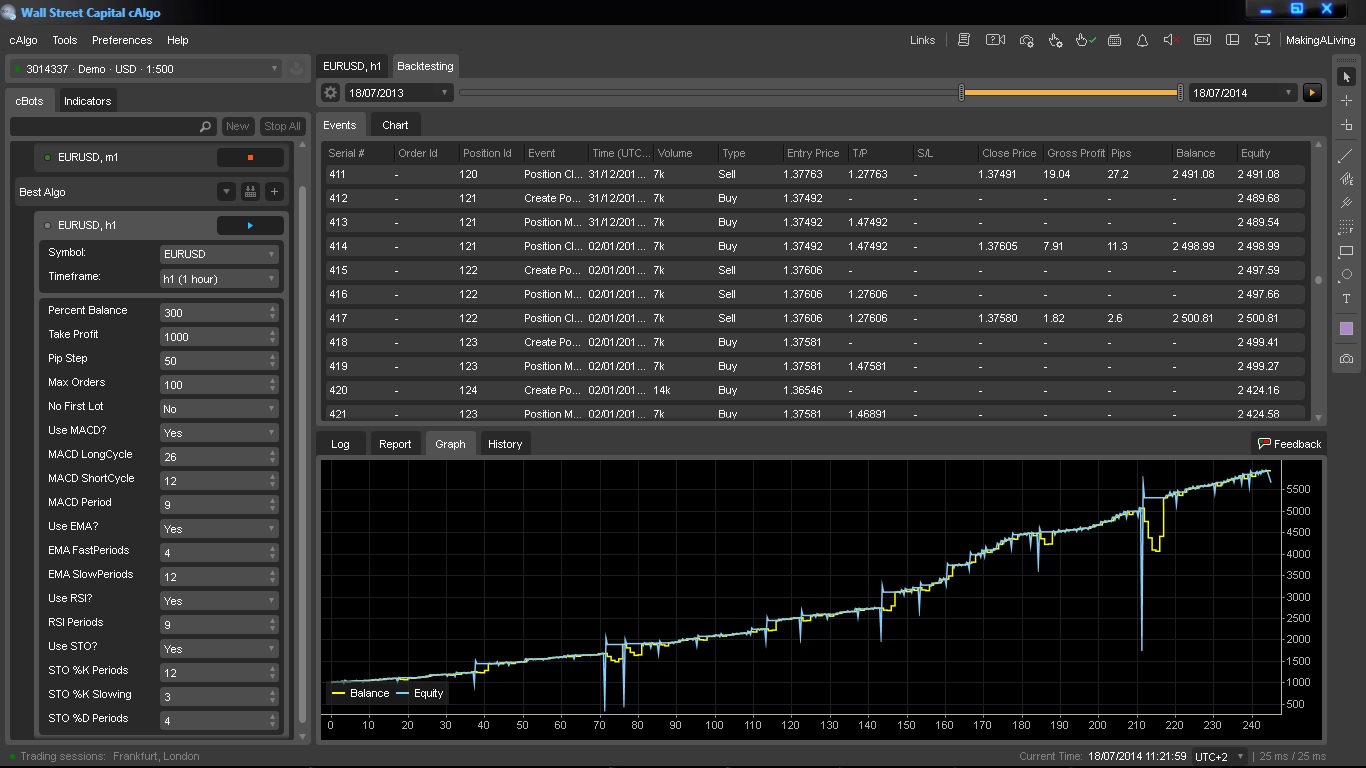

Description

Lets find the best settings.

im gone add the best settings

lets work together to find the best settings and make some cash :)

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot("AI Forex")]

public class BestAlgo : Robot

{

[Parameter("Percent Balance", DefaultValue = 300, MinValue = 0)]

public int PercentBalance { get; set; }

[Parameter("Take Profit", DefaultValue = 1000, MinValue = 0)]

public int TakeProfit { get; set; }

[Parameter("Pip Step", DefaultValue = 50)]

public int PipStep { get; set; }

[Parameter("Max Orders", DefaultValue = 100, MinValue = 2)]

public int MaxOrders { get; set; }

[Parameter("No First Lot", DefaultValue = false)]

public bool NoFirstLot { get; set; }

[Parameter("Use MACD?", DefaultValue = true)]

public bool UseMACD { get; set; }

[Parameter("MACD LongCycle", DefaultValue = 26, MinValue = 1)]

public int LongCycle { get; set; }

[Parameter("MACD ShortCycle", DefaultValue = 12, MinValue = 1)]

public int ShortCycle { get; set; }

[Parameter("MACD Period", DefaultValue = 9, MinValue = 1)]

public int MACDPeriod { get; set; }

[Parameter("Use EMA?", DefaultValue = true)]

public bool UseEMA { get; set; }

[Parameter("EMA FastPeriods", DefaultValue = 4, MinValue = 1)]

public int FastPeriods { get; set; }

[Parameter("EMA SlowPeriods", DefaultValue = 12, MinValue = 1)]

public int SlowPeriods { get; set; }

[Parameter("Use RSI?", DefaultValue = true)]

public bool UseRSI { get; set; }

[Parameter("RSI Periods", DefaultValue = 9, MinValue = 1)]

public int RSIPeriods { get; set; }

[Parameter("Use STO?", DefaultValue = true)]

public bool UseSTO { get; set; }

[Parameter("STO %K Periods", DefaultValue = 12, MinValue = 1)]

public int KPeriods { get; set; }

[Parameter("STO %K Slowing", DefaultValue = 3, MinValue = 1)]

public int KSlowing { get; set; }

[Parameter("STO %D Periods", DefaultValue = 4, MinValue = 1)]

public int DPeriods { get; set; }

private bool Sellingongoing = false;

private bool Buyingongoing = false;

private int FirstLot = 1000;

private int LotStep = 1000;

private int PipStart;

private int Tral_Start = 50;

private int Tral_Stop = 50;

private int PipMulti;

private Position position;

private bool RobotStopped;

private StochasticOscillator _SOC;

private RelativeStrengthIndex _RSI;

private MacdCrossOver _MACD;

private ExponentialMovingAverage slowMa;

private ExponentialMovingAverage fastMa;

private const string label = "Secret to Rich";

private int MaxCout = 0;

private double MinMargin = 99999999;

private double MinEquity = 99999999;

private double EquityBalance = 99999999;

long TotalBuy = 0;

protected override void OnStart()

{

_SOC = Indicators.StochasticOscillator(KPeriods, KSlowing, DPeriods, MovingAverageType.Simple);

_MACD = Indicators.MacdCrossOver(LongCycle, ShortCycle, MACDPeriod);

_RSI = Indicators.RelativeStrengthIndex(MarketSeries.Close, RSIPeriods);

fastMa = Indicators.ExponentialMovingAverage(MarketSeries.Close, FastPeriods);

slowMa = Indicators.ExponentialMovingAverage(MarketSeries.Close, SlowPeriods);

TakeProfit = TakeProfit * 10;

PipStart = PipStep / 10;

PipStep = PipStep * 10;

PipMulti = PipStep / 100;

}

protected override void OnTick()

{

double Bid = Symbol.Bid;

double Ask = Symbol.Ask;

double Point = Symbol.PointSize;

if (Account.Positions.Count > MaxCout)

{

MaxCout = Account.Positions.Count;

}

if (Trade.IsExecuting)

return;

if (Account.Positions.Count > 0 && RobotStopped)

return;

else

RobotStopped = false;

if (Account.Positions.Count == 0)

{

int intValue = (int)(Account.Balance * PercentBalance / 100);

FirstLot = (int)((intValue / 1000) * 1000);

if (FirstLot < 1000)

{

FirstLot = 1000;

}

LotStep = FirstLot;

if (!NoFirstLot)

{

SendFirstOrder(FirstLot);

}

}

else

{

ControlSeries();

}

if (Account.Equity > Account.Balance)

switch (GetPositionsSide())

{

case 0:

if (GetStdIlanSignal() == 0)

{

foreach (var po in Positions)

{

ClosePosition(po);

}

}

break;

case 1:

if (GetStdIlanSignal() == 1)

{

foreach (var po in Positions)

{

ClosePosition(po);

}

}

break;

}

foreach (var position in Account.Positions)

{

if (position.SymbolCode == Symbol.Code)

{

if (position.TradeType == TradeType.Buy)

{

if (Bid - GetAveragePrice(TradeType.Buy) >= Tral_Start * Point)

if (Bid - Tral_Stop * Point >= position.StopLoss)

Trade.ModifyPosition(position, Bid - Tral_Stop * Point, position.TakeProfit);

}

if (position.TradeType == TradeType.Sell)

{

if (GetAveragePrice(TradeType.Sell) - Ask >= Tral_Start * Point)

if (Ask + Tral_Stop * Point <= position.StopLoss || position.StopLoss == 0)

Trade.ModifyPosition(position, Ask + Tral_Stop * Point, position.TakeProfit);

}

}

if (Account.Equity < MinEquity)

{

MinEquity = Account.Equity;

EquityBalance = Account.Equity * 100 / Account.Balance;

MinMargin = (double)Account.MarginLevel;

if (MinEquity <= 0 || MinMargin <= 0)

{

this.Stop();

}

}

}

}

protected override void OnError(Error CodeOfError)

{

if (CodeOfError.Code == ErrorCode.NoMoney)

{

RobotStopped = true;

Print("ERROR!!! No money for order open, robot is stopped!");

}

else if (CodeOfError.Code == ErrorCode.BadVolume)

{

RobotStopped = true;

Print("ERROR!!! Bad volume for order open, robot is stopped!");

}

}

private void SendFirstOrder(int OrderVolume)

{

int Signal = GetStdIlanSignal();

if (!(Signal < 0))

switch (Signal)

{

case 0:

Trade.CreateSellMarketOrder(Symbol, OrderVolume);

TotalBuy += OrderVolume;

break;

case 1:

Trade.CreateBuyMarketOrder(Symbol, OrderVolume);

TotalBuy += OrderVolume;

break;

}

}

protected override void OnPositionOpened(Position openedPosition)

{

double? StopLossPrice = null;

double? TakeProfitPrice = null;

if (Account.Positions.Count == 1)

{

position = openedPosition;

if (position.TradeType == TradeType.Buy)

TakeProfitPrice = position.EntryPrice + TakeProfit * Symbol.PointSize;

if (position.TradeType == TradeType.Sell)

TakeProfitPrice = position.EntryPrice - TakeProfit * Symbol.PointSize;

}

else

switch (GetPositionsSide())

{

case 0:

TakeProfitPrice = GetAveragePrice(TradeType.Buy) + TakeProfit * Symbol.PointSize;

break;

case 1:

TakeProfitPrice = GetAveragePrice(TradeType.Sell) - TakeProfit * Symbol.PointSize;

break;

}

for (int i = 0; i < Account.Positions.Count; i++)

{

position = Account.Positions[i];

if (StopLossPrice != null || TakeProfitPrice != null)

Trade.ModifyPosition(position, position.StopLoss, TakeProfitPrice);

}

}

private double GetAveragePrice(TradeType TypeOfTrade)

{

double Result = Symbol.Bid;

double AveragePrice = 0;

long Count = 0;

for (int i = 0; i < Account.Positions.Count; i++)

{

position = Account.Positions[i];

if (position.TradeType == TypeOfTrade)

{

AveragePrice += position.EntryPrice * position.Volume;

Count += position.Volume;

}

}

if (AveragePrice > 0 && Count > 0)

Result = (AveragePrice / Count);

return Result;

}

private int GetPositionsSide()

{

int Result = -1;

int i, BuySide = 0, SellSide = 0;

for (i = 0; i < Account.Positions.Count; i++)

{

if (Account.Positions[i].TradeType == TradeType.Buy)

BuySide++;

if (Account.Positions[i].TradeType == TradeType.Sell)

SellSide++;

}

if (BuySide == Account.Positions.Count)

Result = 0;

if (SellSide == Account.Positions.Count)

Result = 1;

return Result;

}

private void ControlSeries()

{

int _pipstep, NewVolume, Rem;

int BarCount = 25;

int Del = MaxOrders - 1;

if (PipStep == 0)

_pipstep = GetDynamicPipstep(BarCount, Del);

else

{

_pipstep = PipStep;

//_pipstep = (PipStep * PipStart * (Account.Positions.Count) / PipMulti);

}

if (Account.Positions.Count < MaxOrders)

switch (GetPositionsSide())

{

case 0:

if (Symbol.Ask < FindLastPrice(TradeType.Buy) - _pipstep * Symbol.PointSize)

{

NewVolume = Math.DivRem((int)(FirstLot + FirstLot * Account.Positions.Count), LotStep, out Rem) * LotStep;

if (!(NewVolume < LotStep) && GetStdIlanSignal() == 1)

{

Trade.CreateBuyMarketOrder(Symbol, NewVolume);

TotalBuy += NewVolume;

}

}

break;

case 1:

if (Symbol.Bid > FindLastPrice(TradeType.Sell) + _pipstep * Symbol.PointSize)

{

NewVolume = Math.DivRem((int)(FirstLot + FirstLot * Account.Positions.Count), LotStep, out Rem) * LotStep;

if (!(NewVolume < LotStep) && GetStdIlanSignal() == 0)

{

Trade.CreateSellMarketOrder(Symbol, NewVolume);

TotalBuy += NewVolume;

}

}

break;

}

}

private int GetDynamicPipstep(int CountOfBars, int Del)

{

int Result;

double HighestPrice = 0, LowestPrice = 0;

int StartBar = MarketSeries.Close.Count - 2 - CountOfBars;

int EndBar = MarketSeries.Close.Count - 2;

for (int i = StartBar; i < EndBar; i++)

{

if (HighestPrice == 0 && LowestPrice == 0)

{

HighestPrice = MarketSeries.High[i];

LowestPrice = MarketSeries.Low[i];

continue;

}

if (MarketSeries.High[i] > HighestPrice)

HighestPrice = MarketSeries.High[i];

if (MarketSeries.Low[i] < LowestPrice)

LowestPrice = MarketSeries.Low[i];

}

Result = (int)((HighestPrice - LowestPrice) / Symbol.PointSize / Del);

return Result;

}

private double FindLastPrice(TradeType TypeOfTrade)

{

double LastPrice = 0;

for (int i = 0; i < Account.Positions.Count; i++)

{

position = Account.Positions[i];

if (TypeOfTrade == TradeType.Buy)

if (position.TradeType == TypeOfTrade)

{

if (LastPrice == 0)

{

LastPrice = position.EntryPrice;

continue;

}

if (position.EntryPrice < LastPrice)

LastPrice = position.EntryPrice;

}

if (TypeOfTrade == TradeType.Sell)

if (position.TradeType == TypeOfTrade)

{

if (LastPrice == 0)

{

LastPrice = position.EntryPrice;

continue;

}

if (position.EntryPrice > LastPrice)

LastPrice = position.EntryPrice;

}

}

return LastPrice;

}

protected override void OnStop()

{

Print("Min Equity = " + MinEquity);

Print("Min Margin Level = " + MinMargin);

Print("Equity/Balance Percent = " + EquityBalance);

Print("MaxCout = " + MaxCout);

Print("TotalBuy = " + TotalBuy);

}

private int GetStdIlanSignal()

{

int Result = -1;

int Result1 = 0;

int Result2 = 0;

int Result3 = 0;

int Result4 = 0;

int Result5 = 0;

int sum = 0;

//1 = buy , result = 1

//0 = sell , result = -1

if (UseMACD)

{

if (_MACD.MACD.Last(1) < _MACD.Signal.Last(1) && _MACD.MACD.Last(0) > _MACD.Signal.Last(0) && _MACD.Signal.Last(0) < 0 && _MACD.Signal.IsRising())

{

Result2 = 1;

}

if (_MACD.MACD.Last(1) > _MACD.Signal.Last(1) && _MACD.MACD.Last(0) < _MACD.Signal.Last(0) && _MACD.Signal.Last(0) > 0 && _MACD.Signal.IsFalling())

{

Result2 = -1;

}

}

if (UseEMA)

{

//Moving Average

var currentSlowMa = slowMa.Result.Last(0);

var currentFastMa = fastMa.Result.Last(0);

var previousSlowMa = slowMa.Result.Last(1);

var previousFastMa = fastMa.Result.Last(1);

if (previousSlowMa > previousFastMa && currentSlowMa <= currentFastMa)

{

Result3 = 1;

}

else if (previousSlowMa < previousFastMa && currentSlowMa >= currentFastMa)

{

Result3 = -1;

}

}

if (UseRSI)

{

//RSI

var currentRSI = _RSI.Result.Last(0);

var previousRSI = _RSI.Result.Last(1);

if (currentRSI <= 70 && previousRSI > 70)

{

Result4 = -1;

}

else if (currentRSI >= 30 && previousRSI < 30)

{

Result4 = 1;

}

}

if (UseSTO)

{

//StochasticOscillator

var currentD = _SOC.PercentD.Last(0);

var currentK = _SOC.PercentK.Last(0);

var previousD = _SOC.PercentD.Last(1);

var previousK = _SOC.PercentK.Last(1);

if (currentK >= currentD && previousK < previousD && currentK < 20)

{

Result5 = 1;

//Print("currentK=" + currentK + " >= currentD=" + currentD + "previousK=" + previousK + " < previousD=" + previousD);

}

else if (currentK <= currentD && previousK > previousD && currentK > 80)

{

Result5 = -1;

//Print("currentK=" + currentK + " <= currentD=" + currentD + "previousK=" + previousK + " > previousD=" + previousD);

}

}

//Summary of indicator

sum = Result2 + Result3 + Result4 + Result5;

if (sum > 0)

{

Result = 1;

//Print("BUY ! [MACD= " + Result2 + "] [EMA= " + Result3 + "] [RSI= " + Result4 + "] [SOC= " + Result5 + "]");

}

else if (sum < 0)

{

Result = 0;

//Print("SELL ![MACD= " + Result2 + "] [EMA= " + Result3 + "] [RSI= " + Result4 + "] [SOC= " + Result5 + "]");

}

else

{

Result = -1;

}

return Result;

}

}

}

MrForex

Joined on 17.07.2014

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Best Algo.algo

- Rating: 2.5

- Installs: 5181

- Modified: 13/10/2021 09:54

Comments

The drawdown will wipe the entire account. Greedy ppl look at profit. As I look to your graph, I see huge drawdown!

I reject any strategy that has a potential drawdown greater than 6%

The cbot is not bad in starting, but without SL and or Trailing, it couldn´t be successfull. Can you add some indicators like Bollinger Bands, SAR and ATR. Is it possible, that every indicator get his own timeframe?

regards

Marcia

Check it out! This is my last cbot.

http://www.youtube.com/watch?feature=player_embedded&v=IuUmTnIjnTk

yeah i dont get it if your are rich why bother?

http://www.myfxbook.com/members/Gamezxz/gbpjpy-robot-forex/988960

This is ridiculous.

Hi,

If Your robot is so wonderful it's strange that you still have to collect the $ 99 instead of providing for free ;)

This is ridiculous.

Regards

This is Last Version

In 2 year gain 31,303% from deposit !!!

If you want to download this robot please donate just 99$ one time you will be come VIP member and download other robot in this website

Contact : Gamezxz@gmail.com

"The robot can proved strategies with historical data."

Check this link!

http://www.palaloy.com/blog/the-best-gbpjpy-robot-forex-last-version

The best GBPJPY Robot Forex

In 2 year gain 17,000% from deposit !!!

If you want to download this robot please donate just 99$ one time you will be come VIP member and download other robot in this website

Contact : Gamezxz@gmail.com

"The robot can proved strategies with historical data."

Download Link for VIP Member : http://www.palaloy.com/uploadFile/url/36

I could not get this to open a single order on the backtesting with the settings above

Extra cBot :) only it would be cool if earned month to month and not year to year MrForex.

@MrForex could you please make it to disable the martingale function of this cbot