Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

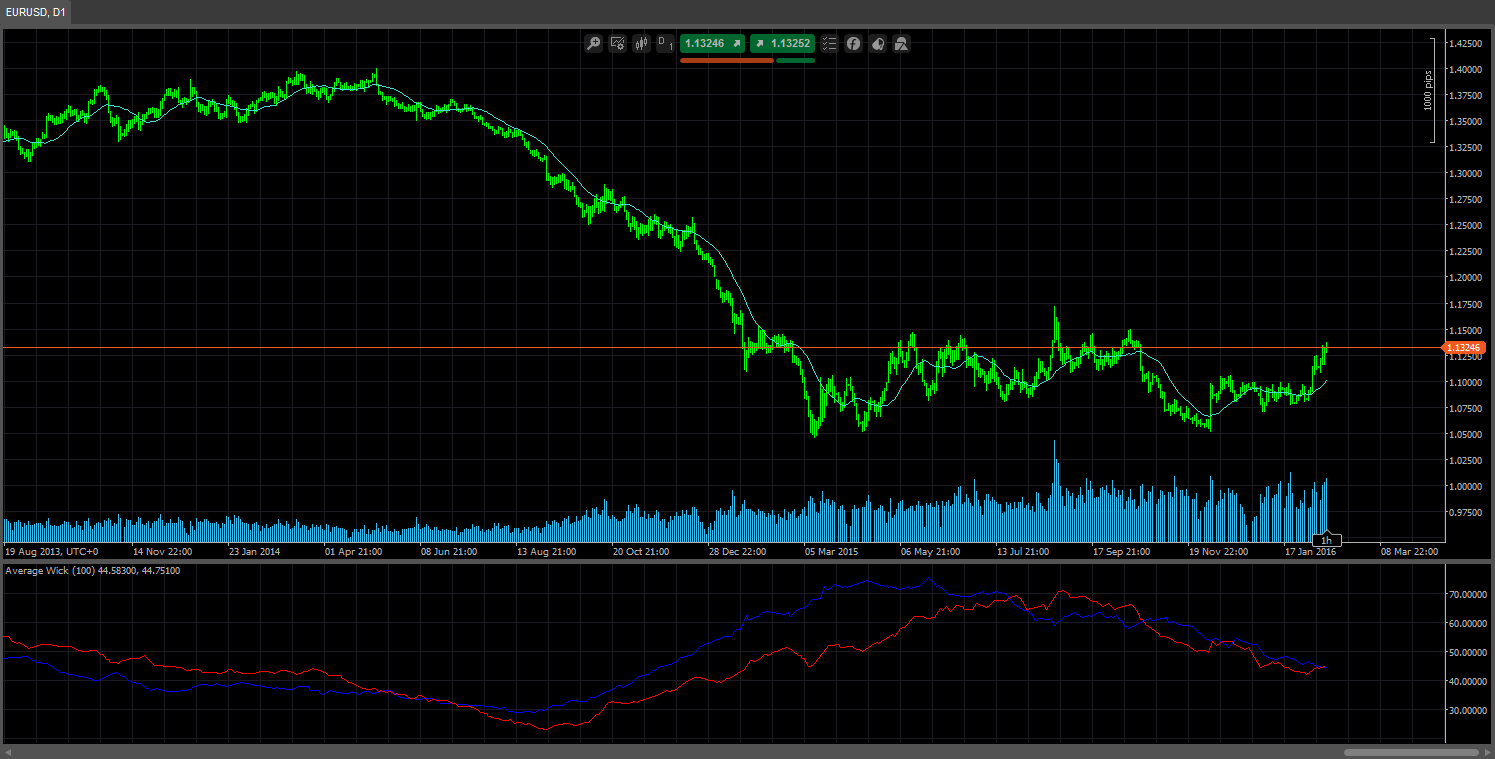

I decided to make a simple indicator to see how wicks behave, some cool patterns seem to emerge.

You can see for example Upwicks tend to be bigger in downtrends and viceversa.

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class AverageWick : Indicator

{

[Parameter("Period", DefaultValue = 10)]

public int _Period { get; set; }

[Output("UpWick", Color = Colors.Blue)]

public IndicatorDataSeries _UpWick { get; set; }

[Output("DownWick", Color = Colors.Red)]

public IndicatorDataSeries _DownWick { get; set; }

double _upresult, _downresult;

protected override void Initialize()

{

}

public override void Calculate(int index)

{

if (MarketSeries.Open.LastValue < MarketSeries.Close.LastValue)

{

for (int i = _Period; i >= 1; i--)

{

_upresult += MarketSeries.High.Last(i) - MarketSeries.Close.Last(i);

}

_UpWick[index] = (_upresult / _Period) / Symbol.PipSize;

_upresult = 0;

}

else if (MarketSeries.Open.LastValue > MarketSeries.Close.LastValue)

{

for (int i = _Period; i >= 1; i--)

{

_downresult += MarketSeries.Close.Last(i) - MarketSeries.Low.Last(i);

}

_DownWick[index] = (_downresult / _Period) / Symbol.PipSize;

_downresult = 0;

}

}

}

}

Waxy

Joined on 12.05.2015

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Average Wick.algo

- Rating: 5

- Installs: 3129

- Modified: 13/10/2021 09:55

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

So what's the concept of how to use it?