Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

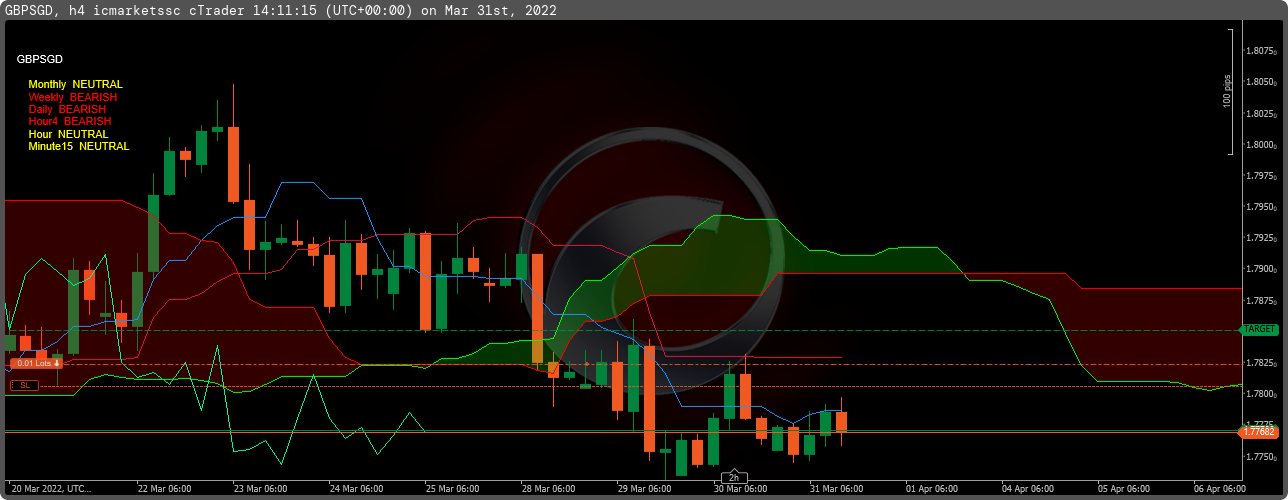

OrglobalFx Ichimoku Multitimeframe Display

Works on Renko Chart

/*

OrglobalFx Ichimoku MultitimeFrame Indicator with Color.

Contact:

Telegram: @orglobalng

For customizations.

E.g Telegram Alerts etc

*/

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

using System.Net;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.EasternStandardTime, AccessRights = AccessRights.None)]

public class _OFX_IND_111320210350_ICHI_MTF : Indicator

{

//Timeframe Selection Parameter

[Parameter("Timeframe1", DefaultValue = "Monthly", Group = "TimeFrame")]

public TimeFrame Time_frame1 { get; set; }

[Parameter("Timeframe2", DefaultValue = "Weekly", Group = "TimeFrame")]

public TimeFrame Time_frame2 { get; set; }

[Parameter("Timeframe3", DefaultValue = "Daily", Group = "TimeFrame")]

public TimeFrame Time_frame3 { get; set; }

[Parameter("Timeframe4", DefaultValue = "Hour4", Group = "TimeFrame")]

public TimeFrame Time_frame4 { get; set; }

[Parameter("Timeframe5", DefaultValue = "Hourly", Group = "TimeFrame")]

public TimeFrame Time_frame5 { get; set; }

[Parameter("Timeframe6", DefaultValue = "Minute15", Group = "TimeFrame")]

public TimeFrame Time_frame6 { get; set; }

//Declarations

public IchimokuKinkoHyo _ichi;

public string lbal;

protected override void Initialize()

{

//Displays the Symbol name on the chart

Chart.DrawStaticText("symbol_label", SymbolName.ToString(), VerticalAlignment.Top, HorizontalAlignment.Left, Color.White);

}

public override void Calculate(int index)

{

//Logic functions Usecase

logicfunction(Time_frame1);

mycolor("a", "\n\n");

logicfunction(Time_frame2);

mycolor("b", "\n\n\n");

logicfunction(Time_frame3);

mycolor("c", "\n\n\n\n");

logicfunction(Time_frame4);

mycolor("d", "\n\n\n\n\n");

logicfunction(Time_frame5);

mycolor("e", "\n\n\n\n\n\n");

logicfunction(Time_frame6);

mycolor("f", "\n\n\n\n\n\n\n");

}

//Bars function

public Bars seriestf(TimeFrame _tf)

{

return MarketData.GetBars(_tf);

}

//The Logic Function

public void logicfunction(TimeFrame _tf)

{

//SSL Initialization

_ichi = Indicators.IchimokuKinkoHyo(seriestf(_tf), 9, 26, 52);

//ichimoku

var kijun = _ichi.KijunSen;

var tensen = _ichi.TenkanSen;

var chiku = _ichi.ChikouSpan;

var sekuA = _ichi.SenkouSpanA;

var sekuB = _ichi.SenkouSpanB;

//Kumo cloud

var cloudupper = Math.Max(sekuA.Last(26), sekuB.Last(26));

var cloudlower = Math.Min(sekuA.Last(26), sekuB.Last(26));

var price = seriestf(_tf).ClosePrices;

var longpricekumo = price.Last(0) > cloudupper && sekuA.Last(0) > sekuB.Last(0);

var shortpricekumo = price.Last(0) < cloudlower && sekuA.Last(0) < sekuB.Last(0);

//Tensen above Kijun or otherwise

var longtensenkijun = tensen.Last(0) > kijun.Last(0);

var shorttensenkijun = tensen.Last(0) < kijun.Last(0);

//Chiku spann above /below price 26 bars behind

var longchikuprice = chiku.Last(1) > seriestf(_tf).HighPrices.Last(26);

var shortchikuprice = chiku.Last(1) < seriestf(_tf).LowPrices.Last(26);

//Checks if the the kumo has flipped

var longkumoflip = sekuA.Last(0) > sekuB.Last(0);

var shortkumoflip = sekuA.Last(0) < sekuB.Last(0);

//Checks if price has crossed above/below the tensen provided that the tensen is above the kijun or otherwise

var shortpricetensen = price.Last(0) < tensen.Last(0) && tensen.Last(0) < kijun.Last(0);

var longpricetensen = price.Last(0) > tensen.Last(0) && tensen.Last(0) > kijun.Last(0);

//Checks if price has crossed above/below the kijun

var longpricekijun = price.Last(0) > kijun.Last(0);

var shortpricekijun = price.Last(0) < kijun.Last(0);

//Checks if kijun is greater or less than cloud

var longkijuncloud = kijun.Last(0) > cloudupper;

var shortkijuncloud = kijun.Last(0) < cloudlower;

//Conditions for bullish

// Current Upper ssl is greater/above current lower ssl. And the current bar on the timeframe is greater than the ssl lines

if (longpricekumo && longchikuprice && longtensenkijun && longkumoflip && longkijuncloud)

{

lbal = " " + _tf.ToString() + " BULLISH";

}

//Bear Condition. Inverse of Bullish

if (shortpricekumo && shortchikuprice && shorttensenkijun && shortkumoflip && shortkijuncloud)

{

lbal = " " + _tf.ToString() + " BEARISH";

}

//

else

{

lbal = " " + _tf.ToString() + " NEUTRAL";

}

}

//Function to change the color depending on the signal

public void mycolor(string tlabell, string llbl)

{

if (lbal.Contains("BULL"))

{

Chart.DrawStaticText(tlabell, llbl + lbal, VerticalAlignment.Top, HorizontalAlignment.Left, Color.Green);

}

else if (lbal.Contains("BEAR"))

{

Chart.DrawStaticText(tlabell, llbl + lbal, VerticalAlignment.Top, HorizontalAlignment.Left, Color.Red);

}

else if (lbal.Contains("NEU"))

{

Chart.DrawStaticText(tlabell, llbl + lbal, VerticalAlignment.Top, HorizontalAlignment.Left, Color.Yellow);

}

}

}

}

Orglobalfx01

Joined on 03.03.2021

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: _OFX_IND_111320210350_ICHI_MTF.algo

- Rating: 0

- Installs: 1252

- Modified: 31/03/2022 14:21

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.