Description

TTM Squeeze is a volatility and momentum indicator introduced by John Carter of Trade the Markets (now Simpler Trading), which capitalizes on the tendency for price to break out strongly after consolidating in a tight trading range.

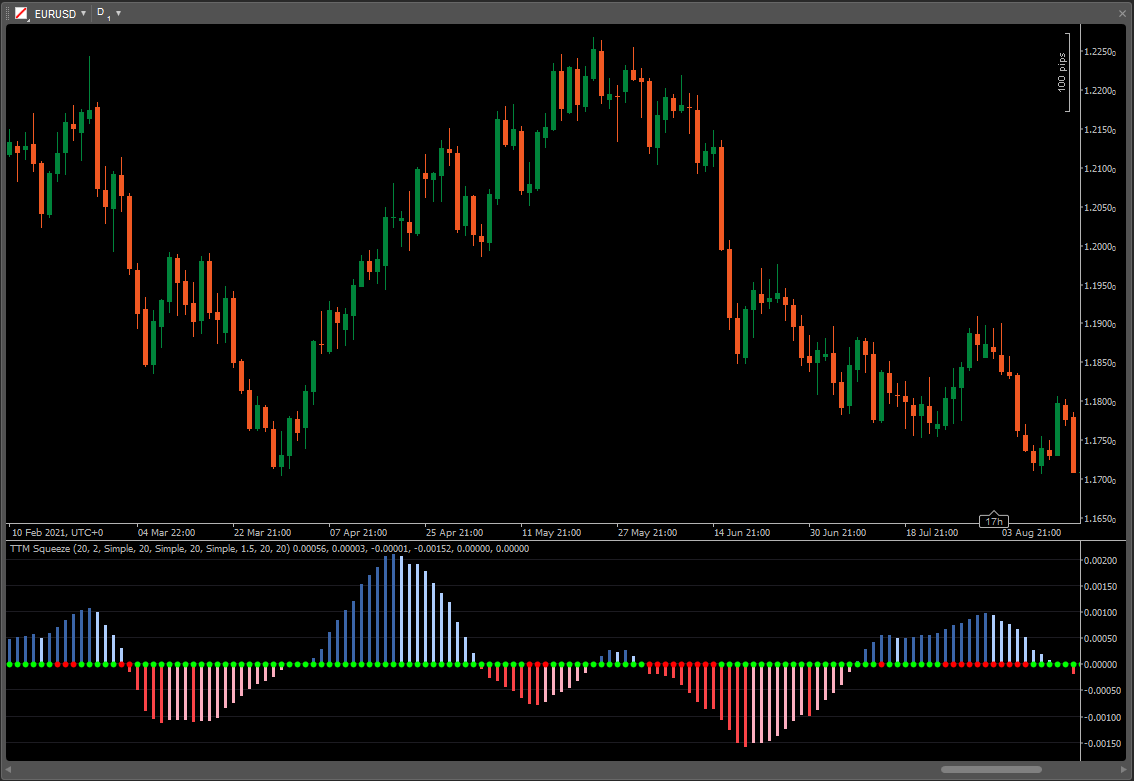

The volatility component of the TTM Squeeze indicator measures price compression using Bollinger Bands and Keltner Channels. If the Bollinger Bands are completely enclosed within the Keltner Channels, that indicates a period of very low volatility. This state is known as the squeeze. When the Bollinger Bands expand and move back outside of the Keltner Channel, the squeeze is said to have “fired”: volatility increases and prices are likely to break out of that tight trading range in one direction or the other. The on/off state of the squeeze is shown with small dots on the zero line of the indicator: red dots indicate the squeeze is on, and green dots indicate the squeeze is off.

The TTM Squeeze indicator also uses a momentum oscillator to show the expected direction of the move when the squeeze fires. This histogram oscillates around the zero line; increasing momentum above the zero line indicates an opportunity to purchase long, while momentum falling below the zero line can indicate a shorting opportunity.

Github: GitHub - Doustzadeh/cTrader-Indicator

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class TTMSqueeze : Indicator

{

[Parameter("Periods", Group = "BollingerBands", DefaultValue = 20)]

public int BollingerPeriod { get; set; }

[Parameter("Standard Dev", Group = "BollingerBands", DefaultValue = 2, MinValue = 0)]

public double StDeviation { get; set; }

[Parameter("MA Type", Group = "BollingerBands", DefaultValue = MovingAverageType.Simple)]

public MovingAverageType BollingerMaType { get; set; }

[Parameter("MA Periods", Group = "KeltnerChannels", DefaultValue = 20)]

public int KeltnerPeriod { get; set; }

[Parameter("MA Type", Group = "KeltnerChannels", DefaultValue = MovingAverageType.Simple)]

public MovingAverageType KeltnerMaType { get; set; }

[Parameter("ATR Periods", Group = "KeltnerChannels", DefaultValue = 20)]

public int AtrPeriods { get; set; }

[Parameter("ATR MA Type", Group = "KeltnerChannels", DefaultValue = MovingAverageType.Simple)]

public MovingAverageType AtrMaType { get; set; }

[Parameter("Band Distance", Group = "KeltnerChannels", DefaultValue = 1.5, MinValue = 0)]

public double BandDistance { get; set; }

[Parameter("SMA Periods", DefaultValue = 20)]

public int SmaPeriods { get; set; }

[Parameter("LRS Periods", DefaultValue = 20)]

public int LrsPeriods { get; set; }

[Output("Up Rising", LineColor = "#FF3B65A8", PlotType = PlotType.Histogram, Thickness = 3)]

public IndicatorDataSeries UpRising { get; set; }

[Output("Up Falling", LineColor = "#FFADCDFD", PlotType = PlotType.Histogram, Thickness = 3)]

public IndicatorDataSeries UpFalling { get; set; }

[Output("Down Rising", LineColor = "#FFFBAEBF", PlotType = PlotType.Histogram, Thickness = 3)]

public IndicatorDataSeries DownRising { get; set; }

[Output("Down Falling", LineColor = "#FFFA4347", PlotType = PlotType.Histogram, Thickness = 3)]

public IndicatorDataSeries DownFalling { get; set; }

[Output("Squeeze On", LineColor = "Red", PlotType = PlotType.Points, Thickness = 5)]

public IndicatorDataSeries SqueezeOn { get; set; }

[Output("Squeeze Off", LineColor = "Lime", PlotType = PlotType.Points, Thickness = 5)]

public IndicatorDataSeries SqueezeOff { get; set; }

private IndicatorDataSeries Midline, Delta;

private BollingerBands BbInd;

private KeltnerChannels KcInd;

private double KeltnerUp, KeltnerDown, BollingerUp, BollingerDown;

private SimpleMovingAverage SMA;

private LinearRegressionSlope LRS;

protected override void Initialize()

{

Midline = CreateDataSeries();

Delta = CreateDataSeries();

BbInd = Indicators.BollingerBands(Bars.ClosePrices, BollingerPeriod, StDeviation, BollingerMaType);

KcInd = Indicators.KeltnerChannels(KeltnerPeriod, KeltnerMaType, AtrPeriods, AtrMaType, BandDistance);

SMA = Indicators.SimpleMovingAverage(Bars.ClosePrices, SmaPeriods);

LRS = Indicators.LinearRegressionSlope(Delta, LrsPeriods);

}

public override void Calculate(int index)

{

BollingerUp = BbInd.Top[index];

BollingerDown = BbInd.Bottom[index];

KeltnerUp = KcInd.Top[index];

KeltnerDown = KcInd.Bottom[index];

if (BollingerUp < KeltnerUp && BollingerDown > KeltnerDown)

{

SqueezeOn[index] = 0;

}

else

{

SqueezeOff[index] = 0;

}

Midline[index] = (Bars.HighPrices.Maximum(20) + Bars.LowPrices.Minimum(20)) / 2;

Delta[index] = Bars.ClosePrices[index] - ((Midline[index] + SMA.Result[index]) / 2);

if (LRS.Result[index] > 0)

{

if (LRS.Result.IsRising())

{

UpRising[index] = LRS.Result[index];

}

else

{

UpFalling[index] = LRS.Result[index];

}

}

else

{

if (LRS.Result.IsRising())

{

DownRising[index] = LRS.Result[index];

}

else

{

DownFalling[index] = LRS.Result[index];

}

}

}

}

}

Doustzadeh

Joined on 20.03.2016

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: TTM Squeeze.algo

- Rating: 5

- Installs: 2222

- Modified: 07/12/2021 04:51