Description

// This cBot was created with AlgoBuilderX

//

// AlgoBuilderX is a powerful tool for creating automated trading strategies on the cTrader platform.

// With an intuitive drag-and-drop interface, you can easily build and customize your own trading

// algorithms without any coding knowledge. Whether you're a beginner or an experienced trader,

// AlgoBuilderX offers a seamless experience for developing, testing, and deploying your very own cBot

//

// Visit https://algobuilderx.com to start building your own cBots today!

This cBot is an example, made for demonstration purposes using AlgoBuilderX and works only on demo accounts.

Since it is a demo version I cannot publish the source code, download it from Google Drive from the link below.

The attached .algo file is a dummy file

>>>>>DOWNLOAD FROM HERE<<<<<

Strategy: The strategy identifies “order blocks” using the Price ROC (Rate of Change) indicator, which measures the percentage change in price over a given time interval. When a strong price movement occurs, the strategy identifies previous candles of the opposite color from the impulsive movement, thus identifying the order block. Next, a horizontal line is drawn on the chart, and when price reaches this line, the trade is opened. The strategy involves the use of a fixed stop loss and a take profit expressed as a percentage of the stop loss to ensure a fixed risk ratio.

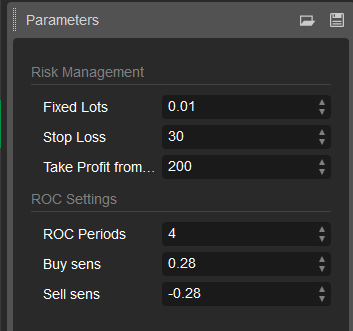

Parameters:

The Buy Sens and Sell Sens parameters determine the target value of the Price ROC. A higher value indicates a larger price change, so a high number will only identify order blocks prior to more impulsive movements, resulting in a smaller selection. Conversely, a lower value will identify less accurate order blocks associated with less significant movements. The same concept applies to the Sell Sens parameter, except that the value must be negative. The default parameters of 0.28 and -0.28 are optimized for movements on H1 timeframes, so it is recommended to run the bot on this timeframe.

Backtest example:

AlgoBuilderX Project Tutorial:

Create your cBot now in an easy and intuitive way!

Try AlgoBuilderX now, no registration required: www.algobuilderx.com

You can find the AlgobuilderX project for free in our Discord channel: https://discord.gg/mjS8PQgUgb

You will be able to import it into the AlgoBuilderX workspace, view it, edit it, or export it.

Important Note:

This cBot is a demonstration example created with AlgoBuilderX and is not optimized for live use. It is designed to illustrate the functionality of AlgoBuilderX and serve as a starting point for creating custom strategies. It is recommended that you carefully test and optimize any strategy before implementing it on a real trading account

using System;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Robots

{

[Robot(AccessRights = AccessRights.None, AddIndicators = true)]

public class DownloadfromDescription : Robot

{

[Parameter(DefaultValue = "Hello world!")]

public string Message { get; set; }

protected override void OnStart()

{

MessageBox.Show("This is dummy algo, download the real .algo from the description", "Welcome to ABX", MessageBoxButton.OK, MessageBoxImage.Information);

}

protected override void OnTick()

{

// Handle price updates here

}

protected override void OnStop()

{

// Handle cBot stop here

}

}

}

AlgoBuilderX

Joined on 30.01.2024

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Download from Description.algo

- Rating: 2.5

- Installs: 1536

- Modified: 06/09/2024 16:23