Description

The Tokyo Fix strategy(ゴトー日) in FX trading involves trading around the time when a benchmark rate for the Japanese yen (JPY) is set in Tokyo. This fix, typically established at 9:55 AM Tokyo time, provides a reference rate used by financial institutions and corporations for various transactions.

What is the Tokyo Fix?

- Definition: The Tokyo Fix is a daily process where a benchmark exchange rate for the Japanese yen (JPY) against other currencies is determined.

- Time: The fix is established at 9:55 AM Tokyo time.

- Purpose: It serves as a reference rate for valuing portfolios, settling contracts, and benchmarking performance in the Japanese financial market.

How the Tokyo Fix Strategy Works

- Timing: Traders focus on the period around 9:55 AM Tokyo time, anticipating increased trading activity and potential price movements due to the fix.

- Trade Volume: The cBot adjust trade volume automatically based on account equity.

Benefits and Risks

Benefits:

- Predictable Timing: The fixed time allows traders to plan and execute their strategies with precision.

- Increased Liquidity: The fix period typically sees heightened liquidity, which can reduce the risk of slippage.

- Transparent Pricing: The fix provides a widely recognized and transparent benchmark rate.

Risks:

- Volatility: The fix period can be volatile, with rapid price movements posing risks if not managed properly.

- Market Impact: Large orders executed around the fix can influence market prices, potentially leading to adverse movements.

- Complexity: Understanding the factors influencing the fix rate and market reactions requires a deep understanding of market dynamics.

Practical Application

- Institutional Use: Institutional traders and asset managers often use the Tokyo Fix to value portfolios, benchmark performance, and settle contracts.

- Retail Traders: Retail traders can also participate, using the fix as a reference point for their trading decisions.

Key Considerations

- Market Sentiment: Understanding the overall market sentiment and economic indicators influencing the yen is crucial.

- Order Execution: Executing orders with precision to minimize slippage and maximize potential gains is essential.

- Risk Management: Employing proper risk management strategies to handle the volatility around the fix is vital for successful trading.

The Tokyo Fix strategy requires careful planning, risk management, and a good understanding of market dynamics to effectively capitalize on the opportunities presented. Traders need to be aware of the potential for significant price movements and the factors influencing the yen to execute this strategy successfully.

Lots : 1.0 (Volume : 100000)

Backtest period : 2011/02/08 ~ 2024/12/01

Profit factor : 1.96

Max balance drawdown : 19.40%

Initial balance : 6,330 USD, Ending balance : 99,870 USD, Return : +1,487%

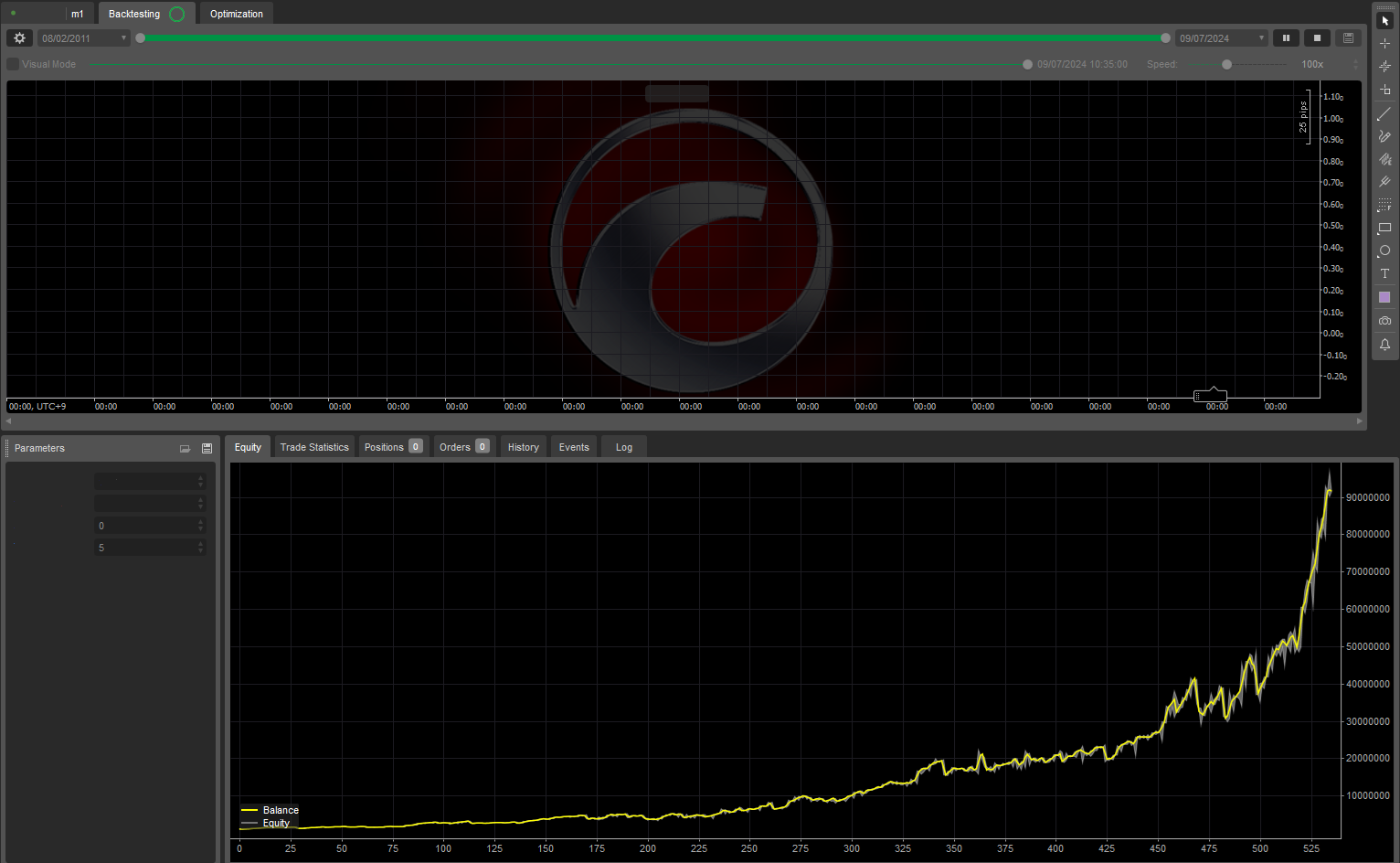

Lots : auto

Backtest period : 2011/02/08 ~ 2024/12/01

Profit factor : 2.25

Max balance drawdown : 47.63%

Initial balance : 6,330 USD, Ending balance : 3,252,267 USD, Return : +51,273%

Free trial: >>>>>> Download the cBot <<<<<<

Contact: jadmad0828@gmail.com

Telegram: https://t.me/jadmad0828

The author decided to hide the source code.

ys2310

Joined on 03.12.2021

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: New cBot (4)_withSourceCode.algo

- Rating: 5

- Installs: 322

- Modified: 21/07/2024 02:34