Description

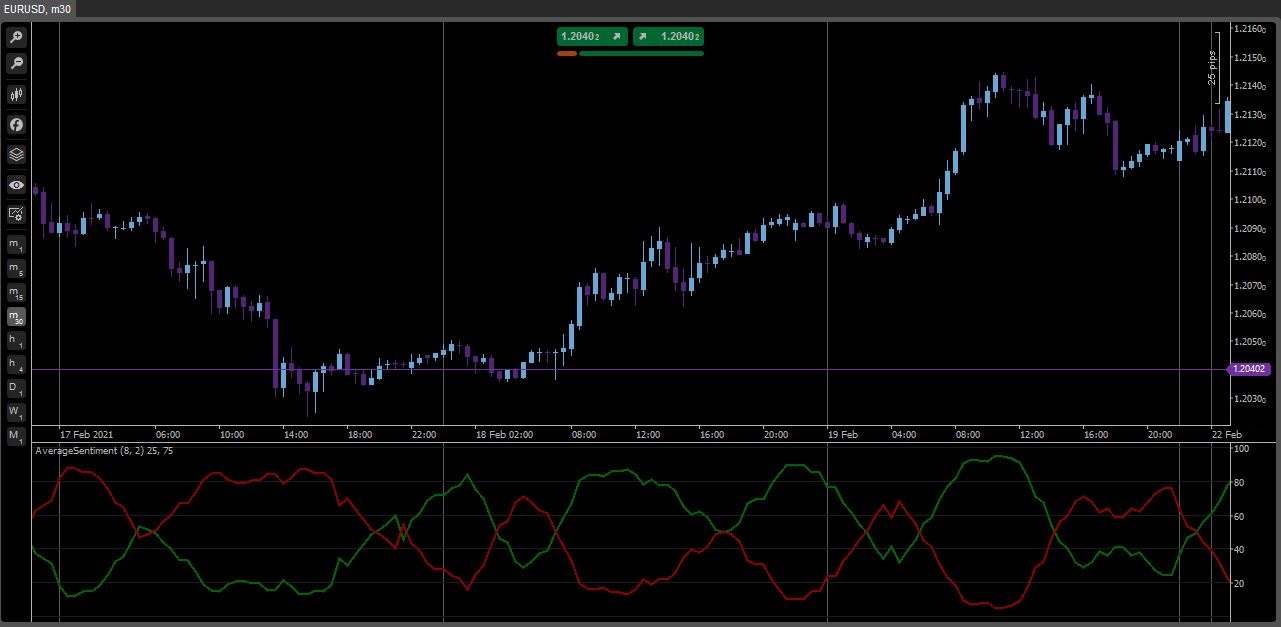

Found this open-source oscillator online and adapted to C# for cAlgo. It’s a combination of two algorithms applied in a different way.

The first one (set MODE to “1”) analyzes the bullish/bearishness of each bar using OHLC prices then averages all percentages to give the final value (the always sum to 100%). The second one (set MODE to “2”) treats the period group of bars as one bar and then determines the sentiment percentage with the OHLC points of the group. The first mode is noisier but also more accurate, whereas the second mode gives smoother results and adds more weight to the price movement range.

They can be used separately as Mode = 1 and Mode = 2, or combined as Mode = 0.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None, ScalePrecision = 0)]

public class AverageSentiment : Indicator

{

[Parameter("Length", DefaultValue = 8)]

public int length { get; set; }

[Parameter("Mode", DefaultValue = 2, MinValue = 0, MaxValue = 2)]

public int mode { get; set; }

[Output("Bulls", LineColor = "DarkGreen", Thickness = 2)]

public IndicatorDataSeries bulls { get; set; }

[Output("Bears", LineColor = "DarkRed", Thickness = 2)]

public IndicatorDataSeries bears { get; set; }

private IndicatorDataSeries intrarange, intrabarbulls, groupbulls, intrabarbears, groupbears;

private IndicatorDataSeries grouplow, grouphigh, groupopen, grouprange;

private IndicatorDataSeries TempBufferBulls, TempBufferBears, K1, K2;

protected override void Initialize()

{

intrarange = CreateDataSeries();

grouplow = CreateDataSeries();

grouphigh = CreateDataSeries();

groupopen = CreateDataSeries();

grouprange = CreateDataSeries();

intrabarbulls = CreateDataSeries();

groupbulls = CreateDataSeries();

intrabarbears = CreateDataSeries();

groupbears = CreateDataSeries();

TempBufferBulls = CreateDataSeries();

TempBufferBears = CreateDataSeries();

K1 = CreateDataSeries();

K2 = CreateDataSeries();

}

public override void Calculate(int index)

{

intrarange[index] = Bars.HighPrices[index] - Bars.LowPrices[index];

grouplow[index] = Math.Min(Bars.LowPrices[index], Bars.LowPrices.Minimum(length));

grouphigh[index] = Math.Max(Bars.HighPrices[index], Bars.HighPrices.Maximum(length));

groupopen[index] = Bars.OpenPrices.Last(length - 1);

grouprange[index] = grouphigh[index] - grouplow[index];

if (intrarange[index] == 0)

{

K1[index] = 1;

}

else

{

K1[index] = intrarange[index];

}

if (grouprange[index] == 0)

{

K2[index] = 1;

}

else

{

K2[index] = grouprange[index];

}

intrabarbulls[index] = ((((Bars.ClosePrices[index] - Bars.LowPrices[index]) + (Bars.HighPrices[index] - Bars.OpenPrices[index])) / 2) * 100) / K1[index];

groupbulls[index] = ((((Bars.ClosePrices[index] - grouplow[index]) + (grouphigh[index] - groupopen[index])) / 2) * 100) / K2[index];

intrabarbears[index] = ((((Bars.HighPrices[index] - Bars.ClosePrices[index]) + (Bars.OpenPrices[index] - Bars.LowPrices[index])) / 2) * 100) / K1[index];

groupbears[index] = ((((grouphigh[index] - Bars.ClosePrices[index]) + (groupopen[index] - grouplow[index])) / 2) * 100) / K2[index];

if (mode == 0)

{

TempBufferBulls[index] = (intrabarbulls[index] + groupbulls[index]) / 2;

TempBufferBears[index] = (intrabarbears[index] + groupbears[index]) / 2;

}

if (mode == 1)

{

TempBufferBulls[index] = intrabarbulls[index];

TempBufferBears[index] = intrabarbears[index];

}

if (mode == 2)

{

TempBufferBulls[index] = groupbulls[index];

TempBufferBears[index] = groupbears[index];

}

// computing Bulls (with EMA)

double sumbulls = 0;

for (var i = index - length + 1; i <= index; i++)

{

if (double.IsNaN(TempBufferBulls[index - 1]))

{

bulls[index] = TempBufferBulls[index];

}

else

{

sumbulls += TempBufferBulls[i] * 2 + (-1) * TempBufferBulls[i - 1];

}

}

bulls[index] = sumbulls / length;

// computing Bears (with EMA)

double sumbears = 0;

for (var i = index - length + 1; i <= index; i++)

{

if (double.IsNaN(TempBufferBears[index - 1]))

{

bears[index] = TempBufferBears[index];

}

else

{

sumbears += TempBufferBears[i] * 2 + (-1) * TempBufferBears[i - 1];

}

}

bears[index] = sumbears / length;

}

}

}

cwik_m

Joined on 26.06.2018

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: AverageSentiment.algo

- Rating: 0

- Installs: 1903

- Modified: 13/10/2021 09:54

Hi guys, could you please suggest a sentiment indcator that has historical data and no calculated data from candles? Thank you