Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

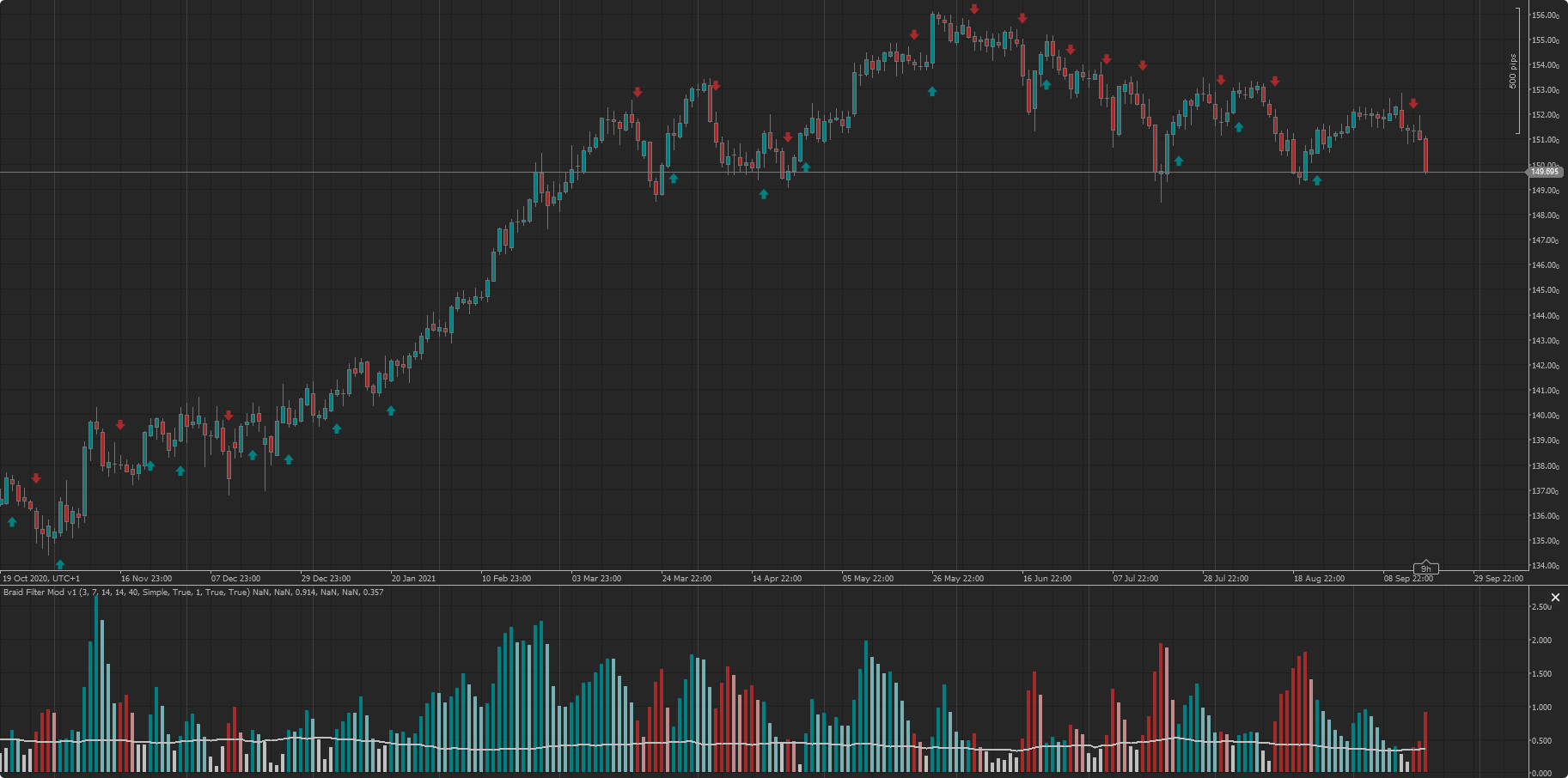

The histogram is based on the difference between the highest and lowest moving average out of the 3. The line is a level based on ATR that filters trading during sideways markets.

This indicator is a modified version of the one coded by kaneida84: https://ctrader.com/algos/indicators/show/2717

The original indicator was coded in MQL4 by Robert Hill after attending a workshop that traded the 15 minutes timeframe.

Log:

Mon Sep 20, 2021 - Fixed the Arrows Yes/No parameter.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class BraidFilterModv1 : Indicator

{

[Parameter("MA1 Period", DefaultValue = 3)]

public int ma1Per { get; set; }

[Parameter("MA2 Period", DefaultValue = 7)]

public int ma2Per { get; set; }

[Parameter("MA3 Period", DefaultValue = 14)]

public int ma3Per { get; set; }

[Parameter("ATR Period", DefaultValue = 14)]

public int atrPer { get; set; }

[Parameter("PipsMinSepPercent", DefaultValue = 40)]

public int pipPerc { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Simple)]

public MovingAverageType maType { get; set; }

[Parameter("Arrows", DefaultValue = true)]

public bool arrows { get; set; }

[Parameter("Arrow Distance", DefaultValue = 1)]

public double arrowDistance { get; set; }

[Parameter("MA Crossing Signal", DefaultValue = true)]

public bool maCrossingArrow { get; set; }

[Parameter("Filter Crossing Signal", DefaultValue = true)]

public bool filterCrossingArrow { get; set; }

[Output("Up Histogram 1", LineColor = "FF008080", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries up1 { get; set; }

[Output("Up Histogram 2", LineColor = "FF77B0B2", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries up2 { get; set; }

[Output("Down Histogram 1", LineColor = "FFA52A2A", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries down1 { get; set; }

[Output("Down Histogram 2", LineColor = "FFC4898A", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries down2 { get; set; }

[Output("Neutral Histogram", LineColor = "FFC0C0C0", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries neutral { get; set; }

[Output("Filter", LineColor = "FFC0C0C0", LineStyle = LineStyle.Solid, Thickness = 2)]

public IndicatorDataSeries filter { get; set; }

private IndicatorDataSeries max, min, dif;

private MovingAverage ma1, ma2, ma3;

private AverageTrueRange atr;

protected override void Initialize()

{

ma1 = Indicators.MovingAverage(Bars.ClosePrices, ma1Per, maType);

ma2 = Indicators.MovingAverage(Bars.OpenPrices, ma2Per, maType);

ma3 = Indicators.MovingAverage(Bars.ClosePrices, ma3Per, maType);

atr = Indicators.AverageTrueRange(atrPer * 2 - 1, MovingAverageType.Simple);

max = CreateDataSeries();

min = CreateDataSeries();

dif = CreateDataSeries();

}

public override void Calculate(int index)

{

max[index] = Math.Max(Math.Max(ma1.Result[index], ma2.Result[index]), ma3.Result[index]);

min[index] = Math.Min(Math.Min(ma1.Result[index], ma2.Result[index]), ma3.Result[index]);

dif[index] = max[index] - min[index];

filter[index] = atr.Result[index] * pipPerc / 100;

var aboveFilter = dif[index] > filter[index];

var hasCrossedFilter = aboveFilter && dif[index - 1] < filter[index - 1];

var upTrend = ma1.Result[index] > ma2.Result[index];

var downTrend = ma1.Result[index] < ma2.Result[index];

var upTrendCrossing = aboveFilter && upTrend && ma1.Result[index - 1] < ma2.Result[index - 1];

var downTrendCrossing = aboveFilter && downTrend && ma1.Result[index - 1] > ma2.Result[index - 1];

var upTrendFilterCrossing = hasCrossedFilter && upTrend;

var downTrendFilterCrossing = hasCrossedFilter && downTrend;

// Indicator

if (aboveFilter)

{

if (upTrend)

{

if (dif[index] >= dif[index - 1])

{

up1[index] = dif[index];

up2[index] = double.NaN;

down1[index] = double.NaN;

down2[index] = double.NaN;

neutral[index] = double.NaN;

}

else

{

if (ma1.Result[index - 1] < ma2.Result[index - 1])

{

up1[index] = dif[index];

up2[index] = double.NaN;

down1[index] = double.NaN;

down2[index] = double.NaN;

neutral[index] = double.NaN;

}

else

{

up2[index] = dif[index];

up1[index] = double.NaN;

down1[index] = double.NaN;

down2[index] = double.NaN;

neutral[index] = double.NaN;

}

}

}

else if (downTrend)

{

if (dif[index] >= dif[index - 1])

{

down1[index] = dif[index];

down2[index] = double.NaN;

up1[index] = double.NaN;

up2[index] = double.NaN;

neutral[index] = double.NaN;

}

else

{

if (ma1.Result[index - 1] > ma2.Result[index - 1])

{

down1[index] = dif[index];

down2[index] = double.NaN;

up1[index] = double.NaN;

up2[index] = double.NaN;

neutral[index] = double.NaN;

}

else

{

down2[index] = dif[index];

down1[index] = double.NaN;

up1[index] = double.NaN;

up2[index] = double.NaN;

neutral[index] = double.NaN;

}

}

}

}

else

{

neutral[index] = dif[index];

up1[index] = double.NaN;

up2[index] = double.NaN;

down1[index] = double.NaN;

down2[index] = double.NaN;

}

// Arrows

if (arrows)

{

if ((filterCrossingArrow && upTrendFilterCrossing) || (maCrossingArrow && upTrendCrossing))

{

Chart.DrawIcon("BraidFilterUp" + Bars.OpenTimes.Last(0).ToString(), ChartIconType.UpArrow, Bars.OpenTimes.Last(0), Bars.LowPrices.Last(0) - (arrowDistance * atr.Result.Last(1)), "Teal");

}

else

{

Chart.RemoveObject("BraidFilterUp" + Bars.OpenTimes.Last(0).ToString());

}

if ((filterCrossingArrow && downTrendFilterCrossing) || (maCrossingArrow && downTrendCrossing))

{

Chart.DrawIcon("BraidFilterDown" + Bars.OpenTimes.Last(0).ToString(), ChartIconType.DownArrow, Bars.OpenTimes.Last(0), Bars.HighPrices.Last(0) + (arrowDistance * atr.Result.Last(1)), "Brown");

}

else

{

Chart.RemoveObject("BraidFilterDown" + Bars.OpenTimes.Last(0).ToString());

}

}

}

}

}

danieljclsilva

Joined on 15.03.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Braid Filter Mod v1.1.algo

- Rating: 0

- Installs: 1571

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.