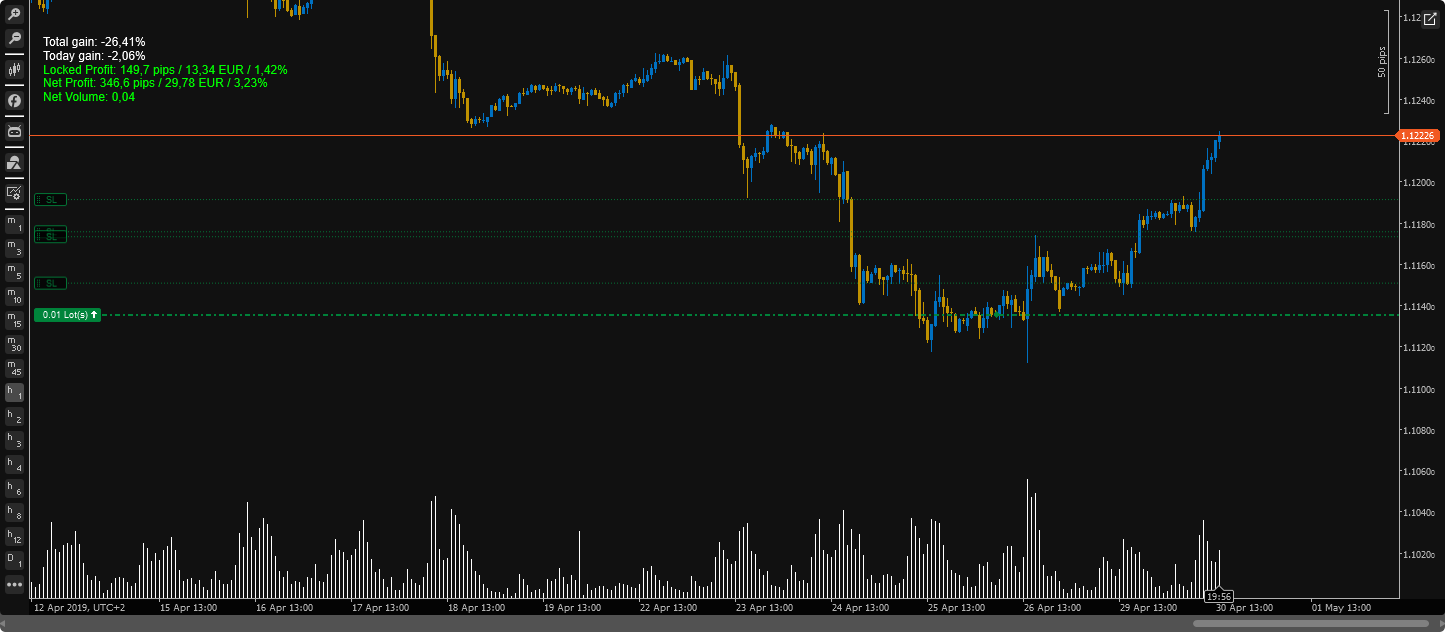

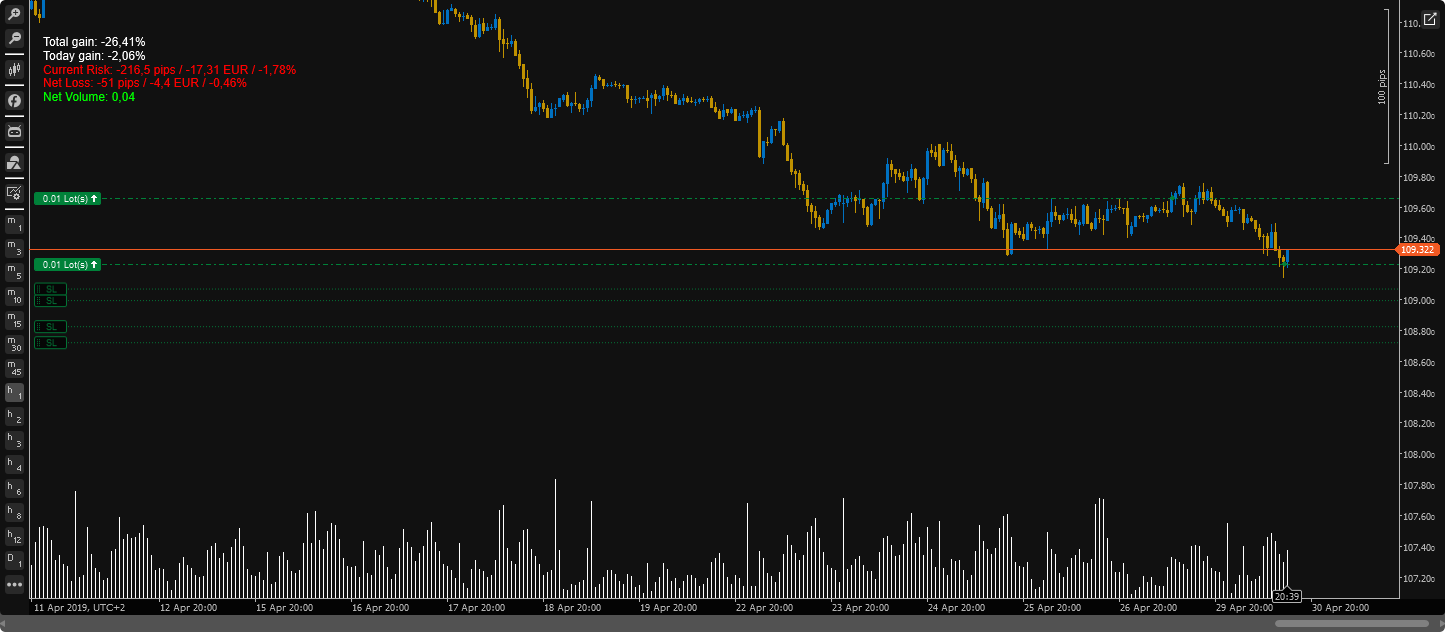

Description

Shows: total gain/dd, todays gain/dd, amount at risk, locked profits (SL in Profit), floating pnl, net short/long(0.02 long + 0.02 short = net no position, good when hedging).

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class ExposureInfo : Indicator

{

protected override void Initialize()

{

}

public override void Calculate(int index)

{

double gain = 0;

double gainToday = 0;

double totalGain = 0;

double totalGainToday = 0;

double exposurePips = 0;

double exposureEuro = 0;

double netProfit = 0;

double balanceExposure = 0;

double profitExposure = 0;

double netVolume = 0;

double netPips = 0;

foreach (var p in History)

{

gain += p.NetProfit;

if (p.ClosingTime.DayOfYear == Time.DayOfYear)

{

gainToday += p.NetProfit;

}

}

foreach (var p in Positions)

{

if (this.Symbol.Code == p.SymbolCode && p.TradeType == TradeType.Buy)

{

exposurePips += Math.Round((p.StopLoss.Value - p.EntryPrice) / Symbol.PipSize, 1);

netProfit += p.NetProfit;

netPips += p.Pips;

exposureEuro = Math.Round(exposurePips * (Symbol.PipValue * 100000) * p.Quantity, 2);

balanceExposure = Math.Round(exposureEuro / (Account.Balance - exposureEuro) * 100, 2);

profitExposure = Math.Round(netProfit / (Account.Balance - netProfit) * 100, 2);

netVolume += p.Quantity;

}

if (this.Symbol.Code == p.SymbolCode && p.TradeType == TradeType.Sell)

{

exposurePips += Math.Round((p.EntryPrice - p.StopLoss.Value) / Symbol.PipSize, 1);

netProfit += p.NetProfit;

netPips += p.Pips;

exposureEuro = Math.Round(exposurePips * (Symbol.PipValue * 100000) * p.Quantity, 2);

balanceExposure = Math.Round(exposureEuro / (Account.Balance - exposureEuro) * 100, 2);

profitExposure = Math.Round(netProfit / (Account.Balance - netProfit) * 100, 2);

netVolume -= p.Quantity;

}

}

if (exposurePips > 0)

{

string s = string.Format("\n\nLocked Profit: {0} pips / {1} {2} / {3}%", exposurePips, exposureEuro, Account.Currency, balanceExposure);

ChartObjects.DrawText("Exposure", s, StaticPosition.TopLeft, Colors.Lime);

}

else if (exposurePips < 0)

{

string s = string.Format("\n\nCurrent Risk: {0} pips / {1} {2} / {3}%", exposurePips, exposureEuro, Account.Currency, balanceExposure);

ChartObjects.DrawText("Exposure", s, StaticPosition.TopLeft, Colors.Red);

}

else

{

ChartObjects.DrawText("Exposure", "\n\nN/A", StaticPosition.TopLeft, Colors.Yellow);

}

if (netProfit > 0)

{

string s = string.Format("\n\n\nNet Profit: {0} pips / {1} {2} / {3}%", netPips, netProfit, Account.Currency, profitExposure);

ChartObjects.DrawText("Profit", s, StaticPosition.TopLeft, Colors.Lime);

}

else if (netProfit < 0)

{

string s = string.Format("\n\n\nNet Loss: {0} pips / {1} {2} / {3}%", netPips, netProfit, Account.Currency, profitExposure);

ChartObjects.DrawText("Profit", s, StaticPosition.TopLeft, Colors.Red);

}

else

{

ChartObjects.DrawText("Profit", "\n\n\nN/A", StaticPosition.TopLeft, Colors.Yellow);

}

if (netVolume > 0)

{

string s = string.Format("\n\n\n\nNet Volume: {0}", Math.Round(netVolume, 3));

ChartObjects.DrawText("NetVolume", s, StaticPosition.TopLeft, Colors.Lime);

}

else if (netVolume < 0)

{

string s = string.Format("\n\n\n\nNet Volume: {0}", Math.Round(netVolume, 3));

ChartObjects.DrawText("NetVolume", s, StaticPosition.TopLeft, Colors.Red);

}

else

{

ChartObjects.DrawText("NetVolume", "\n\n\n\nN/A", StaticPosition.TopLeft, Colors.Yellow);

}

totalGain = Math.Round((gain / (Account.Balance - gain)) * 100, 3);

if (gainToday != 0)

{

totalGainToday = Math.Round((gainToday / (Account.Balance - gainToday)) * 100, 3);

}

string text = string.Format("Total gain: {0,0}% \nToday gain: {1,0}%", Math.Round(totalGain, 2), Math.Round(totalGainToday, 2));

ChartObjects.DrawText("Account Text", text, StaticPosition.TopLeft, Colors.White);

}

}

}

2bnnp

Joined on 12.02.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Symbol_Exposure.algo

- Rating: 5

- Installs: 1803

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.