaHist.IsFilled = true;

if (ShowNumbers)

{

ChartText nbText;

if (DeltaRank[priceKey] > 0)

{

nbText = Chart.DrawText($"{iStart}_{i}DynNumberDelta", $"{DeltaRank[priceKey]}", Bars.OpenTimes[iStart], priceKey, RtnbFixedColor);

if (VolumeViewInput == VolumeViewData.Divided)

nbText.HorizontalAlignment = HorizontalAlignment.Right;

else

nbText.HorizontalAlignment = HorizontalAlignment.Center;

nbText.FontSize = FontSizeNumbers;

}

else if (DeltaRank[priceKey] < 0)

{

nbText = Chart.DrawText($"{iStart}_{i}DynNumberDelta", $"{DeltaRank[priceKey]}", Bars.OpenTimes[iStart], priceKey, RtnbFixedColor);

if (VolumeViewInput == VolumeViewData.Divided)

nbText.HorizontalAlignment = HorizontalAlignment.Left;

else

nbText.HorizontalAlignment = HorizontalAlignment.Center;

nbText.FontSize = FontSizeNumbers;

}

else

{

nbText = Chart.DrawText($"{iStart}_{i}DynNumberDelta", $"{DeltaRank[priceKey]}", Bars.OpenTimes[iStart], priceKey, RtnbFixedColor);

nbText.HorizontalAlignment = HorizontalAlignment.Center;

nbText.FontSize = FontSizeNumbers;

}

}

// ======= Results =======

if (ShowResults)

{

var selected = ResultsTypeInput;

Color dynColorLeft = ResultsColoringInput == ResultsColoringData.Fixed ? RtnbFixedColor : SellColor;

Color dynColorRight = ResultsColoringInput == ResultsColoringData.Fixed ? RtnbFixedColor : BuyColor;

Color compareSumD = DeltaRank.Values.Sum() > 0 ? BuyColor : DeltaRank.Values.Sum() < 0 ? SellColor : SellLargeColor;

Color dynColorCenter = ResultsColoringInput == ResultsColoringData.Fixed ? SellLargeColor : compareSumD;

if (ShowSideTotalInput)

{

int deltaBuy = DeltaRank.Values.Where(n => n > 0).Sum();

int deltaSell = DeltaRank.Values.Where(n => n < 0).Sum();

int percentBuy = 0;

int percentSell = 0;

try { percentBuy = (deltaBuy * 100) / (deltaBuy + Math.Abs(deltaSell)); } catch { };

try { percentSell = (deltaSell * 100) / (deltaBuy + Math.Abs(deltaSell)); } catch { }

string dynStrBuy = selected == ResultsType_Data.Percentage ? $"\n{percentBuy}%" : selected == ResultsType_Data.Value ? $"\n{deltaBuy}" : $"\n{percentBuy}%\n({deltaBuy})";

string dynStrSell = selected == ResultsType_Data.Percentage ? $"\n{percentSell}%" : selected == ResultsType_Data.Value ? $"\n{deltaSell}" : $"\n{percentSell}%\n({deltaSell})";

ChartText Left, Right;

Left = Chart.DrawText($"{iStart}SumDeltaSell", $"{dynStrSell}", Bars.OpenTimes[iStart], lowest, dynColorLeft);

Right = Chart.DrawText($"{iStart}SumDeltaBuy", $"{dynStrBuy}", Bars.OpenTimes[iStart], lowest, dynColorRight);

Left.HorizontalAlignment = HorizontalAlignment.Left;

Left.FontSize = FontSizeResults;

Right.HorizontalAlignment = HorizontalAlignment.Right;

Right.FontSize = FontSizeResults;

}

ChartText Center;

string dynSpaceSum = (selected == ResultsType_Data.Percentage || selected == ResultsType_Data.Value) ? $"\n\n" : $"\n\n\n";

Center = Chart.DrawText($"{iStart}SumDeltaCenter", $"{dynSpaceSum}{DeltaRank.Values.Sum()}", Bars.OpenTimes[iStart], lowest, dynColorCenter);

Center.HorizontalAlignment = HorizontalAlignment.Center;

Center.FontSize = FontSizeResults;

if (!CumulDeltaRank.ContainsKey(iStart))

CumulDeltaRank.Add(iStart, DeltaRank.Values.Sum());

else

CumulDeltaRank[iStart] = DeltaRank.Values.Sum();

int CumulDelta = CumulDeltaRank.Keys.Count <= 1 ? CumulDeltaRank[iStart] : (CumulDeltaRank[iStart] + CumulDeltaRank[iStart - 1]);

int prevCumulDelta = CumulDeltaRank.Keys.Count <= 2 ? CumulDeltaRank[iStart] : (CumulDeltaRank[iStart - 1] + CumulDeltaRank[iStart - 2]);

Color compareCD = CumulDelta > prevCumulDelta ? BuyColor : CumulDelta < prevCumulDelta ? SellColor : SellLargeColor;

Color dynColorCD = ResultsColoringInput == ResultsColoringData.Fixed ? SellLargeColor : compareCD;

ChartText CD = Chart.DrawText($"{iStart}CD", $"\n{CumulDelta}\n", Bars.OpenTimes[iStart], highest, dynColorCD);

CD.HorizontalAlignment = HorizontalAlignment.Center;

CD.VerticalAlignment = VerticalAlignment.Top;

CD.FontSize = FontSizeResults;

if (EnableFilter)

{

CumulDeltaSeries[iStart] = Math.Abs(CumulDeltaRank[iStart]);

DynamicSeries[iStart] = Math.Abs(DeltaRank.Values.Sum());

// ====== Dynamic Series Filter ======

double DynamicFilter = DynamicSeries[iStart] / MADynamic.Result[iStart];

double DynamicLarge = DynamicFilter >= Filter_Ratio ? DynamicSeries[iStart] : 0;

Color dynBarColor = DynamicLarge >= 2 ? ColorLargeResult : dynColorCenter;

Center.Color = dynBarColor;

if (ColoringBars && dynBarColor == ColorLargeResult)

Chart.SetBarFillColor(iStart, ColorLargeResult);

if (ColoringCD)

{

// ====== Cumul Delta Filter ======

double CumulDeltaFilter = CumulDeltaSeries[iStart] / MACumulDelta.Result[iStart];

double CumulDeltaLarge = CumulDeltaFilter > Filter_Ratio ? CumulDeltaSeries[iStart] : 0;

Color dynCDColor = CumulDeltaLarge > 2 ? ColorLargeResult : dynColorCD;

CD.Color = dynCDColor;

}

}

}

}

loopPrevSegment = Segments[i];

}

}

// ====== Functions Area ======

private void VP_Tick(int index)

{

DateTime startTime = Bars.OpenTimes[index];

DateTime endTime = Bars.OpenTimes[index + 1];

if (IsLastBar)

endTime = TicksOHLC.Last().OpenTime;

double prevTick = 0;

for (int tickIndex = 0; tickIndex < TicksOHLC.Count; tickIndex++)

{

Bar tickBar;

tickBar = TicksOHLC[tickIndex];

if (tickBar.OpenTime < startTime || tickBar.OpenTime > endTime)

{

if (tickBar.OpenTime > endTime)

break;

else

continue;

}

RankVolume(tickBar.Close);

prevTick = tickBar.Close;

}

// ========= ========== ==========

void RankVolume(double tickPrice)

{

double prevSegmentValue = 0.0;

for (int i = 0; i < Segments.Count; i++)

{

if (prevSegmentValue != 0 && tickPrice >= prevSegmentValue && tickPrice <= Segments[i])

{

double priceKey = Segments[i];

if (VolumesRank.ContainsKey(priceKey))

{

VolumesRank[priceKey] += 1;

if (tickPrice > prevTick && prevTick != 0)

VolumesRank_Up[priceKey] += 1;

else if (tickPrice < prevTick && prevTick != 0)

VolumesRank_Down[priceKey] += 1;

else if (tickPrice == prevTick && prevTick != 0)

{

VolumesRank_Up[priceKey] += 1;

VolumesRank_Down[priceKey] += 1;

}

DeltaRank[priceKey] += (VolumesRank_Up[priceKey] - VolumesRank_Down[priceKey]);

}

else

{

VolumesRank.Add(priceKey, 1);

if (!VolumesRank_Up.ContainsKey(priceKey))

VolumesRank_Up.Add(priceKey, 1);

else

VolumesRank_Up[priceKey] += 1;

if (!VolumesRank_Down.ContainsKey(priceKey))

VolumesRank_Down.Add(priceKey, 1);

else

VolumesRank_Down[priceKey] += 1;

if (!DeltaRank.ContainsKey(priceKey))

DeltaRank.Add(priceKey, (VolumesRank_Up[priceKey] - VolumesRank_Down[priceKey]));

else

DeltaRank[priceKey] += (VolumesRank_Up[priceKey] - VolumesRank_Down[priceKey]);

}

break;

}

prevSegmentValue = Segments[i];

}

}

}

private double GetWicks(DateTime startTime, DateTime endTime, bool isBullish)

{

double min = Int32.MaxValue;

double max = 0;

if (IsLastBar)

endTime = TicksOHLC.Last().OpenTime;

for (int tickIndex = 0; tickIndex < TicksOHLC.Count; tickIndex++)

{

Bar tickBar = TicksOHLC[tickIndex];

if (tickBar.OpenTime < startTime || tickBar.OpenTime > endTime)

{

if (tickBar.OpenTime > endTime)

break;

else

continue;

}

if (isBullish && tickBar.Close < min)

min = tickBar.Close;

else if (!isBullish && tickBar.Close > max)

max = tickBar.Close;

}

return isBullish ? min : max;

}

private void DrawOnScreen(string msg)

{

Chart.DrawStaticText("txt", $"{msg}", VerticalAlignment.Top, HorizontalAlignment.Center, Color.LightBlue);

}

private void Second_DrawOnScreen(string msg)

{

Chart.DrawStaticText("txt2", $"{msg}", VerticalAlignment.Top, HorizontalAlignment.Left, Color.LightBlue);

}

private void SetNewBar(BarOpenedEventArgs obj)

{

isNewBar = true;

}

// ************************** VOLUME RENKO/RANGE **************************

/*

Original source code by srlcarlg (me) (https://ctrader.com/algos/indicators/show/3045)

Uses Ticks Data to make the calculation of volume, just like Candles.

*/

private void VolumeInitialize()

{

if (LoadFromInput == LoadFromData.Custom)

{

// ==== Get datetime to load from: dd/mm/yyyy ====

if (DateTime.TryParseExact(StringDate, "dd/mm/yyyy", new CultureInfo("en-US"), DateTimeStyles.None, out fromDateTime))

{

if (fromDateTime > Server.Time.Date)

{

// for Log

fromDateTime = Server.Time.Date;

Print($"Invalid DateTime '{StringDate}'. Using '{fromDateTime}'");

}

}

else

{

// for Log

fromDateTime = Server.Time.Date;

Print($"Invalid DateTime '{StringDate}'. Using '{fromDateTime}'");

}

}

else

{

DateTime LastBarTime = Bars.LastBar.OpenTime.Date;

if (LoadFromInput == LoadFromData.Today)

fromDateTime = LastBarTime.Date;

else if (LoadFromInput == LoadFromData.Yesterday)

fromDateTime = LastBarTime.AddDays(-1);

else if (LoadFromInput == LoadFromData.One_Week)

fromDateTime = LastBarTime.AddDays(-5);

else if (LoadFromInput == LoadFromData.Two_Week)

fromDateTime = LastBarTime.AddDays(-10);

else if (LoadFromInput == LoadFromData.Monthly)

fromDateTime = LastBarTime.AddMonths(-1);

}

// ==== Check if existing ticks data on the chart really needs more data ====

DateTime FirstTickTime = TicksOHLC.OpenTimes.FirstOrDefault();

if (FirstTickTime >= fromDateTime)

{

LoadMoreTicks(fromDateTime);

DrawOnScreen("Data Collection Finished \n Calculating...");

}

else

{

Print($"Using existing tick data from '{FirstTickTime}'");

DrawOnScreen($"Using existing tick data from '{FirstTickTime}' \n Calculating...");

}

}

private void LoadMoreTicks(DateTime fromDateTime)

{

bool msg = false;

while (TicksOHLC.OpenTimes.FirstOrDefault() > fromDateTime)

{

if (!msg)

{

Print($"Loading from '{TicksOHLC.OpenTimes.First()}' to '{fromDateTime}'...");

msg = true;

}

int loadedCount = TicksOHLC.LoadMoreHistory();

Print("Loaded {0} Ticks, Current Tick Date: {1}", loadedCount, TicksOHLC.OpenTimes.FirstOrDefault());

if (loadedCount == 0)

break;

}

Print("Data Collection Finished, First Tick from: {0}", TicksOHLC.OpenTimes.FirstOrDefault());

}

public void ClearAndRecalculate()

{

Chart.RemoveAllObjects();

Chart.ResetBarColors();

int index;

if (Lookback != -1 && Lookback > 0)

index = Bars.OpenTimes.GetIndexByTime(Server.Time)-Lookback;

else

index = Bars.OpenTimes.GetIndexByTime(TicksOHLC.OpenTimes.FirstOrDefault());

// Historical data

// index++ every crash to avoid DELTA VOLUME Crash (the given X key is not in dictionary) when re-calculating

for (int i = index; i < Bars.Count; i++)

{

try {

CreateOrderflow(i);

} catch {

index++;

}

}

void CreateOrderflow(int i) {

Segments.Clear();

VolumesRank.Clear();

VolumesRank_Up.Clear();

VolumesRank_Down.Clear();

DeltaRank.Clear();

OrderFlow(i);

}

}

public void SetRowHeight(double number) {

rowHeight = number;

}

public void SetLookback(int number) {

Lookback = number;

}

public double GetRowHeight() {

return rowHeight;

}

public double GetLookback() {

return Lookback;

}

}

public class ParamsPanel : CustomControl

{

// Any

private const string ProfileOrDivided_Inputkey = "ProfileOrDividedKey";

private const string BarsToShow_InputKey = "BarsToShowKey";

private const string RowHeight_InputKey = "RowHeightKey";

private const string ResultType_InputKey = "ResultTypeKey";

// Delta

private const string onlyLargestDivided_InputKey = "onlyLargestDividedKey";

// Buy vs Sell

private const string Operator_InputKey = "OperatorKey";

private readonly IDictionary<string, TextBox> textInputMap = new Dictionary<string, TextBox>();

private readonly IDictionary<string, CheckBox> checkBoxMap = new Dictionary<string, CheckBox>();

private readonly IDictionary<string, ComboBox> comboBoxMap = new Dictionary<string, ComboBox>();

private readonly OrderFlowTicksV20 Outside;

private Button ModeBtn;

private readonly Color BtnColor;

private readonly IndicatorParams FirstParams;

private Panel ResultTypePanel;

private Panel VolumeViewPanel;

private Panel OperatorPanel;

private ControlBase OnlyLarguestPanel;

private ControlBase EmptyDeltaPanel;

private ControlBase EmptyBuySellPanel;

public ParamsPanel(OrderFlowTicksV20 indicator, IndicatorParams defaultParams)

{

BtnColor = Color.FromHex("#7F808080");

Outside = indicator;

FirstParams = defaultParams;

AddChild(CreateTradingPanel());

}

private ControlBase CreateTradingPanel()

{

StackPanel mainPanel = new();

ControlBase header = CreateHeader();

mainPanel.AddChild(header);

StackPanel contentPanel = CreateContentPanel();

mainPanel.AddChild(contentPanel);

return mainPanel;

}

private static ControlBase CreateHeader()

{

Border headerBorder = new()

{

BorderThickness = "0 0 0 1",

Style = Styles.CreateCommonBorderStyle(),

HorizontalAlignment = HorizontalAlignment.Center,

Width = 280

};

Grid grid = new(0, 0);

TextBlock header = new()

{

Text = "Order Flow Ticks",

Margin = "10 7",

Style = Styles.CreateHeaderStyle(),

HorizontalAlignment = HorizontalAlignment.Center,

};

grid.AddChild(header, 0, 0);

headerBorder.Child = grid;

return headerBorder;

}

private StackPanel CreateContentPanel()

{

StackPanel contentPanel = new()

{

Margin = 10

};

Grid grid = new(3, 5);

grid.Columns[1].SetWidthInPixels(5);

grid.Columns[3].SetWidthInPixels(5);

Button button_prev = CreatePassButton("<");

grid.AddChild(button_prev, 0, 0);

Button VolumeModeButton = CreateModeInfo_Button(FirstParams.VolMode.ToString());

grid.AddChild(VolumeModeButton, 0, 1, 1, 3);

Button button_next = CreatePassButton(">");

grid.AddChild(button_next, 0, 4);

var BarsToShow_Input = CreateInputWithLabel("Nº Bars", FirstParams.NBars.ToString(), BarsToShow_InputKey);

grid.AddChild(BarsToShow_Input, 1, 0);

var RowHeightInput = CreateInputWithLabel("Row Height", FirstParams.RowHeight.ToString("0.############################"), RowHeight_InputKey);

grid.AddChild(RowHeightInput, 1, 2);

ResultTypePanel = CreateComboBoxWithLabel("Result Type", ResultType_InputKey);

VolumeViewPanel = CreateComboBoxWithLabel("Volume View", ProfileOrDivided_Inputkey);

OnlyLarguestPanel = CreateCheckboxWithLabel("Only Larguest?", FirstParams.OnlyLargestDivided, onlyLargestDivided_InputKey);

OnlyLarguestPanel.IsVisible = false;

OperatorPanel = CreateComboBoxWithLabel("Operator", Operator_InputKey);

OperatorPanel.IsVisible = false;

EmptyDeltaPanel = CreateEmptyFill();

EmptyBuySellPanel = CreateEmptyFill();

EmptyBuySellPanel.IsVisible = false;

grid.AddChild(VolumeViewPanel, 1, 4);

grid.AddChild(ResultTypePanel, 2, 0);

grid.AddChild(OnlyLarguestPanel, 2, 2, 2, 4);

grid.AddChild(EmptyDeltaPanel, 2, 2, 2, 4);

grid.AddChild(EmptyBuySellPanel, 2, 2);

grid.AddChild(OperatorPanel, 2, 4);

contentPanel.AddChild(grid);

return contentPanel;

}

private Button CreatePassButton(string label)

{

Button button = new()

{

Text = label,

Padding = 0,

Width = 30,

Height = 20,

Margin = 0,

BackgroundColor = BtnColor,

HorizontalAlignment = HorizontalAlignment.Center,

};

if (label == ">")

{

button.Click += NextModeEvent;

}

else

{

button.Click += PrevModeEvent;

}

return button;

}

private Button CreateModeInfo_Button(string label)

{

Button button = new()

{

Text = label,

Padding = 0,

Width = 70,

Height = 30,

Margin = 4,

HorizontalAlignment = HorizontalAlignment.Center,

};

button.Click += ResetParamsEvent;

ModeBtn = button;

return button;

}

private Panel CreateInputWithLabel(string label, string defaultValue, string inputKey)

{

StackPanel stackPanel = new()

{

Orientation = Orientation.Vertical,

Margin = "0 10 0 0"

};

TextBlock textBlock = new()

{

Text = label,

TextAlignment = TextAlignment.Center

};

TextBox input = new()

{

Margin = "0 5 0 0",

Text = defaultValue,

Style = Styles.CreateInputStyle(),

TextAlignment = TextAlignment.Center

};

input.TextChanged += TextChangedEvent;

textInputMap.Add(inputKey, input);

stackPanel.AddChild(textBlock);

stackPanel.AddChild(input);

return stackPanel;

}

private Panel CreateComboBoxWithLabel(string label, string inputKey)

{

StackPanel stackPanel = new()

{

Orientation = Orientation.Vertical,

Margin = "0 10 0 0"

};

TextBlock textBlock = new()

{

Text = label,

TextAlignment = TextAlignment.Center

};

ComboBox comboBox = new()

{

Margin = "0 5 0 0",

Style = Styles.CreateInputStyle(),

};

if (inputKey.Equals("ResultTypeKey")) {

string[] enumNames = Enum.GetNames(typeof(ResultsType_Data));

foreach (var item in enumNames) {

comboBox.AddItem(item);

}

comboBox.SelectedItem = FirstParams.ResultType.ToString();

} else if (inputKey.Equals("ProfileOrDividedKey")) {

string[] enumNames = Enum.GetNames(typeof(VolumeViewData));

foreach (var item in enumNames) {

comboBox.AddItem(item);

}

comboBox.SelectedItem = FirstParams.VolView.ToString();

} else {

string[] enumNames = Enum.GetNames(typeof(OperatorBuySell_Data));

foreach (var item in enumNames) {

comboBox.AddItem(item);

}

comboBox.SelectedItem = FirstParams.OperatorBuySell.ToString();

}

comboBox.SelectedItemChanged += ComboBoxSelectedEvent;

comboBoxMap.Add(inputKey, comboBox);

stackPanel.AddChild(textBlock);

stackPanel.AddChild(comboBox);

return stackPanel;

}

private ControlBase CreateCheckboxWithLabel(string label, bool defaultValue, string inputKey)

{

Border checkBoxBorder = new()

{

Margin = "0 10 0 0",

BorderThickness = "0 1 0 1",

Style = Styles.CreateCommonBorderStyle()

};

StackPanel stackPanel = new()

{

Orientation = Orientation.Horizontal,

Margin = "0 10 0 10"

};

CheckBox input = new()

{

Margin = "0 0 5 0",

IsChecked = defaultValue

};

TextBlock textBlock = new()

{

Text = label,

};

input.Click += CheckBoxClickEvent;

checkBoxMap.Add(inputKey, input);

stackPanel.AddChild(input);

stackPanel.AddChild(textBlock);

checkBoxBorder.Child = stackPanel;

return checkBoxBorder;

}

private static ControlBase CreateEmptyFill()

{

Border borde

srlcarlg

Joined on 25.07.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Order Flow Ticks v2.0.algo

- Rating: 4.82

- Installs: 363

- Modified: 13/12/2024 00:56

Comments

Asante sana!

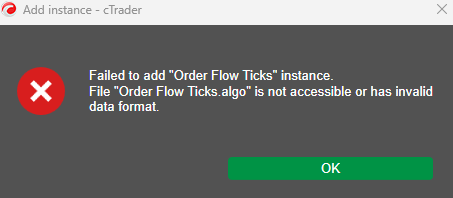

hi, I'm trying to download the indicator but it gives me an error regarding MAC, what can I do?

Tudo que eu precisava para começar meus estudos nesta modalidade. Obrigado!

Hi, This is a great indicator, what time frame is recommended, I scalp on Renko on 3pip block size

thats 3 point block size, and I trade the DAX/GER40 & HK50

Thank you.

Is the code available?

rrrg

Hi,

I've down loaded the algo successfully, however when I look at the Candle it's very small and I am unbale to read the numbersI cannot get this indicator to work on the latest version of cTrader 4.8.30

@srlcarlg many thanks for this remarkable indicator. Grateful if you can respond, it seems that you put buying side on left & sell on right, usually on foot print buying always right & sell left. Any advise why did you do that ?

Excellent Update, thanks so much!

can you do somthing to give signal for robot

Please ignore my below comment as I was referring to timed based chart.

lease update the script as the histogram is not showing the newly “completed” formed candle anymore on the delta chart.

Please update the script as the histogram is not showing the newly “completed” formed candle anymore.

Is there a video I can use to help me understand this Algo ?

Great indicator, thanks boss great work!

Hi there :) First off I'd like to thank you for this amazing indicator, and for making it free! It's incredibly useful and I'm learning a lot from studying the code too, so thanks again for making it visible :D I have one question though: I'm quite the noob when it comes to coding but I'm trying to code something of my own based on various order flow values such as the two percentages beneath each bar as well as the largest buy/sell numbers. Where should I look to find these values if you don't mind me asking?

Order Flow Ticks is an exceptional trading tool that has greatly enhanced my trading experience. Its accurate and real-time data feed, combined with intuitive visualizations, has provided invaluable insights into market dynamics. With its user-friendly interface and comprehensive analysis, the AI video generator feature has been a game-changer, allowing me to create dynamic and engaging videos to share my trading strategies and analysis. I've been able to make more informed trading decisions, resulting in improved profitability. The support team is also highly responsive and helpful. Order Flow Ticks is truly a game-changer for traders seeking an edge in the market.

dsssd

Great job! Please let it be able to turn off the Buy(Total) and Sell(Total) as needed. Thanks.

Is there any chance of having the Cumulative Delta plotted on the chart. I assume it would need to be in a separate window below the chart like the MACD,

To buy many things related to fashion, sport, food, etc please go to the United States B2B Marketplace and order your requirement.

Please visit the Vietnam B2B Marketplace and place your order if you want to purchase a variety of items relating to fashion, sport, food, etc.

Is it possible to set it by sessions?

and any option to have it o the right side of the chart to show the value for all the area shown on the chart?

Does anyone have an automated cBot regarding this indicator?

Fantastic indicator and job mate. Well done.

I very much liked this tool !works great in combination with supply-demand price action methods

suggestion :user should have an option to choose between sum or subtraction in buy-sell mode

Yes, these tricks can help a person trade easily and also earn a good amount of money but there are many classes that guide traders so you can tell someone to take my online class and guide all the process of it.

Hi,

Is it possible that you can update this script so it will work with cTrader Ver. 5+

Thank you