Description

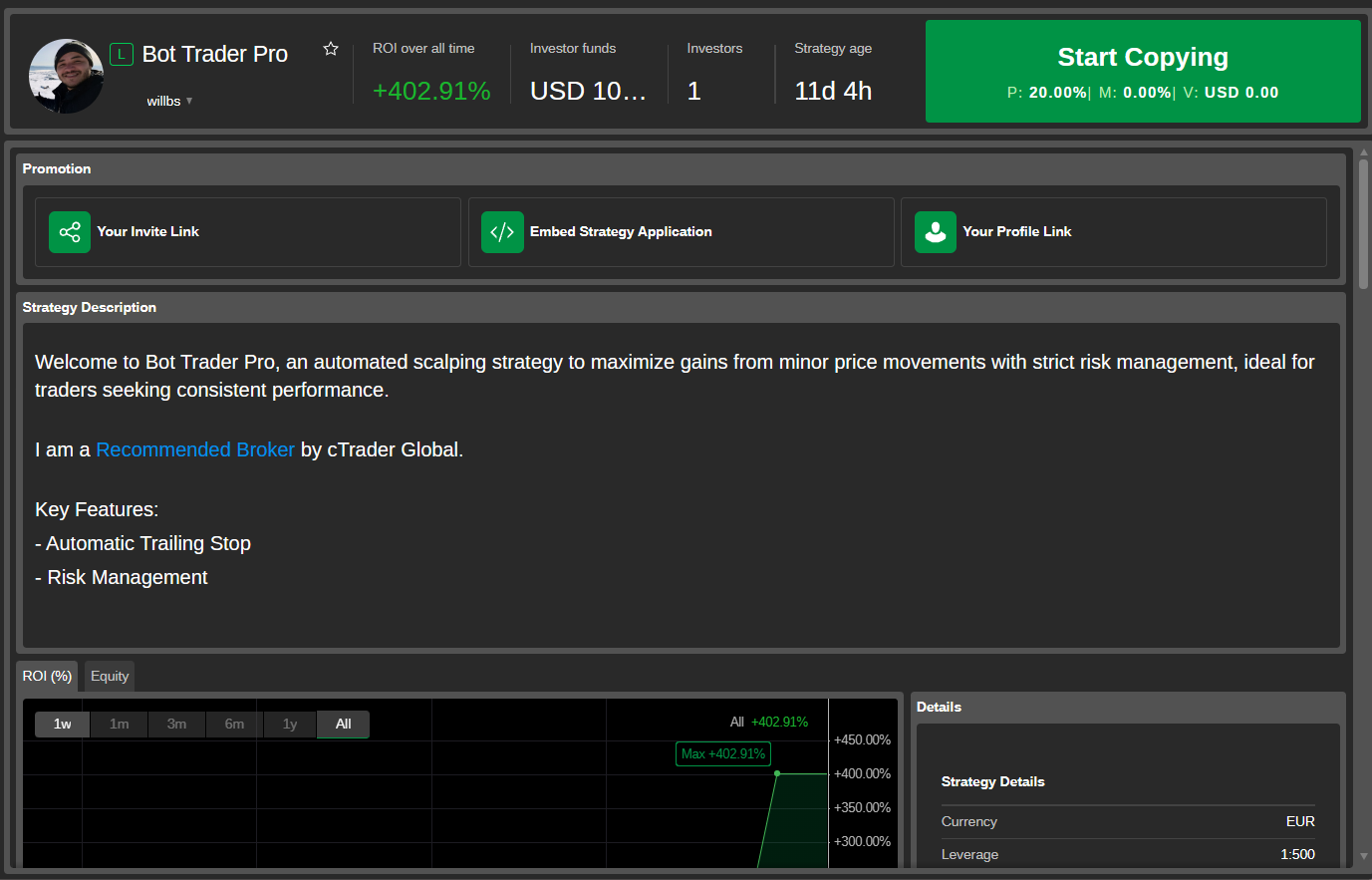

Copy my Strategy: Spotware cTrader | Open Trading Platform

About cBot:

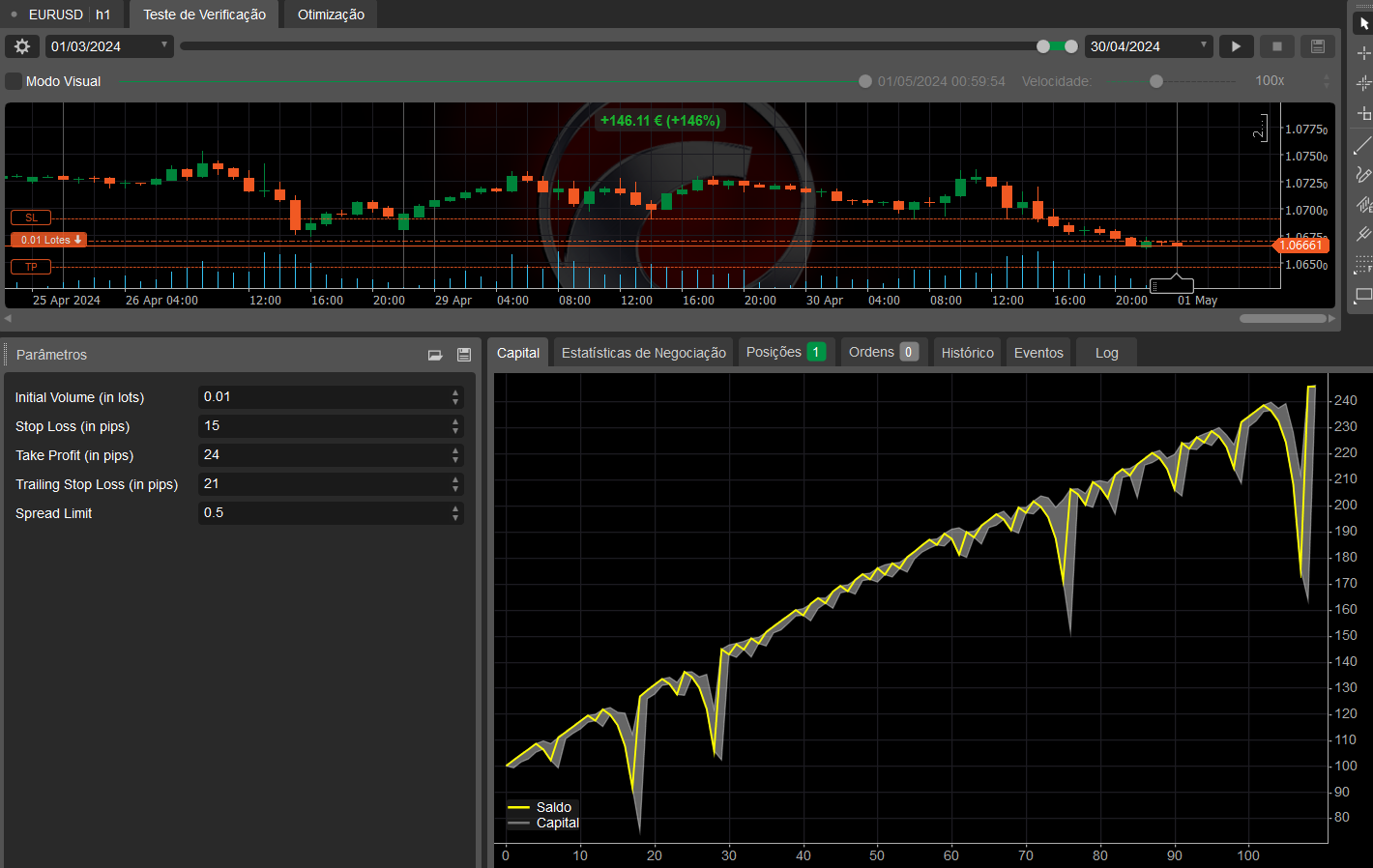

Description: This Sample Martingale Robot is designed for the cTrader trading platform and employs a modified Martingale strategy, which is known for its capability to double the trade volume after a losing trade in an effort to recover previous losses and make a profit. The bot is enhanced to handle Forex trading and aims to capitalize on market volatility by entering trades based on a random decision model, with the option to adjust the trading strategy following the market conditions.

Key Features:

- Martingale Strategy: Automatically doubles the trade volume after a losing trade.

- Random Trade Direction: Initial trade direction (buy or sell) is randomly selected, adding an unpredictability factor to the trading strategy.

- Dynamic Trade Reversal: After a losing trade, the next trade will be in the opposite direction, potentially capturing profit from market reversals.

- Spread Control: Ensures that trades are only executed if the spread is below a predefined limit, minimizing cost during volatile periods.

- Adjustable Risk Management: Users can set parameters such as initial volume, stop loss, take profit, and trailing stop loss.

Updates Applied to the Original Code:

- Lot Size Adjustment: The minimum trading volume has been adjusted to 0.01 lots, making it suitable for accounts that support micro-lot trading.

- Opposite Trade on Loss: Updated the code to place trades in the opposite direction following a loss. This was based on community feedback that suggested this could reduce consecutive losses and perform better during strong market trends.

- Error Handling: Enhanced error handling to stop the robot if there is insufficient balance to open a new position.

Usage Instructions: Before deploying the robot, users should test it in a simulated trading environment to understand the impacts of its strategy under various market conditions. It is advisable to set risk management thresholds in accordance with one's trading capital and risk appetite.

Disclaimer: Trading Forex and CFDs carries a high level of risk, and may not be suitable for all investors. The use of leverage can work against you as well as for you. Before deciding to invest in Forex or CFDs, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

WillBS

Joined on 05.08.2021

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Martingale Trailling.algo

- Rating: 5

- Installs: 598

- Modified: 04/05/2024 17:05

Comments

It is somehow similar to “Zone Recovery Hedging Trading System”.

I've made something similar. Opposite bet is great in the trendy market but it's bad in the ranging market. Same side bet is great in ranging market but it's bad in the trendy market. So I tried to use BB, Keltners band some some indicator to identify trend and switch in between Opposite and Same side bet. Still on progress.

Hello, I have to stop and restart my bot every week manually, otherwise no trades are employed. I think this happens after the spread limit has been exceeded. Can you check this bug please?