Description

Ladies and gentlemen, welcome.

Today I propose as a curiosity an indicator based on two concepts: Mean reversion and time noise filtering.

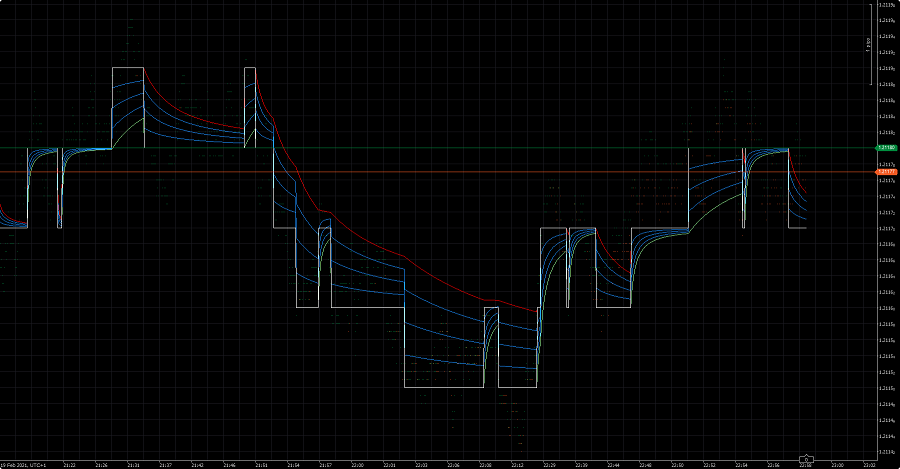

Designed for TFm1.

Instead of price, the trend lines are calculated from the white line that tries to simulate a renko chart.

I hope you like it and enjoy it.

Dedicated to trading heroes.

Affectionately,

Sergio Raimi

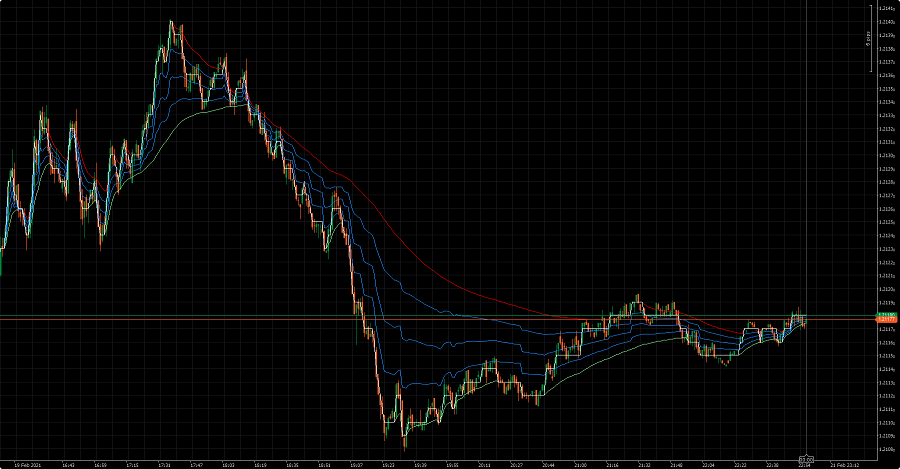

This is how it looks on TFt1. The core.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class MRPLOverlay : Indicator

{

[Output("Result1", LineColor = "lightGreen")]

public IndicatorDataSeries Result1 { get; set; }

[Output("Result2", LineColor = "Red")]

public IndicatorDataSeries Result2 { get; set; }

[Output("Result3", LineColor = "DodgerBlue")]

public IndicatorDataSeries Result3 { get; set; }

[Output("Result4", LineColor = "DodgerBlue")]

public IndicatorDataSeries Result4 { get; set; }

[Output("Result5", LineColor = "DodgerBlue")]

public IndicatorDataSeries Result5 { get; set; }

[Output("Result6", LineColor = "White")]

public IndicatorDataSeries Result6 { get; set; }

private Bars tf;

private int idx;

private int previousIdx;

private int buyPeriod;

private int sellPeriod;

private double buyAverage;

private double sellAverage;

private int savedbp;

private int savedsp;

private double CenterMean, UpperMean, LowerMean;

private double price, previousLevel;

private IndicatorDataSeries level;

protected override void Initialize()

{

tf = MarketData.GetBars(Bars.TimeFrame);

level = CreateDataSeries();

}

public override void Calculate(int index)

{

idx = tf.OpenTimes.GetIndexByTime(Bars.OpenTimes[index]);

if (idx > previousIdx)

{

buyPeriod++;

savedbp = buyPeriod;

sellPeriod++;

savedsp = sellPeriod;

}

if (buyPeriod == 0)

buyPeriod = savedbp;

if (sellPeriod == 0)

sellPeriod = savedsp;

//---------------------------------------------------------------------------------------------------------------------------------------------------------

price = Bars.ClosePrices[index];

level[index] = Math.Round(price, 4);

if (level[index] > previousLevel)

if (price < level[index])

level[index] = level[index] - 0.0001;

if (level[index] < previousLevel)

if (price > level[index])

level[index] = level[index] + 0.0001;

//---------------------------------------------------------------------------------------------------------------------------------------------------------

buyAverage = level.Sum(buyPeriod) / buyPeriod;

sellAverage = level.Sum(sellPeriod) / sellPeriod;

if (level[index] > buyAverage)

{

buyAverage = level[index];

buyPeriod = 0;

}

if (level[index] < sellAverage)

{

sellAverage = level[index];

sellPeriod = 0;

}

CenterMean = (buyAverage + sellAverage) / 2;

UpperMean = (buyAverage + CenterMean) / 2;

LowerMean = (CenterMean + sellAverage) / 2;

Result1[index] = sellAverage;

Result2[index] = buyAverage;

Result3[index] = CenterMean;

Result4[index] = UpperMean;

Result5[index] = LowerMean;

Result6[index] = level[index];

previousIdx = idx;

previousLevel = level[index];

}

}

}

srm_bcn

Joined on 01.09.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: MRPLOverlay.algo

- Rating: 0

- Installs: 1157

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.